Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model that applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

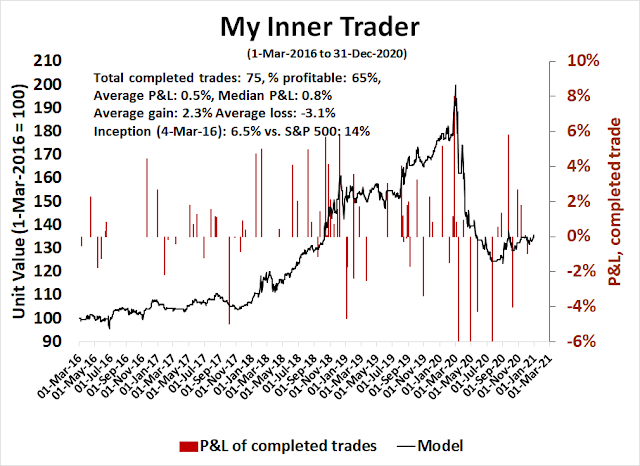

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts are updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Bullish

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

No stampede

Three weeks ago, I rhetorically asked if the market would surge higher during a seasonally favorable time of year (see

Time for another year-end FOMO stampede?). I observed that “the Fear & Greed Index followed a pattern of an initial high, a retreat, followed by a higher high either coincident or ahead of the ultimate stock market peak.” (Warning, small sample size of n=4).

Since I wrote those words, the S&P 500 rose a respectable 2.5% while the

Fear and Greed Index fell to 51. It’s not exactly a stampede. The main question is: “Will Fear and Greed exhibit a second peak before the actual market peak?”

The bull case

Here are the bull and bear cases. The bulls can point out that the S&P 500 staged an upside breakout to fresh all-time highs while trading in an ascending channel, which is constructive.

Ryan Detrick at LPL Financial found that strong late year momentum carries on into January and the following year. Since the S&P 500 is up 14.3% in November and December, investors can expect further gains (small sample size: n=5).

I am indebted to

Urban Carmel for the idea for a generalized version of Detrick’s study of two-month price momentum. My analysis added a sentiment indicator, which shows that there were 12 episodes where two-month S&P 500 returns reached 10% or more. Only 2 of the 12 resolved in a corrective manner. Moreover, overly bullish sentiment, as measured by the AAII bull/bear spread, did not matter to returns. However, Urban Carmel added a caveat that the current episode is not like the others, which “all happened at major lows (like March of this year); 1987 started after SPX dead flat for 9 months”.

Analysis from Nomura indicates that hedge fund positioning in developed market equities is not excessive. Should the market engage in a momentum chase, there is more room for this fast money to buy.

Technical warnings

However, a number of ominous warnings are signaling a rising likelihood of a market correction. The NYSE McClellan Summation Index (NYSI) is starting to roll over. NYSI levels of over 1000 were signals of strong momentum, but pullbacks after 1000+ readings are a warning of market weakness. There have been 16 such signals in the last 20 years. 11 of them have resolved bearishly (red vertical lines), while 5 have been bullish (blue lines).

In addition, the quality factor is also flashing a warning by behaving badly. The relative performance of both large and small-cap quality factors have plunged, indicating a low-quality junk stock rally. Such conditions during past market advances have been indications of excessive speculation, and an imminent market top.

There is a minor negative divergence from my equity risk appetite indicators. The ratio of high beta to low volatility stocks is starting to fall, which is indicative of poor internals. As well, the equal-weighted consumer discretionary to consumer staple ratio, which minimizes the weights of Amazon and Tesla, is also exhibiting signs of minor weakness.

In addition,

Jeff Hirsch of Trader’s Almanac wrote that the traditional Santa Claus rally, which stretches from December 24 to the second day of January, sees an average S&P 500 gain of 1.3%. The return so far to December 31 have already exceeded expectations at 1.8%.

Sentiment readings continue to be very frothy. In addition to the stretched condition of numerous sentiment surveys, the divergence between the equity-only put/call ratio, which mainly measures retail sentiment and shows excessive bullishness, and the index put/call ratio, which is used for institutional hedging and shows rising cautiousness, is worrisome.

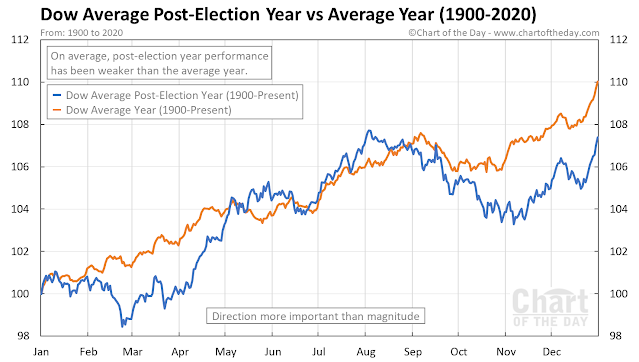

The current technical and sentiment backdrop is consistent with the seasonal post-election year pattern of a January peak and a bottom in late February. Before the bearish contingent gets all excited, the average pullback is only about -2%.

In conclusion, the stock market has behaved as expected during the period of seasonal strength. However, a number of technical warnings are starting to appear. As the market’s period of positive seasonality ends in the coming week, be prepared for the possibility of a short-term top. On the other hand, historical price momentum studies are pointing to further gains.

Keep an eye on the Fear and Greed Index for a second peak as a tactical warning of a correction. However, there is a distinct possibility that a second peak in the Fear and Greed Index may not appear this time before the market corrects. In this situation, traders are advised to keep an open mind, and maintain trailing stops as a form of risk control.

Disclosure: Long SPXL

Time for learning and introspection.

End of every year is a great time to reflect back, and learn from what worked and did not, and for me, charitable giving. Much of these reflections have been written in the last few days, but here are a few that need to be considered;

1. Ken’s moonless nights, have been replaced by perhaps a thousand suns (of fiscal stimulus). Sorry Ken, I like your ideas and this should not be seen as a criticism of your work, but just a reflection, that the moons are now shining during day light hours! Central banks have won.

2. Cam’s long term target of 1600-1800 on the S&P 500 seems remote now, unless there are extrinsic factors, like a war or a lengthy pandemic or another virus that causes a different pandemic. Statistical probabilities are low here.

3. Both the above are based on money printing. I expect 50 Trillion $ as a goal, each 1 Trillion pushes gold by 100 $ per oz. Sure enough, Bitcoin may reach 7 figures.

4. So far, no post election violence has happened (see Cam’s missives earlier in the year, with elevated VIX and so on). Nada, zip. Statistically, what is the probability of significant street violence in the US, in the next few weeks? Close to zero?

5. Back in the day, my sons used to learn Chess from a guy, let us call him Boris. I would sit in the room and hear what Boris used to teach my sons. Boris himself is a phenomenal chess player and taught everything he knew about chess to his son. Boris’s immigrant son, in his debut tournament clocked out at 2100 at the US Chess Federation game (2500 is Grandmaster). While these three kids were learning chess, the only thing I learnt was to position your pieces and lowly pawns ahead of time. China is doing just that, positioning its pieces and pawns, strategically, on a global chess board, slowly, deliberately, moving each with a pair of chopsticks. Last I checked, Australia was being force fed Chinese business methods, with chop sticks. The west never had a monopoly on great thinkers, philosophers, artists and musicians. We need to give credit to Chinese thinkers also. Chinese geopolitical thinkers will tell you, as they carefully lay down their pawns and pieces, this is not time for a war with the US. It is too early. They will wait, for further divisions in the US. The warfare will be asymmetric and non-conventional. We are already seeing the early manifestations of such strategies. Look to the East, and you will see the arc of Covid has been controlled better in the far East, China included, at much lower cost. Why? What is it that the world can learn from these people? It is not just China, but much of far East that has delivered, quietly, efficiently, without much brouhaha. The US on the other hand struggles with vaccine distribution, less said the better. For those reading this, there is an interesting documentary series titled The Chinese exclusion act of 1870. It details the same anti China rhetoric in the past 150 years, as we see today. Go figure.

6. January and February seem like months where we see major bottoms. Let us see if this holds true. What would be the catalyst? Georgia runoffs? Missile strikes on Iran? An accident in the Strait of Hormuz or a major cyberattack that shuts down the US Federal Reserve or the Pentagon?

7. It is too bad Urban Carmel stopped writing his phenomenal blog. I owe him a pound of debt.

8. We can justify that the markets are technically cheap based on Real Earnings yield. This has not been a correct argument in the past however, but may be, just may be this time “is” different !!!), especially if ten year Treasury yield approaches -5% in ten years. This “factor” was not taken into account by Cam, in his articles this year, IMHO. Sure, we are not at -5%, at least not yet, but moving in that direction.

9. Professional investors and advisers lost out to retail investors this year. Retail investors stayed the course. This may be a recurring theme. Cam’s recent missive that the trading model going forward may become partly superfluous in a running bull market is a reflection on this important caveat. One could see a one and done for the next decade, if we get a 10-15% correction in the next quarter. Let us pencil in 6th March as an intermediate bottom, and see if it works.

10. There are American growth companies that will keep producing gains. These will not be FAANG, but may be what is bought by ARKK (ETF). Growth led capital gains are not likely to go away. Value, Cyclicals, small caps, EMs and non-US markets may deliver better gains, but for how long? Liz Ann Saunders did acknowledge these trade idea, but somewhat reluctantly and not wholeheartedly . Sure, one can go with the flow, until the music is playing.

Cheers and apologies. This post is not to be taken personally and not a political statement.

China is and will be the hardest global power to deal with. They are a proud and nationalist people who work extremely hard and are laser focused. Xi Jinping is the modern ‘emperor’ who wants to put China on the top and establish their hegemony. Human Rights, basic freedoms are not important to that mission.

I worry US does not have adults who can develop a long term strategy for mutual benefit.

https://www.schwab.com/resource-center/insights/content/georgia-runoffs-hold-key-to-senate-control-2021-policy-agenda

An excellent perspective on GA runoffs. I have a feeling that GA may elect two Democratic senators (based on what I read in the above article).

GA elections will be very close. Rs had the upper hand in the November senate races but early Black turnout is 3% above the November pace, which gives Ds the advantage. Rs need to turn out in numbers on Election Day.

It’s going to be a nail biter.

As for the markets, a D sweep could be interpreted as bullish (more fiscal stimulus) or bearish (higher taxes). The reverse is true for an R win. We’ll see which narrative the market adopts.

Ga elections will have consequences. One could be that some of the dog eat dog mentality takes a back seat to finding more of a centrist ground. Biden is a moderate who will be pulled hard to the left by Pelosi-Schumer-AOC nexus counterbalanced by moderates in both parties and razor thin majorities. Biden is already backtracking on many campaign proposals.

Democrats will have lot more senatorial seats to defend in 2 years than Republicans. Some Democrats would be at home in either party.

Americans are more moderate than realized. Trump/Biden won by a combined less than 50,000 votes in three states. No mandate for either side.

Key issues are equality of opportunity, helping hand for less fortunate, rule of law, and climate rehabilitation.

I am optimistic either way.

Each time thousand suns are shining on the economy, it is hard to see the emerging clouds. We always think we have found nirvana, that we can position ourselves defensively when the time comes, all to no avail except for a few. It behooves us to keep the primary purpose of the money and the goals for our investment process in mind all the time.

Post December 2018 debacle, it became clear that essential funds should be defensively positioned. That paid handsome dividends last year. Regardless of dire warnings of catastrophic collapse, it allowed to stay fully invested.

I feel discomfited that Cam has turned incredibly bullish. Out of three models, one would not be useful, other two likely staying the course. We know that there are corrections each year averaging 14% unless it is different this time.

Both bullish and cautious. LT bullish, but penciling in a 5-10% pullback in Q1. Not sure about timing.

Well – I’m buying back in between now and the close.

I would agree with a -5% to -10% pullback, but I don’t think we head higher before we head lower.

Typo->I think we head higher before we head lower.

Basically, I reopened all positions closed last week – at higher weightings.

Also reopened what will be my first long-term position in QS.

It’s notable that despite today’s selloff + the fact that I began buying only after the market had started climbing back from the intraday lows – there were a few positions that I was only able to reopen at higher prices: XME, EEM, even VEU.

I’m not sure what to make of the move in cryptocurrencies over the last 7 days. Its like institutions suddenly found them more appealing after 10 years of churn.

All in all, my opinion has not changed on them. Sticking with 1-4% asset allocation – no more.

https://www.bloomberg.com/news/articles/2020-12-10/169-year-old-insurer-massmutual-invests-100-million-in-bitcoin

USO gapping up.

Adding a position in EWZ on the early selloff.

My take at this point is that we head higher over the next 3-4 days. Then we head lower. JMO.

Trimming back on USO/ BABA/ XLE/ KRE – simply b/c I’ve noticed a tendency for these positions to pull back during the day. Of course, today may be the one time they don’t.

Closing positions in FXI/ EEM/ XME, as they’ve hit my targets for this week.

Out of the high-beta plays->RIG/ FCEL/ RIOT.

Closing EWZ.

Closing JETS. Closing out USO-> I think it’s topped out for the day.

Doing my best to hold the LT position in QS. Should prices pull back to ~50 will open a ST trading position.

Adding back to KRE. Looks like XLE/ BABA/ even USO won’t be offering any reentry opportunities.

Adding to an existing position in VTV.

Adding to XLF/ XLI.

Undecided as to whether XLE is a sell or an add here – ie, is the sector finally breaking out never to look back?

Out of KRE/ XLE/ BABA/ XLF. You could say I’m opting out of the breakout scenario, as I expect reentry opportunities over the next week or so.

It almost feels like 2021 has compressed two weeks’ of trading into two days.

I’ve set up fund positions to close end of day->50% VTIAX + 16.7% each in RYSPX/ RYDHX/ RYRSX.

Out of VEU/ VTV.

Looks like Cam’s inner trader is cashing out as well. That seals the deal for me.

Remember the silver coins I prepared to sell last July – right before a -8% plunge in silver prices. We’ll probably sell ’em today – undoubtedly right before a +8% jump in prices tomorrow.

I tend to be early, and I’m well aware of the tendency. I do my best to hedge against it, but there are many occasions when it works in my favor – usually when taking losses quickly. So I’ve learned to accept it as a character trait that often caps potential gains…but also occasionally mitigates losses.

Giving in on QS. Taking gains here.

+1.1% ytd.

Lots of cross-currents.

(a) Yields up. Banks up. Do I regret closing positions yesterday? Can’t waste any time on that. I booked decent one-day gains, and I’m happy with that.

(b) Infrastructure spending. Tanks (ie, industrials) up. Ditto.

(c) More regulation + higher taxes. Large-cap tech down. There may be a buying opp here at some point.

Obviously, there’s a lot more happening in areas like cannabis/ crypto/ EV. But I think it’s important to orient myself around the big picture right now.

Election results, as far as I know, are not yet finalized.

Definitely not chasing the banks and tanks here.

Glad we sold our silver stash yesterday 😉

Watching QQQ/SPX support levels ~305/ 3662.

On March 4, 1957, the index was expanded to its current 500 companies

Then 1954 is just a joke

Impressive rally off the open for SPX. Not sure why, but I’m not buying it.

Looks like I’m wrong.

I bought into it. Although… small position here.

I got stopped out of a NQ futures last night. Not a good feeling.

Cam- Wondering if you have buy targets for either IEF or TLT?

Noticed the 30Year might break out. Pretty significant gap

Adding on more to XLE

Looks like Mr Market is liking Democrats in the Senate.

It’s starting to feel like a blowoff top.