Mid-week market update: BoA published its monthly Global Fund Manager Survey (FMS) this week and the results were not a big surprise. In the last few months, the FMS had increasingly become a price momentum indicator whose readings were fairly predictable based on recent market trends. Respondent risk appetite was turning up after bottoming out in late 2022 and global managers were buying risk again.

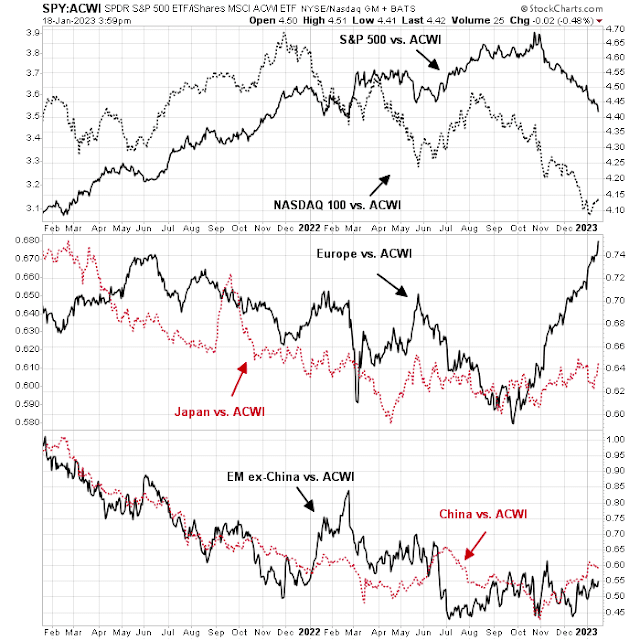

Within their global equity allocations, managers were buying emerging markets (read: China) and eurozone equities and selling US equities, which is consistent with what I have observed in my relative return analysis.

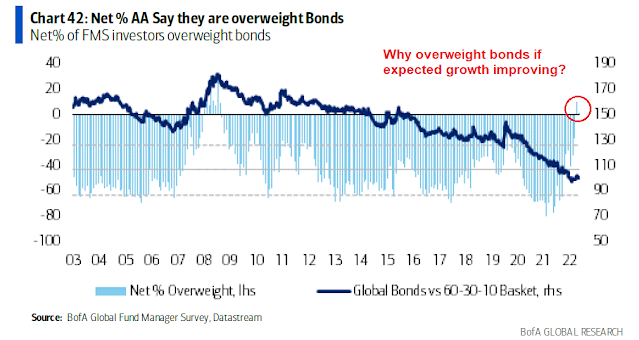

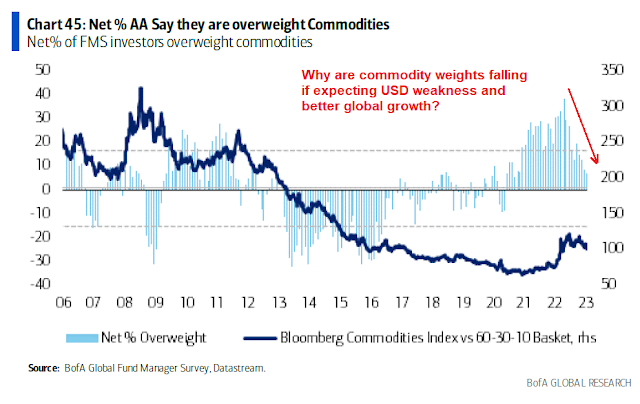

Hidden beneath these obvious headlines is a far more cautious asset allocation positioning that are inconsistent with the macro outlook implied by the risk-on nature of the recent equity stampede. A schism is appearing between the how the asset allocators view the market and how equity managers view the market.

Sentiment divergences

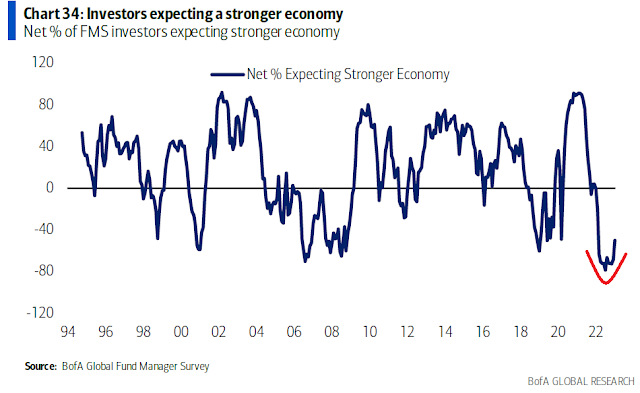

The risk-on sentiment in the FMS is reflective of the turnaround in growth expectations for the global economy.

Here is the puzzle. If investors are expecting stronger growth, why are they buying bonds, which should lag as economic growth accelerates?

Similarly, if growth expectations are rising, why are fund managers selling commodities?

The schism in macro views has been laid bare by the FMS survey. While equity positioning is telling a cyclical risk-on story, asset positioning (bonds and commodities) has a far more cautious view. Somewhere in these vast investment organizations, the left hand doesn’t know what the right hand is doing.

The VIX puzzle

There has been a lot of recent excitement among technical analysts over different versions of breadth thrusts that could potentially signal the start of a new bull market. Many of the historical studies show strong returns over a six and 12-month time horizon.

From a long-term perspective, the VIX Index is nearing a test of multi-year support. Should VIX break support, it would be another reason supportive of the new bull market thesis, as the VIX is historically inversely correlated to stock prices.

Before you get too excited, there is a divergence between the VIX Index and MOVE Index, which is a measure of bond market volatility. Even as the VIX began slowly falling since mid-2022, the MOVE Index has remained relatively steady over the same period. Which index should you believe?

Waiting for the follow-through

Last week’s stock market rally was led by short-covering. The Goldman basket of most shorted stocks surged by 15.7%, which is a level that was last exceeded in April 2020. While short covering provided the spark, the bulls need a FOMO stampede to take hold in the rest of the market in order for stocks to advance further.

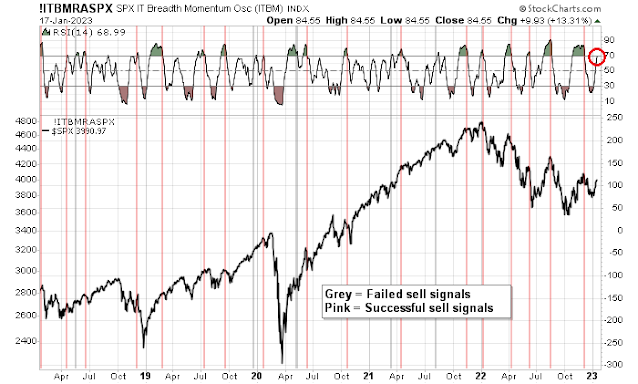

I highlighted a tactical sell signal last week, based on the combination of extremely overbought conditions and a spike in S&P 500 and VVIX correlation, which is an indication that the market is skeptical of the advance. The S&P 500 Intermediate-Term Breadth Momentum Oscillator (ITBM) is on the verge of becoming overbought on its 14-day RSI and real-time estimates of ITBM RSI indicate that it has moved into overbought territory. Further market weakness in the coming days could see this model flash a sell signal, and the ITBM model has been a very reliable short-term trading indicator.

The market continues to grapple with the uncertainties posed by Q4 earnings season. I continue to believe that short-term risks are skewed to the downside. My inner investor is neutrally positioned at roughly the asset allocation weights specified by investment policy. My inner trader is short the S&P 500. The usual disclaimers apply to my trading positions:

I would like to add a note about the disclosure of my trading account after discussions with some readers. I disclose the direction of my trading exposure to indicate any potential conflicts. I use leveraged ETFs because the account is a tax-deferred account that does not allow margin trading and my degree of exposure is a relatively small percentage of the account. It emphatically does not represent an endorsement that you should follow my use of these products to trade their own account. Leverage ETFs have a known decay problem that don’t make the suitable for anything other than short-term trading. You have to determine and be responsible for your own risk tolerance and pain thresholds. Your own mileage will and should vary.

Disclosures: Long SPXU

Is there a short term price target on the downside based on your analysis?

Have bonds moved into overbought territory?

Thanks

The ITBM might flash a “buy” or a “sell”, you meant sell right?

I have to say this market has me confused, will we have a horrible crash or one last hurrah before a horrible crash?

All we can do is watch the technicals and think of fundamentals

Yes, sell signal. That has been corrected in the text.

This is op-ex week. Expect down markets short-term since we have been up so much in such a short period of time. But market internal is very strong. New 52w-lows are so few now. Actually new 52w-lows peaked last summer. Since then many stocks have gone up a lot. There are many 52w-highs now. So if you treat it as a market of stocks, instead of a stock market, you should have found many opportunities. Indices are now range-bound until the mega and large caps join the move up.

Just two simple relative indicators to show economy should be fine: ITB/SPY and SMH/SPY.

Another great call by Cam.

Re Deemer – he pointed out the June 2020 failure in one of his tweet replies today.