Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

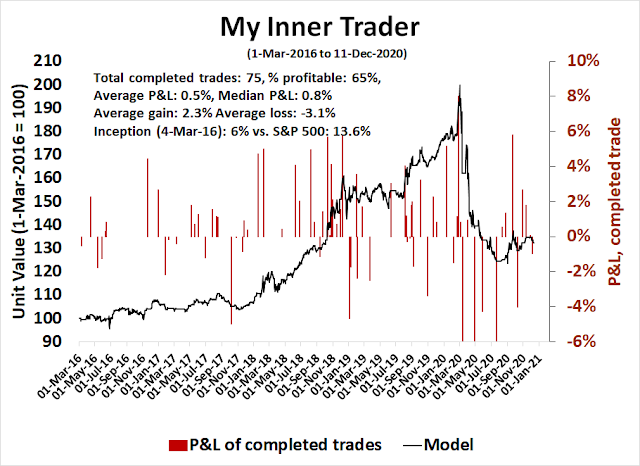

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts are updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Bullish

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

The ketchup effect

The bulls suffered a setback when the S&P 500 violated a minor rising uptrend (dotted line), though secondary uptrend support (solid line) is holding at 3640. Before anyone panics, the uptrends in the S&P 500 and breadth indicators are intact. In all likelihood, the market is just undergoing a period of consolidation since the start of December.

The Swedes call it ketchupeffekt, or the ketchup effect. It’s what happens when you try to pour ketchup on food. Nothing happens for a long time, then it all happens at once. The market weakness of last week is a display of ketchupeffekt. Suddenly, all the bad news is happening at once. If this is indeed the start of a pullback, how bad can it get?

Let’s explore the downside scenarios.

Bearish catalysts

There are a number of catalysts for further market weakness. First and foremost is a possible disappointment out of Washington. Lawmakers are deadlocked on the details of a CARES Act 2.0 stimulus bill. The

Washington Post reported that Mitch McConnell had no support from Republicans for the bipartisan compromise negotiated by a group of Republican and Democrat senators.

Staffers for Senate Majority Leader Mitch McConnell (R-Ky.) also told leadership offices in both parties Wednesday night that McConnell sees no possible path for a bipartisan group of lawmakers to reach an agreement on two contentious provisions that would be broadly acceptable to Senate Republicans, according to a senior Democrat familiar with the negotiations.

Investors may also want to brace for a possible disappointment from the Fed’s December FOMC meeting on Wednesday. Expectations are rising that the Fed will ease further by shifting their buying to longer term maturities in the Treasury market, otherwise known as yield curve control (YCC). Fed watcher

Tim Duy thinks that the Fed fumbled its communication strategy and YCC is not in the cards.

The Fed kind of screwed up the communications with all the emphasis on downside risk. They didn’t spend enough time explaining that the downside risk was very short-term and they really couldn’t do anything about it. They didn’t spend enough time saying that their tools are still powerful in response to a tightening of financial conditions but the economy fell into a deep hole and they can’t do much beyond create accommodative financial conditions that allow the economy to heal but that healing takes time. They have spent time explaining the importance of fiscal policy in the near term but haven’t until last week explained they couldn’t compensate for a lack of that policy because monetary policy works with a lag and by the time it kicks in we will be on the other side of the surge. That said, last month Clarida was very clear that financial conditions were accommodative and that more wasn’t necessary. I don’t know that anyone was paying attention.

Duy concluded:

It seems to me that the Fed is telling us they are going after the low-hanging fruit of putting some guidance on the asset purchase program at this next meeting. The Fed did discuss in November potential changes such as the duration mix or the size of asset purchase but this discussion regarded policy beyond the current surge of Covid-19 cases. With financial conditions currently easy and the Fed literally unable to impact near-term economic outcomes, there doesn’t seem any reason to change policy next week. Of course, an unexpected tightening of financial conditions would be something that the Fed could address should that occur between now and the meeting.

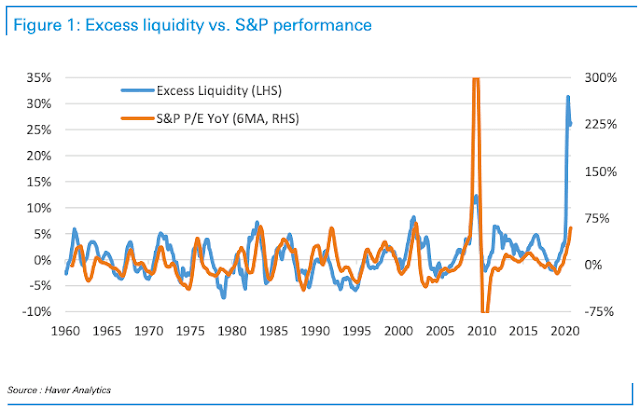

The stock market has been boosted by a flood of central bank liquidity. Disappointment over expectations of further easing measures could be a catalyst for a risk-off setback.

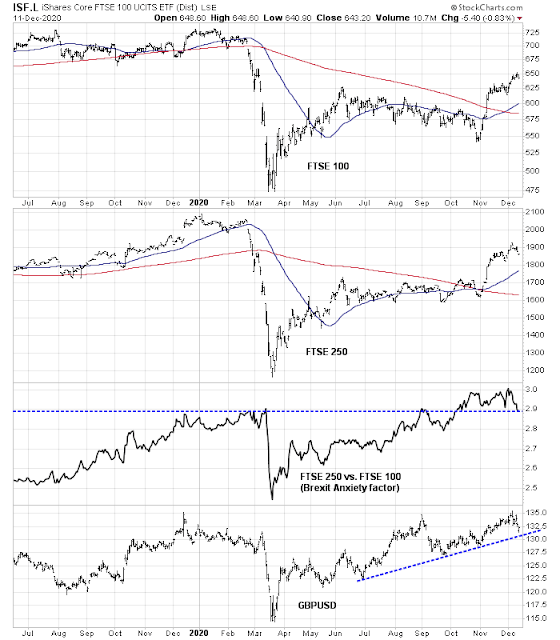

Another possible source of risk appetite volatility are the Brexit negotiations. Even though the “final deadline” for negotiations is supposedly Sunday, the absolute “drop-dead” deadline is December 31, which is the date new arrangements and a new relationship between the UK and the EU will come to force assuming there is no extension or a deal has been struck. So far, indicators of Brexit anxiety, as measured by the relative performance of the FTSE 250 to FTSE 100 and the GBP exchange rate, are showing heightened signs of concern, but no panic yet.

The prospect of a no-deal disorderly Brexit could spark a global risk-off episode.

What could go right

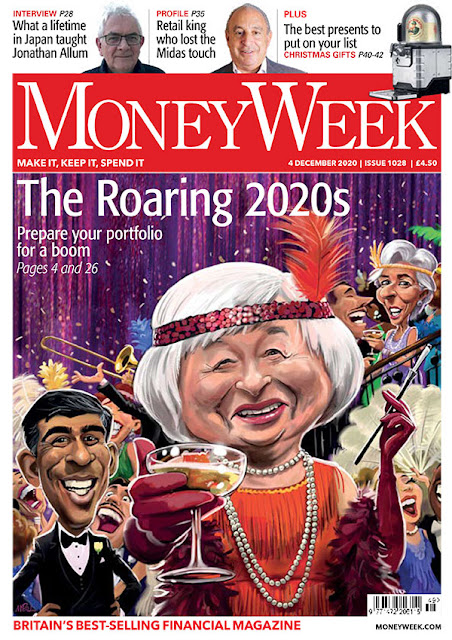

The widespread concerns raised by technicians over the extended nature of investor sentiment is a concern for the bulls. The cover of Money Week in the UK is an example of a contrarian magazine cover warning.

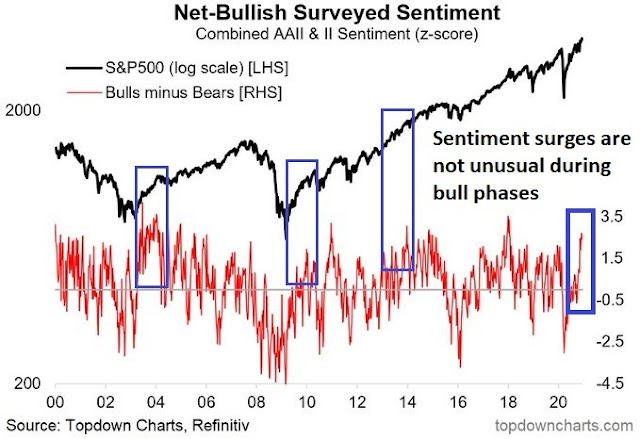

However, this chart from

Callum Thomas shows that bullish sentiment surges are not unusual during bull phases of the market (annotations are mine).

As well, bearish warnings from sentiment models are offset by strong bullish momentum conditions. Here is a big picture perspective.

Urban Carmel pointed out that the McClellan NYSE Summation Index (NYSI) recently spiked over 1000. “The last time it closed >1000 was early June; [and the S&P 500] promptly lost 8%.” While past episodes have tended to be long-term bullish, about two-thirds of the occasions have resolved themselves with either corrections or sideways consolidations (pink boxes). A closer examination of the correction and consolidation episodes saw the market on average top out roughly a month after the initial signal of a NYSI close above 1000.

I have also been monitoring the recent surge in correlations between the S&P 500 with the VIX Index, and the VVIX, or the volatility of the VIX. We have seen 14 similar warnings in the past three years. Eight episodes were resolved in a bearish way (red vertical lines), and six saw the market either consolidate sideways or continue to rise (blue lines). On the occasions when the market has pulled, back the average drawdown from the initial date of the signal was -4.9%.

I would add that while this analysis is tilted towards the bear case, the object of the exercise is to estimate downside risk. The bull case has been made elsewhere (see

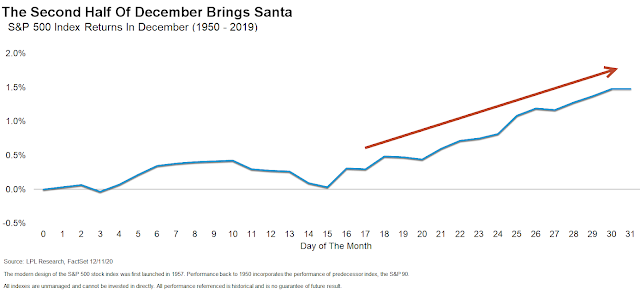

Time for another year-end FOMO stampede?). On average, the prospect of a 5% drawdown is all the ketchup effect can muster for the bears, Several investment banks have called for a short-term pullback, and if too many traders are waiting to buy the dip, any corrective action should be shallow. Arguably, this is the dip that you should be buying into. Analysis from LPL Research shows that positive December seasonality doesn’t start until the last half of the month.

In conclusion, the intermediate and long-term outlook for stock prices is up, but there is a possibility that the market could see some short term weakness. Should the S&P 500 break uptrend support at 3640, the estimated average downside risk is about -5%, or 3484.

Short-term risk levels are rising. While traders may wish to trim their long positions at these levels, investment oriented accounts should take advantage of any market weakness and buy the dips. In particular, the FOMC meeting on Wednesday is a source of possible volatility that traders should be aware of.

Disclosure: Long SPXL

Latest flash. Brexit talks extended, though no specific new deadline set. Another act in the usual European theatre.

https://www.bbc.com/news/uk-politics-55292890

There was a deadline of 31 March year 20xy. Now I hear a deadline of 31 December 2020. I am not sure I take these deadlines seriously anymore.

https://www.bbc.com/news/52937766

The British people want to have their cake and eat it too. They have been negotiating and renegotiating and re-renegotiating for a while now, with more negotiations on the horizon.

Truth is Britain needs to stand on its two feet. The world of bitter and harsh competition awaits the UK. Such competition will test the mettle of the British people and rightfully so.

Last time we saw such a thing in modern times was the bankruptcy of New Zealand, circa 1984. NZ was left shivering in the cold Pacific waters as Britain joined the EU, circa 1960s and NZ could not trade preferentially with the UK and earn a living. Britain will likely face the same fate. Without devaluing the British pound, it will be hard to make the UK competitive. Market reforms will push UK to privatize NHS (ohhhh, I did not say it; this is like Lord Voldemort, a name that cannot be said).

All of this happened in NZ and is chronicled in a book by Sir Roger Douglas titled, Unfinished Business.

China is teaching a lesson to proud Australia, as I write this. Tiny NZ saved itself from drowning in the South Pacific. Post Brexit world will be interesting. There will be money to made for globalized businesses as Britain lets off its training wheels, and learns to cycle on its own, for the first time, not as lord and masters, but more in the servant class. The world comes a full circle, especially for some countries that bore the bloody wrath of colonial Britain.

Cam had recommended buying British ETF. My worry is devaluation of the British pound (say below parity to the USD) would also shave off $ returns in such British ETF. Hence so far, I am reluctant to buy British ETFs.

With the EU credit rating shell around Britain gone, a post Brexit world would see to it that the UK has its own credit rating (without EU).

Making Britain competitive, would need a cheaper pound which would hurt the British retirees and also those in the work force. Again, history is witness to such things, based on what happened in NZ in the last few decades.

Health insurance companies must be allowed to share the burden of NHS bills. This will open the doors for US insurance companies. What happens to British engineering companies? Would they have an incentive to move to cheaper countries?

UK actually has many very competent technical talents, based on my experiences working with them in the past. Just some problems with them. The concept of cost and survival is very weak (France has the same problems). This is probably a reflection of the society. Brits seem to be content and happy (on the surface) with the status quo. Granted some of them perhaps just gave up on any notion of improvement.

Brexit may turn out to be the moment Brits start to be re-energized and make the Country more competitive. A lot of major companies might increase their operation there. Some major talents might move to US.

My main indicator is City of London and its offshore operations. You can’t run a country mainly on handling illicit money as your main source of income. Like I am using TSLA as the indicator for the currently inflating bubble. The moment TSLA deflates I would get out.

Ingjiunn

“You can’t run a country mainly on handling illicit money as your main source of income” or Imperial tourism or being a destructive colonial power or being part of EU or selling warm flat beer, fish and chips or selling expensive liberal arts college education to third world students at inflated prices.

There are American laws that prevent such companies operating in the US.

My friend, study history. NZ was a recent experiment in free market economics. If NZ was a blue print, for Britain, it will take decades to get back to being globally competitive, and being at par. Asian countries led by China are demanding their pound of flesh, in as many words. Near mortal wounds of flesh are not forgotten that easily. Yes, I realize there are vast differences between the pint sized, primary produce dependent NZ economy and Pound sized British economy. British technical challenge is hardly unique and will be met with stiff global competition. Britain will need a lot more humility and lot less arrogance to make any progress.

Measured by national wealth, Britain would be the most poor state if it was part of the US. It will need a lot to climb up that ladder. Her “unique” relationship with the US may help, whatever that means!

British people are brain washed into believing a “cradle to grave” system of benefits. Very very unfortunately, some of these are my friends who believe in such non sense. I am unable to shake them off their delusional beliefs and do not even try, doing so.

Thanks for sharing your take on TSLA. One of the Investments advisories out there uses what is called The Gorilla Index, which has already peaked out, slowly.

https://www.yahoo.com/news/boris-johnsons-government-told-uk-095153237.html

“On Friday, Johnson said it was “very, very likely” that Britain would fail to strike a trade deal before January”.

What a joke!

It’s my opinion that anyone looking for an entry into any of the sectors highlighted recently has one right now.

put on some hedges here on my longs.

Change of plans.

I’ve closed all positions that can be closed within the first hour of trading. That leaves me with two mutual funds that will need to wait until the close.

We all have our own agendas, I suppose. In this case, it comes down to this:

It’s been a turbulent year. A brutal -30% bear market in March followed by a complete recovery to new highs.

Not unlike ending the first quarter down by 21 points, then battling back to being ahead by a touchdown at the two-minute warning. A smart coach would run out the clock at this point to guarantee a win.

I’m not sure many would call a +7% gain for the total portfolio in 2020 a ‘win.’ But relative to the bleak outlook last March, it qualifies as a win for me.

It will actually be three positions that will be closed end of day. VTIAX, VEMAX, and RYDHX.

Agree. Closed SPXL today.

End the day ~ -0.4% <ATH. Pure luck.

https://www.marketwatch.com/story/two-words-that-define-the-relentless-bull-market-as-a-reckoning-takes-shape-11608048206?siteid=yhoof2

There will be more. Money printing is a moral hazard and once one makes a deal with the devil, there is no looking back.

Good News!

Is it time to sell all the good news? What does the market look for in news for an encore?

I think a buying opp will materialize prior to December 31.