Mid-week market update: In my update last weekend (see Waiting for the sell signal), I observed that the S&P 500 was oversold and due for a relief rally. The market cooperated by printing a hammer candle on Monday, which is a capitulative reversal indicator, and confirmed the reversal with a bullish follow through on Tuesday by recapturing the 50-day moving average. The index finished the move today with a doji candle, which indicates possible indecision.

That was the buy signal. There was also a sell signal.

Time to sell?

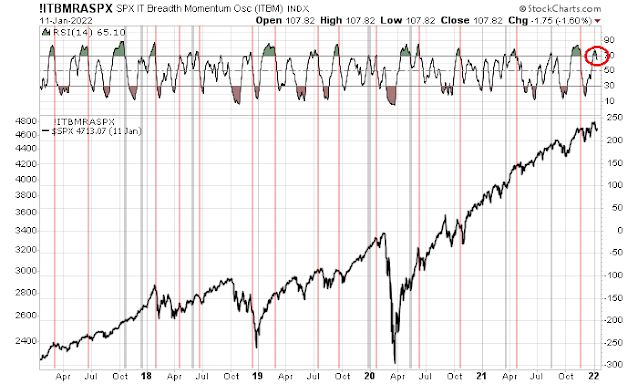

On the weekend, I also highlighted a possible deterioration in the intermediate breadth momentum oscillator (ITBM). I was waiting for the 14-day RSI of ITBM to recycle from overbought to neutral as a sell signal for the market.

I got the signal on Tuesday. The chart below shows ITBM sell signals in grey for bullish outcomes and in red for bearish outcomes. The sell signals have been correct about three-quarters of the time.

In addition,

Ed Clissold of Ned Davis Research pointed out that NDR Trading Composite Sentiment is still in neutral. Trader sentiment isn’t washed out yet and there is more room on the downside for stock prices.

Similarly, all the components of my market bottom model are also neutral. If the stock market were to experience a downdraft, there is lots of downside potential before a bottom can be reached.

Jason Goepfert at

SentimenTrader observed that defensive sector breadth is exhibiting an off-the-charts level of internal momentum.

He did add a caveat that these conditions are not necessarily bearish.

It’s assumed that if investors are so hyper-focused on defensive stocks, it’s a bad omen for the broader market. Not to be. While the S&P 500 didn’t exactly go gangbusters after these signs of long-term internal momentum in the defensive sectors, it still showed above-average returns.

I interpret these readings as the bears are seizing control of the tape. The combination of neutral sentiment and a loss of intermediate momentum raises the odds of an air pocket for equity prices in the near term. Subscribers received an email alert today that my inner trader had initiated a short position in the S&P 500.

Disclosure: Long SPXU

Closing COIN on the after-hour pop.

PLTR/ QS closed after hours for a small loss.

AA closed after hours for a small gain.

IWM closed after hours flat – I was actually well ahead on this one at one point but bet incorrectly that buyers would lift the indexes in the final minutes.

Neglected to mention a position in ARKK which I’m closing now for a small loss.

Would love to see a whoosh down – I just don’t think it will be that easy. The dip-buying mentality is so entrenched that a slow/prolonged drip into negative territory seems the most likely scenario.

Cam, are you thinking that the downdraft would lead to Trend Model turning neutral?

In a down draft, would tech lead the way or something else

Previously the thought was that it may be 10%+ correction. Any change?

I have been steamrolled enough times trying to short this market over the years.

My only comment on the candlesticks is the doji today happened at a good S/R line of the tops of November early December

Opening positions in ASHR/ BABA.

TIP (TIPS) looks attractive here as well.

We purchased additional allotments of Series I Savings Bonds the first week of January. I still think they’re a great alternative to buying long-term care insurance.

COIN reopened.

PLTR/ QS/ NIO reopened earlier + a small position in QQQ around the same time.

A glance at the Marketwatch front page was a little disconcerting, but surprisingly my portfolio is still green. Which I attribute to having opened positions on weakness in decimated sectors and stocks.

Will it be China and/or bonds and or small-cap growth stocks that are already deep in bear markets that begin to outperform from here?

Great call by Cam.

As I avoid short positions, my alternatives are cash/ bonds/ occasionally a position in VXX/ simply buying weakness for a bounce.

No bounce.

Now out of all positions with the exception of TIP.

Opening positions in QQQ/ SPY.

Adding VTV.

IWM.

XLF.

Closing TIP at breakeven.

Truly a tough market to time correctly.

IMO, this morning’s repeat trip to the lows qualifies as a whoosh. Opening in the hole was well-telegraphed and therefore expected – traders were either braced for it or looking forward to it. The immediate retest was unexpected – and probably elicited enough fear for a ST low.

Another retest!

My stop loss? At the point where I give back Monday’s gains. I would give it 50/50 odds at this point.

All positions off – taking gains and will await the next setup.