Mid-week market update: There remains a fair amount of stock market skittishness among my readers and on my social media feed. Let me assure everyone that bear markets simply don`t start this way.

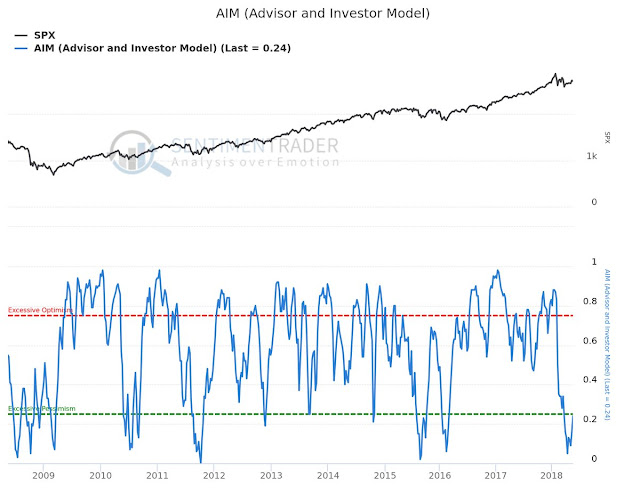

SentimenTrader has an intermediate to long-term sentiment model called AIM “which averages the momentum of the four major sentiment surveys”. This model is not perfect at calling the exact bottoms or spotting exact turning points. Nevertheless, it has done a good job of defining the risk and reward of owning stocks when readings are at bearish extremes, which is contrarian bullish. The model is currently on a buy signal.

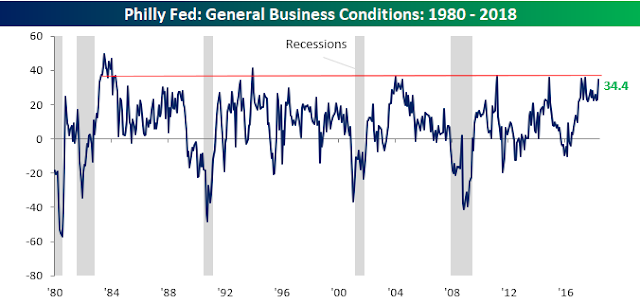

From a top-down macro perspective, Bespoke recently pointed out that the Philly Fed General Conditions Index hasn’t been this high for some time. Despite the mutterings of permabears (I’m looking at you Rosie), recessions simply do not start this way.

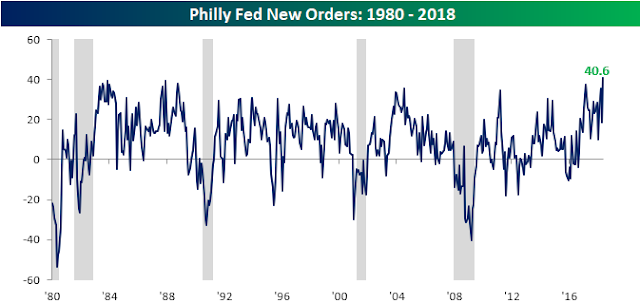

BTW, the Philly Fed New Orders component surged to an all-time-high, and the last time it rose this much in a single month was October 2005.

These conditions are all pointing to further intermediate term equity strength. Expect a test of the old highs in the major equity indices this summer, and probably new all-time highs.

However, stock prices don’t go up in a straight line. The short run equity outlook is a little different.

Trust the bull, but verify the trend

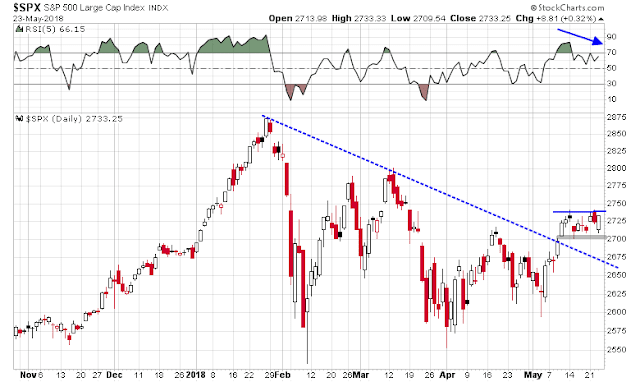

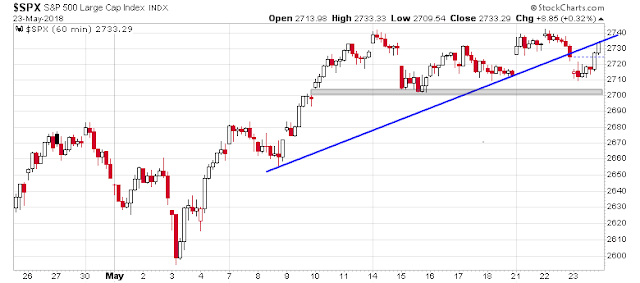

In the short-term, the bulls face a number of challenges. While the upside breakout through the downtrend line is constructive, the SPX failed at 2740 resistance while exhibiting a negative RSI-5 divergence. These conditions suggest some consolidation or pullback over the next few days. Likely support can be found at the partially filled gap at about 2700.

The hourly chart is also supportive of the minor pullback thesis. The index breached an uptrend line that began on May 8, 2018. Under these conditions, minor weakness is likely, and it will be up to the bears to see if they can take control of the tape.

In light of the recent resurgence of small cap leadership and likely short-term market weakness, my main working hypothesis calls for either a successful SPX test at 2700, or a test of the small cap relative uptrend as signals that the pullback is over.

My inner trader remains partially long the market. He trusts the bull, but he is verifying the short-term trend.

Disclosure: Long SPXL

Let me offer a different way of looking at this. Rather than asking if this is the way a bear market starts, ask if the January peak marked the way a bull market ends. I believe it does. Up to and including the bear market of 2008, we had peaks in investor sentiment and excessive valuation after a good economic years. This was soon followed by a recession caused by Fed tightening. So the peak in valuation and sentiment were closely tided to the beginning of an economic downturn. What I see in the peak of January 2018, was a classic valuation and sentiment bull market peak to be followed by a bear market that ends with pessimism among investors and stocks that are valued cheaply.

Bubbles were everywhere, bitcoin, weed stocks, real estate in hot areas, tech stocks with no earnings etc. We had an unnaturally consistent uptrend in the stock market for a year and a half, causing a sense of rising confidence that was followed by a parabolic upswing after the tax cuts made stocks seem bulletproof. Now THAT was a classic sentiment high.

On the AIM chart above, take a look at 2008. What you see is the indicator stay in the bottom range for a full year of failed rallies. That is a bear market in sentiment after a bull market in sentiment ended in late 2007. Since then we’ve experienced bull market version of AIM where the quick dips to pessimism are perfect ‘buy on dips’ opportunities followed by protracted periods of optimism and bull market strong market gains.

If we have hit a bull market peak in sentiment in January and are heading into a bear market in sentiment, we will see that indicator have failed rallies for the next year where ‘sell the rally’ is the profitable approach.

What about the economy, which usually tanks shortly after a bull market peak. That weakness is nowhere in sight. Agreed. I’ve said in the past that we are in a Moonless economy where the Central Bankers (the Moon) are not shifting the tides of interest rates ruthlessly like the old days, for fear of another GFC, hence no general recessions. That means that each industry has its own business cycle and the stocks in that industry have their own bull and bear markets. The groups are not synchronized like before.

So, we may not see a general S&P 500 bear market but rather ones in Staples, Home Construction, Utilities, Telecom, Healthcare, Tesla etc. In 2015, we had bear markets in so many industries after the sentiment peak in the spring that the Russell 2000 was down over 25% and every country in the world saw their index lose greater than the 20% measure of a bear market.

I do fear that Powell’s Fed may raise rates too quickly on a heavily indebted world. That wouldn’t be the Moon coming back, it would be an asteroid smacking into the world.

So I believe I’ve seen a bull market sentiment and valuation ending in January in many sectors of the stock market and countries of the world. Many are already below their February 8, low.

But just like 2015, where many non-cyclical industry sectors did well and held the S&P 500 index up from declining the bear market measure of 20%, there could very well be many industry sectors that do fine because of their particular, positive business and stock market cycle; think technology and energy.