Mid-week market update: The stock market gapped down on Monday on China Evergrande contagion fears. The technical outlook darkened further Tuesday when a rally attempt failed. The markets took on a risk-on tone this morning when Evergrande issued an ambiguous statement that a coupon due on its yuan-denominated bond. An agreement had been reached with its lenders but the statement didn’t specify the nature of the payment, or when it would be paid.

While today’s rally is constructive for the bulls, the S&P 500 has yet to fill in the gap from Monday’s downdraft.

Was that the bottom?

Market bottom models

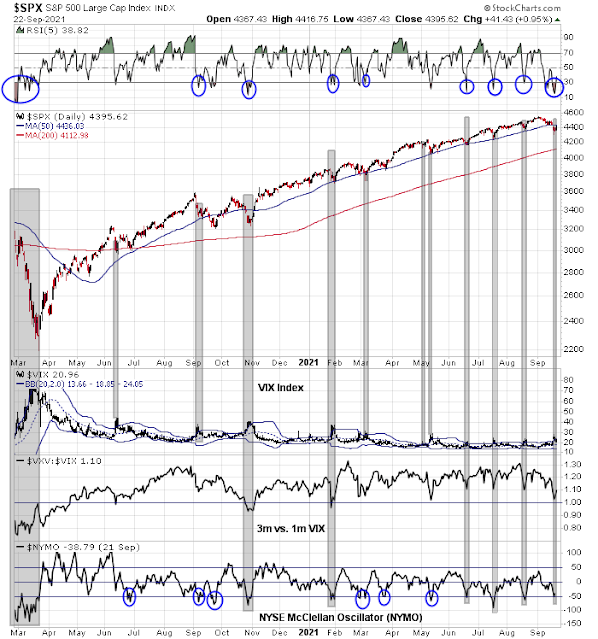

Three of the four components of my short-term market bottom model flashed signals on Monday. The 5-day RSI was deeply oversold; the VIX had surged above its upper Bollinger Band, and the NYSE McClellan Oscillator had fallen into oversold territory. The near-miss was the failure of the VIX term structure to invert, though it did briefly invert intraday Monday. Barring the appearance of further negative fundamental drivers, historically this has meant that a short-term bottom is near.

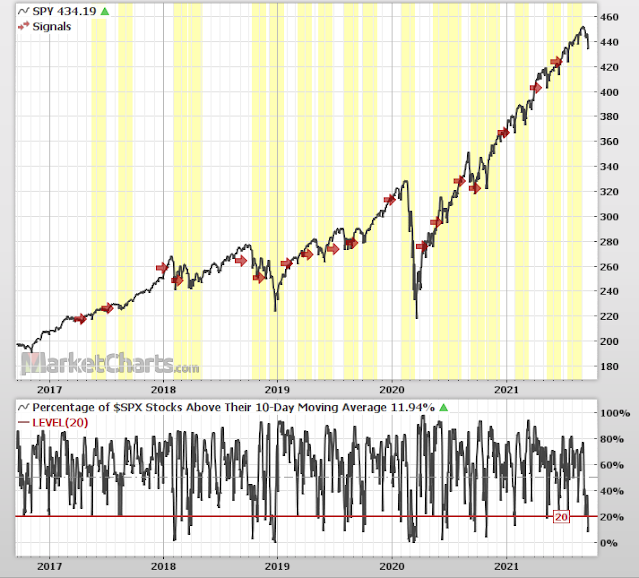

Other historical studies indicate risk/return is skewed to the upside. The % of S&P 500 stocks above their 10 dma is in extreme oversold territory. In the 18 instances over last five years, the 30-day subsequent median return return was 4.6%, wich a success rate of 83% – and that study includes the COVID Crash.

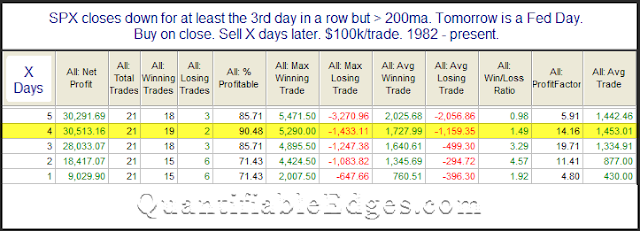

Rob Hanna at

Quantifiable Edges also found that a three-day consecutive decline into an FOMC day has historically resolved bullishly.

Not out of the woods

Even though the historical studies show that risk/reward is skewed to the upside, bullish traders and investors are not totally out of the woods. Washington is still embroiled in a debt ceiling battle and

Mark Hulbert has documented that the market does not perform well ahead of such deadlines, which is expected to be September 30.

I interpret current conditions as a bottom has either been reached, or the market is forming a complex W-shaped bottom. Downside risk should be limited unless the market is presented with another unexpected shock, though traders should be prepared for a retest of the old lows next week as debt ceiling anxiety continues.

Disclosure: Long SPXL

That analysis is on point. Cheers.

The ex-dividend explanation.

Monday’s selloff was so brutal I didn’t bother to look under the hood. I recall feeling the hit to my portfolio seemed unexpectedly harsh given the fact that I’d backstopped with smaller position sizes.

As it turns out, Monday was ex-dividend date for several of the funds I closed. A little less than half of the dividend payments arrived this morning, and it appears the remainder is scheduled for next week. Together with trading gains on Tuesday and Wednesday it narrows my weekly loss from what appeared to be a -1.17% hit on Monday to (an expected) -0.19% as of this morning.

The greatest edge we have when trading is a combination of good judgment and an understanding of our own psychology, and at least in my case both are impacted by daily P/L numbers – for better or worse, that’s just the way it is.

Evergrande does matter, but it is not the only reason that markets may have finally started to correct. I don’t know if yields are finally going to start their move higher today, but we shall not forget that some disappointing PMI, consumer confidence and retail sales readings may still be in the cards after those reports started to deteriorate in August. Cost of energy rising and inflationary pressures not abating at all. The market has become quite complacement with its ability to ignore all that.

Are we witnessing a short-squeeze this morning, or is another V-shaped recovery underway?

Being a guy who never chases, there are only three items on my watch list this morning that look interesting-> GDX/ TLT/ BABA.

My take is that selling on BABA will accelerate should prices break (and remain) below 149.

GDX looks vulnerable as well around the 30 level.

Taking a swing at TLT ~149.1x…

Out for a loss @ 148.8x.

BABA @ 150.7x.

Adding to BABA ~150.2x.

Reopening a position in FXI.

Sometimes I try to tune out the noise and focus on places I find true value.

Opened small positions in GDX/ TLT after hours. Why do I often wait for the extended-hours session? Near ST/LT lows, there will usually be one or more traders that want out at any reasonable or even slightly unreasonable bid, and limit orders below the intraday lows are frequently hit.

SPY:TLT had a failed breakout so far. On the weekly chart it lost a trendline. Steady downtrend in treasuries since the Fed decision.

Closing BABA/ FXI in the premarket session for minor losses. The fact that neither Alibaba nor the Hang Seng were able to catch bids overnight negates my thesis re a ST bottom. We may be near a bottom, but that remains to be seen. Both may well gap down further on Monday.

Closing TLT/GDX for minor gains. I opened both positions at attractive levels after hours, and flipping premarket.

My portfolio is ~-1% off its ATH. I think China may be a good LT buy here, but I don’t like the fact that the consensus opinion is that Evergrande will survive intact. The contrarian viewpoint may in fact be correct, and in hindsight we’ll all realize that Evergrande was the obvious catalyst for a major decline.

Selling in BABA is indeed accelerating as it breaks/ remains below 149.