Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “

Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The

Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found

here.

My inner trader uses a

trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Sell equities

- Trend Model signal: Neutral

- Trading model: Neutral

Update schedule: I generally update model readings on my site on weekends. I am also on Twitter at @humblestudent and on Mastodon at @humblestudent@toot.community. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Dissecting the sources of European strength

As investors wait for the resolution of the debt ceiling talks, I would like to pivot away from the U.S. market and focus on the sources of underlying European strength. As regular readers are aware, we have been bullish on European equities for some time (see

The market leaders hiding in plain sight).

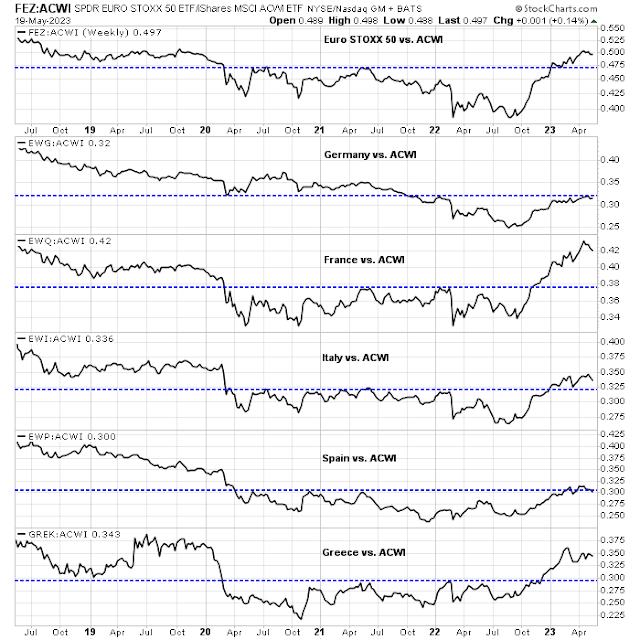

Here is the major reason we are bullish. The Euro STOXX 50 staged a relative breakout from a long base in early 2023. France has been the leader among the major core and peripheral European countries, along with Italy and Greece. However, Germany has been the laggard, testing a key relative resistance level.

I analyzed the sources of European equity strength and show why the latest move is sustainable. The possibility exists that this could be the start of a major bull leg in Europe, much like how the U.S. FANGs led global markets in 2008.

Emerging leadership

One surprising source of European strength has been financial stocks. European financials have been on a tear relative to U.S. financials (top panel). This doesn’t mean that they were immune to banking crisis fears. It’s just that European financials managed to hold a key relative support zone, while U.S. financials, and U.S. regional banks in particular, weakened.

The relative strength of this sector compared to the U.S. has resulted in strong relative performance of markets with high bank weights such as Italy and Greece.

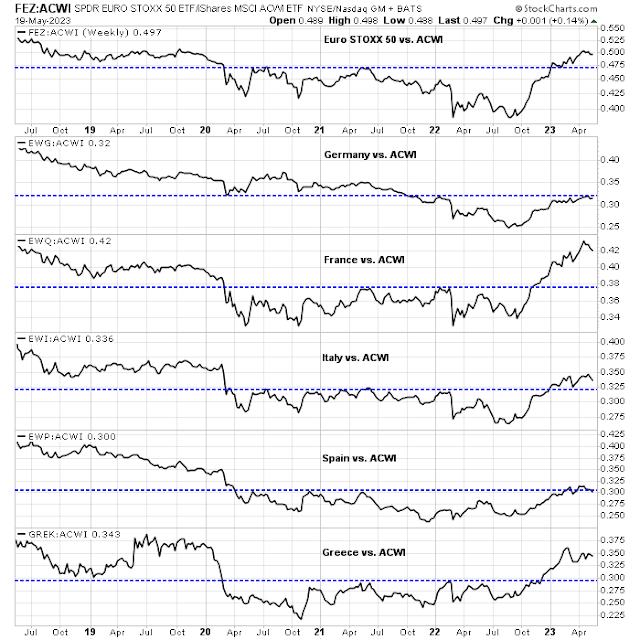

The other strong market in Europe is France. Looking beneath the hood, it is the luxury goods companies that have led French equities upward. Shares of companies like Hermès and LVMH have risen strongly, thanks to spending by the high-end Chinese consumer. Here is Hermès, which has outperformed global consumer discretionary stocks and the MSCI All-Country World Index (ACWI).

LVMH has a similar technical pattern.

I interpret these technical patterns as the market signaling a cyclical recovery from a downturn in Europe, while the U.S. slips into recession.

Special cases to watch

Here are two special cases that investors should watch. Poland has been a major staging ground for Western aid to Ukraine since the start of the Russo-Ukraine War. MSCI Poland recently rallied to a new recovery high and it has been performing well against both Euro STOXX 50 and ACWI. This is a bullish indication of fading geopolitical risk premium and possibly in anticipation of a successful Ukrainian counter-offensive this spring and summer.

No discussion of Europe is incomplete with the U.K. History shows that the relative performance of large-cap U.K. stocks was highly correlated to the relative performance of energy stocks, mainly because of the significant weights of energy in the large-cap U.K. index. The two began to decouple in 2021 and seriously bifurcate in early 2022, reflecting increasing nervousness over the British economy. This was confirmed by the relative underperformance of U.K. small-cap stocks that began in late 2021.

More recently, energy stocks lagged ACWI in 2023 while U.K. large-caps were flat. As well, small-cap relative performance has bottomed against large caps. This is may be an early sign that the U.K. market is bottoming and this is a bullish set-up, though not an actual buy signal, for U.K. equities.

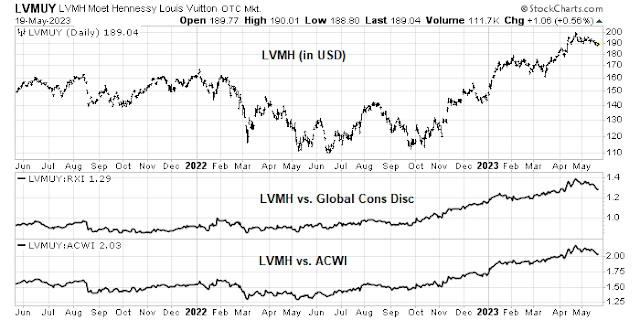

The strength in the UK economy is coming from a surprising source.

The Economist featured an article highlighting the outperformance of the British service sector, while its goods sector lagged.

In conclusion, European stocks staged a relative upside breakout against global stocks from multi-year bases, which makes us bullish on the region. An analysis of the region shows that different sources of underlying strength are sustainable into the future. The possibility exists that this could be the start of a major bull leg in Europe, much like how the U.S. FANGs led global markets in 2008.

There is a mini bubble forming in the US FANG stocks because of AI. All the major hedge fund players like Steve Cohen, Paul Tudor Jones etc. are involved. I was wrong not to catch it. Looking at my P&l I made more this year being short the Nasdaq than being long. However, the strength in SOXX index last week has got me questioning my position. Bubbles and Manias have a life of there own. Hence, if we see more strength next week I would imagine that it would be premature to give up on US FANG stocks.

AI application is real, just like the Internet. It will also create a lot of wealth. As usual, in the process of adoption and finding right business model it will be bubbles, just like the crazy days of 1999. But this time the scale will be smaller because investors are more experienced. The first place in which AI makes big difference is education. Look at stocks of CHGG and DUOL. Imagine a scenario where a lot of unnecessary colleges will shut down while the best colleges getting even more powerful. In business and in society in general the strong will get bigger disproportionally, and at very fast clip. If not handled right a dystopian is very much a distinct possibility.

Read thru reports of all the startups and major advances, most promising are all AI-related and some in energy space (small modular nuclear). AI adoption is very much in high-gear in bio/chem and pharma. Personalized medicine is now very doable in less than 5 years. The current business model of big pharma will be totally overthrown. Too many reports and not enough time, exhausting and exciting at the same time.

I appreciate and welcome readers opinion. More so, if they contradict my thoughts and ideas. It gives me an opportunity to question my assumptions. As a caveat, I almost always have my money where my mouth is. Also, I am a very short term trader. My trading horizon is 0 to 6 days.

Ingjiunn,

Thank you for sharing your thoughts.

Would appreciate if you could share some references / resources (AI, China, etc.) that helped you shape your ideas.

What bothers me about the China story is that there is this huge trade surplus with the USA. So if the USA goes into recession, and/or the consumption post stimulus checks causes a decrease in trade with China because consumption was pulled forward, how does that impact high net worth Chinese and their spending? Since a lot of Chinese wealth is in real estate, if I am not mistaken, and the demographics in China do not support owning excess real estate and recently prices have weakened. At what point does the spending for purses etc slow. We seem to have forgotten the euro issues, the Italian debt etc.

Perhaps sentiment was so bad after the invasion of Ukraine that the eurozone is due for a rise.

Don’t forget that underneath everything is the price of energy. Cheap labor can compensate for expensive energy as can efficient workplaces, but does that apply to Europe?

To what extent does the magician focus our attention on things to change our sentiment?

Do not worry about China. It will not be a global hegemony and it will stay at this location just like throughout history. China today is a country where 100MM+ CCP members lord over the rest 1.3B. These CCP members own the total wealth of China and buying luxuries is never a problem. Apple and Tesla continue to make big money in China, as other luxury brands. This setup will not change unless China breaks into smaller countries. And it is very difficult for this to happen. Chinese as a people has not changed. Many countries changed fundamentally and culturally, like Japan, but China in essence is the same. The only times Chinese revolted are when they starved. But as in Great Leap Forward and Cultural Revolution tens of millions perished and nothing happened. This demonstrates the firm grip of power of CCP. Many Westerners are very naive in dealing with CCP. Be practical and deal with facts and facts only.

China will not go away or change. But we can reduce the relationship over time. There is very little we absolutely need from China. Factories are systematically moving to SE Asia and India/Mexico. It takes time but doable. China will be still happy as the Middle Kingdom.

But Russia is a different matter. The Ukraine invasion has rendered Russia a subjugate of China. This has enraged nationalist Russians. There is real possibilities of Putin being removed from within. Chinese media has started to change Vladivostok to its traditional Chinese name in publication, as well as a total of 10 Russian cities and regions in the border area. Siberia is also a flash point for Russians because of Chinese looting of natural resources permitted by local corruption. There is a good possibility Russia will be pro-West post-Putin because of China. China is not idling and actively courting Central Asia countries.

But you should watch Japan. It is rapidly re-militarize and open up many industries thru cooperation with foreign countries. The deflation is over after 30 years and NIKKEI is finally above 1990 high last week. Buffet has made tons of money since his investment two years ago. Now hot money is pouring in. I like Japan over Europe. A strong Japan financially and militarily is the best for stability in that region.

Nothing really changes does it? I have been wondering how long it would take for friction to develop between China and Russia and they would not be as likely to gang up on us.

Geez, the world is not like when I was a kid.

I think this sums up the market today. Of course, very few will agree with this.

“The market is attempting to break out of its current very well-established trading range, and it’s doing so with very little speculative capital involved and a great deal of short interest, hedging, and cash in large long-only portfolios.”