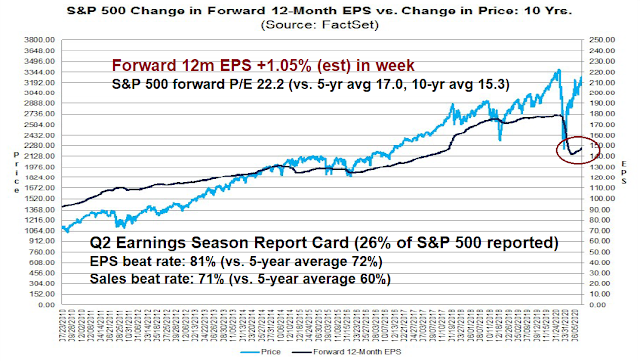

Q2 earnings season is now in full swing. So far 26% of the market has reported. FactSet reported the EPS beat rate rose to 81% from 73%, last week which was well above the 5-year average. The sales beat rate was fell to 71% from 78% last week, but it remains ahead of the 5-year average of 60%.

The bottom-up consensus forward 12-month estimate rose 1.05% last week The market is trading at a forward P/E of 22.2, which is well ahead of historical norms.

A qualified upbeat tone

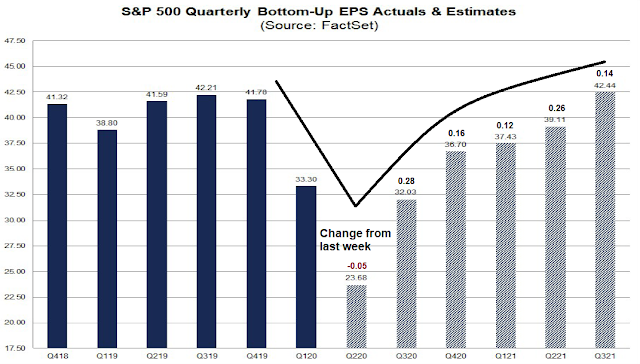

So far, earnings reports have taken on an upbeat tone. Both the EPS and sales beat rates are well ahead of their historical averages. As a consequence, analysts have upgraded quarterly earnings estimates across the board, except for Q2 2020 earnings.

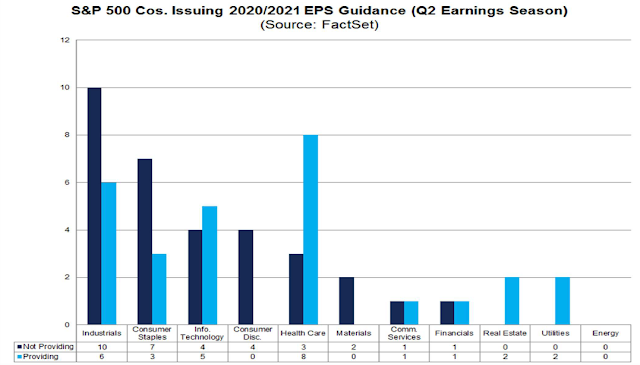

Earnings visibility is improving. More companies are now providing earnings guidance in Q2 compared to Q1. The sectors in which there are more companies with guidance exceed those without are healthcare and technology.

The percentage of companies issuing negative guidance is 22%, which is well above the 5-year average of 69%. That said, 53% of companies are still not issuing or have withdrawn guidance. They cite the uncertainty surrounding the pandemic as the reason for their cloudy outlook.

Is this an upbeat earnings season, or a case of “if you can’t say anything positive, don’t say anything at all”?

From the ground up

Courtesy of The Transcript, which monitors the earnings calls, the tone of the earnings calls had turned negative last week.

The economy was rebounding in May and June, but the recovery seems to have stalled out as infections have rebounded. CEO commentary was particularly negative last week. Business leaders are rapidly losing confidence and do not see a V-shaped recovery materializing. There’s a sense that government stimulus appears to be the only thing propping up the economy and it’s creating distortions in unemployment and financial markets. Still (perhaps because of this stimulus) the hot housing market suggests that consumers may not actually be in such bad shape after all–just spending on different things.

Here is a summary of the macro outlook.

- The economy was rebounding, but activity is slowing with the surge in infections (Southwest Airlines, Blackstone)

- Optimism is fading (Marriot International, Delta Air Lines)

- CEOs are losing confidence in a V shaped recovery (Manpower Group, Neogen, Unilever)

- The world has been turned upside down (Southwest Airlines)

- Businesses are breaking (Airbnb, Southwest Airlines)

- And life is unlikely to return to normal until there is a vaccine (Accenture, American Airlines, Unilever)

- We’re facing a very, very bumpy ride (Goldman Sachs)

- But government stimulus is keeping the economy afloat for now (Everbrite, Capital One)

- It’s also creating distortions (Manpower Group)

- The biggest distortion of all is probably in financial markets (Goldman Sachs)

- A new generation of day traders has been born (Interactive Brokers)

From a sector perspective, there were downbeat assessments from consumer services, oil and gas, and materials. On the other hand, the housing market is on fire, and the technology sector outlook is holding up well.

“We spent 12 years building our business and within six weeks, lost about 80% of it. When a business drops that quickly, not only is there this feeling of losing much of what you created, but things start breaking.” – Airbnb (AIRB) CEO Brian Chesky

“We’re in an environment where it’s almost like we’re starting our business from scratch” – Southwest Airlines (LUV) CEO Gary Kelly

“We believe that North America production is likely to remain structurally lower in the foreseeable future and has slower growth going forward. The shrinking demand for shale oil and limited access to capital markets, the inevitable rationalization will continue, and we expect to see a more disciplined market with stronger operators and service companies.” – Halliburton (HAL) CEO Jeff Miller

“I am very pleased to report that the recovery in new home demand that we experienced over the course of the second quarter was nothing short of outstanding. Our second quarter results show a remarkable rebound in demand as April net new orders fell 53% from last year, only to see year-over-year orders increased 50% for the month of June. Led by strong demand among first-time buyers, we saw meaningful improvement across all buyer groups and geographies as the quarter advanced. This improvement culminated in June orders increasing 77% for first time, 48% for move up and 21% for active adult over June of last year…buyer demand is clearly experienced a dramatic recovery in the quarter and has remained strong through the first three weeks of July.” – PulteGroup (PHM) CEO Ryan Marshall

“…we continue to see good mortgage activity in the U.S. In fact, in the second quarter, we saw mortgage growth, and we actually had record mortgage loan balances at the end of the quarter ” – UBS (UBS) CFO Kirt Gardner

“I am optimistic, because the combination of low mortgage rates, still in under supplied markets and the broader nesting trend which we see across consumers, I think spells good news for the builder channel” – Whirlpool (WHR) CEO Marc Bitzer

“The combination of strong demand and limited inventory has also allowed us to raise prices across many of our communities. In fact, more than half of our divisions report raising prices in 50% or more of their communities. The typical price increase is in the range of 1% to 3% and includes changes in base price and/or reductions in incentives” – PulteGroup (PHM) CEO Ryan Marshall

“The last months have accelerated the shift to digital, which was already underway..” – eHealth (EHTH) CEO Scott Flanders

“…we’ve seen an acceleration in adoption rates of technology initiatives with multiple years of consumer adoption being compressed into 10 or 12 weeks’ time.” – Tractor Supply (TSCO) CEO Harry Lawton

“I would say, in the last five months is that digital technology is no longer viewed as just new project starts, but it’s becoming perhaps the most key for business resilience.” – Microsoft (MSFT) CEO Satya Nadella

“…we are also already seeing evidence that this crisis is accelerating the technical and soft skills transformations that we have been tracking and predicting for some time. Acute skills shortages in tech, cyber security, software development, and data analysts for example continue unabated, reinforcing that the need for skills revolution is here in force” – ManpowerGroup (MAN) CEO Jonas Prising

Valuation still elevated

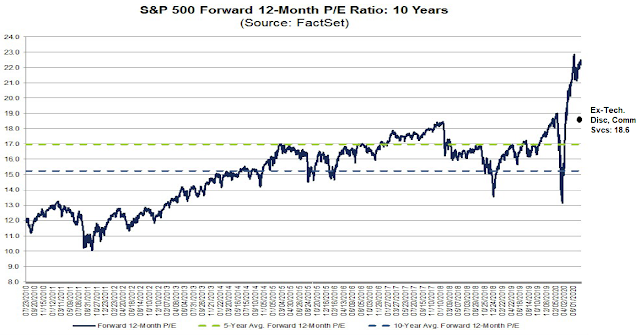

The market valuation is still elevated. The forward 12-month P/E ratio is 22.2. which is well above its 5-year average of 17.0, and 10-year average of 15.3. I estimate what would happen if we to eliminated the technology, consumer discretionary (AMZN), and communication services (GOOG, NFLX) sectors from the P/E calculation. The forward P/E would be 18.6, which is still above the market’s 5 and 10 year averages.

The market reaction

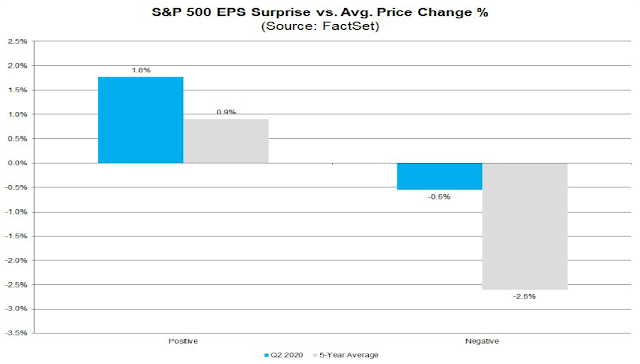

For the companies that have reported earnings, the market reaction has been positive. The market has rewarded earnings beats at a rate above the historical average, and even earnings misses have seen prices fall less than average.

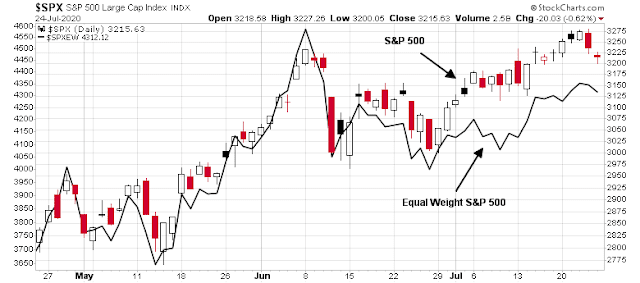

Despite the upbeat tone of the earnings reports, the S&P 500 traded with a heavy tone last week. In particular, the equal-weighted S&P 500 diverged and underperformed the float-weighted S&P 500 since early July, which is the period coinciding with earnings season.

The tone of earnings calls indicate that the macro outlook is turning sour. As I pointed out last week (see Earnings Monitor: Waiting for Congress), the “elephant in the room of the earnings outlook is what happens when the fiscal support from CARES Act expires at the end of July”.

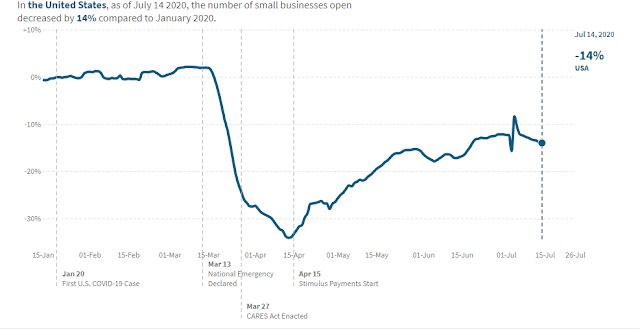

High frequency data is increasingly telling a story of a softening economy. The CARES Act support is expiring, and so are tenant eviction moratoriums. Last weekend was the deadline for an agreement so that states can re-program their computers to conform to a new support package.

The Democratic controlled House passed a $3 trillion rescue package two months ago as the opening offer in negotiations. The Republicans were scheduled to table a proposal last Thursday, but they have been divided and unable to present a united front. In all likelihood, there will be a rescue package, but the market will be focused on the details and the level of support.

Time is of the essence. Small businesses are failing or operating at low capacity, which results in a job shortage. If a rescue bill makes further cuts to aggregate household income, it will depress demand, and add to a death spiral of more failing businesses, more job losses, and further nosedive demand.

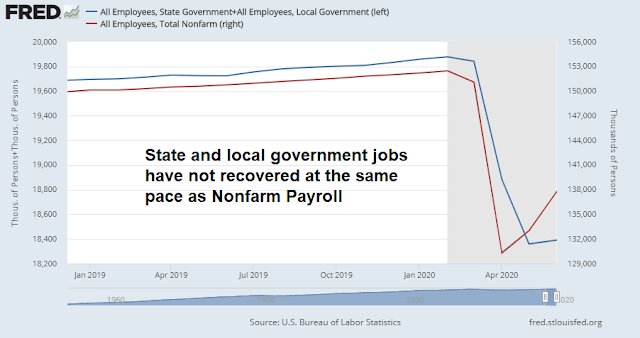

State and local government budgets are under tremendous pressure. Without aid, employment in that sector will collapse. Previews of the upcoming July Employment Report outlook is already starting to look ugly.

The rest of the FANG+ stocks are expected to report this week, namely Facebook (FB), Apple (AAPL), Amazon (AMZN) and Alphabet (GOOG). Their reports will probably be overshadowed by events in Washington.

Stay tuned.

https://www.cnbc.com/2020/07/23/e-trade-experiences-record-trading-in-the-second-quarter-as-the-retail-trading-boom-continues.html?__source=iosappshare%7Ccom.viber.app-share-extension

This is very very disturbing!

Thanks for the link.

I don’t find it disturbing, though. It’s valuable data that helps to explain the relentless bid under markets. Perhaps it’s the beginning of a new era, where younger/ less experienced traders have an edge over those of us burdened with historical comparisons/ expectations?

It just means that much of the new share holders are weak hands and could exasperate a selloff.

My early morning take was way off the mark, which forces me to reconsider the bullish scenario. I actually thought long and hard about reopening positions in the 15-20 minutes leading up to the close. I wasn’t able to pull the trigger, which may be a contrarian tell (ie, there must be a ton of other traders who struggled with the same decision and opted not to chase).

I would occasionally spend an hour at the craps tables in Vegas (or at least I used to). It’s always a valuable experience. I learn a great deal about my approach to risk – my emotional reactions to the flow of wins/losses. For instance, I’m often afraid to size up when the odds improve.

Peter Lynch came out with a series of radio ads in the Nineties differentiating investing from gambling. I always found myself disagreeing with him – what exactly are fund managers doing when they invest other people’s money into individual stocks? Every decision in life involves risk.

In any case, as of right now I think we see SPY 327 before we see 317. And I regret not reopening a starter position. Of course, I may be wrong again.

I had a conversation with an acquaintance this afternoon re current refi rates. She’s currently offering qualified clients a 30-yr fixed @ 2.875% with no points/no fees. That is truly amazing.

Helene Meisler has been pointing out the risks in sentiment, put/ call ratio, % bulls capitulating in her tweets, suggesting some potential for pullback at some point. Last week of the month has been bullish through most of 2020 though…

Francis sticks his neck out:

“Having a safe and effective vaccine distributed by the end of 2020 is a stretch goal, but it’s the right goal for the American people,” said NIH Director Francis S. Collins, M.D., Ph.D. “The launch of this Phase 3 trial in record time while maintaining the most stringent safety measures demonstrates American ingenuity at its best and what can be done when stakeholders come together with unassailable objectivity toward a common goal.”

https://twitter.com/NIHDirector/status/1287863233232035841

Risk happens fast and we have renewed outbreak fears emerging in Europe.

Interesting times again, as there is widespread consensus among investment banks that Europe is going to see a relatively quick economic rebound while the US recovery may be delayed. But these new outbreaks in several european tourist locations already seem to be out of control and so the market may very soon again have to deal with news that it wasn’t prepared for. At least I suspect that European countries are not going to tolerate US-like infection numbers.

Jan, I and everyone I know are getting tired of these “interesting times.” If Europe infections re-emerge like here, I don’t think they will have any choice but to tolerate it until there is a viable vaccine.

When is it time to be a contrarian investor in Airline Stocks?

Can sentiments get worse for this sector?

I’m watching the dollar and interest rates closely.

Moving back into portfolio approach – using a different setup this time.

I’ve been a fan of Paul Merriman for several years, and I’ve reread a lot of his stuff over the past two weeks (someone here also recently linked his website). This time I’m giving his portfolios a chance.

Portfolio allocations as of today’s close:

RETIREMENT PORTFOLIO

I’m not able to duplicate his recommendations exactly (nor is it necessary). Here’s how I’m tweaking it:

VFIAX (SPX) 28%

VVIAX (Large-Cap Value) 28%

FSSNX (Small Cap Index) 10%

VSIAX (Small-Cap Value) 10%

FSPSX (International Large-Cap Blend) 8%

VTRIX (International Value) 8%

VEMAX (Emerging Markets) 8%

TRADING PORTFOLIO

10% into each ETF listed below (which includes some REIT exposure + greater weighting to international value funds):

vti rpv ijr ijs vnq vea efv fndc dls dgs

The following 60/40 portfolio harnesses the markets collective wisdom. On the cheap.

VTI. 40%

VXUS. 20%

BND. 20%

Love the simplicity. Follow Cam for possible Alpha.

I’ve simplified it even further in the past using just VT (or VTWSX, which is no longer offered by Vanguard).

Merriman explains the rationale behind each of the additions to VTI:

https://www.marketwatch.com/story/the-ultimate-buy-and-hold-strategy-2019-update-2019-03-20?mod=mw_latestnews

‘The result is a low-cost equity portfolio with massive diversification that will take advantage of market opportunities wherever they are, and at about the same risk as that of the S&P 500.’

‘By moving only 10% of the portfolio from the S&P 500 into large-cap value stocks (thus leaving the other 90% in the S&P 500), you create what I call Portfolio 2.

Although only 10% of the portfolio has changed, the 49-year return improves enough to be worth noticing. Assuming annual rebalancing (an assumption that applies throughout this discussion), the 10.4% compound return of Portfolio 2 was enough to turn $100,000 into $12.9 million.

In dollars, this simple step adds more than 10 times your entire original investment of $100,000 — the result of changing only one-tenth of the portfolio. If that isn’t impressive, I don’t know what would it would take.’ [Indeed!]

‘Let’s pause for a moment to recap.

•First, Portfolio 5’s increase in compound return over Portfolio 4 was small, but over 49 years that tiny step produced an additional $617,000 or so. This is a lesson I hope you won’t ever forget: Small differences in return, given enough time, can add up to big differences in dollars.

•Second, Portfolio 5, with its substantially higher return, actually had slightly less statistical risk than the S&P 500 index. Higher returns, bundled with lower risk, has to add up to a winning combination.’

I am no Paul Merriman! But will explore his ideas. Thanks!

As we head into seasonality headwinds, are there any catalysts that may in fact launch the SPX to new all-time highs?

(a) Successful completion of Phase 3 trials. A revolutionary start to finish.

(b) China and Europe demonstrate the ability to return to pre-pandemic production levels.

(c) Passage of a second stimulus package which, in concert with (a) and (b), proves to be just enough to kickstart the US economic recovery.

Roaring Twenties to follow.

SPY may test 330 post-Fed!

I view the mini-pullback to <325 as a buying opp for anyone who isn't already long. JMO, of course.