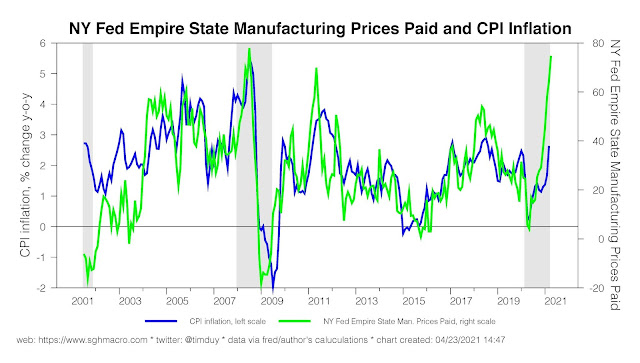

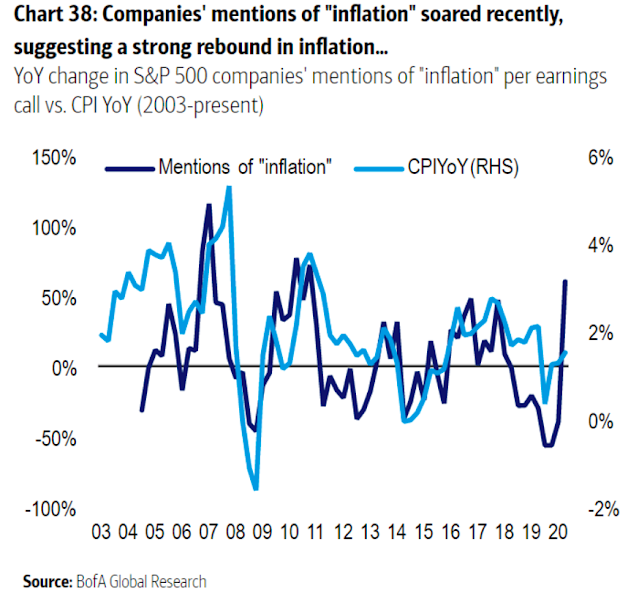

Rising inflation fears are all over the headlines. From a top-down perspective, inflation pressures are clearly rising.

“…the inflationary pressures, particularly surrounding some of our key commodities, looks like it is going to be more of a headwind in ’22” – Coca-Cola (KO) CFO John Murphy

“…we’re watching and seeing SG&A inflation in different parts of the world and in different parts of the business, ranging from wage inflation in selective geographies. You’ve got global logistics inflation. You’ve got commodity inflation.” – Genuine Parts (GPC) President William Stengel

“In the first quarter, global semiconductors and resin shortages amplified existing supply constraints, and thus impacted our product availability. Further, we are faced with rapidly rising inflationary pressures, primarily in steel and resins. To address these issues, we swift the responses with the necessary actions to protect margins and product availability. We announced significant cost based price increase in various countries across the globe ranging from 5% to 12%” – Whirlpool (WHR) CEO Marc Bitzer

Who’s afraid of inflation?

The inflationary menace for equities has two components. The Fed could raise interest rates in reaction to rising inflation, which makes fixed-income securities more competitive to stocks. If the Fed does not react, it risks setting off an inflationary spiral if it loses control of inflation expectations.

My sense is that the Fed intends to wait until we push through the initial rebound of the economy before shifting policy. In the midst of the strongest part of the cycle there is a risk of complacency about the durability and pace of the recovery.

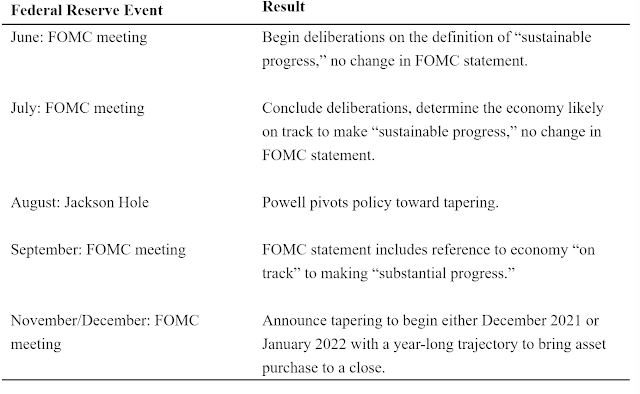

Duy believes that the Fed will not make any public statements about tapering until later this year.

Lavorgna isn’t fearful of goods and services inflation, and, as a result, says the Fed won’t begin to taper its bond purchases before 2023 — and won’t lift interest rates before the next presidential election. The New York Federal Reserve’s survey of primary dealers, in March, found Wall Street expecting that the taper would begin in the first quarter of 2022, with the first hike in the third quarter of 2023. “If you’re going into 2022, and growth is a lot slower, the delta is negative, and inflation isn’t really picking up, it’s going to be very hard for the Fed to taper,” the Wall Street veteran says.

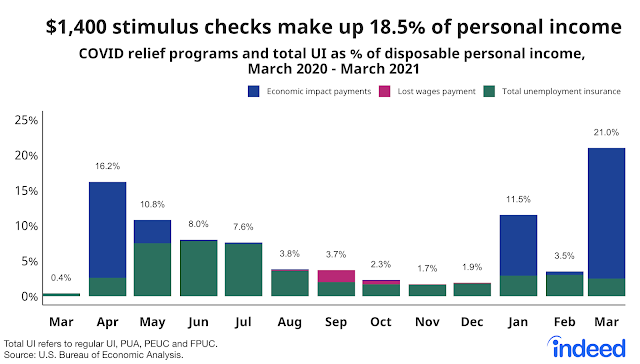

In the meantime, a flood of liquidity is hitting the economy. The March personal income report revealed that stimulus payments made up 18.5% of personal income.

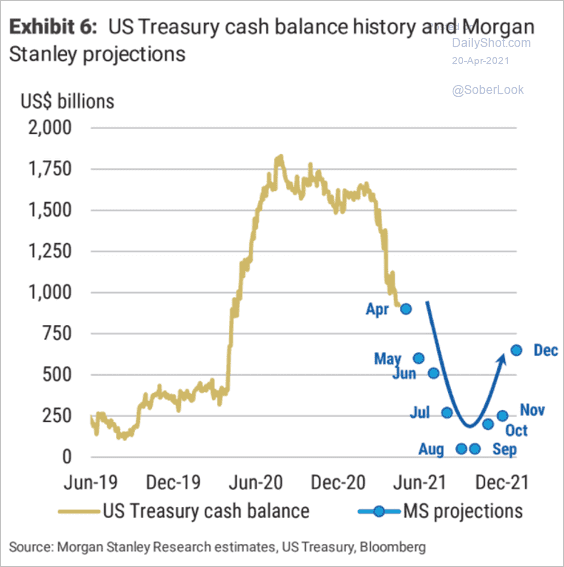

Treasury cash balances are falling quickly and fiscal stimulus will continue until Q3. Equity investors shouldn’t be so worried about inflation.

Long-term inflation threats

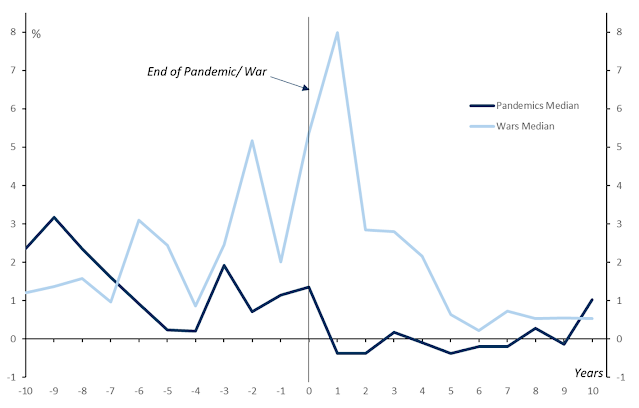

Every war and pandemic is different, and we should be cautious of drawing lessons from events that occurred in the long-distant past and in very different circumstances. One feature of the current pandemic that is clearly distinctive to past episodes is the size of the government response. Equally, however, one can argue that an unusually large government response was necessitated by an unusually large collapse in private sector demand.

What is clear is that history provides no evidence that higher inflation or higher bond yields are a natural consequence of major pandemics.

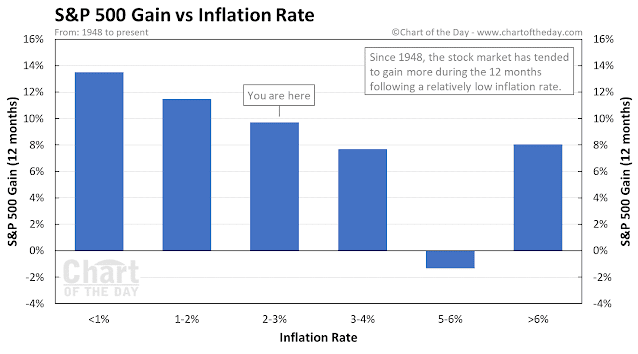

Even if you are worried about runaway inflation, a historical study of inflation expectations compared to S&P 500 returns finds that the environment is benign. Expectations are in the 2-3% range. Equity returns don’t turn negative until inflation rises to 5-6%, and the Fed can be depended to tap on the brakes well before the economy overheats that much.

In short, inflation fears are overblown. This is not the time to worry about transitory rising inflation pressures.

The tax threat

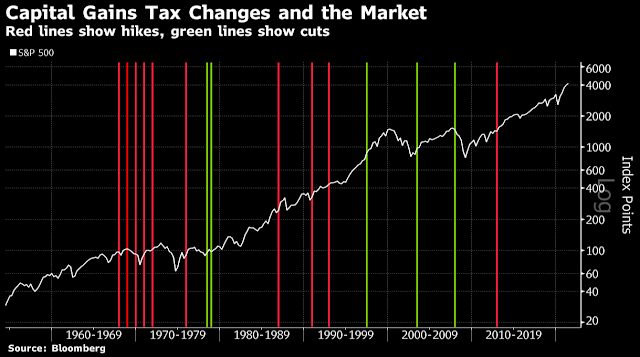

Instead of inflation, the real threat to equity prices is rising taxes. No, equity investors shouldn’t be overly worried about Biden’s proposal to raise taxes on high-income individuals, an end of the carried interest provision, or higher capital gains taxes over $1 million. In fact, there was a flood of analysis showing that capital gains tax rates has little effect on the stock market.

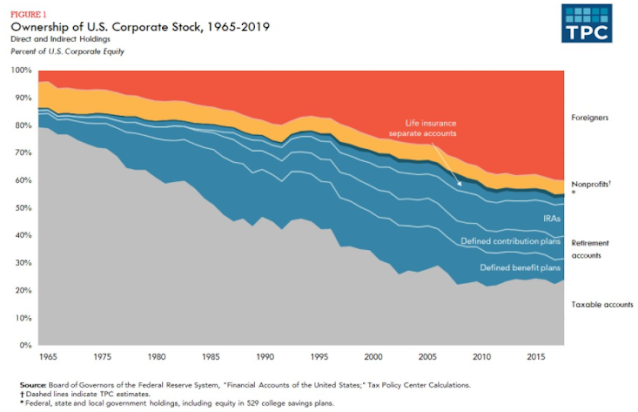

That’s because equity ownership has increasingly shifted away from taxable individuals to foreigners and deferred-tax accounts.

I believe the most important threat to equity prices is Biden’s corporate tax proposals. David Fickling hit the nail on the head when he wrote in a Bloomberg Opinion article that “Yellen’s Global Tax Plan Is on the Level of Trump’s Trade War with China”.

If you expected the administration of President Joe Biden to be a return to normalcy on trade issues after the drama of Trump-era tariff battles and tweet diplomacy, Treasury Secretary Janet Yellen has other ideas.

That’s because her plans announced Monday to introduce a global minimum corporate tax rate represent quite as much of a shock to the international economic order as Trump’s decision to wage trade war on China.

The two phenomena are connected as fundamental aspects of the modern global economy. Corporations have cut operating expenses at the top of their income statements by sending manufacturing offshore to China and other emerging economies where labor costs are lower. At the bottom of their income statements they’ve done the same with tax expenses, by offshoring their profits to low-tax jurisdictions such as Bermuda, the British Virgin Islands, the Cayman Islands, Ireland, the Netherlands, Luxembourg, Singapore, and Switzerland.

In a separate Bloomberg report, Germany and France have come out in support of Yellen’s corporate minimum tax proposal. (They’re looking at you, Ireland.)

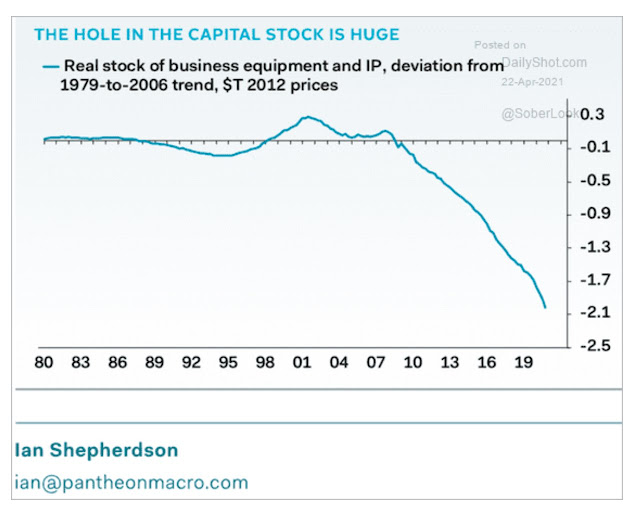

A corporate tax increase is justified by the Biden administration on the grounds that the Trump tax cuts did not spur investment activity. Corporate CapEx has been falling for years and you have to squint to on the chart to see when the Trump tax cuts occurred.

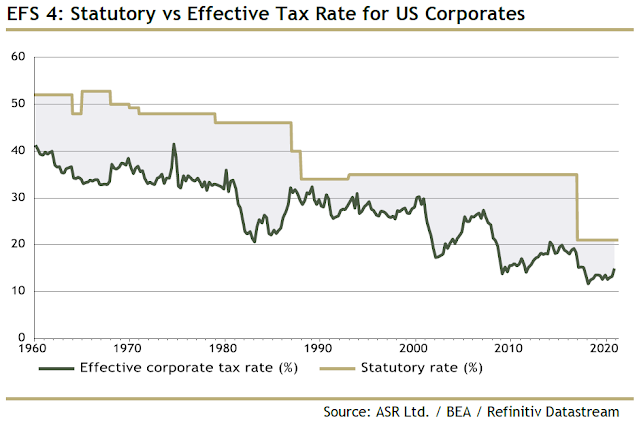

While there will be some inevitable bargaining over the statutory tax rate, which is expected to rise from 21% to 25% instead of the proposed 28%, the real story is how effective tax rates will change.

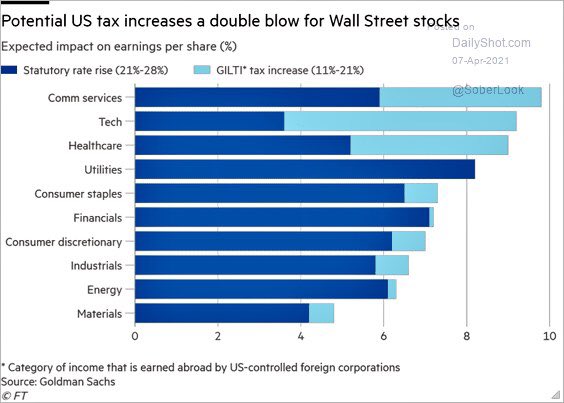

Notwithstanding the proposal of a corporate minimum tax, the more important component of Biden’s proposal is an increase in GILTI tax from 10.5% to 21%. For the uninitiated, GILTI stands for Global Intangible Low-Taxed Income. A GILTI tax is intended to prevent companies from shifting their IP profits to low-tax jurisdictions. The relative losers are in communication services, technology, and drugs. The relative winners are in the value and cyclically sensitive materials, energy, and industrial sectors.

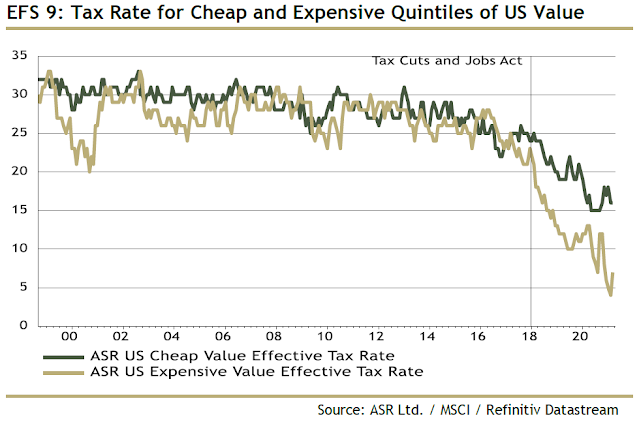

A separate analysis by Absolute Strategy Research found that the Trump tax cuts favored growth over value stocks. The tax rates between the most extreme quintiles of value were roughly the same until Trump’s Tax Cuts and Jobs Act. After the implementation of the tax cuts, the cheapest value stocks (blue line) experienced a much smaller tax cut than the most expensive (gold line).

To conclude, here are my main takeaways from this analysis:

- Worries about inflation are overblown. While some short-term supply chain bottlenecks are putting upward pressure on prices, they are transient and the Fed is not about to allow inflation to run away to 6%.

- The bigger threat to equity prices are changes to the effective tax rate in the form of a minimum corporate tax on offshore profits.

- Major losers under the Biden tax proposals are growth stocks that have offshored their IP: communication services, technology, and drugs.

- Relative winners under the new tax regime are value and cyclically sensitive sectors: materials, energy, and industrials.

My responses are below the sentences in quotes.

“That’s because her plans announced Monday to introduce a global minimum corporate tax rate represent quite as much of a shock to the international economic order as Trump’s decision to wage trade war on China”.

Does anyone in really believe that India and China would comply with such “Global minimum corporate taxes”? Such US enforcement may become difficult if not impossible.

“In short, inflation fears are overblown. This is not the time to worry about transitory rising inflation pressures”.

With very high long term unemployment, in the US and globally, deflation should take hold at some time, in the not too distant future.

“As growth expectations decline, expect 10-year yields to follow”.

Let us pencil sub 1% US ten year yield. This would be a good time to add to dividend paying stocks, and bonds, for balanced portfolios.

“The Fed will not raise rates until it begins to taper its QE purchases”.

Haven’t we been hearing the word “taper” and “emergency measures” since 2008? Seriously, are we really going to see “tapering” in our lifetime?

“Relative winners under the new tax regime are value and cyclically sensitive sectors: materials, energy, and industrials”.

What happened to FAANMG stocks last week? Sure, Netflix and Apple probably did not do that well, but they will simply make it up next quarter. Isn’t this how it works? To be sure, I have been hearing how these companies are being threatened by anti trust litigation etc. but so far, that seems like a threat in far distant future, at least for now.

Sorry Cam, much as though I like your analysis, the premise of FAANMG rolling over and taking the major indices down with them has not worked. Short term pull back calls have not really worked (where is the catalyst?). Sure, seasonal headwinds may play a part, now that we are in May, but one never knows. We have seen summer rallies too, haven’t we?

https://www.morningstar.com/news/dow-jones/2021050113/five-tech-giants-just-keep-growing

It is still a FAAAM world FWIW (Facebook, Apple, Alphabet and Microsoft). Sure, the naysayers will say it seems like Oracle, Cisco, Intel, Microsoft of Y2K, but not really.

Add Tesla to the mix.

FAAMG world (Facebook, Amazon, Alphabet, Microsoft and Google).

Sure, Apple is a laggard for now. But what is the catalyst for a pullback? What is the catalyst for Apple not to gain from the 5 G super cycle?

This is a very logical analysis of inflation but humans are not logical creatures. The inflation indexes do not show home prices properly and that area shows how inflation at the human level is going. In Canada, we are seeing an insane increase in home prices and the U.S. is moving towards similar. Used car prices are surging irrationally. Is this a temporary thing or a new long term mindset. I’d say it’s impossible to say because human herd instincts are unpredictable. My own guess from living in an inflationary world in the 1970’s, is I expect the surprise will be a secular shift to inflation.

As we can see from one quote above (Whirlpool), that company is rushing to raise prices a lot to offset higher input costs. Because savings rates are so high now because of lockdowns and helicopter cash from Uncle Sam, I believe consumers will pay up for products. This will signal to companies to not worry about raising prices. Even companies without higher input prices will raise (note Netflix keeps raising). when they see consumers don’t flinch.

Also wages are set to rise significantly for skilled workers. They are in short supply. These are the consumers with spending power to absorb higher prices and are less price sensitive. Just listened to a brilliant strategist that says Consumer Discretionary stocks lead when wages are going up.

This week saw the first sector hit by supply disruptions, autos, when Ford talked of problems. This took all auto related down.

It might be best for a while to avoid Value areas that may have input cost pressures and stay with Value that doesn’t (Banks and Financials key). Value that is raising input costs (mines, oil, materials for example) are beneficiaries because they are the cost pushers..

I think the areas that are experiencing cost pressures will do well later when they push through higher product prices and consumers surprisingly accept them (as in home prices).

Robert Stermer

You asked for my contact info to see my Momentum and Factor Research. Here it is; ken.macneal@tacticalfactorresearch.com

Happy to show you or anyone else what I’m doing.

Thanks, Ken, I’ll email you next week when I get back in the office

Innovative Growth sector in general (ARKK types) and Clean Energy (ICLN) in particular fell with a big momentum THUD this week after Powell and Biden sent the bond market into a dive on Thursday when investors absorbed all the implications of their messages.

Here are charts of the two ETFs. They fell sharply from their mid-February all-time peaks when bonds started down and have been violently sideways 20-25% below for the last while. We are technically at an important point. If the breakdown below this range, we could have a messy decline and talks of bubbles bursting. Or if we recover, then D.V. will be proven right and it’s up and away.

I’ll ask you to guess if I bought ARKK 120 May 7th puts or calls on Tuesday, the day before Fed Day, with just eight trading days left to run?

ARK Innovation ETF ARKK

https://product.datastream.com/dscharting/gateway.aspx?guid=38027716-d192-4104-a2a9-25b3336aaf6d&action=REFRESH

Int’l Clean Energy ETF ICLN

https://product.datastream.com/dscharting/gateway.aspx?guid=ef6a84e8-0ce3-4c97-8105-31483ee19fb5&action=REFRESH

Note: ICLN has finished their index reorg.

Value oriented sectors are still Momentum leaders.

Big business especially tech are Biden’s biggest backers. Furthermore, there is some risk of movement of IP to China/Singapore etc. if this really happens. Seems like real IP tax reform is not that likely.

I think we are entering secular inflation in the US, but for different reasons than above.

I think the global wealth increases with productivity. The more efficient we are globally at producing something, ie, more for less, the world is wealthier.

The US used to be a manufacturing powerhouse, but now the economy is 70% service. To pay for a service, well, you have to pay! Where does the money come from? Could be savings, or borrowed.

This is why the US has shifted from greatest creditor to greatest debtor.

Sure those stimulus checks will cause a pop as the money is spent, but long term Asia will develop and will compete for resources. The trade deficits have gone on for decades and I don’t expect that to change. Has there ever been an economy that ran trade deficits forever? So long long term the $ devalues, and this will cause inflation here, if the rest of the world is competing for resources.

Near term, the stimulus checks will cause a pop. If companies raise prices, fine, but people have to buy. It’s only the elitist stuff that raising prices makes things more desirable. You know if your local restaurant raises prices, do you go more often, the same or less?

Automation, or should I say “autonomation” will progress and this does not create jobs any more than outsourcing so yes wages will go up, perhaps mostly because those low paying jobs have disappeared. Unemployment will be low because all those who give up are not counted. So the government will be spending more to keep people out of the streets. The other options are not pretty from the social unrest perspective to say the least.

Yes, people are not rational, so expect irrational behaviour (Canadian spelling), but in the long run, what wins irrational or rational? This is the problem with sentiment extremes, when you get a new all time extreme, they compare to the prior one, they don’t mention that the prior one when it exceeded it’s prior extreme that it kept going up. So in short, we don’t know when the top will come in, but I’m pretty sure that at some point sentiment will be much lower.

I think Bitcoin is emblematic of the times.

Anyone interested in REITs? In the last eight years I have gradually accumulated lots of them to replace bonds, banks, utilities, staples. If you plan in detail and follow thru, you can make good money with smaller volatilities. The dividends are unbeatable across all asset classes. And you can find REITs in all aspects of the economy. It is especially attractive today because of the much lowered cap rates. Basically you get inflation hedge, capital appreciation, and dividend compounding all together. If you are doing retirement planning, REITs can be part of it. As you go along further, just increase the REITs percentage in your portfolio.

On my momentum rankings REITs have gone from laggards to outperforming. They were shunned because the office building and mall REITs were toxic in a work and shop from home world. Now the REIT index has turned up strongly. I wonder if buying non mall and office REIT company stocks is better than buying giant over-arching REIT ETFs is better.

In REIT world, only lazy investors use VNQ, XLRE, IYR. You can find many combos of individual REIT stocks to suit your style and need. Most of the price actions are fairly predictable. So you look at the historical average yields of the REITS (all eREITs and mREITs) you are interested in and determine if it is over/under-valued compared to the current yield (in the context of current treasury yields) and decide if you want to reduce/increase allocation. This sounds very simple, but I am pretty sure not many people will follow thru.

Offices will be back, but big malls will not. Currently most of the REITs can be considered attractive because their cap rates are lowered substantially during this pandemic. So their cost structures are very favorable and enterprise values are rising. I think some people noticed and started to move money into this sector. This is probably now the only sector which still has some value untapped.

I’ve been reading stories like this one for months-

https://www.mercurynews.com/2021/04/30/big-real-estate-deal-investor-palo-alto-office-building-tech-stanford/

REITs may in fact replace bonds as a great source of fixed income.