As the markets remain in risk-on mode, readers should be aware of several lurking risks that may appear from the FOMC meeting. Undoubtedly, Powell will repeat his dovish mantra that the Fed is a long way from neutral and policymakers are focused on the labor market.

- What will the “dot plot” convey about the path of interest rates and how does that differ from market expectations?

- Will the Fed do anything about the soaring 10-year yield, which has risen above 1.6%, i.e. yield curve control (YCC)?

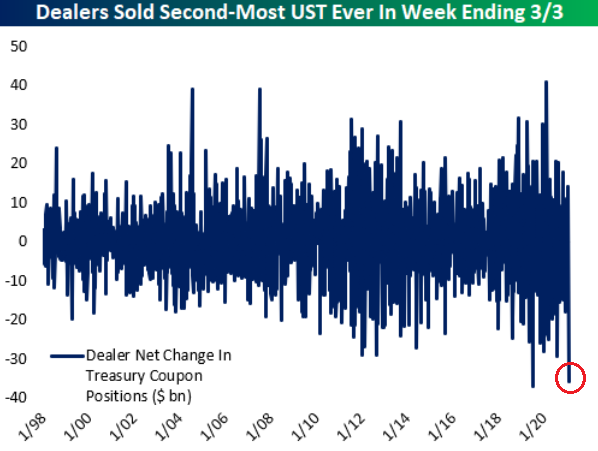

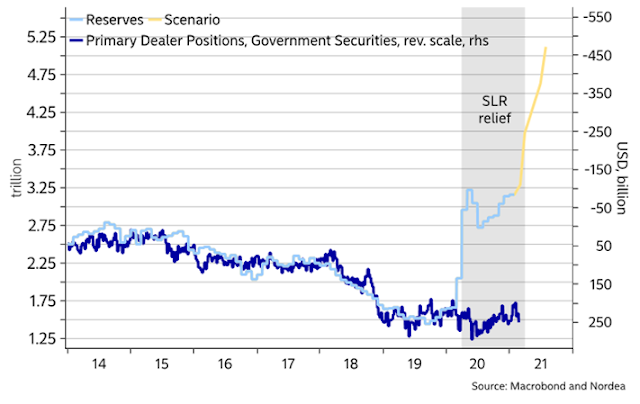

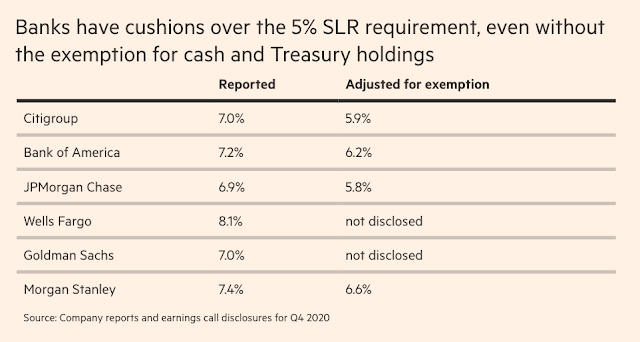

- What will happen to the Supplementary Leverage Ratio (SLR), and will the banks get SLR relief after March 31?

Timing of rate hikes

Fed watcher Tim Duy expects a dovish response from the Fed:

The Fed will likely not signal a 2023 rate hike at this week’s meeting. Doing so would call into question the Fed’s commitment to the new policy framework…It would begin the rate hike discussion before the tapering discussion.

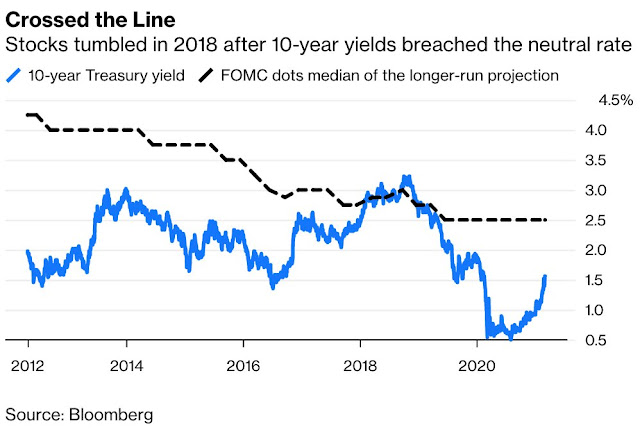

Also, keep an eye on the long-term neutral rate. In the past, this rate has acted as a ceiling for the 10-year Treasury yield.

SLR explained

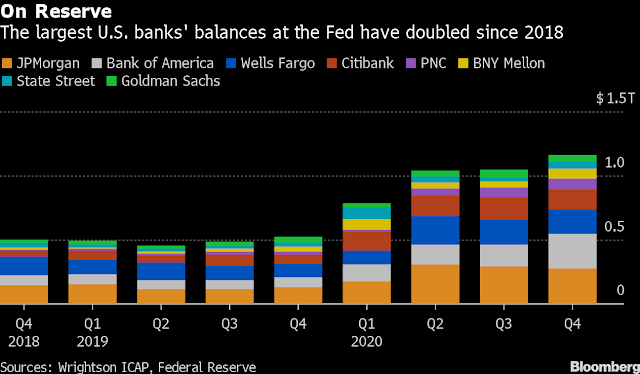

The latest acronym on Wall Street’s mind is SLR: the supplementary leverage ratio. In normal times, SLR required U.S. banks to hold a minimum level of capital against their assets as a buffer against losses. However, the Federal Reserve exempted Treasuries and deposits at the central bank from those requirements roughly a year ago. Banks took advantage, with balance sheets ballooning by as much as $600 billion as a result of the regulatory relief.

If Pozsar thinks it is incoherent as an overall strategy for G-SIBs [large systemically important banks], if JP Morgan doesn’t think it is risky, if Warren and Brown think it is bad politics and, if the FDIC would have to reverse itself, then, despite worries about Treasury market panics, the SLR exemption should be allowed to expire.

If there is turmoil in the repo market, what we have learned from September 2019 and March 2020 is that given our market-based financial system, there is no alternative but for the Fed to intervene as the first responder. No amount of private balance sheet capacity will make a significant difference and it is better to keep the risks out of the G-SIB balance sheets.

If we do need Fed intervention, it should be massive and prompt and avoid the market plumbing becoming a political issue. The September 2019 and March 2020 panics were buried. No reason, if necessary, not to bury interventions in 2021.

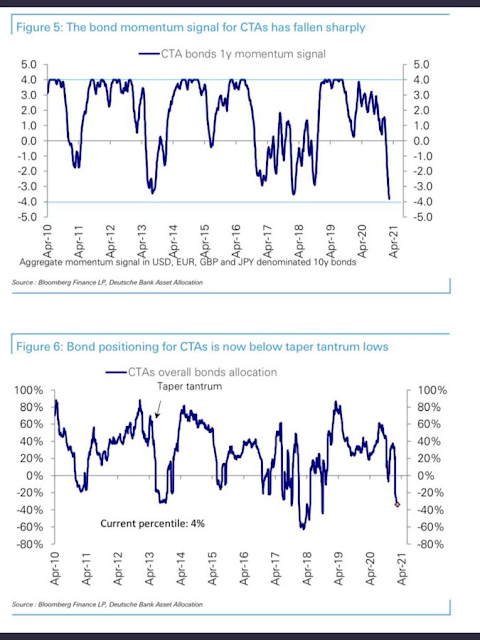

In other words, don’t turn all Zero Hedge Apocalyptic on the prospect of SLR expiry. CTA hedge funds are already in a crowded short position in bonds. Any positive surprise has the potential to spark a “rip your face off” bond rally.

In summary, there are several risks that investors should be aware of ahead of the FOMC meeting. My tentative conclusion is we should see a dovish response from the Fed. While these risks do exist and they are always present, the anticipation of any pain may be worse than the event itself.

If the markets turn risk-off ahead of the FOMC announcement, don’t be afraid to buy the dip.

My sense is that the pain trade will be higher without a pullback.

In one sense, we’ve already had a pullback – albeit only in the Nasdaq. That may be enough. What about value? It had a brutal selloff last year – now that it’s breaking out, is it really necessary to zig zag its way back? Instead, it may be a series of successive gaps up that simply doesn’t allow easy boarding. In any case, that’s exactly why I needed to start boarding today – which really wasn’t that difficult. I suspect that opening positions is about to get much harder.

Opening a couple of positions after hours. IPOE. QCOM.

Lot of disbelief that the market can go higher. I’m seeing the same thing with the crypto market.. lots of skepticism, although justifiable fundamentally.

Main street still hurting and income in the service and travel industries haven’t recovered.

https://quantifiableedges.com/dji-momentum-a-potential-positive-for-intermediate-term/

Adding to XLE.

Adding to KBE.

Adding a position in IJS.

Reopening a position in JETS.

Closing QCOM for a +3% gain.

Adding to PICK.

Reopening a position in QS.

Adding to KRE/ XLI.

Trimming back on QQEW.

Opening a position in AA.

Diversification is working out well today. Gains in QQEW/ FXI/ ASHR/ EEM/ VEU offsetting the decline in banks/ industrials/ energy.

Adding to X.

Due to the CPCE under 0.4 I decided to sell all positions in SPY, QQQ. I will buy them next week hopefully at lower price.

Fair enough. My take right now:

(a) We may have seen the ST low for QQQ. Although I’m playing QQEW for what I think will be a better return.

(b) We’re at all-time highs in the DJIA/ SPX. An immediate selloff from ATHs is unlikely, IMO. I think it’s shorts who should be afraid here – which may explain the CPCE.

(c) The crowd tends to be right during trends, and easily misled at turning points. Are we at a turning point? Personally, I don’t think so.

Seeing lots of positive news regarding US vaccinations. A few states are planning on opening appointments to all cohorts above age 18 by end of March.

Currently averaging about 2 MM doses administered per day and 220 MM doses to be manufactured by end of month.

This is a bull market.

Nice call on QQQ, Alex.

I plan to add back the QQEW that I trimmed back on yesterday.

Energy trading lower (probably on lower oil prices but who really knows), whereas banks/ materials are indicated higher.

Emerging markets trading down today after trading up yesterday.

Sometimes it’s better to admit that I don’t have a clue re why prices move up or down on a daily basis, and just focus on the fact that it’s a bull market – which keeps me on the right side of the market.

AA/ X up 4% to 5%.

Now emerging markets are in the green. I just don’t think it’s possible to micromanage this market.

Trimming a few positions here.

(a) The portion of QQEW that I reopened this morning.

(b) I opened a position in FCX earlier today/ closing it now.

(c) Cutting back on AA.

(d) Cutting back on BABA.

Ended up trimming 50% of all positions in the last ten minutes.

Just hedging my bets.

~50% invested heading into today. Then ~67% after adding back a second tranche in QQEW. Now 25% invested.

One thing I’ve noticed is the daily gyrations in prices. Now that I’ve noticed and plan to try gaming the ups and downs, that will probably stop.