A considerable gulf has opened up between the Fed’s stated monetary policy path and the market’s expectations. Ed Yardeni recently conducted a LinkedIn poll of interest rate expectations. While the poll is unscientific in its methodology, the results roughly parallel market expectations that the Fed would begin to raise rates in late 2022, and raise them several times in 2023. By contrast, the Fed’s own Summary of Economic Projections doesn’t see any rate hike until late 2023.

The roots of the market’s skepticism

Interpreting the FOMC minutes

Following those transitory pressures associated with reopening it’s more likely that the entrenched inflation dynamics that we’ve seen for well over a decade will take over then that there will be a sustained surge in inflation for a persistent period.

The FOMC minutes also makes it very clear that it believes higher bond yields is reflective of my reflation scenario of a better economic outlook. This means no yield curve control or another QE Operation Twist, where the Fed directs more Treasury purchases to the belly or long end of the yield curve. Brainard qualified that view by stating that the Fed would intervene should the bond market become disorderly.

Powell’s Great Policy reversal

Given the growing gulf between the Powell Fed and market expectations, it occurred to me that Jerome Powell may be the Un-Volcker. During the 1980’s, Paul Volcker wrung all the inflation expectations out of the system and convinced everyone that the Fed is an inflation hawk. In light of the Fed’s new framework, Jerome Powell is attempting a mirror image policy of convincing everyone the Fed is an inflation dove.

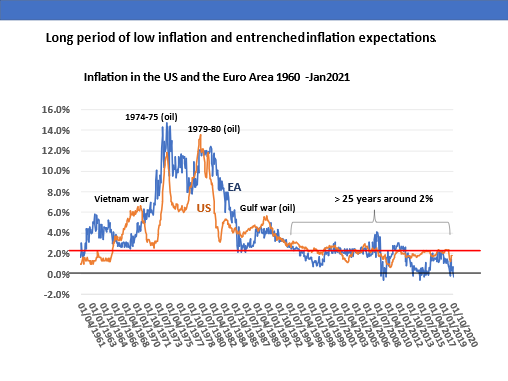

An Un-Volcker stance may be entirely appropriate in light of the economy’s anemic growth and weak inflation outlook. Former ECB board member Vitor Constâncio pushed back against the inflationistas who believe that runaway inflation is just around the corner and central bankers need to act soon to stamp that out. Constâncio observed that inflation in the US and Euro Area has been stable for the last 25 years. Past episodes of inflation spikes were linked to either wars or oil shocks. A major war is not on the horizon, and the window for another oil shock is narrow as the world transitions away from hydrocarbons to renewable energy in the next 10 years.

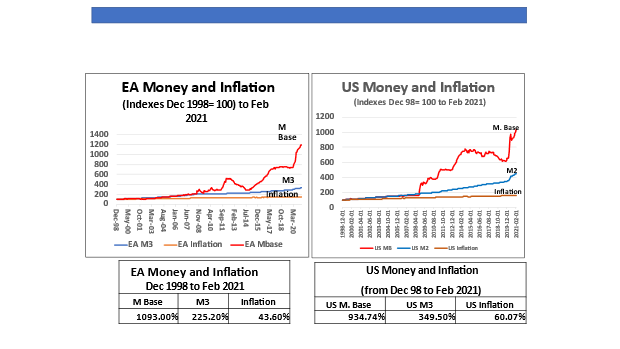

What about all the money growth (PQ=MV) as outlined by Milton Friedman and the monetary economists? Constâncio observed that despite the recent episodes of “runaway” money growth, inflation has been tame.

Portfolio manager Conor Sen argued in a Bloomberg Opinion article that “a Fed rate hike next year won’t be because of 2022 inflation”.

But what we know is that the Fed will largely look past any price increases this year. Even if inflation were to accelerate enough to concern them, Chairman Jerome Powell has said that before the Fed raises rates, it would need to slow down asset purchases, and before that it would give the public plenty of notice. So there won’t be a rate hike in 2021.

And that means it’s inflation in 2022 that will determine whether or not we get an interest rate increase. Merely maintaining elevated 2021 prices wouldn’t be enough — it would require additional price increases to reach a concerning rise in the rate inflation. But there’s a reasonable chance that as auto production catches up to demand, used vehicle prices will fall. Sawmills will have time to ramp up, putting downward pressure on lumber, and so on.

Even in a scenario where 2022 economic growth remains robust, the dynamic of production catching up to consumer demand would lead to slowing price growth on a year-over-year basis — and that’s true even if price increases look strong on a trailing two or three-year basis.

It might take until 2023 to get past these pandemic-related pricing math quirks, making that the year inflation could become more of an issue should vigorous expansion continue. It may depend more on how the numbers get calculated, but the cycle should keep measures of inflation in check while the Fed evaluates the state of the expansion in 2022.

If my assessment of Powell as the Un-Volcker is correct, what does that mean for investors?

Market implications

The most obvious implication of the Un-Volcker thesis is the bond market’s inflation expectations may be too high. While the 2s10s yield curve has steepened in anticipation of better economic growth, the spread between the 2-year and 3-month T-Bills has also edged up in anticipation of higher Fed Funds rates. At a minimum, expect lower 2-year Treasury yields and possibly lower 10-year yields.

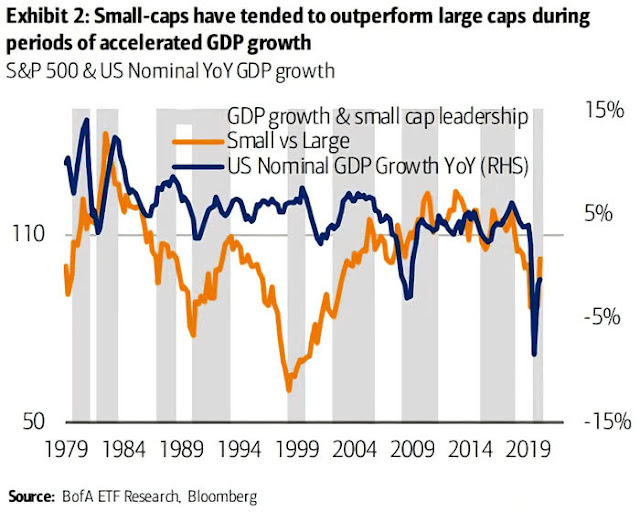

From a big picture perspective, steepening yield curves have been equity bullish especially when the economy recovers from a recession. As well, BoA found that small caps perform well during periods of strong GDP growth. Stay with small-cap exposure as the economy recovers from the COVID recession.

Indeed, GDP growth is expected to be strong. The Atlanta Fed’s GDPNow estimate is 6.2% and the IMF has upgraded global growth to 6.0% in 2021 and 4.4% in 2022.

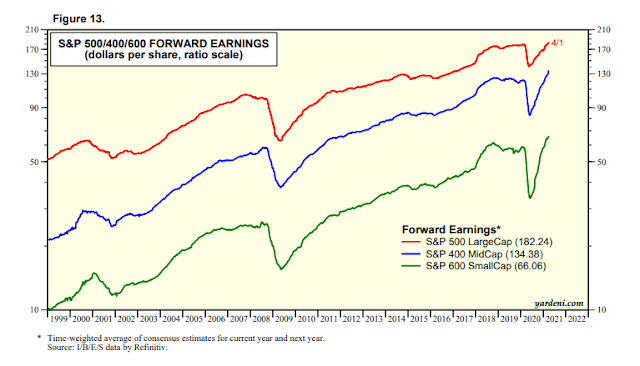

Strong economic growth is propelling EPS estimates upwards. Forward 12-month EPS estimates have been rising across the board. Small and mid-cap estimates have recovered more strongly than the large-cap S&P 500, which is supportive of my bullish small cap call.

Equity price gains in the last year are mainly attributable to rising EPS estimates. The forward P/E ratio has remained steady during this period while the S&P 500 has risen in line with estimates. As the main source of earnings gains have come from cyclical stocks, this argues for an overweight exposure to cyclical sectors, which tend to be more categorizes as value such as financials, industrials, energy, and materials.

Despite evidence of positive momentum, the cyclical trade is not crowded. Hedge funds are still excessively positioned in defensive sectors and their cyclical exposure is still low.

For what it’s worth, FactSet reported that bottom-up derived S&P 500 one-year price target is +9.8% even after the recent advance. In the past, analysts have overestimated the price target by 1.3% in the last 5 years, by 2.1% in the last 10 years, and by 9.1% in the last 15 years. However, they underestimated the price target by a whopping 16% a year ago. Based on the experience of the 5 and 10 year overshoots, my expected one-year price return is about 8%.

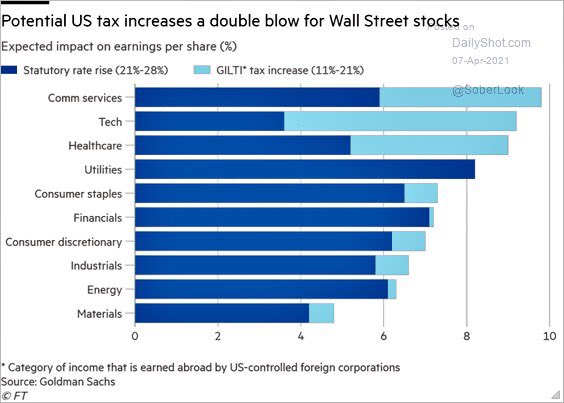

Lastly, the potential effects of Biden’s tax proposals are expected to fall heavily on the communication services, technology, and healthcare sectors. For the uninitiated, GILTI stands for Global Intangible Low-Tax Income, and it is a tax intended to prevent erosion of the tax base by discouraging multinationals from shifting profits from intellectual property low-tax jurisdictions such as Ireland. The most affected sectors tend to be comprised of growth companies, and this argues against an overweight position in growth.

In conclusion, Powell is turning out to be the Un-Volcker Fed Chair. Paul Volcker wrung all the inflation expectations out of the system and convinced everyone that the Fed is an inflation hawk. By contrast, Jerome Powell is attempting a mirror image policy of convincing everyone the Fed is an inflation dove. For investors, this has several implications:

- The bond market’s inflation expectations are too high, expect lower yields, especially at the short end of the yield curve.

- Barring any pandemic hiccups, this is a V-shaped recovery. Small caps perform especially well in such environments.

- Similarly, cyclical and value exposure is expected to outperform.

“The bond market’s inflation expectations are too high, expect lower yields, especially at the short end of the yield curve”.

Same conclusion by Cathy Woods (inflation may be lower than anticipated).

As life long portfolio construction goes, I like to think that a certain proportion of stock holdings should be invested in classic income producing basket (Tobacco, Utilities, Staples, Phone companies, may be big pharma, US bonds of short maturity etc.). If bond yields are likely to be lower in the next 1-2 years, this may be a good time to accumulate this basket. To be sure, these stocks have not had any major correction despite rise in bond yields this year.

Though inflation expectation may be lower in reality than headline, Ocean front properties in certain parts of Florida are experiencing significant price rise this year (asking prices are up 20% this year by comparison to last year). This is a unique subset of real estate, that acts as an inflation hedge (much like gold or perhaps bitcoin).

It is not only stocks but certain segments of real estate that are experiencing price rise. This is mostly due to inventory squeeze, limited building construction and tight lending standards, perhaps some migration to Florida. Unique factors.

D.V. I was think that one big source of supply, elder folks selling and moving to care homes has totally dried up. Who would go into a care home after the tragedies that happened in them?

Excellent insight! The homebuilder stocks may continue to rise especially if we see the countertrend rally in bonds continue for a few more months.

I think elderly may also be staying at their homes for longer because of better remote health care monitoring options available now. Moreover, many are also fitting their homes with ramps and lifts for easier strides. Delivery of groceries, prepared food and other stuff also make it easier to live at home.

Interesting take Ken and Sanjay. I suppose senior citizens love their McMansions and American love affair with these mega houses continues, as does American fascination for ocean front real estate.

My momentum update this weekend see the Homebuilders ETF is outperforming for the first time since the November Vaccine Super TWIST. Take a look.

https://refini.tv/3rGDwEZ

It was a big outperformer last year but was lagging badly after the TWIST when other Value sectors stole the attention and mortgage rates went up. Maybe it’s getting it’s mojo back.

Canadian home prices are soaring (up almost 20% YTD in the big cities). This could be a leading indicator for the US near future. We have seen almost half a million new jobs announced here in two months. On a 10-1 relationship to the US economy, that is equivalent to five million new job in America. Just imagine if or when those types of jobs numbers happen there as herd immunity arrives. House building might ignore higher mortgage rates and prosper.

BTW I am now using the Equal-Weight S&P 500 Index (RSP) as a measure. This is much tougher for any sector ETF to outperform. RSP outperformed the market weight SPY by over 10% since the TWIST.

In my opinion, bonds are no longer investable. Experts are incredibly divided in their forecasts. It’s a classic ‘i don’t know’ situation. Meanwhile the area where the bulk of investors own, namely corporate bonds now have stupidly and ridiculously low spreads that offer an investor all the risk with little reward. I am seeing big corporate blowups that tells me the credit market has risks that bankers and credit agencies are missing.

Regardless of who is right about inflation being transitory or a new secular trend up, it is going to FEEL like it’s never ending for the next year as Central Bankers ignore the big ŕises and keep telling us not to worry. A herd of worried investors can do anything. They are not logical. There could be a time when rates get very high and juicy when the crowd panics on bonds. That isn’t any time soon.

As a reminder, I wrote about what balanced funds should do if bonds are no longer investable.

https://humblestudentofthemarkets.com/2021/03/13/60-40-resilience-in-an-inflation-age/

Ken

Do you mind sharing these “corporate blow ups”? I am aware that this is a segment of the market that has ridiculous pricing and Corporate bond sell off has been talked about as a black swan event waiting to happen. Having said that, I do not know what is happening in this segment. I see LQD is showing modest losses (7% or so).

Pacific Gas and Electric, several energy companies hurt by the Texas deep freeze, a large German international payments company, a very large international receivables financing firm, a few airlines. Even the multi-billion Bill Hwang collapse is a warning on lax credit standards coming back to haunt bankers.

In my experience, I have found that bankers wait for an economic recovery when sitting on a bad loan. They don’t pull the plug when there is no market for the assets backing the loans. So the second half of the year might see a wave of bankruptcies when the economy recovers and it becomes obvious that a highly leveraged company will not survive even when the economy turns good.

Here is an anecdote about how much liquidity there is sloshing around today.

A Canadian corporation had about USD 10 million in an account with a Big 5 Canadian bank that they had no immediate need for. So they decided to put it into a 30-day term deposit with the bank. The bank said that they had too much USD and turned down the term deposit.

First time in my life I’ve heard of a bank turning down deposits.

I offered the company the following deal: Give me all your money. I promise I won’t pay you back. You get to write it off as a bad debt….waiting to hear back about my proposal.

Shocking! How can they say ‘no’ to such a generous offer! Lol!

I was listening to Richard Bernstein on Wealthtrack.com. Richard was making the argument that high-yield bonds will perform well even if the interest rates rise as the issuers of those bonds will repair their balance sheets as the economy improves. There will be fewer bankruptcies as well.

Thanks.

Morgan Stanley says small caps will continue to underperform as smaller companies going to be less capable of absorbing increasing cost pressures (which have been front and center in recent PMI reports globally)

This Dallas Fed paper observes the behaviour of investors after the Volcker Fed regime change:

https://www.dallasfed.org/~/media/documents/institute/wpapers/2012/0117.pdf

The commonly cited regime shift in U.S. monetary policy occurred in 1979. There was a sharp fall in inflation expectations in the early 1980’s, but even after this switch to a stable monetary regime there is considerable volatility in far-forward measures of inflation expectations like the 5-year-5-year forward.

…

If the change in monetary regime occurred in the early 1980’s, why do the volatility of long-run inflation expectations fall much later?

To explain the persistence and variability of long-run inflation expectations, this paper will construct a model where agents are unsure about the central bank’s inflation target. If the central bank has limited credibility and cannot perfectly anchor beliefs about the long-run level of inflation, then agents will update their beliefs about the central bank’s inflation target based on past observations of inflation. Thus a period of high inflation can lead to higher long-run inflation expectations, which become self-fulflling.

What probably needs to be taken into account is that the market will remain unsure about the Fed’s real inflation target – as the Fed remains overly focussed on preventing an unorderly bond-market sell-off, investors are likely going to assume that the Fed is simply not going to care about inflationary pressures. This lack of a credible central bank inflation target may lead to increased volatility in inflation expectations.