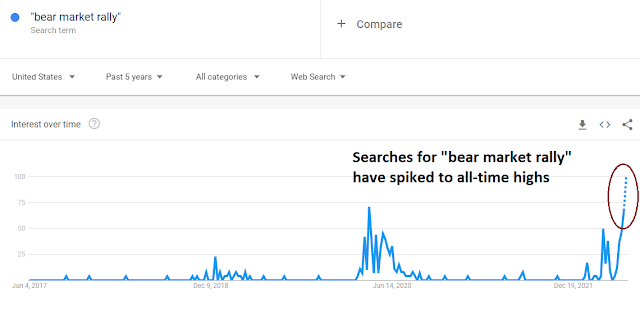

Mid-week market update: As the stock market rebounded from a deeply oversold condition last week, a consensus is building that this is a bear market rally, and I am in that camp. A Google Trends search for “bear market rally” has spike to all-time highs.

The contrarian conclusions are either the rally will carry much further than anyone expects, or the recent bottom represented the actual low for the current market cycle. With that thought in mind, what should the bullish investor be buying?

The insider’s view

The bullish analytical framework begins with insider activity, which saw buys (blue line) outnumber sells (red line) during the last episode of market weakness.

For further detail, JPMorgan analyzed insider activity by sector and found:

- Buying activity in industrials, consumer discretionary, healthcare, technology, communication services, and real estate.

- Selling activity in Energy and Utilities..

- All other sectors have either marginal buy or neutral readings.

An emerging theme

A theme is emerging from insider activity analysis. Insiders are buying the growth stock losers and selling the winners.

Take a look at the relative performance of technology stocks. Relative performance appears to be bottoming out, and so are the relative breadth indicator (bottom two panels).

Communication services shows a similar pattern of bottoming relative performance and improvements in relative breadth.

The consumer discretionary sector is dominated by two growth large-caps (AMZN and TSLA). The sector formed a V-shaped relative bottom. While relative breadth is showing some signs of improvement, the signs of a turnaround is not as distinctive as in the previous two growth sectors.

Industrial stocks, which are not classified as growth but cyclical value, are exhibiting a choppy relative uptrend and some signs of relative breadth improvement.

Healthcare stocks have been in a relative uptrend for all of 2022, though insiders are buying during the latest period of relative weakness. Relative breadth has improved during the latest market rebound.

The technical outlier among the sectors exhibiting strong insider buying is real estate. While the sector is exhibiting a relative uptrend, relative breadth is poor.

By contrast, here are the two sectors experiencing insider selling. Energy stocks have been on a tear, both on an absolute and relative to the S&P 500. However, there may be warning signs that relative breadth may be rolling over.

The utilities sector remains in a minor relative uptrend, but minor signs of breadth deterioration are also starting to appear.

Insiders are bottom fishing

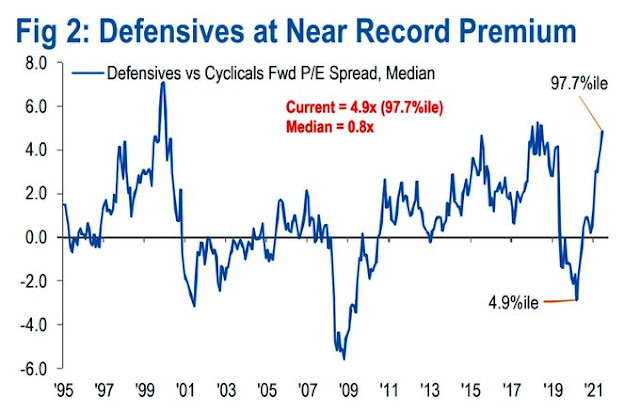

In conclusion, a technical sector review shows that insiders are buying the beaten-up growth sectors, along with healthcare and industrials. They are selling energy and utilities, which may be a sign that some defensive stock valuation has gotten out of hand.

In the meantime, there are numerous studies that point to further market strength based on the strong price momentum shown by the market last week. As an example, Rob Hanna at

Quantifiable Edges analyzed instances when the market exhibited three consecutive days of at least 70% of upside volume. The market tended to consolidate its gains for the next 1-2 weeks, but risk/return was extremely positive after 70-90 trading days.

I will address the bear case in a later post.

Disclosure: Long SPXL

Cam,

As per the chart you posted, Insiders are also buying the Materials sector. What’s your analysis of that sector?

Thanks!

Looks like someone has compiled stats on ‘near misses’ in the ZBT.

https://twitter.com/MohamedHawary/status/1530493299898867714

Closing all positions in SPY in the premarket session. When day trading in a bear market, it seems prudent to lock in an overnight gain of +0.5% immediately (I had about 50% of the portfolio invested).

The premarket gap-up in SPY has faded altogether and is quickly transitioning into a gap down…

Checking in on crypto and cannabis – the dot.coN stocks of the 2020s.

Reopening a position in SPY as it exceeds my sale point in the premarket session. Buying interest may be enough to take prices higher here.

Closing SPY here.

Sure feels like the market wants to head higher.

Max pain? Forcing sidelined investors to chase today’s close ahead of the Friday’s job report – which then catalyzes a move to SPY 420.

Or a move to SPY 399.

There are times when it’s prudent to watch and wait.

Ken is missing in action and awfully quiet, he must be accumulating for his clients. =) I am just kidding of course since we haven’t had any of Ken’s musings lately.

I’m still actively watching. IMO this is a bear oversold rally while the global economy is experiencing a sudden shock. The economically sensitive Value stocks will take us down to the eventual low as earnings estimates drop but that is only slowly creeping into the picture. I’m willing to wait.

I will say that if the junk spreads stop their rally and surge to new highs, I expect all hell breaks loose.

BTW early in every big bear market, insiders buy too soon. It’s when the recession is happening and stocks are WAY down that insider buying marks an important turning point.

Junk spreads may be a coincident indicator. I’m not confident they will give us a warning signal.

https://fred.stlouisfed.org/graph?graph_id=582384

The FOMO is there, but I keep telling myself that a new bull market won’t happen with financial conditions tightening.

https://fred.stlouisfed.org/graph/?g=MD9R

Raising rates to slow inflation, how does it help? I seems to me that what happens is that economic activity slows because the debt burden gets harder to bear and borrowing is less because of the cost. Will this make more food or gas or whatever….ok so prices may come down some because one needs to clear inventory, but won’t jobs be lost? Doesn’t that cause suffering for the less fortunate? I think they would tell us that the cart pushes the horse, that’s why the horse is in front. My problem is that I am debt phobic and what has been going on for many years makes me nervous, but I can’t print money and stay out of jail. Printing will resume at some point because the cart will be tired, or an insolvent sovereign will abdicate? Not likely

I heard a good explanation for this recently: inflation affects 100% of the population. However, if unemployment goes from 3% to 5-6-7%, that only affects a few percentage. Yes, the rich aren’t affected as much by inflation, but their excess risk-taking is clipped quite a bit. And the vast majority of HENRYs (high earners, not rich yet) are actually living paycheck to paycheck.

On days when I’ve left significant gains on the table (I cashed out of SPY way too early), it often helps to compare my actual weekly outcome with the outcome had I opted for the road not taken.

Would I have done better had I not cashed out last Friday? Turns out it would have made no difference.

A position in bond funds split equally between TLT/ IEF/ IEI/ TIP would have resulted in a loss of -1.15% (June 1 dividend payments included). The overall hit to the portfolio would have been 0.4*(-1.15%) or -0.46%.

A position in VT would have resulted in a gain of +1.36%. The overall gain in the portfolio would have been 0.6*(1.36%)=+0.82%.

I would have netted an additional +0.36% by sitting tight.

However, my day trades in SPY over the past two days netted a combined gain of roughly +0.4%.

Neither path outperformed the other.

Good traders are able to keep emotions at bay. That’s not me. So I’m left with the next best approach, which is to neutralize potentially detrimental emotions. In this case, mission accomplished.

Note that any reason(s) I come up with need a factual basis. I can’t just make something up.

TLT changing hands back at the May 17 lows. That may represent a decent reentry point.

Staying away for now.

Decent reentry point for SPY might be 407.xx.

Edging back into SPY @ 410.

Adding @ 410.5x.

Third allocation here as SPY retests 411.

Closing SPY positions here as price falls below 410 for a loss. It happens.

Good gains for the week, however.

Naturally, SPY now waving out the window at me as it charges higher 😉

Possible replay of 05/18/22 except perhaps smaller in magnitude. There was a large $CPCE engulfing spike (touched both sides of Keltner) yesterday morning to take out and reset the shorts and the market rallied nearly 2% with low volume but it is followed this morning by a large spike up in $CPCE today to wrong foot the longs.

It is now taking out the short term market structure high (MSH) short trigger of 4115.50 and possibly 4072.25 (ES.D S&P futures).

https://ibi.sandisk.com/action/share/305de67e-6e50-4266-8f4a-a1ffcc57d6f6