Mid-week market update: There had been some recent buzz around the positive effects of price momentum on stock prices (see The breadth thrust controversy). In particular, Ed Clissold at NDR highlighted several breadth thrust buy signals, which are based on the positive effects of price momentum. Since then, the equity rally has fizzled and the major market indices across all market cap bands are struggling just below key resistance levels. More importantly, today’s weakness left the S&P 500 just below its 200 dma.

Momentum, Schmomentum!

What bad breadth looks like

Here are some reasons to be concerned. Technical analysts like to talk about breadth. An analysis of different flavors of Advance-Decline Lines shows that the S&P 500 A-D Line has been holding up well, with the others having been far weaker. This is what bad breadth looks like.

From a fundamental perspective, forward margins for the S&P 500 are rising while forward margins for the mid-cap S&P 400 and small-cap S&P 600 are wobbly. In other words, large cap stocks are holding up well while the rest of the market is deteriorating beneath the surface.

Failed momentum

Here is why this matters from a price momentum perspective. Regular readers know that I monitor the Zweig Breadth Thrust indicator, which is based on NYSE internals, on a regular basis. A ZBT buy signal is generated when the indicator moves from an oversold to an overbought condition within 10 trading days. ZBT buy signals are very rare, but they can be highly effective signs of the bullish effects of price momentum.

I also developed a similar ZBT indicator based only on S&P 500 components (bottom panel). The S&P 500 ZBT indicator is less effective and often produces false signals. In the last five years, there were 12 instances when the S&P 500 ZBT indicator became overbought without a classic ZBT overbought signal. The market resolved in a bearish manner in eight, or two-thirds, of those cases.

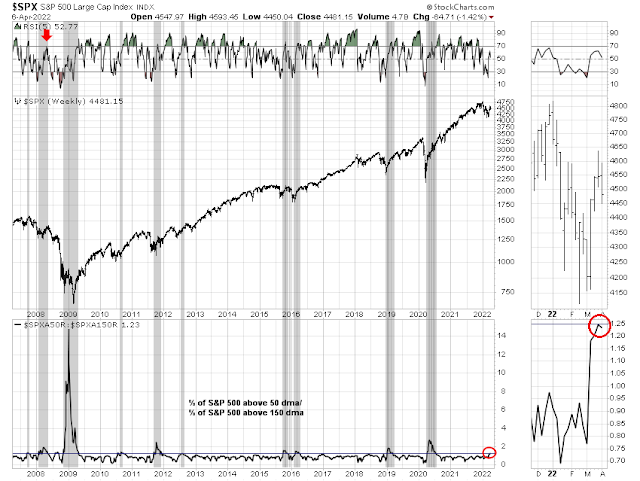

Current conditions are starting to look like the case of failed momentum. Instances of failed momentum rallies are rare. I constructed a momentum indicator based on the ratio of % of S&P 500 stocks above their 50 dma to % above their 150 dma (bottom panel). I defined a strong momentum condition when the indicator reached 1.25. In almost all cases, market rallies didn’t fade until the 5-week RSI reached an overbought condition. You have to go back to early 2008, which is the start of the GFC bear market, to find a similar case of momentum failure (red arrow).

While I am not implying that the market is about to undergo a 2008 waterfall decline, the circumstances are nevertheless ominous.

No sell signal yet

Despite the disturbing internals, I see no actionable sell signal just yet. It’s just a bearish setup. Notwithstanding the false breakdown, the head and shoulders pattern may still be in play, but good chartists know that a head and shoulders formation is incomplete until the neckline breaks.

I continue to monitor the S&P 500 intermediate-term breadth oscillator (ITBM) for a sell signal, based on a recycle of its RSI from overbought to neutral.

Keep an open mind about the anticipated sell signal. ITBM sell signals are highly effective on direction but not on the magnitude of the move. Any decline could be halted at the head and shoulders neckline support.

While my inner trader leaning bearish, he is not ready to pull the trigger and go short. One day at a time.

The Transport Index and the Semi-Conductor Index are generally considered good barometers of the economy and the stock market. They either tend to lead or are coincidental with the general trend of the stock market.

This week they have fallen out of bed with substantial declines. Something to keep in mind and not get caught up in the short term rally. Bear Market rallies are vicious.

The great thing about markets is no one really knows where prices are headed or how/when they get there. When we buy or sell, there is always a counterparty with a different opinion. Which is what makes a market.

Sometimes buy-and-hold is the only way to capture all of the gains (along, of course, with all of the draw downs).

Most of us are by default in buy-and-hold with our principal residences. About a year ago someone at work casually mentioned that it must be nice to have seen my home price increase by 20% in just a few months. I thought he was kidding. There is no way I would have predicted that kind of price movement with home prices already seemingly out of reach for so many. Yet that is exactly what happened – after which prices just kept on climbing.

Is there anything more challenging (ie, more unpredictable) than the capital markets?

It’s difficult to outsmart the markets because price movements are based on sentiment/emotion, and not (necessarily) logic.

Hence the truisms about maximum pain and maximum frustration.

I traded California Earthquakes for Florida Hurricanes. Miami is the new gold rush. The whole of New York hedge funds guys are moving here.

To me this looks like robust athletes playing a game and we are trying to figure out which one will win. Meanwhile the oxygen is being sucked out of the stadium (the relentless rising interest rate and inflation background).

The game seems off and sluggish but these new factors are invisibly at work. Most investors don’t watch macroeconomics. They are too busy figuring out what Musk is doing or Apple is making. Only rarely does the macro appear like a steamroller.

The collapsing bond market this week is ominous. Everything technical as Cam has been saying was set up for a momentum follow through for Growth. But the rug was pulled out from under it by the macro.

Witness mortgage rates skyrocketing and the Home Builders and great companies like Home Depot going down over 30%. At extremes, macro matters most.

Growth stocks thrive on lower interest rates and hate higher, simple. They may show strength occasionally as the oxygen is being sucked out of the air, They are champions that don’t give up easily. It’s sad to see them flounder.

Well this is one thing that they don’t talk about when they speak about inflation. We did a refi early 2021 at 2.875% for a 30 year fixed, now it is 5.1 something! OK that’s somewhere around 70%. Now that is inflation. So what’s the Fed gonna do? You know maybe 8 to 10% inflation vs 70+%…..housing is important….so are they going to leave this huge increase in mortgage rates, let it get even bigger? I dunno, but to me that’s a big deal. Well if the Fed is not buying MBS, what do you expect, who wants to hold on to these hot potato mortgages?

Homebuilders create these huge debts called mortgages, which are someone else’s credits and expanding credit is a big economic boost. Shutting it down is a problem. Never mind financing the federal deficit, to me it’s just a question of when the Fed blinks. What the market will do in the near future is anyone’s guess, but long run, it’s like if you owe the bank a ton of money, will you want to raise the rate?

The collapsing bond market.. deals are getting done. AMC bond deal was oversubscribed several times over. Pension funds and insurance companies are deep pockets and matching their liabilities at a much better yields. The bid/ask is normal. Buyers and sellers are there. Yes, interest rates have gone up and existing bonds are getting repriced. Collapsing? Need credible evidence.

Growth stocks come in all flavors as value stocks do. Those with no earnings and cash flow got clobbered in the stock price but their technology didn’t. Growth stocks like Googl, Microsoft and other of this mold generate more current cash flows than most value stocks. Emotional and sentimental factors play a role in the stock price but not in their value.

I understand the views and camp your investment dollars are in. Mine are in a more sanguine view of the macro. It looks and feels really bad but are the longer term prospects really bad post this period of adjustment?

https://fred.stlouisfed.org/graph/?graph_id=582384&rn=562

Markets discount what lies ahead. What if:

(a) The January lows discounted a black swan in Europe and the gas prices we see today + the rate increases revealed in yesterday’s Fed minutes?

(b) Q1 earnings actually come in better than expected?

(c) The next Fed surprise arrives on the wings of a dove?

(d) A protracted war in Ukraine transitions into a peaceful resolution?

Did the markets set a ST bottom this morning? I have no idea, but it’s looking a lot better right now.

Hi Cam,

Do you follow Dow Theory? The Transportation Index made a lower low – broke the previous low before we had this sharp rally.

Down So Long It Looks Like Up.

It’s been negative for quite some time. I’m starting to look over the valley to the other side. Things will get better in the second half, and the market should begin discounting that scenario.

Some people sees weakness some sees strength, that is how markets are made. The summation indices of S&P and Naz (red and green respectively on these charts) may offer a clue but it is often not conclusive. The daily is showing weakness but the weekly is showing 4 weeks of strength and longer term you have to go with the weekly strength which is 4 weeks and counting. If this keeps up for another week or two, it may actually be bullish. Have a nice weekend.

https://ibi.sandisk.com/action/share/339e5096-3f04-4e95-a451-333f24f7e232