Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model that applies trend following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Sell equities

- Trend Model signal: Neutral

- Trading model: Neutral

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

Defying gravity

Why is the stock market holding up so well? What happened to all the warnings from the Fed? One speaker after another warned that the Fed is nowhere near a dovish pivot. CNN reported that former New York Fed President Bill Dudley issued a similar warning that rising stock prices translate into even more rate hikes:

Dudley added that another rate hike of three-quarters of a percentage point is still “potentially in play,” depending on how the economy evolves. He expects the Fed will need to raise interest rates to 4% or higher — up from 2.5% today…

Dudley warned that the uptick in the stock market may be counterproductive because it translates to easier financial conditions. And that’s exactly the opposite of what the Fed wants as it tries to tame inflation.

“Ironically,” Dudley said, “the big rally in financial markets increases pressure on the Fed to do more.”

Wall Street shrugged off the Fed’s warnings and Friday’s hot jobs report. The S&P 500 is testing a key resistance level, and the NASDAQ 100 blew past resistance and it is now approaching a key falling trend line.

Why is the market defying gravity?

The bear case

The bear case is easy to make. I have already outlined the warnings from Fed officials. Despite the strong rally off the June bottom, net NYSE and NASDAQ new highs have not turned convincingly positive.

NASDAQ 100 stocks have been the leaders in the latest advance, but on balance volume, which measures net accumulation and distribution, is exhibiting a negative divergence.

John Authers at Bloomberg reported that Jason Goepfert of SentimenTrader is warning his Dumb Money Indicator is flashing a sell signal.

This threshold generally serves as a good delineator between healthy and unhealthy markets. During persistent bull markets, the model consistently levitates above 60%. When it stays below 60% consistently, sentiment is poor and periods of recovery tend to bring in sellers.”

The chart above shows that Dumb Money Confidence loosely tracks the S&P 500. When the market is going well, the dumb money gets more bullish and vice versa. The last couple of times it significantly rose, it quickly peaked and equities turned as well. That implies that the next down leg is imminent. So far this year, as the chart below shows, Dumb Money Confidence has continued to tend to chase the S&P, and the 60% barrier has twice acted as a point at which the market turns down (bringing traders’ confidence with it):

Earnings estimates are falling

In addition, forward 12-month EPS are falling and the forward P/E valuation is no longer compelling. Q2 earnings season is subpar as measured by EPS beats but slightly above average on sales beats. Perhaps one reason why the market has acted well is forward guidance is better than average.

Nevertheless, it’s disconcerting to see negative EPS revisions across all time horizons.

The bull case

Here is the bull case. Hedge funds are still pressing their short bets in S&P 500 futures and positioning rivals the COVID Crash bottom levels of 2020. The crowded short reading should act to put a floor on prices should the market weaken.

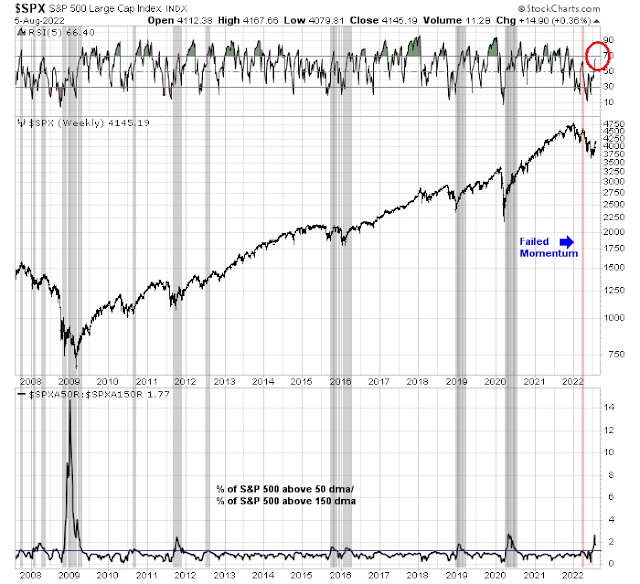

Price momentum (bottom panel) is very strong. Past episodes of strong momentum in the last 20 years have resolved bullishly. The only exception was last March (pink vertical line) when the 5-week RSI failed to reach an overbought condition. Keep an eye on this indicator, if RSI were to become overbought a new bull is confirmed.

All the talk of sentiment and momentum aside, the overlooked reason for price strength is the market may be sniffing out disinflation. The S&P 500 has been inversely correlated with oil prices, and WTI fell below $90 last week, which is a level not seen since the Russia-Ukraine war began.

Tactically, the S&P 500 is following the FOMC pattern of 2022, when the market rallied in the wake of an FOMC meeting. In the past, the peak has occurred 1-2 weeks after the meeting. If history is any guide, that should put the timing of the peak about now.

My base case scenario continues to call for a re-test of the June lows, but I allow that there is about a one-third chance the market is undergoing a V-shaped bottom. The coming days should bring more clarity from the market.

Stay tuned.

THE OVERLOOKED REASON THE RUG WILL BE PULLED OUT FROM UNDER THE MARKET

North American investors (includes Canada) are very myopic, looking almost only at their own markets. That is a big flaw if something very nasty is happening offshore that can sideswipe their home base. That nastiness appears to be the case with my Leading Edge Momentum rankings confirming the recent bad economic and social unrest news out of China. All China-related ETFs are lagging extremely as are their trading partner countries, Korea, Japan, Asia and Germany. Commodity prices have also fallen off a cliff. China is a huge consumer of industrial commodities. The U.S. dollar gains traction in an unstable world putting pressure on global borrowers. Pelosi’s visit to Taiwan is making US relations with China worse and snowballing negative economic policies between both countries could occur. There has been a huge fraud uncovered in China with large portions of copper inventories backing copper futures not in warehouses. We see riots outside banks that won’t give access to savers bank accounts.

This is the second largest economy on earth. A crisis there will be felt everywhere. Investors would be very confused with ramifications as headline inflation would drop, interest rates too initially (with investors cheering) but with the global economy imploding as a sad lagging effect. Stresses could cause a war.

UKX, the UK 100 index is sometimes use as a weather vane for what is to come. In market rallies and bottoms, use of the Smart Money index applied to UK 100 may be of use; in many cases it is less pumped and dumped to extremes as the SPX. A live chart view can also be set up for free on tradingview.

https://i.imgur.com/zrTkevG.png

Good comment by Cam on Twitter about using FTSE 250 instead of FTSE 100 because of more representative of businesses in the UK, the ETF symbol would be HMCX. It looks like the much weaker FTSE 250 is rolling over with the Smart Money index. The last time it did this was June 1, 2022:

https://i.imgur.com/Be1jVY5.png

CPI release tomorrow 8/10/22 at 8:30 ET from the BLS site. Every time in 2022 this has lead to a sell off of 2 to 5 weeks as CPI mostly steadily increased and even when it fell fractionally in April this year, the market sell off was particularly strong, lasting more than 5 weeks. There is usually time to position for the sell off if it ever comes however, because the $CPCE would be elevated and increasing and we saw that in April, May and June but not now so far in August. So this time may be different and there is probably nothing wrong in sitting on the side line and watch.

Live chart of SPX, CPI, SmartMoney Index. CPI would have to drop below 8.29 (blue line) to be significantly bullish by some models:

https://www.tradingview.com/chart/iBqgb4AS/

‘ the $CPCE would be elevated and increasing’

8/9/2022 12:35:28 PM ET

The daily $CPCE has now increased by >12.5% and if the rise stays >11.5% then it would trigger a short signal on the SPX, first time since the top in July.

S&P Futures up 1.7% on CPI 8.5%

The tradingview ‘live chart’ may not update the CPI data live, perhaps by market open. Meanwhile, it appears a lot of traders jumping the gun on the inflation model. Technically, with CPI of 8.5 for end of July, the 6 period (month) MA becomes 8.48, so not quite make the criteria, but may be close enough. Tradestation chart to show the updated inflation trade; the signal is far from perfect and can be early:

https://i.imgur.com/gdyKPGD.png

Apologies to anyone using the live chart (newbie error on tradingview platform). The CPI didn’t update live perhaps because the CPI used was set using monthly and would not have updated until EOM. The live chart has now been updated to use daily resolution and corrected.

Drag chart to the left if you can’t see the price marker on the right axis.

https://www.tradingview.com/chart/iBqgb4AS/

https://www.mercurynews.com/2022/08/07/water-wars-in-a-drying-california-new-money-vs-old-power-in-san-joaquin-valley/

The 21st century version of ‘Chinatown’ playing out in the Central Valley.

The river water is melted snowpack on Sierra Nevada. Who owns the snowpack? A lot of laws need to be changed. This ain’t no robber baron era anymore.

We need a nosy PI and a crook who fathered a daughter with his own daughter to make it interesting.

‘Veteran strategist Dennis Gartman says it’s still a bear market with no Fed pivot in sight.-

-Marketwatch headline.

Scaling into a long SPY position.

Added a second allocation + first allocation into QQQ.

Picking up a little FXI/ BABA.

It is a “inflation has peaked” vs “growth scare” market, today the disinflationary impulse was not strong enough to overcome bad news on the earnings front from NVDA and others. A violent rally would have made no sense with this kind of background and ahead of the CPI report. I’m curious as well if the market can continue to shrug off bad news for another month or two, but I remain reluctant to trsut any breakouts to the upside here. The selling may just come back in full force once the summer doldrums have passed. The geopolitical background is just so very different to the “age of globalization” that we have learnt to trade in for the last 20-30 years – and hope is fading that this is just a brief period of geopolitical uncertainty.

The market frequently moves in mysterious/illogical ways. That’s just the way it is.

The Gartman headline provides added heft to the bull case. If there was a one-third chance of a V bottom on Sunday, his comments probably bumped it up to 35%.

I would even say a 15-20% chance of a breadth thrust on Tuesday that takes the SPX above 4200.

Added to existing positions in SPY/ QQQ in the premarket session.

According to my rough calculations, total monetary base increased by 68%, and Fed’s total assets by 131% as compared to pre pandemic levels. This increase in liquidity may help explain why the market is so strong, despite the impairment in fundamentals. Interest rate is not the only driver of the market, IMHO.

Finally freed up after a long meeting.

Looks like I was wrong. Which happens all the time.

No problem. Closing all positions (SPY/QQQ/ FXI/BABA) after hours for a minor overall loss.

No way am I heading into Wednesday morning long or short. I’ll hope for a little volatility and look for good entries.

It would probably take a move to SPX ~3090 for me to load up aggressively.

I meant SPX 3900.

Wow. SPY +1.6%/ QQQ +2.3% on the CPI data.

The title of Cam’s post says it all.

If I were to look for an entry into SPY it would be at the gap-fill ~412. I doubt that we see it today.

What are the odds of a red close?

You don’t see a flat line CPI month over month like today too often – it is as if somebody drew a flat line on a rising slope. The other time it did this was June 1919 with the record inflation after the last global pandemic of similar size (1918-1919). At the time the CPI number looked hopeful in flattening, but it didn’t and the rest was ugly as CPI continued upwards for another year.

https://fred.stlouisfed.org/graph/?g=SFeE

Live chart of SPY-US inflation rate-SmartMoney index except these are 2 hour bars instead of daily. This shows some distribution even as the market gained 2% – usually the green SMI will try to curl up towards the smoothing orange line as price rises, but not today. If one scrolls back the live chart, one sees a little bit of that on Mar 29, 2022 in a similar gap up where the green SMI could not rise very much even with a gap up and eventually lost it all. Perhaps these are the smart money after all. This has not happened in a while.

https://www.tradingview.com/chart/inBHJqBl/

I don’t know about the rest of you, but days like this (where the market threatens to run away to the upside while you’re sidelined) are the most difficult for me to manage.

It comes down to patience – but the market has a way of knowing exactly when the majority of traders will run out of patience!

They want to have more retail investors join the party before they sell in September. You really want to hold into the next PMI readings?