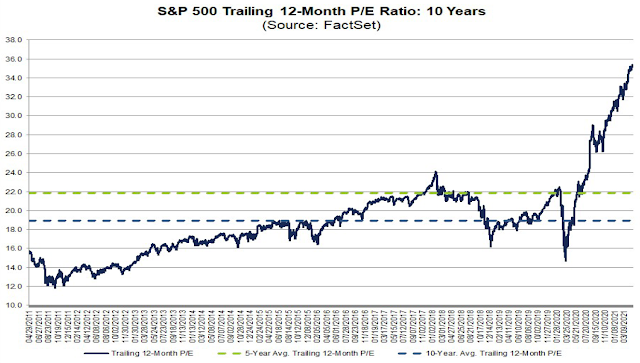

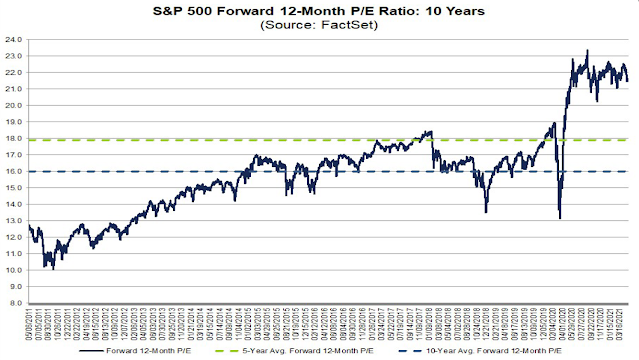

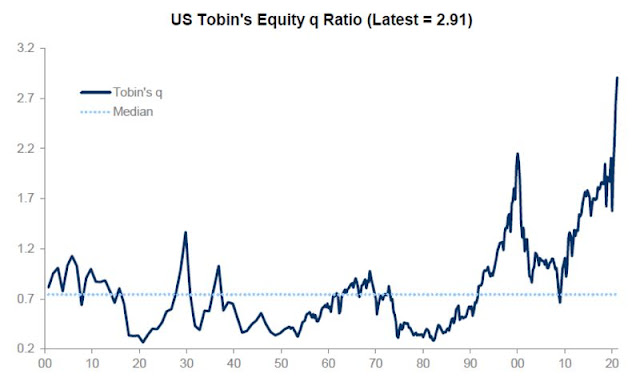

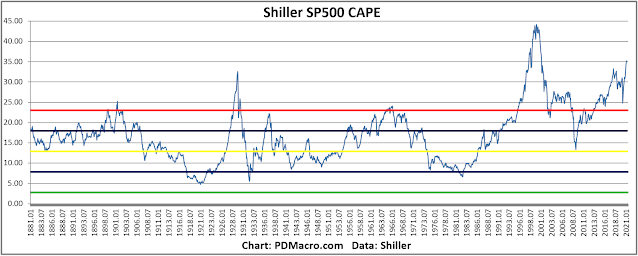

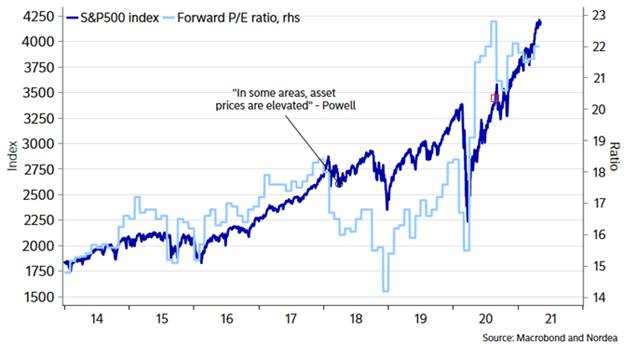

How expensive are US equities? Fed Governor Lael Brainard warned about “stretched valuations” in the preamble to the May 2021 Financial Stability Report:

Vulnerabilities associated with elevated risk appetite are rising. Valuations across a range of asset classes have continued to rise from levels that were already elevated late last year…The combination of stretched valuations with very high levels of corporate indebtedness bear watching because of the potential to amplify the effects of a re-pricing event.

An expensive market

Unpacking the equity risk premium

Many have been puzzled that the world’s stock markets haven’t collapsed in the face of the COVID-19 pandemic and the economic downturn it has wrought. But with interest rates low and likely to stay there, equities will continue to look attractive, particularly when compared to bonds.

The Excess CAPE yield compares the market’s CAPE to interest rates by calculating an equity risk premium (ERP) for stock prices.

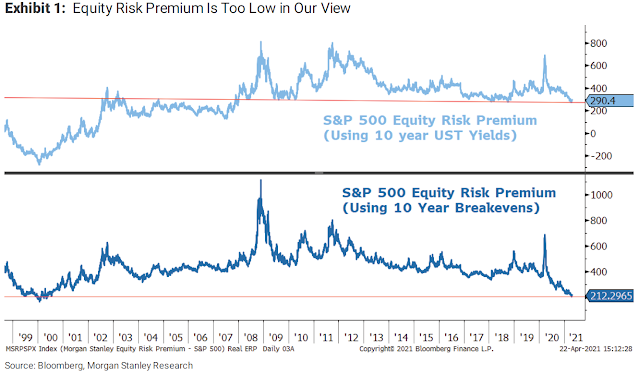

Another way of calculating ERP is the Fed model, which is the market’s forward E/P minus the 10-year Treasury yield. Morgan Stanley found that the ERP calculated this way appears extended (top panel). If the analyst were to substitute the 10-year breakeven yield (because investors are more interested in real returns than nominal returns), valuations are comparable to the dot-com bubble top.

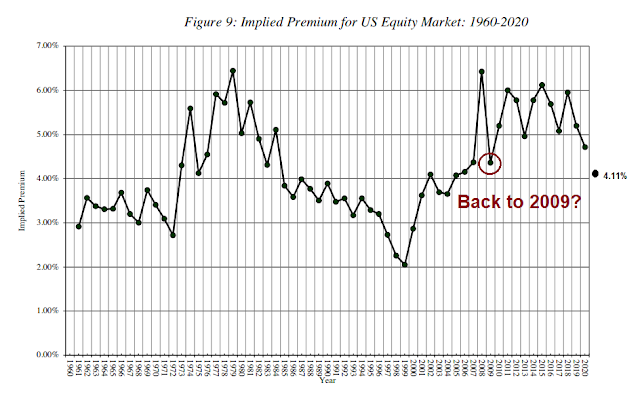

Does that mean the market is wildly stretched, even on ERP? Not necessarily. Aswath Damodaran, professor of finance at the Stern School, calculates his own ERP using a detailed technique explained in a long paper. Damodaran’s history went back to 1960 compared to Morgan Stanley’s 1998. Damodarn’s latest update on May 1, 2021 showed an ERP of 4.11%. This puts both the Fed Model (Morgan Stanley’s top panel chart) and Damodaran ERP at roughly 2009 levels.

Household equity holdings

No correct valuation

“A rich prisoner who possesses two thousand ducats but needs two thousand ducats more to repurchase his freedom, will place a higher value on a gain of two thousand ducats than does another man with less money than he.”

A, B, and C, each of whom has different starting wealth, required ending wealth, and time horizon. For the sake of simplicity, we’ll suppose each has the exact same view of a security’s future volatility and return, which are labeled as s and m in the figure.

When we place these three prisoners in the marketplace, we would expect Prisoner A and Prisoner B to sell their shares to Prisoner C at the price of 1/c until Prisoner C exhausts his liquidity or Prisoner A and Prisoner B exhaust their inventory. Then, the price drops to 1/b, and Prisoner A continues to sell to Prisoner B. From there, the price drops to 1/a, and Prisoner A would buy, but no one would be willing to sell.

Prisoner C is an enigma. Traditional utility models would not expect anyone to accept lower returns in response to higher volatility. But goals-based investors can be variance-seeking when their initial wealth is low enough. Behavioral finance characterizes their goals as “aspirational.” This is why people buy lottery tickets and gamble: Increasing the volatility of outcomes is the only way of increasing their chance of achieving life-changing wealth.

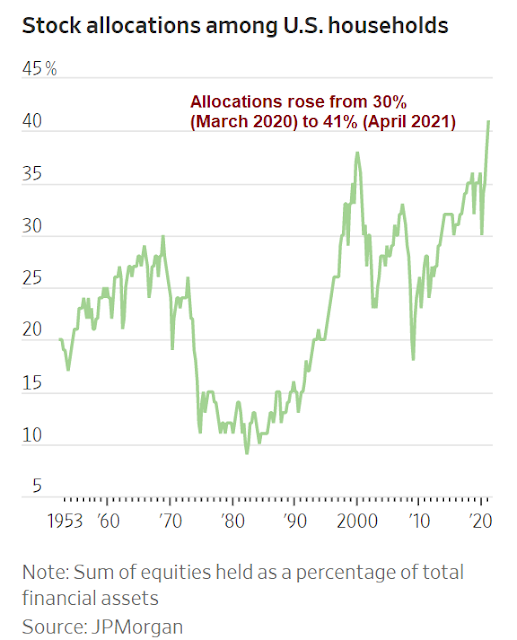

A very present example is our current regime of ongoing quantitative easing (QE) from central banks around the world. For investors befuddled by sky-high stock valuations, the difference between Prisoner A and Prisoner B is illuminating. They are exactly the same except for one thing: Prisoner B is wealthier today.

In general, then, this means that adding cash to financial markets creates investors who are willing to pay more for the exact same security. Conversely, when excess liquidity is drained from markets, prices should drop, all else equal, because investors with less cash today require higher returns. Thus line B moves back to line A.

Another key component of price: each investor’s relative liquidity in the marketplace. If enough aspirational investors, or Prisoner Cs, deploy their cash into a security market, prices can remain elevated or spike until their liquidity is exhausted. Sound familiar, GameStop?

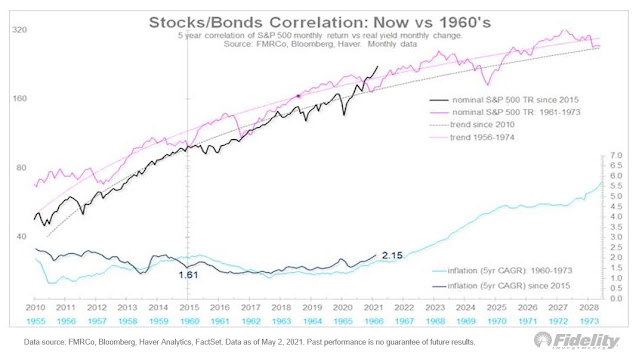

A secular bull

The ‘60s comparison is compelling, especially now that we’re going to have higher capital gains taxes 4-5 years after a cut in income taxes. The parallel is the Kennedy/Johnson tax cut of 1964 followed by the Nixon tax hike in 1969. It was “guns and butter” back then. Now it’s Covid and a progressive capital-to-labor wave. The late ’60s had social unrest and a speculative frenzy in growth stocks—sound familiar?

In my view, our current inflation rate essentially mirrors where things were in the 1966-67 time frame, before inflation really took off.

MMT argues that governments create new money by using fiscal policy. According to advocates, the primary risk once the economy reaches full employment is inflation, which can be addressed by gathering taxes to reduce the spending capacity of the private sector. MMT is debated with active dialogues about its theoretical integrity, the implications of the policy recommendations of its proponents, and the extent to which it is actually divergent from orthodox macroeconomics.

More than anything else, this probably explains larger differences between the Obama and Biden approaches. President Barack Obama operated in a world in which deficits mattered politically. Biden doesn’t. Between the unfunded Trump tax cuts and a year of hog-wild pandemic spending, politicians have largely given up even pretending that they ought to pay for things their constituents want; it’s no longer even a good cudgel with which to beat the opposition when you’re out of power.

Investment implications

- The equity bull has a long way to run.

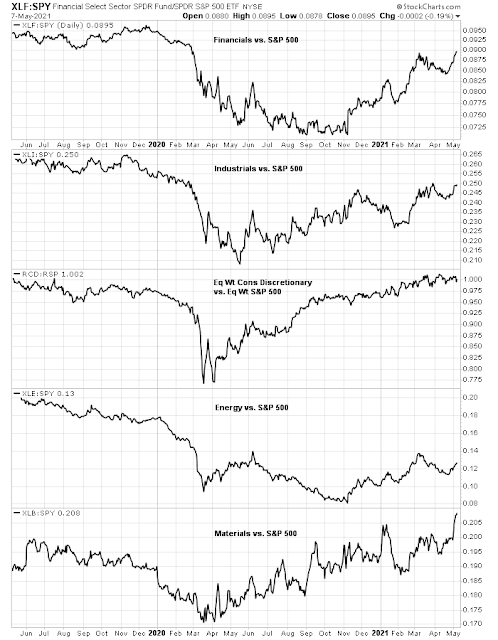

- The cyclical recovery is bullish for value-oriented and cyclically sensitive sectors like financials, industrials, consumer discretionary (excluding high flyers like AMZN and TSLA), energy, and materials.

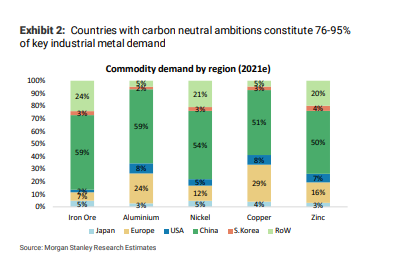

- Secular growth in green infrastructure is poised to benefit mining (see A “value” industry that’s about the be the “Next Best Thing”). While China still makes up the lion’s share of commodity demand, countries with carbon-neutral ambitions constitute 76-95% of industrial commodity demand.

- Balanced fund investors need to be prepared for greater volatility and re-think portfolio construction in an era of rising bond yields (see 60/40 resilience in an inflation age).

In the US, this all feels like a repeat of 2010, except this time its congress taking the lead in facilitating an economic rebound with stimulus programs.

As for work, everyone is watching India closely due to so much of our engineering and support is based there. These aren’t outsourced operations, but major campuses that were frequented by co-workers across the world. I haven’t heard specific details, but this could have a much larger economic impact than what’s discussed publicly. I suspect similar issues at other competitors.

Valuation and earning do matter all of a sudden. The Renaissance IPO ETF has been plunging along with innovative growth things like ARKK ETF that have little or no earnings. New IPOs of money losing companies are over 80% of issues. The SPAC ETF is also plunging since new SPAC companies don’t have earnings either.

So in 2021, investors see a post-Covid reopening with earnings of economically sensitive old-line value companies surging. So why own a concept company that has no intrinsic valuation metric? Just ride the coming profits tidal wave of value stocks.

(Warning broken record coming)

By separating Value and Growth stocks and analyzing them separately you get a truer picture.

The Value ETF VLUE has a trailing PE of 15.7 and a forward PE of 12.5 times with a dividend yield of 2.4% equal to the 30 year T-bond.

The FANNG friendly Growth ETF VUG has a trailing PE of 46.3 and a forward PE of 33.1 times. With a dividend yield of 0.6%

Mixing Growth and Value is like having a herd of cows and ostriches. I think milking the cows is a good thing this year.

Last weeks action was high up on the most incredible list of my career.

As bonds were doing better over the last couple of weeks, the good value growth stocks (RPG ETF) were starting a decent comeback and then Value especially Resource Value had a huge week leaving Growth in the dust.

The jobs number was incredibly good for stocks. The terrible number takes the heat off the Fed and puts the inflation bears back in hibernation.

If the number had been off forecasts higher rather than lower, let’s say a 2 million number twice the forecast as opposed to the one third the estimated lower, the stock market and the bond market would have tanked. The worries of a Taper coming soon would have escalated.

The TLT bond ETF going down on Thursday and Friday after the bad jobs number tells me that the economy is still okay so economically sensitive stocks are fine. It also says rates are not going to fall and help the Growth stocks valuation metrics.

Many readers will be tempted to buy gold and oil related here as a commodity play. Most investors have owned gold and oil in the past and feel comfortable with it where they haven’t owned industrial and agricultural commodities. The industrial group (mines, lumber, food producers) does best when the global economy comes out of a recession. Gold has a different cycle and oil has major ESG and political issues.

Another big happening in Momentum last couple of weeks, up until mid-April Defensive sectors like Utilities, Real Estate and Staples had been doing well. I suspect investors were positioning for a market drop. Well, the last two weeks have seen them underperform in a big way especially last week.

Investors are back aggressively buying the economic recovery (I’d rather look at it that way as opposed to saying ‘risk-on’)

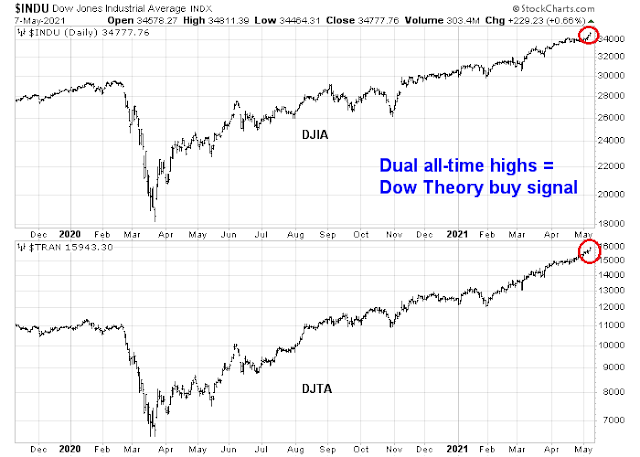

Transports, as measured by IYT, have substantially outperformed SPY since mid Feb. PE is ~28, but E is almost certainly Covid depressed.

Cam- Do you think the bad jobs numbers from Friday are enough to negative the 5-10% decline scenario?

I would have thought that the huge NFP miss would have tanked the stock market, but then what do I know?

Exactly- the numbers were terrible, but the market just shrugged it off. The 5 day rsi was headed down, then reversed. VIX was above the 2 sd line, then completely reversed and ended up below its ma. NYMO was below 0 then reversed to close at almost 19. What appeared to be setting up as a textbook correction vanished like dew on a hot car hood. So, if the market can ignore really bad numbers like we saw on Friday, why would we expect a correction to be imminent?

All about the Fed. Bad report was still positive, perhaps pointing to a longer and slower slog back, which you’d think would be bad news. But that also means inflation risk decreases, which allows the Fed to stay the course on rates and purchases. Party on Wayne!

That is my thinking. Slower than expected jobs equals a slower rise in inflation and interest rates. The worry for a BIG selloff was a continuing steep rise in interest rates as the reopening was too hot with too much stimulus from the Biden checks. The shocking bad jobs number snuffed that argument.

Thinking that it means the economy is weak just doesn’t hold water with strong PMI numbers and mobility

Not all positive, the unemployment rate was up.

The market will do what it wants – prices will be pushed in the direction determined by the aggregate behavior of traders on any given day. We do our best to predict what will happen, fully aware that we’re acting on guesstimates. When the market behaves otherwise, we’re forced to rethink our predictions. The media has an explanation for everything – after the fact. It’s human nature to want an explanation, but after centuries of stock market analysis are we any closer to reliably predicting market moves? I don’t thinks so. The best we can do is to manage our own reactions to what actually transpires.

It’s also helpful to keep in mind that trading is not supposed to be easy. It’s always a challenge. That’s why we’re all here, right?

https://www.yahoo.com/finance/news/here-comes-the-stock-buyback-explosion-goldman-sachs-163731245.html

Adding fuel to fire. Low interest rates continue with Fed still expanding balance sheet by 120 Billion $ per month. Huge pool of unemployed workers should keep wage driven inflation down. Sure, the Fed may tolerate some inflation as a temporary blip. This needs to be watched whether the Fed keeps its word and not raise raise rates if inflation takes off.

https://twitter.com/CarterBWorth/status/1390695060174422016?s=20

The dip in yields may be over. We really need for rates to rise here.

https://www.barrons.com/articles/green-economy-will-be-a-gold-mine-for-copper-51620424287?mod=past_editions

Dr. Copper may have an upside to 20K per tonne. If this is not cyclical/green/value trade/inflation trade, what is?

Inflation is real. A friend of mine used to operate a cat house in south bay, and had a shutdown due to COVID19. He had a grand re-opening recently. He said this is his patriotic duty to do his part to contribute to US economy. I gave him kudos. Guess what? The new price is 20% higher. I will be watching if there is demand destruction.

Copper is in similar situation. Is there going to be demand destruction due to sky-high prices? By extension, lumber prices. “Absurd” probably is appropriate. A typical new American house now has a framing cost of $40K, up by 300% from early last year. Do you think it is going to affect the home builders, or not? Even remodeling old houses is going to have problems, on top of escalating home purchase prices. So don’t get too carried way. Make money but also watch for signs.

I am a disciple of both Soros and Farrell. Soros said we need to join bubbles as soon as we spot them. And Farrell said that parabolically rising prices will go longer than you think. We have both now. Resources (commodities) space is really small. I have bought pretty much all the stocks, including bad vehicles DBA , DBB ,DBC. These three are futures based, and have a lot of trading cost in them. Last week most of them have gone vertical (not just parabolical). And that prompts me into devising a plan B. Farrell also said the following correction phase is not sideways. I don’t know when. Imagine the moment when all the momentum players flock into commodities. Soros never offered advice regarding the ensuing mean reversion. But knowing his “when the ducks all lining up the game already has changed” I will assume he will sell everything when the players all showed up. I will follow his approach.

Remember what I wrote a few weeks ago. It’s not just copper, but a lot of other minerals that will benefit from electrification:

https://humblestudentofthemarkets.com/2021/04/17/a-value-industry-thats-about-to-be-the-next-best-thing/

I think this is a curious case. Many lower income people suddenly discovered they can save a few thousand dollars when staying home. No more child care cost. So they refuse to go back to work the old low-paying jobs. It is almost like a large group of Americans suddenly found religion about finance. Some may go back to their old jobs after blowing the stimmies, on dogecoins. Musk in the SNL skits probably marks the beginning of the end for all sorts of coins (TSLA too?). I viewed it as a serious warning sign for the Market.

Morningstar’s recent article makes some interesting points for investors:

https://www.morningstar.com/articles/1033962/value-has-bounced-back-but-it-might-be-too-soon-to-call-it-a-comeback?utm_source=eloqua&utm_medium=email&utm_campaign=newsletter_stockstrategist&utm_content=29203

Traders may do better if they can successfully time the moves.

I believe cyclically sensitive sectors will lead to better relative returns over the expansion phase. To judge ARK investments over 3 month period is myopic.

Greg Ip recently outlined inflation expectations 3 % or above as the biggest risk to equities. Fed has a plan till it gets punched in the face.

Ken and Cam have been pouring the table for buying value, now for a while. Both are on record that we may be early in the value cycle turning up and this may be a several years long move, Morningstar article not withstanding.

One thing that I have learned over the last forty year of investing is not to follow any one blindly. I trust Cam but he has his blind spots or biases. Taxable accounts pose another challenge. For sleeping at night, total market ETFs are best for me. Dividend paying stocks are an important sleeve. So are GARP growth stocks. For alpha over longer periods, I go with CW.

I really don’t get so called ‘value’. Maybe some day I will read a good definition on these pages. An ETF called VLUE is a collection of stocks with doubtful prospects.

I have been a little critical of your assertions about stock overvaluation in the past because I thought they were a bit too casual. Thank you for this extremely rigorous analysis. It’s all on point.