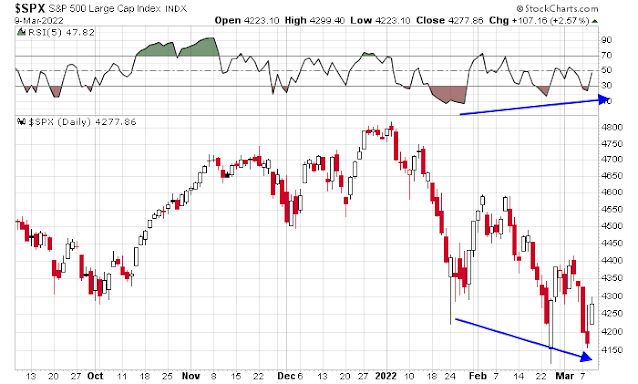

Mid-week market update: The S&P 500 put in a potential double bottom when it tested its recent lows while exhibiting a positive RSI divergence. Stock prices rallied on the news of a ceasefire in order to allow civilians to evacuate.

News from the front

- A constitutional change that Ukraine would not join any blocs, i.e. EU or NATO;

- Ukraine recognizes the breakaway regions become independent republics; and

- Ukraine cedes Crimea to Russia.

Russian forces are tied to railroad from factory to army depot and to combined arms army and, where possible, to the division/brigade level. No other European nation uses railroads to the extent that the Russian army does. Part of the reason is that Russia is so vast — over 6,000 miles from one end to the other. The rub is that Russian railroads are a wider gauge than the rest of Europe. Only former Soviet nations and Finland still use the Russian standard — this includes the Baltic states.

Russian forces have a much smaller logistical tail compared to western forces.

Russian army logistics forces are not designed for a large-scale ground offensive far from their railroads. Inside maneuver units, Russian sustainment units are a size lower than their Western counterparts. Only brigades have an equivalent logistics capability, but it’s not an exact comparison. Russian formations have only three-quarters the number of combat vehicles as their U.S. counterparts but almost three times as much artillery.

The Russians don’t have enough trucks, and Ukrainians have been ambushing supply truck convoys.

The Russian army does not have enough trucks to meet its logistic requirement more than 90 miles beyond supply dumps. To reach a 180-mile range, the Russian army would have to double truck allocation to 400 trucks for each of the material-technical support brigades. To gain familiarity with Russian logistic requirements and lift resources, a useful starting point is the Russian combined arms army. They all have different force structures, but on paper, each combined army is assigned a material-technical support brigade. Each material-technical support brigade has two truck battalions with a total of 150 general cargo trucks with 50 trailers and 260 specialized trucks per brigade. The Russian army makes heavy use of tube and rocket artillery fire, and rocket ammunition is very bulky. Although each army is different, there are usually 56 to 90 multiple launch rocket system launchers in an army. Replenishing each launcher takes up the entire bed of the truck. If the combined arms army fired a single volley, it would require 56 to 90 trucks just to replenish rocket ammunition. That is about a half of a dry cargo truck force in the material-technical support brigade just to replace one volley of rockets. There is also between six to nine tube artillery battalions, nine air defense artillery battalions, 12 mechanized and recon battalions, three to five tank battalions, mortars, anti-tank missiles, and small arms ammunition — not to mention, food, engineering, medical supplies, and so on. Those requirements are harder to estimate, but the potential resupply requirements are substantial. The Russian army force needs a lot of trucks just for ammunition and dry cargo replenishment.

For fuel and water sustainment, each material-technical support brigade has a tactical pipeline battalion. These have lower throughput than their Western equivalents but can be emplaced within three to four days of occupying new terrain. Until then, fuel trucks are required for operational resupply.

The UK estimates that the war costs the Kremlin about £1 billion a day, which is a strain in light of the severe sanctions imposed by the West. The latest briefing from the Pentagon indicates that the Russians have committed roughly all of the forces arrayed at the beginning of the invasion, which is about 190K troops, which amounts to roughly 55% of all available ground troops. This compares to about 24% of US ground force commitment for the invasion of Iraq during Gulf War II. Retired Australian Major General Mick Ryan wrote:

In military operations, casualties and fatigue, as well as equipment losses, wear and tear, will decrease force strength over time. Rotation of forces is necessary for any missions of even medium length duration. Humans can only fight for so long before becoming non-effective.

While Kyiv is at risk of encirclement, current Russian force strength in the north is insufficient to create an effective cordon around the city. Most military analysts estimate that it would take about half of all Russia’s invading forces to encircle Kyiv, which would be a stretch in light of military operations in the rest of Ukraine. Add to that the necessity of force rotation, the Russian High Command faces a problem. On the other hand, Ukrainians are receiving western aid in the form of anti-tank missiles and other weaponry, as well as a reported 40K foreign volunteers to help defend Ukraine. It’s a race against time to see if Ukrainian forces can hold out before Kyiv is besieged.

In summary, the Ukrainians are exposed militarily but the Russians are close to exhaustion and vulnerable to supply disruptions. If there is no settlement, this could be a long war that could last years. Western sanctions are certain to bite well before then and the Kremlin will face both military and domestic political problems.

Both sides have strong incentives to settle.

Short-term equity outlook

What does this mean for the stock market? One hint can be found in the price action of European stocks, which are the most sensitive to the Russia-Ukraine war. The Euro STOXX 50 ETF (FEZ) traced out a bullish island reversal similar to the ones seen in November 2020, July 2021, October 2021, and December 2021. The odds are that the latest reversal will also resolve in a bullish manner, which should positive for all risk assets.

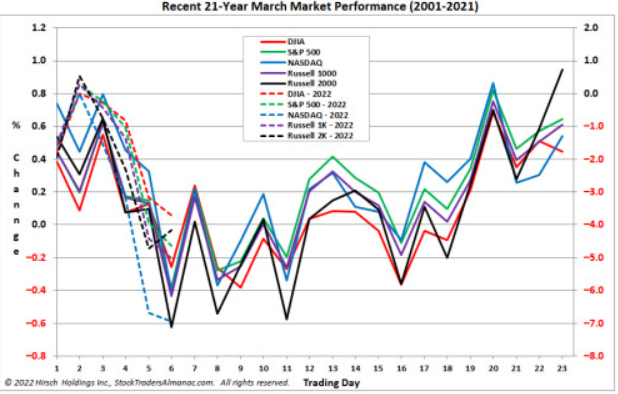

Jeff Hirsch at Almanac Trader pointed out that the market has tended to weaken early in March and find a bottom around the sixth trading day of the month, which is today. The subsequent trend has been choppy but exhibited a bullish bias until the end of the month.

That sounds about right. Tomorrow morning’s CPI release and next week’s FOMC meeting promises to be sources of potential volatility.

In conclusion, stock prices have likely reached a short-term bottom, but the coming weeks could still be treacherous. My inner investor remains cautious, but my inner trader is still long risk.

Disclosure: Long TQQQ

We could be making a falling wedge, but to do it right, prices would have to drop briefly below 4100, which would not please me. or we could have finished the correction and be heading up but we would need to be a lot higher for that. There are many other possibilities, of course, but what impresses me is how well the market has held up

Cam, thanks for the fascinating analysis.

This looks like a job for options.

Cam, that was a fascinating analysis.

Btw, is there a good WWII movie about military supplies? Though less captivating than pummeling cities, it could nonetheless be quite absorbing.

Here’s an interesting read on the on-going negotiations. Seems to reflect the public sentiment.

https://theweek.com/politics/1011048/peace-in-ukraine-is-worth-putins-price

You have missed the key issue which is not whether you can trust Putin. He has been at war with Ukraine for 8 years and is currently killing civilians. There will be no ‘deal’ to leave Ukraine alone until Putin thinks he benefits, that is, when he is militarily losing. Putin has repeatedly said Ukraine is not a country. How can you negotiate with him when he starts with that, and begins a total war against Ukraine?

I think as Cam outlined, he may want to end the war to save face. His military campaign is not going well. He has deeply underestimated the Ukrainian resolve and the pushback from the rest of world. He also needs to save Russia’s economy and his own crown.

He has united NATO, EU, turned neutral countries into NATO members, forced Germany to turn to nuclear energy and take up defense, and of course made Russia a pariah state for many years to come. I don’t think he ever expected this.

As you rise to the top, you lose touch with the reality. Ultimately, you only get left with ‘yes’ men who never bring you bad news. It is possible he is getting a taste of reality now.

I also think time is on Ukraine’s side. They will get stronger over time while Russia weaker.

The ‘deal’ is a good off-ramp for everyone. Fingers crossed! Peace.

Having experienced the wrath of the world he will think twice before pulling any dirty tricks after a peace deal. More importantly what can be done now for the Ukrainian people is to at least give peace a try by going neutral on NATO & EU. Failing to do that will only fuel the theory that the NATO powers are encouraging innocent Ukrainians to fight their geopolitical war for them without sending in a single troop. Heck, now politicians aren’t even shying away from saying that they want to make use of innocent Russians by making them so miserable that they would be desperate enough to revolt. It’s not like they can help it if they can’t not ‘elect’ Putin given the circumstances and brainwashing that happens.

Is there a rule that says you have to draw your Price-RSI arrows below the curves? Why not above – then you get both pointing down, and the implication is a continued bear market. Or perhaps you can ‘average’ the arrows, with the same conclusion.

Good point, that is why Technical analysis remains a challenged premise.

Right. Should we focus on a series of higher lows – or a series of lower highs?

Scaling back in – small – to trading positions in SPY/ QQQ.

You know what? I’m closing ALL positions on all time frames right here and flipping to a bearish outlook.

Just barely green ytd and prefer to keep it that way for now.

This could change fairly quickly but if you are bullish so far this year, you are fighting a losing battle. The common notion that upvolume days (say 80%) should be bullish would be wrong. If you had shorted on daily close that were 80% up volume and held the shorts for more than 5 trading days, the cumulative return so far in 2022 would have been 13.40% with a maximum drawdown (trade close to trade close) of only 0.15%. There were 5 trades with one on-going. All the winning trades were 4% gains or more and only one losing trade which is a scratch at -0.13%. So the odds so far is against the bulls for 2022.

The last short signal was yesterday Mar 10, 2022 on close.

edited: should be Mar 9, 2022 on close.

I should specify that this strategy used $upvolsp and $dnvolsp, the respective S&P500 up volume and down volume. Others could use NYSE up/down volume or NYADV vs NYDEC but they are similar ideas. The following tweet from David Keller, CMT today

@DKellerCMT

·

5h

Yesterday was about a 72% up day for NYSE stocks. Days with high advancers (>75%) will happen in a bear market- see late Jan and late Feb! Less of an “all clear” signal and more of a “pause before further downside” sort of signal.

Then again if you are bullish, you can point to $VIX and $SPX closing red on the same day as being bullish with positive returns in the next 5 trading days. We had that on 3/10/22 and likely to see that today 3/11/22 as well – so doubly bullish? may be. Last time we saw a back to back signal was the 3/23/20 bottom. Earlier tweet from Steve Deppe, CMT on 3/10/22 (he is trying to tell you he is bullish).

Steve Deppe, CMT

@SJD10304

·

20h

Ran-dumb:

All trading days that saw the S&P 500 close red, with trailing 20-day returns of -3% or worse, with the $VIX falling 2 points or more on the session?

3/10/2022

4/3/2020

3/31/2020

3/23/2020

3/20/2020

8/25/2015

7/2/2010

11/3/2008

8/20/2007

9/18/2001

8/7/1990

‘Both sides have strong incentives to settle’ — sound reasonable and sensible, i.e. if the assumption the actors are reasonable and rational. This is Putin’s war and one can not make such assumption that he’s rational, irrational, crazy, or crazy like a fox. I believe this war has no precedent — if Putin make threat to use tactical nuclear weapon, or even use it to achieve his goal (whatever that might be), what could the West response be? I saw a headline on the WSJ — ‘Market generally go up but sometime they go away’

Stephen,

Does that mean, Cash is King? Right now? Russian market may well be gone.

I think so. I fought the decline for two and a half weeks when I would have done much better trading the ups and downs.

This may be one of those times where despite historic negative sentiment levels, the market just keeps selling off. During the GFC that’s exactly what happened.

Part of the problem lies in the uncertainties associated with:

(a) An historic spike in inflation (we’ve seen 7-8% in the past, but we’ve never seen a spike from 2% to 8% occur this quickly)

(b) The fallout from the sanctions on the Russian economy.

(c) The highly unpredictable turns taken by Vladimir Putin.

Perhaps a full-bore bear market lies ahead.

But,

if Inflation is a worry, How’s Cash in the bank King?.

Totally agree with Unpredictable Putin.

But like Cam has shown us numerous times over the years, Russian stock market circa `1927 went to Zero, as did German circa 1942.

So, stay local.

Understood. I had the same thought last week, but after reflecting on the ‘cash will never catch up’ scenario I settled on ‘sitting in cash + buying back into the market hopefully at a deep discount’ as the only rational solution. In other words:

(a) TIPS are expensive.

(b) Stocks will protect against inflation in the long term – but can easily wipe out a large percentage of your portfolio while you wait through a bear.

(c) I bonds work – but severe restrictions in the amount we’re able to purchase.

So,

Here is anecdotal evidence of this excellent learning place Cam has created and thanks to Ken, RxChen and others (you guys know who you are). So this is a small part of my portfolio which I have been picking things to buy based on, “recommendations”, (I know, no one is recommending anything), only. Things when Ken mentions, ETFs etc. Others, like Rivendra, Sanjay, Livewell, YoDoc2003. So all stuff, and there is a motley of disparate things, but this is to illustrate Buy-And-Hold (at least for the last 3 yrs, 2019-2022).

XLE, VWTAX, RMDAX, PLTR, NGLOY, DE, DBEZ.

First one was added in 08/2019, newest one was added 02/24/2022. Mostly 100 shares. Sold off GOAU at a loss of approx. $500. which is reflected. This is current snapshot in my account

Net Account Value

$24,594.60

Total Unrealized Gain

$6,372.43 (35.98%)

Day’s Gain Unrealized

$356.72 (1.50%)

Figured, we can all use some uplifting News, when we are worried about out investments.

Cam’s work and all your contributions keep me Sane and actually, enjoying life, rather than worry about very normal Ups and Downs(yes, I say that knowing well, “This time it’s different” “The world is ending.” etc).

Also, this is just a snapshot of a small Haphazard, portfolio. I am taking it on the chin in my Larger, Investment account. Down 13.5%

Perspective!!!

Good job.

Thank D.V.

But, then again, I am only getting this return because of this site and members like yourself, which make you see things from different perspective, all the time.

Thanks for all your contribution, over the years.

Opening trading rentals in SPY/ QQQ/ VT.

Opening FXI.

BABA.

Adding second allocations here.

After all these years, crowd psychology and the whipsaws of emotional response never cease to amaze me.