Some chartists have recently become excited over the commodity outlook. Setting aside the headline-driven rise in oil prices, the long-term chart of industrial metals like copper looks bullish. Copper is tracing out a cup-and-handle pattern breakout that targets strong gains in the years ahead. Moreover, the one-and the two-year rate of change, which is designed to look through the effects of the COVID Crash, are elevated but not out of line with past bull phases.

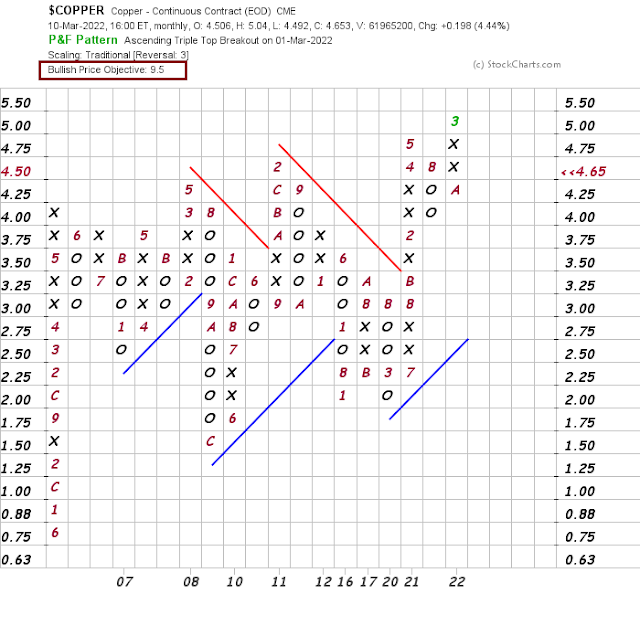

The point and figure chart of copper appears equally impressive. The measured target on a point and figure breakout is an astounding 9.50, which is over a double from current prices.

Is this the start of a new commodity bull? I would argue that this is not your father’s commodity bull market.

Bullish chart patterns

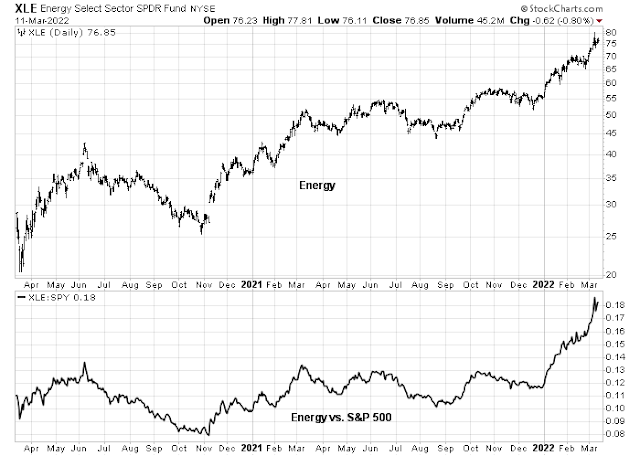

The chart patterns of commodity-related equity sectors look equally impressive. Energy stocks are already in both absolute and relative uptrends.

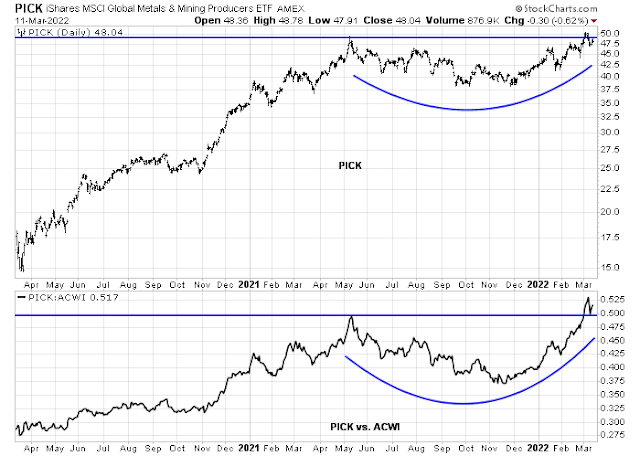

Global mining stocks are testing resistance while forming a saucer-shaped base, and they have already staged a relative breakout when compared to the MSCI All-Country World Index (ACWI).

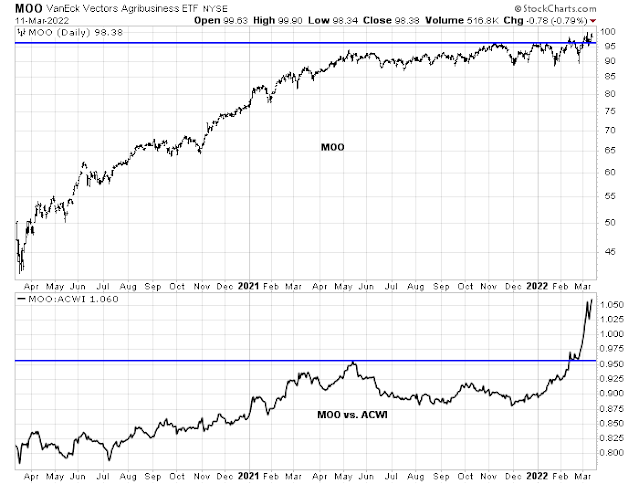

The agribusiness industry has also staged an upside breakout from a long base, and the relative breakout is also evident.

Demand destruction ahead

While I love a commodity bull story, there’s a difference between a healthy bull and a destructive one. We are headed for the latter. Commodity bull markets are caused by a supply/demand imbalance. A healthy bull stems from demand outstripping supply.

On the other hand, a destructive bull is caused by a shock of supply withdrawal. If supply can’t come online quick enough, prices must then rise to the point of reducing demand. That’s a destructive bull market because it’s unsustainable. Prices spike and then crash as consumers pull back on demand.

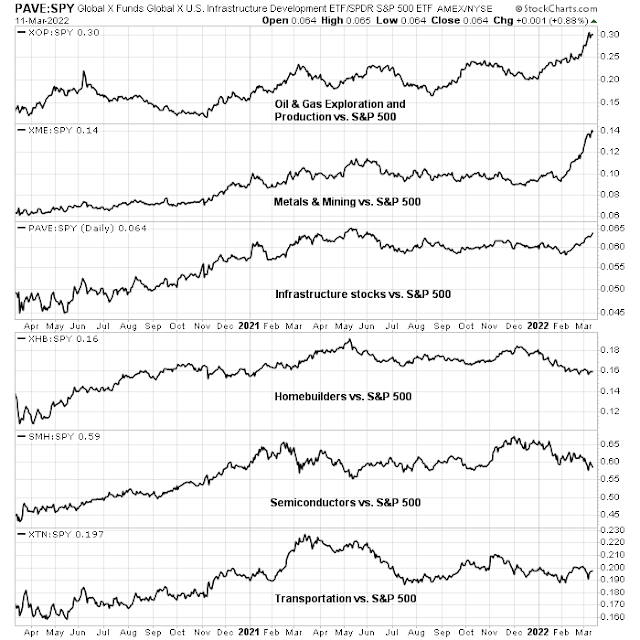

Here is what a supply shock looks like. The relative performance of cyclical industries tells the story. The relative returns of oil and gas extraction and mining stocks have suddenly spiked, but the relative returns of other cyclical industries are range bound. In a healthy bull, strong cyclical demand should be lifting all boats. Instead, this is a picture of a supply shock related to the Russia-Ukraine war.

A long-term analysis of the CRB Index shows that it staged an upside breakout through a falling trend line (dotted line) but it is approaching a key resistance level. The one and two-year rates of change are highly extended by historical standards.

The commodity price spike is also causing dislocations in the financial markets. Nickel prices soared to as much as $100,000 per tonne on the LME before the exchange suspended trading last week. Chinese tycoon Xiang Guangda, who controls the world’s largest nickel producer, Tsingshan Holding Group, had built a large short position in nickel futures and is rumored to have incurred losses of as much as $2 billion at the price peak of $100,000. The company later secured a bank lifeline and prices stabilized in Shanghai, though the LME nickel market remains suspended.

Imagine the panic if this had happened in wheat or corn and the hedger was a Russian or Ukrainian producer that couldn’t meet its margin calls.

A hawkish Fed

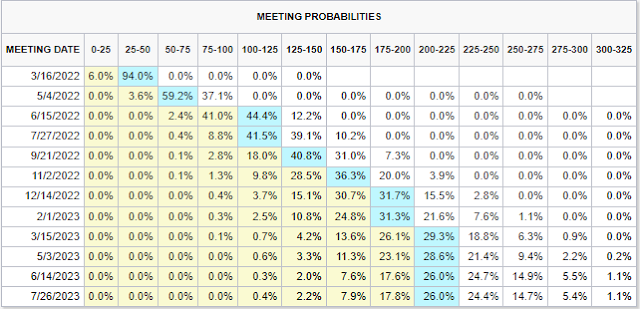

The commodity price spike puts the Fed in an uncomfortable position. The February CPI print was in line with market expectations, but headline CPI reached a 40-year high and it is expected to rise further owing to the strength in energy and food prices. As a consequence, Fed Funds futures have turned even more hawkish. The market now expects rate hikes totaling 1.75% by the December FOMC meeting.

The silver lining is that energy intensity has fallen dramatically since the Arab Oil Embargo price shock of the 1970’s. Energy expenditures as a percentage of PCE (blue line) and gasoline prices to average hourly earnings as a measure of affordability (red line) have both risen but levels are not extreme compared to their own histories.

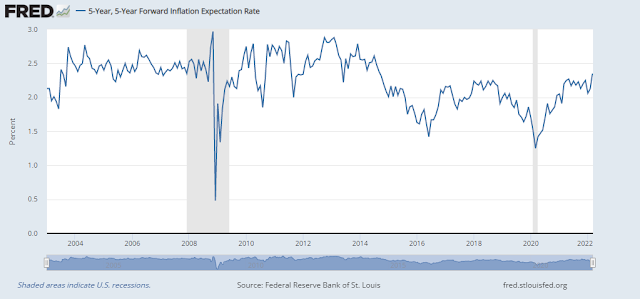

However, inflation expectations are rising and they are at risk of becoming unanchored. Jerome Powell is

on record as willing to drive the economy into recession in a Volcker-like manner. Is a recession ahead? When will the Fed stop?

Even Paul Volcker was cognizant of financial stability risk – and the first task of central bankers is to be financial firefighters. Don’t forget that the Volcker Fed eased policy in response to the Mexican Peso Crisis in August 1982.

The accompanying chart is a history lesson of that era. The DJIA, which was the market benchmark of that period, topped out in 1981 as the Fed tightened policy and raised rates. The share price of Citigroup, which is representative of the banking group, topped out with the Dow and began a slow descent as financial conditions deteriorated. Cyclical indicators such as the platinum-gold spread, which was relevant because both metals had precious metal components but platinum also had an industrial use in automotive catalytic converters, topped in early 1980 and fell negative. When Mexico announced that it couldn’t meet its debt obligations and devalued the Peso, financial stress spiked and threatened the stability of the US banking system. The Fed responded by easing policy and that incident marked the beginning of a long equity bull.

Fast forward to 2022. How far is the system from a Mexican Peso Crisis moment? To be sure, yield spreads are rising as financial stress increases, but readings are nowhere near crisis levels. Don’t expect the Powell Put to be activated under the current conditions.

An unexpected supply shock

In summary, the latest spike in commodity prices should be interpreted as an exhaustive move instead of the start of a new bull cycle. It is a supply shock that should resolve with demand destructive in the coming months, which implies a slowdown in economic activity. The yield curve is flattening quickly, indicating market expectations of an economic slowdown.

I had highlighted last September a different source of stagflation risk. Former Fed economist

Claudia Sahm (of Sahm Rule fame) observed that the risk is “supply chain disruptions became more frequent as climate change disasters become more commonplace”. Little did I expect the supply chain disruption would come from a war. As an illustration, a recent

Financial Times article reported that Volkswagen warned that the economic damage from the war could be even worse than the pandemic.

Much will depend on how the war develops and the evolution, the effects of the accompanying sanctions, and how governments react to shortages.

In conclusion, the recent strength in commodity prices is exhaustive and not the start of a secular bull trend. Treat any narrative of a new commodity bull or super cycle with caution. To the extent that investors hold or overweight energy and mining stocks, consider rotating into long duration Treasury bonds in anticipation of a bond market rally as the economy slows.

Excellent article, that dovetails nicely with your earlier missive of fading the commodity rally (a few weeks ago). Thanks.

Would you reduce gold and oil positions as well?

Yes

Thanks.

“consider rotating into long duration Treasury bonds in anticipation of a bond market rally as the economy slows”.

Would TLT (and IEF) be a good way to gain this exposure, or is there any other mechanism?

IEF and TLT are ideal vehicles. If you want a high beta play, consider ZROZ.

Thanks.

The copper/gold ratio is rolling over which confirm Cam’s observations.

Agriculture in my opinion will be a consistent performer. Ukraine and Russia are huge exporters of ag commodities. Plus climate change is hurting production. So modern ag methods are needed. Nutrien and MOO are acting better than energy or mining stocks.

Maulden this morning is calling for a global recession and bear market especially in emerging markets. I agree.

I believe gold has started a long term uptrend on inflation as well as future doubts of the American dollar as the reserve currency after weaponizing it against Russia via SWIFT sanctions and seizing their foreign reserves.

“I believe gold has started a long term uptrend on inflation as well as future doubts of the American dollar”

1. Would Crypto be in the same basket as gold?

2. Has oil been weaponized also, and if so, do you think oil positions should not be sold here (or add on a dip)?

Well,

Cryptos are not holding up as well as Gold. They are not crashing either, so I guess there is some value in Cryptos. So, the long term thesis of Cryptos as a limited resource, investable as Gold, isn’t quite working. The question becomes, since humans like to hold on to something tangible, to feel “owning something”, which is Gold so far in history. Something that can be wiped out by one EMP, does it feel tangible enough to be an Asset? =)

Emerging markets will likely suffer more than the developed markets because of this staggering inflation. I won’t be surprised to see some riots and uprisings either.

You pointed out here first about the impact of SWIFT sanctions and freezing of foreign reserves. Thank you. What do expect to replace the USD as reserve currency? Russia and China won’t replace USD with Euro. There isn’t enough gold and silver in the world. China doesn’t have enough friends to get the yuan accepted as the reserve currency.

The creation of Euro was partly driven to push back against the hegemony of USD. It only succeeded partly.

Some points worthy of consideration:

1. It is irrelevant if it is “your father’s commodity Bull Market or not”. Bottom line is that prices are rising and will continue to rise till demand equals supply or is less then supply. To guess when that will happen is again trying to catch the turn. You are better off using trailing stops and getting stopped out at some point in the future. As of now XOP and XME are up in excess 30% for the year. DBC is up 25%.

2. Ken and I have both pointed out in our past missives that Gold and Oil are in a bull market. I would like to further add that Gold Mining stocks as a general rule have more explosive moves then the metal. GDX would be my choice.

I suppose, one can maintain gold and oil, but lighten up on other commodity exposure?

If one looks at the actual market forces going on without exogenous events perhaps we get a better idea of what to expect.

The pandemic was not due to markets, it affected them and oil prices crashed along with the markets, but then worked their way back up. Now we have the Ukraine, this is also in my opinion exogenous, so things should settle down with time.

We are due at some point for a recession, which also should be bearish for prices.

So although I expect at some point central banks will print to avoid a depression, I think it will occur in response to a recession which will most likely depress all prices, including precious metals. I am concerned by the divergence of GDX and Gold, new ATH in gold, but not in GDX, does it mean anything?

When, no idea, but I would be surprised if we go 5 years without one, so keep some stops, take money off the table.

GDX and GLD do not move in tandem (we are seeing something similar in energy; XLE is much cheaper than oil prices suggest. Historically, sometime GDX has outperformed and vice versa. With rising input costs (=oil), GDX may underperform GLD. Mining is usually sensitive to energy costs and in the current environment, GLD may be a better instrument than GDX, IMHO.

GDX is trailing gold because of the cost of extraction goes up because of energy cost. The cost of extraction of gold mines on average is $1200. At some point in the future the price of GDX and junior mines will accelerate.

So many moving parts that interact and affect various asset classes.

Gold – I think it will have stronger demand from Central Banks for holding the reserves. Crypto can be blocked (FBI traced and seized accounts with stolen crypto goods). Countries friendly or not to the western world will diversify. GDX could be a tactical alpha play but Gold is the alternative reserve currency.

Copper, Nickel, Chromium have secular tailwinds of EV and Batteries. Demand will go down during recession but recessions average 18 months. Clean Energy and renewables are the big macro trend of the next decade. Policy is behind it. Why fight the Big Government?

Oil is more cyclical and at current prices will encourage more production. It always does. Russian oil will find buyers in China, India and other nations at reduced prices. We started to reduce our XOP position.

Natural Gas – This commodity will be in an uptrend. Not so easy for Russia to build pipelines or LNG terminals. Looking for ideas on best investment vehicles.

Wheat, corn – Agricultural products are always subject to exogenous factors. Not enough rains or too much , or too late etc. (One became acutely aware of it growing up in India. I remember having to skip a meal every month due to nation wide food shortages). The unfortunate situation in Ukrain hopefully ends soon enough to plant the spring wheat crop. Russia should have no issues planting in Spring. So, this may be a tactical opportunity at best. If not, the demand for nutrients would diminish as well. You can’t use twice the nutrient to double the production!!

The big question is economic growth or lack there of. Are we going into a recession in US and other parts of the world? What that would do to interest rates, commodities, value stocks and GARP stocks?

No one really knows yet contrary to various calls on both sides. Some are calling for 20% increase by year end while some are calling for a recession by then. Both can’t be right.

Being an intrepid septuagenarian, I believe it will be ok. Invest for the long term. Trade for the short term. US has been and will be a land of technological innovation. Companies that are down 70-80% have great technologies by and large. Many will go away but many will be leaders of the future.

USDA’s recent report on grains.

https://downloads.usda.library.cornell.edu/usda-esmis/files/zs25x844t/9593vz755/v979w611p/grain.pdf

A very good post. I agree with you on most points. On copper, I would just point out that most analysts are forecasting sustained deficits in copper supplies for many years to come. The industry hasn’t made a discovery of a major copper mine in many years.

On natural gas, Russia already has pipelines to China. It will take Europe many years to build alternative sources of energy. Meanwhile, they have no other option but to rely on Russian gas. If the relations between Russia and the West do not improve, Russia has to build pipelines and LNG terminals to somewhere.

Regarding agriculture products, the war is not ending soon. I just think Ukraine won’t plant a full spring crop this year. Russia may also be dependent upon western equipment and even seeds which may not come.

Thank you.

There is heightened uncertainty and hence volatility. Each commodity has its context and nuances as you point out.

If West is serious about weaning itself from Russian energy, it has the financial and technological prowess to do so in an expedited time frame. Saudis and Emiratis security interests lie with the West. Negotiating better treatment from Biden for their war in Yemen will open up the spigots. Do they want to be blamed for a US recession due to oil prices? I don’t think so.

Europe has woken up to the fact that transition to clean energy will take longer. Natural Gas and Nuclear (yes, nuclear) are good alternatives during the transition. I do think that NG/LNG will be in an uptrend.

But, above all, keep an open mind.

My understanding of Cam’s postings since December is that:

Prepare for slower growth and a possible recession in 2023. Favor quality growth companies with great balance sheets and CASH flows ( 60% equity or the policy position) Fade value stocks.

Long term bonds in anticipation of slower growth (40% of the bonds or policy position).

Negative on commodities.

Cam,

I’m seeing a lot of contradictions in this post. On one hand, yield curve is flattening quickly, indicating market expectations of an economic slowdown. On the other, the market is expecting the Fed Funds to reach 1.75% by Dec. Powell won’t endanger a recession by raising rates so quickly in an election year.

I am not sure if it is reasonable to compare the rise in commodities to the flat cyclical industries. Oil & Gas, metals are global markets while homes and transportation are more national in nature, and there affected by global vs local forces. Both homebuilders (XHB) and semiconductors (SMH) are suffering because of the supply-chain issues, not because of lack of demand.

Yes, there will be demand destruction but will it be greater than the supply shock caused by the Russia-Ukraine war to oil & gas, grain and metals production? The war is not over and may continue for many weeks or even longer. No spring planting in Ukraine. I don’t know to what extent if the oil & gas, and metals and Ag production in Russia is dependent on tools and seeds from the West. That’ll production as well.

It is probably not the beginning of a super-cycle but the demand and supply probably won’t be in balance for many months to come either.

If the bond markets rally, shouldn’t that boost the tech / growth stocks as well? Are stocks a better bet here?

Yes, there is a lot of contradictory opinions here. That said the cardinal truths the way I see it is the Fed is on throat of the markets, it is going to control inflation that generally is not good for commodities, gold complex included. One can make a tactical case for long dated treasuries, as growth slows or we head into a mild recession.

Recession due to increase in rates would strengthen USD again bearish for oil, and other commodities also (this is not what Ken is saying though). One off factors like war usually have a limited life, and should fade, at some point (like pandemic).

DV,

I don’t think the Fed can afford to raise the interest rates beyond a token amount. It is bound to cause a recession or even worse. The global economy is very leveraged. It will just unravel the house of cards we have built over the years. It’ll tolerate higher inflation rather than bust the economy for now hoping that supply-chain issues will be resolved and the war will end, easing inflation.

ECB won’t raise interest rates in 2022. Both monetary and fiscal policies are likely to be loosened this year to address the oil and electricity prices, and increased defense spending.

The US may attract the capital from Europe as Europe now looks riskier. The odds of a chemical and/or nuclear war have definitely risen. And, so have the odds of a recession. The USD may strengthen in short-term.

Oil may be peaking partly because of demand destruction, and partly because of additional supply (international reserves, Iran, Venezuela, etc.), and partly strong USD (like you said).

I don’t know if the other commodities (copper, gold, Ag) are peaking yet, short pullbacks aside.

Yes, wars usually have a limited life. I don’t think Russia can fight for years but they can continue for several months. If that’s the case, peak for some commodities may still be out.

Russians respect strong leaders. There is only one way out for Putin – a decisive win. I don’t know how he is going to spin it for domestic audience.