Mid-week market update: It’s difficult to make a coherent technical analysis comment on the day of an FOMC meeting, but the stock market remains in a holding pattern. While the S&P 500 remains in an uptrend (blue line), it has been consolidating sideways since late November and early December.

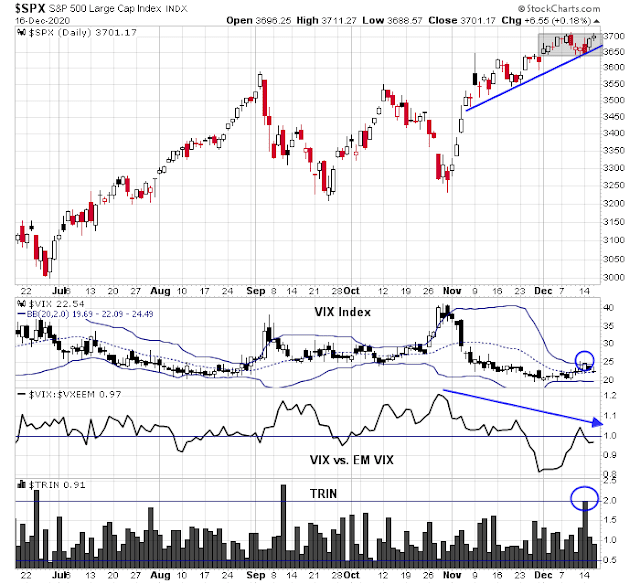

Until we see either an upside breakout or downside breakdown out of the trading range (grey area), it’s difficult to make a definitive directional call either way. The bull can point to a brief spike of the VIX above its upper Bollinger Band on Monday, which is a sign of an oversold market. TRIN also rose to 2 on Monday, which can be an indication of panic selling. As well, the VIX Index is normalizing relative to EM VIX since the election. The US market has stopped acting like an emerging market as anxieties have receded. As the S&P 500 tests the top of the range, these are constructive signs that the market is about to rise. On the other hand, the bears can say that even with all these tailwinds, the stock market remains range-bound and unable to stage an upside breakout, indicating that the bulls are having trouble seizing control of the tape.

Signs of consolidation

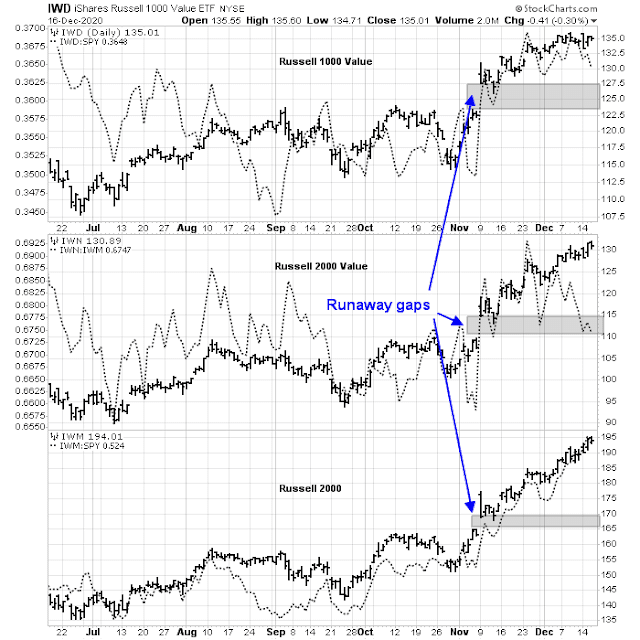

The market is definitely showing signs of consolidation. The Vaccine Monday rally of November 9, 2020 marked a turnaround in risk appetite and factor leadership. Since then, small caps and value stocks have led the way. These “Great Rotation” groups gapped up on Vaccine Monday by exhibiting runaway gaps and haven’t looked back since.

The dotted lines in the chart above depicts the relative performance of each of the groups relative to the S&P 500. Both large cap value and small cap value have started to trade sideways relative to the market in the past few weeks. Only small caps have continued their outperformance.

These are signs of consolidation and a market digesting its gains.

A bearish tripwire

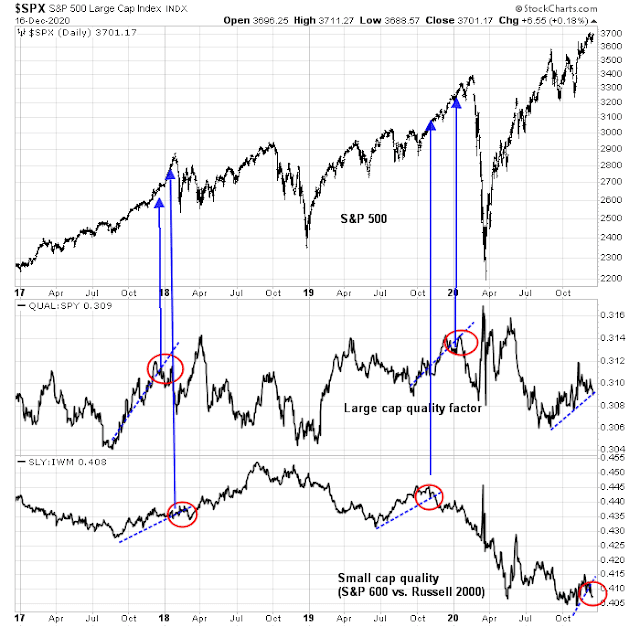

What’s next? One of the bearish tripwires that I outlined on the weekend (see Time for another year-end FOMO rally?) has been triggered. The low-quality small cap Russell 2000 is outperforming the high quality S&P 600. This is an early warning of a correction, especially in light of the highly extended nature of sentiment readings. However, the low quality factor signals of impending weakness have tended to be early in the past. Large cap quality are still performing well. These conditions are not an immediate cause for concern.

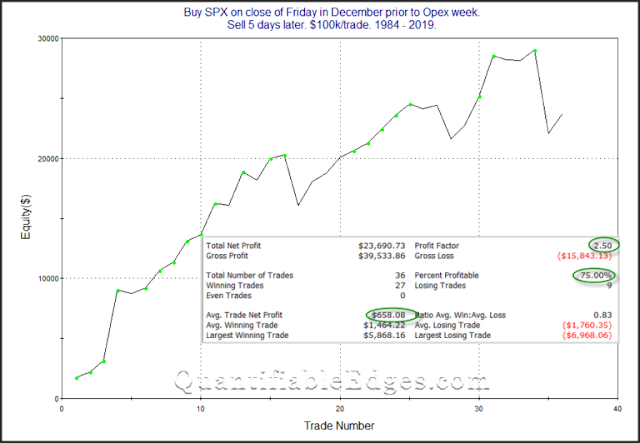

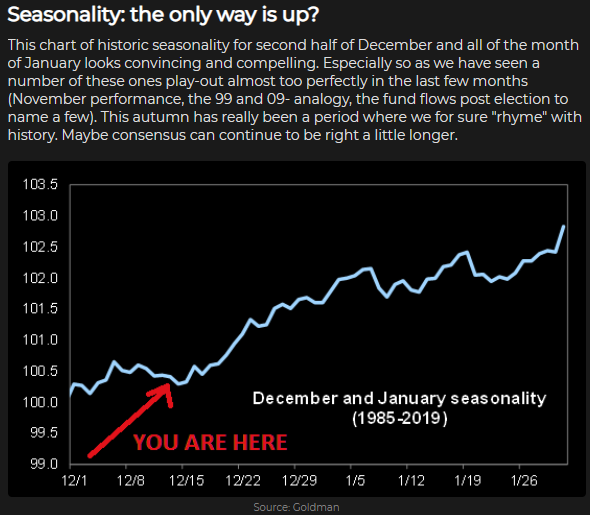

In the short run, the market is enjoying some seasonal tailwinds. This is option expiry week, and Rob Hanna at Quantifiable Edges found that December OpEx week has historically been bullish.

As well, seasonal patterns have tended to be bullish this time of year. I see few compelling reasons why this year would be an exception.

I interpret these conditions as a market poised for a year-end rally into January. Enjoy the party, but watch out for the hangover in a month.

Disclosure: Long SPXL

Taking a few trades purely for pullback bounces. XLE. KRE.

One momentum play in PLTR.

QS/ NIO.

I added to longs with QQQ. Hope I don’t get punished into EOM.

CLose and open above previous sell off from these levels is bullish price action.

Not sure if this indicative of a top or not.

Out of all positions. One minor loss (QS), otherwise gains add up to a +0.18% bump for the port. Given my bearish ST outlook, that’s good enough.

Should have given QS a longer leash!

I think there’s quite a bit of disbelief that the market should be this high , especially given all the hardships inflicted on the economy.

I don’t even understand it myself.

Was that the breakout?

Reopened a few positions end of day for an overnight hold. PLTR/ NIO/ NNDM/ FUV.

How are you licking these ideas? NNDM is hardly a known name. FUV, maybe as they have been touring investor conferences.

Go meme stocks!

You mean just invest in currently popular stocks?

PLTR / NIO / TSLA gets pumped a lot on wallstreetbets

Sorry, picking…

If you follow enough people on Twitter, it isn’t hard to come up with ideas.

In any case, I’ve closed all positions and ending the day flat as losses on PLTR has eclipsed gains on everything else.

Cam – are you maintaining a bullish stance heading into the weekend? If so, I may reopen a couple of index positions at the close.

I got walloped this morning. Still hanging on.

The Fed approved the share buybacks by the large banks. JPM, C and BAC are all up by 4.5% – 5.5% afterhours. XLF and S&P500 are likely to glitter over the coming days, and carry this Santa rally into new year!

The catalyst for a Monday rally may be the possibility of a Sunday vote on a stimulus package.

No positions.

Sanjay – My take is a little different. I’ve noticed that buying banks on strength has not worked well this year. A +5% move in the banks on approval of share buybacks is likely to mark an interim top in the sector.

In other words, if you own the banks – consider selling into a Monday rally. A +4-5% gain is nothing to sneeze at.

Rx2, Cam and Ken have given a lot of a reasons for a rally into year-end and next year. This just adds to their list of catalysts for the rally, however minor.

I generally do not invest in financials.