Mid-week market update: One of the concerns I had after last Friday’s market turnaround was that a bounce had become the consensus view. Virtually every technical analyst was calling for a bear market rally, followed by further weakness. It sounded too easy. Either the bounce was going to fail, or the market was going to roar to new highs.

The market followed through Friday’s strength with a 2% gain in the S&P 500 yesterday (Tuesday), but managed to give it all back and more today. The hourly S&P 500 chart exhibited a possible upside breakout through an inverse head and shoulders pattern, which was thwarted by today’s weakness. While there is nothing worse than a failed breakout, it could be argued that the market is in the process of forming the last shoulder of the formation.

In light of today’s market action, is the bounce over?

The bull case

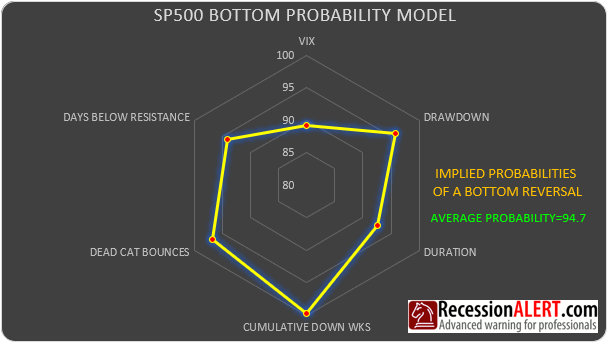

Here are the bull and bear cases for the bounce. Technical analysts were fretting about a lack of capitulation in the market last week. RecessionALERT revealed that ll of its multi-factor S&P 500 models were past their 90th percentiles, which is a highly unusual condition because the uncorrelated nature of the components.

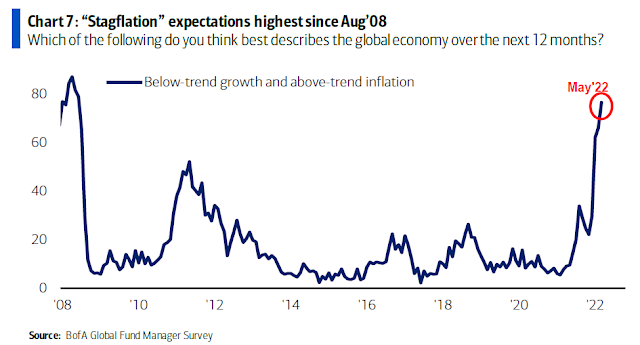

The latest BoA Global Fund Manager Survey also gave some clues about the institutional mood. If this wasn’t a capitulation, then it was a high degree of worry. Cash levels were at levels consistent with past panics and major market bottoms.

Portfolios were positioned for stagflation. Overweight cash and commodities; underweight stocks and bonds. Within equity portfolios, managers were rotating into defensive sectors in order to lower their equity beta.

The behavior of equity factors is also revealing. Low quality junk stocks should be leading the rally in a bounce off a deeply oversold condition. This is precisely the scenario as the lower quality Russell 1000 large cap index is leading the high quality S&P 500.

Similarly, the speculative growth ARK Innovation ETF (ARKK) has held up remarkably well both on an absolute and relative basis in today’s market pullback.

The bear case

Last week’s market downdraft was headlined by the implosion of the LUNA stablecoin, weakness in Crypto-Land is likely to affect overall market risk appetite (see The crypto contagion risk to the stock market). Beneath the surface, the problems in crypto are not resolved. In fact, confidence continues to deteriorate even as Bitcoin struggles to hold support at about 30,000.

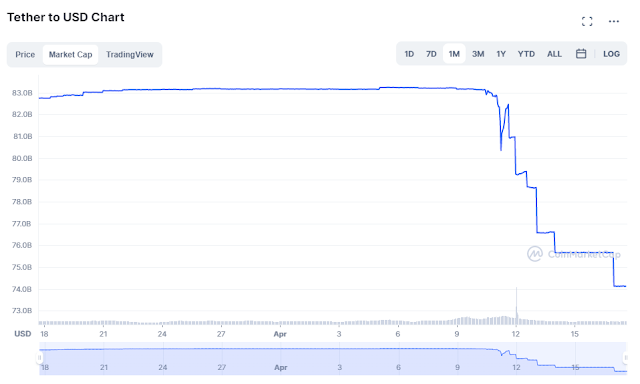

Tether, the largest stablecoin, broke the buck and never recovered. This is like a money market fund trading below par owing to credit problems in its portfolio. Confidence wanes and investors rush to pull out their funds.

Funds are flowing out of Tether. This is what a bank run looks like.

In offshore Crypto-Land, there is no lender of last resort that comes to the resue. Equally worrisome is the refusal of Tether management to document how its stablecoin assets are backed on a 1-1 basis to the USD.

The bulls can argue that since ARKK is outperforming, the stock market is decoupling from the crypto market. The bears will argue that the crypto implosion is just starting and its effects will affect global risk appetite.

The short-term outlook

Here is how I resolve the short-term outlook. Other than a few CTAs, hedge funds had an abysmal Q1 and April performance was also disappointing. Many hedge funds have Q+30 day or Q+45 day redemption windows. We just passed the Q+45 day window and managers have already received their redemption notices. The recent market weakness may be reflective of the redemption pressures, which should abate in the near term.

In conclusion, this is a relief rally in a bear market. Bear markets are volatile and experience short and sharp rallies. I am encouraged by the appearance of a sudden surge of insider buying. A similar episode put a temporary floor on the market in January.

My inner investor is cautiously positioned. My inner trader has been accumulating long positions on weakness.

Disclosure: Long SPXL

Watching CSCO earnings, what are the odds of a disorderly unwind of risk assets starting to happen now? Once we lose last week’s lows should we expect to see some automated selling programs start to kick in? The 1987 market crash started with a very bad Wednesday.

‘Ponzi will not reveal business secret.’ Perfect.

Glad to see Cam hasn’t thrown in the towel.

As much as I’m leaning towards the ‘discipline requires that I sell’ perspective, my sixth sense tells me this is a buy point and not a sell point.

RxChen2

Definitely too late to sell and will definitely lock in your losses. Buying time is closer than selling time with S&P reaching 3800-3600.

Agree. TGT -25%. COST -12%. CLX/ GIS -7%. A sign of capitulation.

Note the recent negative correlation between stocks and bonds.

All kinds of bottom signals.

Naturally, no one thinks it’s a bottom. But we may look back in six months and realize that (as is always the case) that the bottom was hiding in plain sight.

‘Is this the bottom’? No one is quite sure nor anyone wants to stick their neck out. VIX at 40 is the new mantra. However, we had VIX close to 80 at pandemic bottom.

Cam has been faintly consistent in his call for a relief rally. I now think it will come when there is a catalyst to break the momentum. Fed has tripled down on their goal to kill inflation. No catalyst there. China is preparing to reopen Shanghai in the next two weeks and stimulate the economy. This hasn’t provided any support so far. Cessation of hostilities in Ukraine? Not on the horizon. Next CPI report?

It may be a choppy action with a downward bias till then.

I do think long duration bonds can provide a ballast to equities going forward. I have been gradually accumulating municipals and will start adding to higher quality corporates and selected high yields as well.

If bonds move higher (unless it is a flight to safety) and USD weakens, I think it is bullish for equities.

We’ll see.

If anything, I doubt politics will be the who to bring in a good news. There is this western-world-wide narrative that they can blame Russia for every issue when their economic policies are not working as intended. As already pointed out in the comments section, US and the US politicians are likely hoping to drag the war in Ukraine as much as possible for both internal (political) and external (disempowering Russia) reasons.

While recession is not the case right now, this opens up a real danger of doubling down in the next few quarters.

The consensus of the blogs above are yet fishing for the ” bottom”. What is the contrary view point? It won’t happen till they give up or the we have a selling climax. In this market the morning gaps are so big that being on the wrong side of the trade costs you dearly.

Cash is king and chicken little survives to fight another day!

Traders should be aware of the trend and cycle especially now in a strong down trend environment and trying to go long. For educational purposes only, the following chart shows the Spearman’s rank correlation study of not price, but up volume which shows clearly the cycle length and duration one can hope for if one is buying the SPX – it is only about 4 days or so and one can expect about 6 or 7 days of sell off following. Try not to trade against the trend unless a trader has a good reason.

https://ibi.sandisk.com/action/share/05db118c-f941-4479-9558-ccf953135404

For educational purposes and entirely as an exercise, how would a trader trade the bottom in December 2018 based on this chart using Spearman’s rank correlation? We could be in a similar position as the down red arrow on 12/14/2018 with SRC rolling over. Would a trader take a long 12/14/2018 and hope the up volume will show up when it hadn’t done so in its recent past after a peak in up volume? Or would a trader wait for the SRC up vol data to come in and prove itself in the next days and even a week or two? The result in December 2018 was that price bottomed and reversed only after SRC bottomed and flattened out, before rising. A patient trader would have waited for the 10% correction at that time (2600 to 2350).

It is entirely possible that we see something completely different, but there is no way of knowing until the market has traded and the up volume showed up sufficiently in measured time.

https://ibi.sandisk.com/action/share/1fa05ffe-ac70-4165-be24-804f95bb433a

Friday’s options expiration final 30 minutes gave a more favorable picture to the bulls by pinning SPX to 3900, but more selling is likely in the following days. If the market was bullish, SPX will not still be mired at 3900 and down 7 weeks in a row with a 3.05% loss this week. It will end with a reversion and likely in the coming weeks no doubt but the SPX can still see a 6% lower low from here. The last time this happened was in 3/23/2001.

The following chart updated for Spearman’s rank (SRC) using various market internals for EOD Friday showing options expiration has not altered the downward path and the short term bottom could still be days away.

https://ibi.sandisk.com/action/share/987f9a6e-8607-4abc-a78c-d15bc4fbd9dd

What if this correction is similar to the1962 Kennedy Slide?, a loss of 29% from it high in 28 weeks and within that a 14 week slide of 27.7%? Today there was some silly post non-proportionately comparing that ’62 correction to what is currently. The following chart shows what it should more correctly look like in proportion to 1962 – we will have another 9 weeks to the bottom, near 07/22/2022 to a low of 3393 to the neckline that was the pre-pandemic high.

https://ibi.sandisk.com/action/share/c8b14a19-e23d-45cb-b732-e0ab285998dc

Bonds are higher.

VT is outperforming VTI.

I see both as being in the early innings of a mean reversion process.

This would be Day 4 of the window for a potential ZBT buy signal.

Almost inconceivable – which is why it’s now more likely to occur than it was on Tuesday. JMO.

A parabolic rally out of nowhere with no catalyst in sight is what’s needed.

RxChen2

We did get a Parabolic rally, followed by an counter rally. 3-4% up and down.

A durable parabolic rally that generates a genuine ZBT buy signal.

Are we carving out a bottom?

What does this back-and-forth, up-and-down action remind one of?

Earnings estimates are being revised down, CEOs are slashing their expectations, the Fed said loud and clear they don’t care about the stock market and want to bring down inflation. Market makers decided they want to let puts expire at around the SPX ~3900 level. Surely we may have bottomed, but I like to take pre-opex price action with a grain of salt.

https://www.marketwatch.com/story/this-isnt-just-gonna-go-away-long-covid-is-crashing-the-retirement-hopes-of-many-americans-11652961935

A looming health care crisis that – depending on the ultimate number of chronic cases – could easily precipitate an economic crisis as well.

Kids too:

https://www.bloomberg.com/news/features/2022-05-04/long-covid-in-kids-has-effects-that-last-beyond-hospital

What if the earnings misses by WMT/ TGT + decline in home sales tells the Fed they’ve done their job?

What if Ukraine wins the war?

What if the Fed continues raising rates and it no longer matters to investors?

What if Ukraine loses the war and it no longer matters?

The lure of the falling knife…it’s real.

For me, the big question is when the Fed is shown to be wearing no clothes. It won’t be a certain level on the S&P, but I think it will be the inevitable exposure of it’s “inverse Ponzi scheme of suppressing rates”. Just like a Ponzi gets revealed when money flows out faster than going in, the Fed has the same problem, only to the second power.

First it has MBS it says it will unload at some point…Who will buy them, and at what price?

Second it has all these treasuries…ditto, who will buy them and also who will buy the new ones coming out as the federal deficits continue? Unless the Fed buys all this stuff, rates will go higher, and we will have issues of recession, more federal deficit, more carrying costs of the debt.

It’s kind of like….we could nuke ourselves and end inflation too….

So at some point the Fed will be shown to be powerless, just like the politicians have given up even pretending fiscal responsibility for the simple reason that it’s not our money any more and we can still print the stuff, and amazingly people take it.

In Weimar Germany, the stock market did well. I remember years ago reading how the Zimbabwe stock market was the best performing in the world…in Zimbabwe currency of course.

Does anyone really believe the federal debt will be paid back, ever?

From the government’s perspective, low rates help…the Fed is just an intermediary for printing and holding, like Japan. What happens if the market goes up? Well some people have cap gains to pay taxes on and some pension funds are less stressed, or we can have a recession, market collapse, rising unemployment, less tax returns and perhaps less inflation.

The Roman Empire took centuries to decline, and during that time the gold in the currency went from basically 100% to I think around 1%.

The question is….how long will this take? It’s going to hammer the economy Stupid! Are you listening?

The sellers aren’t done yet.

In the meantime, bonds and VT continue to outperform.

VTI prints a new 52-wk low. VT has yet to do so.

I follow a few analysts on FinTwit. They all had been calling for a “bear market rally” for the last 7-8 days, and everyone has been proven WRONG!

Clearly, they all saw something bullish but the market still continued to go down.

What made everyone wrong this time? What did they miss?

Maybe it’s all part of getting retail to sell out. The problem is with psychology, which of course is very fuzzy. It’s also like divergences, which work until they don’t.

For those of us who have a conservative bent, the last decade has been one of waiting for things to come apart, only they haven’t yet.

If you look at the FINRA ? margin numbers, there is an abyss waiting, ditto if cryptos implode, but how come we haven’t had those huge selling days yet?

My biggest worry is that even if I am right on my stock selection that PEs reset to the 70s and so the price of the shares is down even for those that do well.

Don’t overextend yourself, keep a good amount of cash in case we get the big one, and watch the trend.

Right now it may not be down on a 10 year chart, but for the last 5 months we are going down, so if you want to go long….do it in small size that won’t hurt

Probably the timing. When everyone expects the same thing, the psychological conditions just aren’t in place for it to occur. Doesn’t necessarily mean the expectations are wrong – just means it will ultimately take place at a time and in a way that no one expects. That’s just how the market works.

It’s all green.