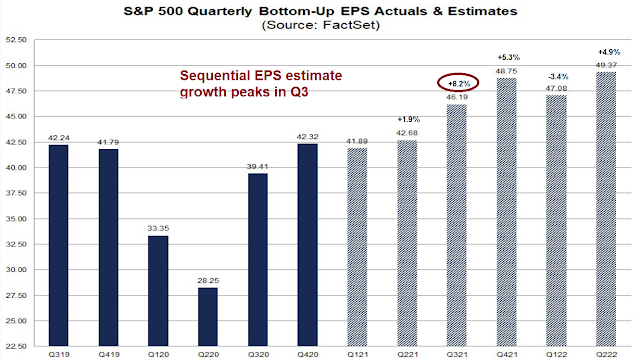

Q1 earnings season is well underway. 25% of the S&P 500 has reported, and a number of large-cap bellwether technology companies will report this week. So far, the EPS and sales beat rates are above their historical averages, and forward 12-month EPS estimates continue to surge.

An upbeat earnings season

The market has been behaving as expected in reaction to earnings reports by rewarding beats and punishing misses.

The economic dam is bursting and the economy is booming. Demand in the US was described as “very, very strong” and “phenomenal” thanks to strong consumer balance sheets and vaccinations. Supply chains are still disrupted and there are significant inflation pressures.

Reopening continues around the globe“…we see continued progress being made in the health crisis. More businesses are now opening up. Unemployment continues to decline. Consumers are spending at record levels. We are optimistic that expanding economic activity will in turn fuel loan growth as companies borrow, build inventory invest and hire more employees.” – Bank of America (BAC) CEO Brian Moynihan

“China appears to be the furthest along in terms of reopening, with activity levels largely back to normal. The US is not all the way back just yet, but is moving in the right direction. And an increase in vaccination rates across the country appear to be driving some of this progress. Europe is improving broadly. And while certain areas have recently experienced setbacks in the process of reopening, we’ve not seen any material impact.” – Danaher (DHR) CEO Rainer Blair

The US is very, very strong“I would say the U.S. was very, very strong.” – ManpowerGroup (MAN) CFO Jack McGinnis“I saw some commentary sort of questioning demand. Demand out there is absolutely phenomenal, across almost every sector. Very, very strong and it would appear to be there for the rest of this year going into next…So we see strong demand, tight supply, record low supply chain inventories across the space.” – Steel Dynamics (STLD) CEO Mark Millett

“And you heard us before talking about consumer demand, to be honest, in all the years I’ve been doing the earnings call, this is probably the year that I’m most bullish about mid-and long-term consumer demand trends in North America. So I’m not worried about consumer demand. ” – Whirlpool (WHR) CEO Marc Bitzer

Consumers have healthy balance sheets“Our FICO scores stayed extremely stable as have our debt-to-income levels. So it’s showing us that the buyer and the consumer is healthy today. And there are still plenty of people out there that can afford to buy a house.” – D.R. Horton (DHI) VP, Investor Relations Jessica Hansen

The economic dam is bursting“I think as you see the vaccine spread, this economic dam is really starting to burst and it’s going to be widespread in terms of an increase in activity and revenues across most businesses.” – The Blackstone Group (BX) COO Jon Gray

There are rapidly rising inflation pressures“…the inflationary pressures, particularly surrounding some of our key commodities, looks like it is going to be more of a headwind in ’22” – Coca-Cola (KO) CFO John Murphy

“…we’re watching and seeing SG&A inflation in different parts of the world and in different parts of the business, ranging from wage inflation in selective geographies. You’ve got global logistics inflation. You’ve got commodity inflation.” – Genuine Parts (GPC) President William Stengel

“In the first quarter, global semiconductors and resin shortages amplified existing supply constraints, and thus impacted our product availability. Further, we are faced with rapidly rising inflationary pressures, primarily in steel and resins. To address these issues, we swift the responses with the necessary actions to protect margins and product availability. We announced significant cost based price increase in various countries across the globe ranging from 5% to 12%” – Whirlpool (WHR) CEO Marc Bitzer

Reopening giddiness?

The tech sector’s acid test

Cam, You said that longer-term, the reopening trade is at risk in the US, but not globally.

Why is the reopening trade at risk in the US?

TSLA net earnings were a record $438 Million, but $101 Million was the result of successful BTC speculation.

Thanks. I closed my latest position (opened after hours @ 720) @ 723. I’m not a BTC bull right now – odds are it retests at least 40k.

This alone should immediately raise a big red flag for serious investors in TSLA.

As of tonight, Plan A for Tuesday remains the same as it was for today. Buy any dip in GDX/ TLT and/or growth/ QQQ. Value isn’t working right now.

Patience – always an effective trading strategy.

TLT now -0.72% intraday and back to April 19 levels.

GDX now -1.5% intraday and below its April 19 close.

Assuming no material change in prices, I plan to reopen sized-down positions in RYGBX and RYPMX end of day.

Also reopening positions in GDX and GDXJ.

Reopening QQQ here.

Will reopen a sized-down position in RYOCX at the close.

COIN.

Opening a position in MSFT after hours ~255.

Reopening positions in QS/ NIO/ PLTR after hours.

Reopened positions in TSLA and NFLX after hours.

GDX/ GDXJ gapping down this morning.

Adding second tranches to both.

Reopening a position in X.

Reopening a position in JETS.

RIOT.

Currently every position opened last night is indicated lower – which happens all the time. My job isn’t to tell the market what to do, but to make probabilistic trades. And when the move against me, my job is to manage them. Right now, I still like the way I’m positioned.

Quick reversals in GDX/ GDXJ from opening gaps down.

Adding to QQQ.

Reopening a position in DISCA.

Reopening a position in VIAC.

Re GDX/ GDXJ. One thing I’ve learned over the years – when taking positions in miners following successive days of declines, any further gaps down should be recognized as potential capitulatory shakedowns ahead of a reversal. Not saying that’s necessarily the case this morning – but it sure feels that way.

IQ.

Reopening a position in KRE on the intraday pullback.

I’ve been waiting to add a second tranche of TSLA – I think the intraday low of 693 holds; adding here.

Closing RIOT for ~+7% gain.

End of day ramp?

Miners and Nasdaq lifting off…

Claims corporate buybacks plus Fed liquidity injections are what is driving the market higher despite net outflows from equities.

https://www.zerohedge.com/markets/selling-frenzy-among-bofa-clients-accelerates-buybacks-soar-sending-market-record-high

Bollinger bands on the VIX are very narrow, upside breakout in volatility looming? Not much room on the downside with the VIX at 17.66.