Mid-week market update: I wrote on the weekend (see Where’s the fear?) that the relief rally that began last Thursday was unconvincing and my base case scenario called for a retest of the lows. The retest appears to be underway.

Spikes of the VIX Index above its upper Bollinger Band (BB) were signals of an oversold market. Such episodes were resolved in two ways. Strong market rallies were characterized by price momentum and definitive violations of the VIX 20 dma (blue arrows). On the other hand, if the VIX was unable to fall below its 20 dma, the S&P 500 advance stalled and weakened again (grey bars). The current situation appears to fall into the latter category.

Nevertheless, I believe that any pullback should be shallow and the S&P 500 is likely to successfully test its 50 dma. It is already exhibiting a positive RSI divergence, and other market internals are tilted in a bullish direction.

A shallow pullback

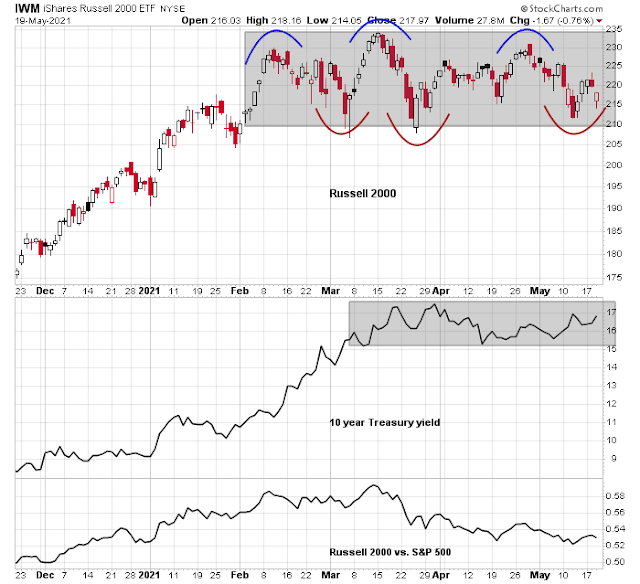

Consider, for example, small-cap stocks, as represented by the Russell 2000. The chart of the Russell 2000 has been stuck in a trading range. Moreover, it is showing ambiguous formations of both a possible bearish head and shoulders (black), which is bearish and inverse head and shoulders (red) formations. Similarly, the 10-year Treasury yield has also been stuck in a tight range.

The technical pattern of growth stocks, which have suffered the brunt of the selling, is also constructive. The NASDAQ 100 is also exhibiting a positive RSI divergence. The high-octane ARKK ETF recently bounced off a relative support level and it is beginning to outperform again.

If and when the market recovers, the odds favor a growth stock revival over the next 1-2 weeks.

More weakness ahead

Tactically, there may be a little more weakness ahead before this pullback is over. The Russell 1000 Value Index violated a rising trend line, which is a sign of technical damage that needs to be repaired by way of a period of sideways consolidation and basing. By contrast, the Russell 1000 Growth Index is now testing a key support level.

Sentiment is deteriorating, but panic hasn’t set in yet. The Fear & Greed Index is falling, but readings haven’t reached the sub-30 target zone yet.

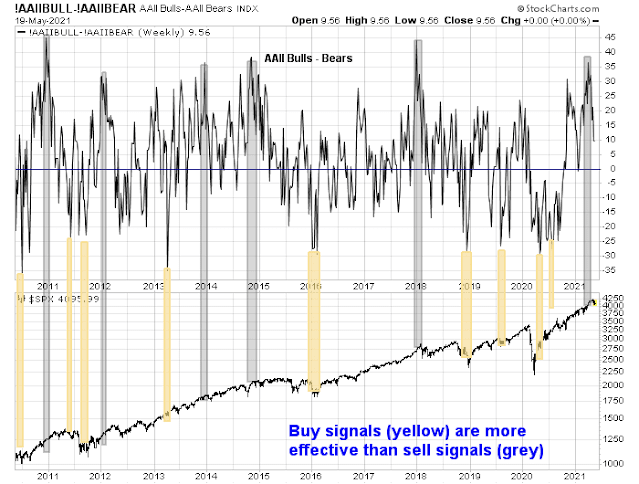

The latest AAII sentiment survey shows the bull-bear spread narrowing, but the bulls still outnumber the bears.

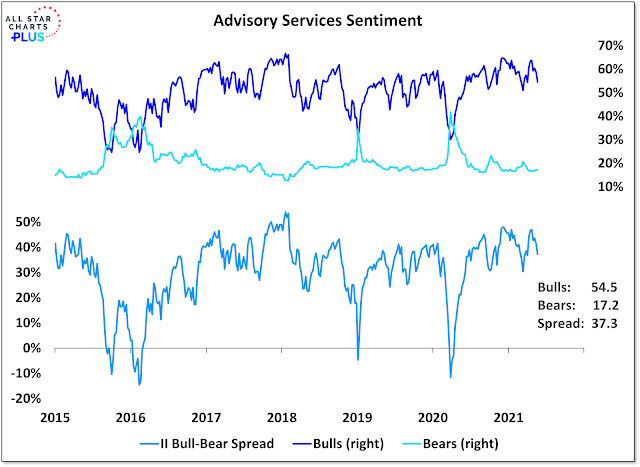

The same could be said of Investors Intelligence. The number of bulls edged down, but bearish sentiment hasn’t spiked.

A similar level of complacency can be seen in the options market. The term structure of the VIX hasn’t inverted, which indicates fear. At a minimum, I would like to see the short-term 9-day VIX rise above the 1-month VIX.

I conclude from this analysis that the bottom is near, but not yet. The odds favor one more flush downwards in the next few days before a durable bottom is made. However, I am open to the possibility that today’s approach of the 50 dma represents a successful test of that support level. Watch for bearish follow-through in the next couple of days. If the market were to decisvely rally from here, then today was “the bottom”.

Two thumbs up.

Thanks

F

I second that.

In my opinion, the late-day reversal is a better set-up for for a whoosh down tomorrow than a close at the lows would have been. It’s human nature (maybe a form of recency bias) to expect continuation->whereas a close at the lows would lead to expectations of further weakness on Thursday, closing as we did above the morning lows has everyone expecting continuation of the reversal.

Plan A is to buy in the hole. Plan B is to continue sitting out the back-and-forth market while waiting for a real selloff.

Scaling into a few positions in the premarket session.

As suggested by Cam, redirecting my focus to growth.

Starter positions in QQQ/ XLK/ SMH.

Restarters in PLTR/ QS/ DISCA/ NIO/ IQ.

BABA. CSCO.

XLE.

SMH/ QQQ/ XLK off near the open.

Plan is reopen.

CSCO off.

NIO/ QS/ PLTR/ DISCA/ IQ off.

Plan is to reopen.

FXI/ EEM (also restarted premarket) off here.

Plan is to reopen.

BABA off.

XLE off (my only loss, which I’ll take as one minor indicator of rotation from value->growth).

Back to 100% cash. The bet is that traders have sold the open, and another entry will set up.

QS/ PLTR/ DISCA.

COIN.

VIAC.

PICK.

IQ.

JETS.

Reopening SMH.

XLK isn’t backing down today. That’s a change in character.

Reopening another starter.

Out of PICK – flat. Value isn’t a happening sector today.

Out of repeat positions in XLK/ SMH.

All positions closed.

+0.145% for the day. I’ll take it.

Not sure why exactly, but it’s difficult for me to believe in this rally.

Initiated trading positions and added to longer term investments. I am comfortable that this was the retest. I always seem to miss the bottoms and the tops anyway.

As we all know, catching the bottoms and tops only happens on TV.

It seems to me that the ‘froth’ in Robinhood trading, crypto, spacs, and innovative growth companies has dissipated. Markets should focus more on economic recovery and growth. Cam has indicated that inflation should not be a problem. Good time to trade and upgrade the portfolio.

Hold in May, and have a good summer?

I feel we are now a “vaccine economy.” Only to improve as the numbers continue to climb.

Reopening QQQ/ XLK/ SMH here.

Reopening BABA.

Reopening EEM/ FXI.

Reopening PICK here.

Opening a position in ASHR on the -1.56% pullback.

Reopening GDX on its -1.4% pullback.

COIN.

RIOT.

Cam- Any further thoughts on PICK?

Not sure what you’re looking for. Looks like an ok entry point at these levels

Cam’s been hitting right notes. Targeting growth/ Nasdaq over the next week or two sounds right. At the same time, it makes sense to scale back into value on weakness.

A new Momentum ETF: QQQA

“Combining the Nasdaq 100 and Dorsey Wright Momentum produces a large cap growth strategy well-positioned for the growth component of a core equity allocation. QQQA’s long-term goals are to generate an attractive risk/reward profile and generate outperformance.”

https://www.nasdaq.com/articles/proshares-launches-nasdaq-100-dorsey-wright-momentum-etf-qqqa-2021-05-20-0