Global markets have taken a decided risk-off tone today. The spark is the China Evergrande implosion. Fears are rising that Evergrande is turning from a liquidity crisis in which the company doesn’t have enough cash to pay its obligations, to a solvency crisis in which the company’s assets are less than its liabilities if it is forced to fire-sale its properties.

A domestic crisis

So here is the key question: What kind of a moment will the Evergrande Moment be? Will it be a Minsky Moment, akin to the Lehman collapse? Or will it be more akin to the LTCM Moment? Or might it just be altogether less momentous? To measure this we need to resuscitate another concept of which many of us thought we had heard the last more than two decades ago: Asian contagion. How much effect will Evergrande’s troubles have on the rest of us?

Global markets have been relatively unscathed by the crisis. There will be little global contagion effect because it will all be contained in China.

So why is there still relative calm? It boils down to a close reading of the Chinese authorities’ intentions. They have no interest in staging their own Lehman. There has been alarm about the possibility of a Minsky moment for years in Chinese circles, frequently voiced out loud. Officials know what could happen and are determined to prevent it if they can. Efforts to rein in credit have been going on for years. And Evergrande is in trouble largely because the government itself decided to clamp down on property developers through the “three red lines” policy last year.

Authers concluded:

To be clear, an LTCM outcome isn’t great. It leaves the risk of more moral hazard. And while the PBOC can probably avert a full-blown credit crisis, it can’t stop the weakness of the property sector turning into disappointing economic growth for China. Many small savers and hopeful property buyers will inevitably be hurt by whatever deal can be thrashed out — and the precise shape of that deal will matter a lot. But for the moment, world markets are nervous that this could be another LTCM, while comfortable that it won’t be a Lehman. On balance, both of these points look reasonable. Now let’s see what happens.

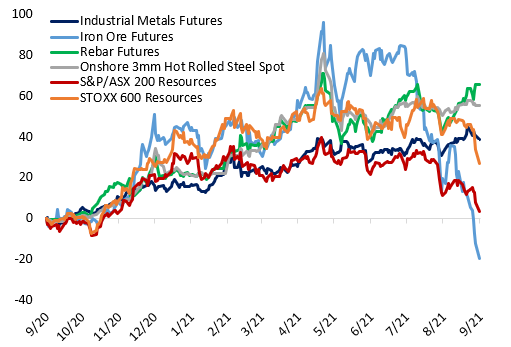

A number of bearish investors have pointed to plummeting iron ore prices as signs of slowing growth in China, which could have global repercussions. But George Pearkes at Bespoke pointed out that steel and other industrial metal prices are still holding up well.

Relax. Any contagion effect will be minimal.

A panic bottom?

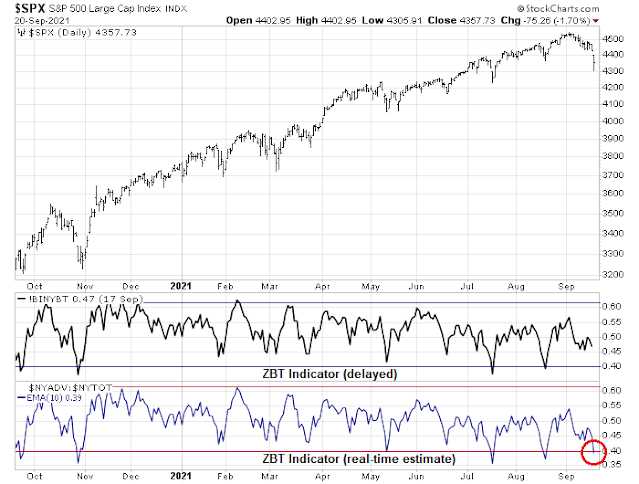

In the US, the stock market is starting to flash signs of a panic bottom. The Zweig Breadth Thrust Indicator has plunged into oversold territory, which is often a signal of a short-term bottom.

My S&P 500 bottom models are starting to flash buy signals. The 5-day RSI is deeply oversold. The VIX Index has surged above its upper Bollinger Band, which is another oversold signal. The term structure of the VIX inverted intraday, indicating fear.

To be sure, this week (the week after September OpEx) is historically the weakest week of the year, as documented by Rob Hanna at Quantifiable Edges. However, Hanna pointed out that the average weekly “weakest week” drawdown is -2.3%. As the S&P 500 is -1.7% today, the index is nearing its average downside target.

While oversold markets can become more oversold, a bottom is near. Nevertheless, this market isn’t without risk. Mark Hulbert studied the stock market’s return in the two weeks prior to debt-ceiling showdowns and returns have been disappointing. As well, the FOMC meeting this week could be a source of volatility.

My inner trader plans to take an initial position on the long side in the S&P 500 at the open tomorrow morning. This is a volatile market and traders should size their positions accordingly. Be prepared for a short-term bounce, followed by a retest of the lows later this week or possibly next week.

Would you say for investors (not traders), it may be a reasonable time to add to its existing stock portfolio position?

Ca, Curious why are you expecting a retest of the lows? You didn’t expand on that.

=> Be prepared for a short-term bounce, followed by a retest of the lows later this week or possibly next week.

Cam

We have had a 2.5% or 100 points rally in futures since late yesterday. Still good time to go long for a trade, this AM? Thanks.

My guess is that the SPX will be in a trading range for a few days – maybe between yesterday’s lows and resistance at the 50 dma.

Thanks Rx.

Started scaling into SPY ~433.2x and now adding ~434.7x.

Late post for the first buy. My real time entry somehow didn’t pass the Captcha barrier…

My thinking is that SPY will ultimately retest 428 (and probably at least 425 or lower) – but not today as too many traders are looking for 428.

Of course, neither do I believe we’ll see SPY 441 today. But Rob Hanna shows we have a good setup for the remainder of the week:

https://twitter.com/QuantifiablEdgs/status/1440298684055359490/photo/1

Closing SPY positions here.

And reopening a half position in SPY here about two bucks lower. Trading is 50% luck!

Make that just a buck lower.

And now two bucks lower.

Adding an add’l quarter position ~432.8x.

I think we see 428 at some point tomorrow.

Recovered about a third of Monday’s losses today.

Monday dump and weak bounce on Tuesday does not seem like an ideal setup.

A good article!

Xi Jinping Aims to Rein In Chinese Capitalism, Hew to Mao’s Socialist Vision

https://www.wsj.com/articles/xi-jinping-aims-to-rein-in-chinese-capitalism-hew-to-maos-socialist-vision-11632150725?mod=article_relatedinline

Closing SPY ~435.8x premarket. This is a market where I take gains when I have them.

I still think we see 428 at some point today. But we may also see 441 at some point. We may even see both within the first 30 minutes post-FOMC.

Opening positions in BABA and PLTR.

Closing BABA and PLTR.

I’ve now recovered about 50% of Monday’s losses.

Nice call by Cam re the SPX trade.

It feels as if everyone is convinced that Powell has the market’s back, but I prefer to wait for the reaction/ countermove before staking another position.

Back at the 50 dma.

Just short of the 50 dema.

Post-FOMC is always a tricky tape.

I’m hoping for another selloff – which means it’s off the table. On the other hand, I’m not interested in reopening a position at these levels.