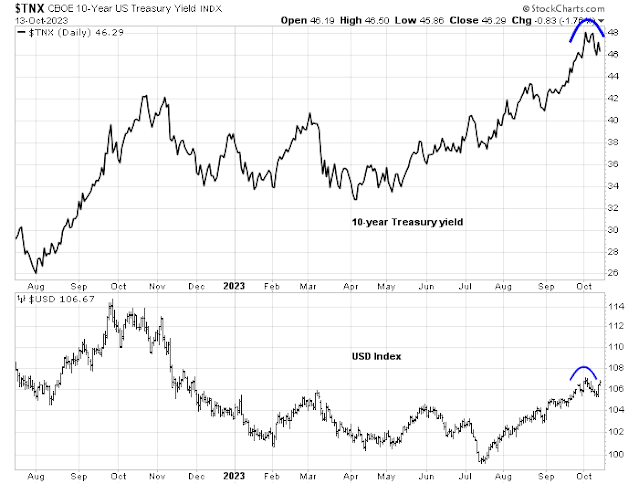

Here’s what has happened since the peak in rate anxiety. In the space of a week, the market had to face a blowout jobs report, a surprise Middle East war, and hot PPI and slightly hot CPI prints. In the face of such news, one would think this would put upward pressure on yields. Instead, Treasury yields retreated.

The fall in yields was initially attributable to a flight to safety, but such an explanation doesn’t seem plausible as the USD Index fell in lockstep. If there had been a flight to safety, the USD would have been bid.

What happened? The most reasonable explanation is that the jitters over rising term premium and real rates was a red herring.

A matter of psychology

When I discussed this issue last week, I concluded, “I believe the market is at or near the point of maximum pain and investors should be prepared for a FOMO scramble for bonds and risky assets.” I stand by those remarks.

Higher for longer?

At the height of the bond market panic, I privately pondered at what point would the Fed come to the rescue of the Treasury market in order to prevent a disorderly unwind in the manner of the gilt crisis of 2022. Since then, various Fed officials have spoke and given dovish guidance.

Financial conditions have tightened notably in recent months. But the reasons for the tightening matter. If long-term interest rates remain elevated because of higher term premiums, there may be less need to raise the fed funds rate. However, to the extent that strength in the economy is behind the increase in long-term interest rates, the FOMC may need to do more. So, I will be carefully evaluating both economic and financial developments to assess the extent of additional policy firming that may be appropriate to deliver on the FOMC’s mandate.

Other Fed officials have spoken out and the tone has become more dovish. Boston Fed President Susan Collins believes in taking a more patient approach to monetary policy now that rates are at or near their peak, though further rate increases are still possible. Atlanta Fed President Raphael Bostic added to the dovish tone with remarks that the Fed may have done enough with its interest rate hikes to bring down inflation.

All participants agreed that the Committee was in a position to proceed carefully that policy decisions at every meeting would continue to be based on the totality of incoming information & its implications for the economic outlook as well as the balance of risks,

The September CPI report didn’t move the needle on monetary policy expectations. Core CPI was in line with market expectations and headline CPI was slightly above. Monthly annualized core CPI (blue bars) edged up, and so did the closely watched services ex-shelter CPI (red bars). I interpret this to mean that while the Fed may stay on hold, the possibility of one more rate hike is still on the table.

Putting it all together, the market doesn’t expect any further rate hikes and cuts to begin in mid-2024.

A durable rebound

In conclusion, the turnaround from the recent bond market tantrum was mainly attributable to excessive bearishness rather than to fundamental factors. Bearish sentiment was also evident in the equity market. S&P 500 breadth, as measured by the percentage of stocks above their 50 dma, fell below 10% in the most recent sell-off. While there are no guarantees, recent episodes of similar breadth wipeouts saw the stocks rally until this indicator reached at least 80%, indicating further upside in the coming weeks. Similarly, the 10-year Treasury yield should decline and find support at the 4.25–4.35% zone.

I had rebased my ETF ranking list to October 5 since the next leg up in the bull market seemed to be starting the next day. Last week, the first week of the possible new leg, interest sensitive sectors surged. TLT Long Bond ETF did great as did the US (yield 4.6) and Global Utilities (4.3%) as well as US REITs (4.6%). Notably, the Dividend ETF DVY which has been a huge laggard, also did well (yield 4.8%). Interesting that the Staples ETF (2.7%) was not a winner. It seems investors are returning to dividend payers as they might be seeing a peak in interest rates and the dividend payers having fallen too far. Sentiment on these has been historically pessimistic.

Is this the start of a investor preference shift?

The rankings show Innovative Growth areas just okay in performance when before they were big leaders by a wide margin. Extreme Innovation stumbled very badly. Case in point, ARKK fell 88 ranking spots from 27th to 115 0out of 120. FANG Friendly ETF VUG fell a minor 17 spots from 29 to a still outperforming 46 on the list.

Of course, Energy surge to the top of the list but tellingly the globally economically sensitive Base Metals, Steel and Uranium plunged to the bottom of the rankings.

Europe also went to the bottom.

This smells like global and possibly US economic weakness is finally coming into the interest rate picture.

Two sectors, staples and medical tech, are victims of algos gone wild. Algo-driven superfast hot money pile up in short selling when the news that NVO’s obesity drugs showed efficacy in treating kidney disease breaks out and the clinical trial is halted early. Apparently these drugs are perceived in the future to kill a lot business of food companies and medical tech companies. Obviously these are simpleton thinking. But that’s what we get in this market. It also gives us opportunities to pick up some shares at a better price points.

Europe is in bad shape. Germany is in recession. Shares of France’s LVMH crashed, one more data point for China’s uncertain economy. Now NVO is Europe’s biggest company.

NVO’s success is the harbinger of very effective drugs and treatment methods coming in the near future. The accompanying disruption will create a lot of chaos in the market. Looks like Pareto rule of 80/20 will be more like 90/10 in AI era. American big techs will be even more dominant. Investment money will flock here.

What was the deal after SLV? They could price long duration bonds at face value for 1 year…after a year, then what?

Japan the central bank holds a crazy amount of the bonds…yield control.

Can we pay 5% on the federal debt for 30 years? I really doubt it. Can the economy grow that fast for 30 years? Since it is a service economy, which means spending, and debt is so high, where will the money come from?

Rock and Hard place, but no hard money.

We are most likely due for an inflationary depression, apparently they are not rare. Not a Zimbabwe style, but a long period of inflation and sub par economic growth.

If one looks at growth since the 60s, it has been going down, so it is sub par.

Inflation will come as deficits increase, increase, increase…I could go on, but you get my point.

Commodities should do well, but timing is everything.