Mid-week market update: In case you missed it, the Dow Theory flashed a definitive buy signal. Both the Dow Jones Industrial and Transportation Averages made all-time highs on Monday. This is the granddaddy of all technical analysis systems, and investors should sit up and pay attention. Moreover, the Dow may be tracing out a series of “good overbought” conditions that are indicative of a sustained rally.

On the other hand, sentiment models are flashing crowded long and overbought signals. Is the market ripe for a pullback, or is this the start of a “good overbought” advance?

The bull case

The bull case is simple. There is nothing more bullish than higher prices. In addition to the Dow, the broadly based Wilshire 5000 is also overbought, and possibly rising on a series of “good overbought” conditions. In addition, the VIX Index has not breached its lower Bollinger Band, which is a warning of an overbought signal and prelude to corrective action.

Frothy sentiment

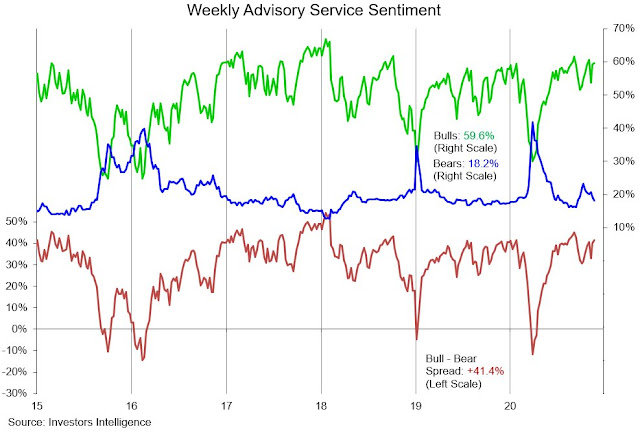

On the other hand, sentiment models are at or near bullish extremes, which can be contrarian bearish.

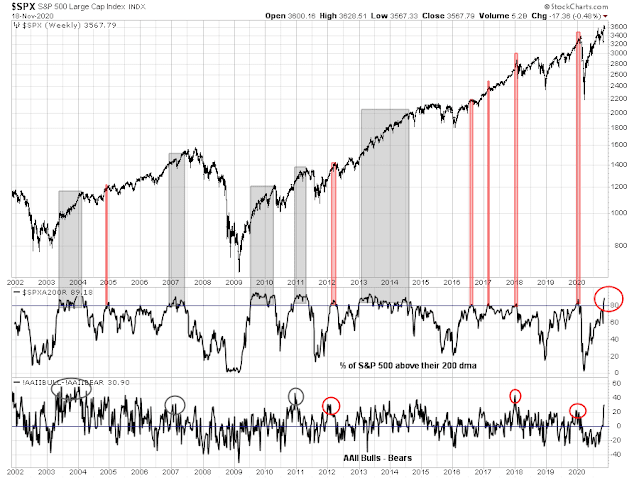

There has been some excitement that the percentage of S&P 500 stocks trading over their 200-day moving averages (dma) have risen above 80%. In the past, such conditions have either been signals of a prolonged bull phase (grey), or corrective action (pink). It’s difficult to know how the latest episode will be resolved. Sentiment models, such as AAII weekly sentiment, are not helpful. AAII has flashed excessive bullish readings during prolonged bull phases and corrective phases.

As well, NDR Crowd Sentiment is also stretched. The market has historically faced headwinds in rising when NDR Crowd Sentiment is above 66. On the other hand, these readings have stayed “overbought” for considerable periods in the past before correcting.

Resolving the bull and bear cases

So what’s the verdict? Is the market about to take off, or pull back?

My inner trader dipped his toe in the water on the long side today, but he was stopped out at the S&P 500 5-day moving average near the close. The trading model signal is neutral.

The probability of the correction scenario is rising. Keep an open mind to all outcomes.

Crowded long.

Maybe we see this playing out: 3,900 – Morgan Stanley’s 2021 target. But warns of near-term range of 3150-3550 as market deals with “second wave of virus, remaining election uncertainties and the specter of higher rates”

A pullback coming before month-end? Probably before Thanksgiving?

Goldman Warns Of “Massive” $36BN Month-End Pension Selling, 4th Largest On Record

https://www.zerohedge.com/markets/goldman-warns-massive-36bn-month-end-pension-selling-4th-largest-record

The 2020 market has run more fake-outs than any other I can recall.

I think we’ll see a runaway train to the upside before the current rally is over.

There’s a lot of pessimism going into the holidays. Watching carefully for a setup into the end of year.

The last quarter of an year, is not necessarily bullish. Some of the nastiest corrections have happened in the November to December time frame.

Political uncertainty looms large to a certain extent and the vaccine news may be “fade the event”. Jan’s post sounds about right. I am waiting for a retest of 3250 (similar thing happened in 2018 Q4; range bound market that fell through the bottom of the range. That said, what would be the trigger that pulls the market below 3250? Covid?

I’ll be opening the day ~where I closed on Monday. So my mental approach is to trade as if I simply held all positions through the downdrafts on Tuesday and Wednesday.

Opening a small position in FCEL on the premarket pullback.

FCEL off.

‘HAD simply held all positions’

Kind of feels like most of the weak hands have been taken out-> a brutal close yesterday followed by all indexes opening in the hole is sometimes enough.

Out of NIO. Should have held onto FCEL.

VXUS>VTI.

Now VTI>VXUS.

BABA – it’s been down so long it’s no surprise it’s green.

No bid whatsoever under this market. If nothing changes by the close, I plan to close all positions. At this point, preserving gains outweighs the potential for further upside.

Closing BABA/ BA/ JETS.

Closing most of my remaining positions here- a few of them (BAC/ XLE/ KRE) at significant percentage losses.

Will close all positions in RYSPX/ RYDHX/ RYRHX end of day.

Will the market finally take off on Friday? Sure, that’s possible – but that’s a little too much like gaming. The risk/reward just isn’t good enough.

We regained or at least touched support at 3580 and now are flagging for a possible Friday push. This seems really bullish to me anyway, today was really constructive for the bull case (definitely not trying to convince anyone to stay invested, this could certainly breakdown as well).

Holding longs into next week. Will add on any dips.

Opened starters in GME and RIOT.

And suddenly we have a bearish setup heading into Friday. No deal Brexit more likely, more curfews and business shutdowns and further indications that the post-election and transition period might not be going smooth.

Maybe the croissant guy has it right.

Reopened XLE after hours ~35.5x.

A limit order for BAC filled as well. Not sure I buy into the after-hours decline, but I have no problem literally buying into it for a bounce.

I think XLE has some more room to run. going from 29 to 36 looks pretty strong to me.

Sounds good!

Added to RIOT/ GME. Opened a starter in RIDE.

They couldn’t take the indexes down for long. I’ll be considering a reentry into the markets this morning.

Out of all FCEL/ GME/ RIDE positions for 1-day gains of 4-6-7%. RIDE was actually a 3-hour gain.

Trading in and out of RIOT around a core position opened yesterday ~5.8x.

No longer considering any index plays – I’ve been doing better just playing momentum positions. Maybe the market is telling us that’s where the action is right now.

Reopening GME ~12.6x (earlier exit was ~13.3x).

Off ~12.9x.

It’s online gaming stuff like the above that’s working right now. Whereas index trades have gotten me nowhere.

Out of all remaining positions (basically just XLE/BAC) and back to 100% cash. I don’t have a good feel for what might happen next week.

Friday afternoon ramp – 60% of time, it works every time. /ES 3530 next support as we lost 3550 here. I see this as two solid weeks of consolidation, at some point we will breakout or breakdown – seems like competing forces of rampant COVID growth going into a “let’s all get together and sit around a table inside” holiday week, plus whatever else trump might think up as a wildcard, versus vaccine and stimulus optimism. Still positioned for the breakout play here, plenty of doubt as to the path we will take to get there, but still think we will get there.