The market has been getting excited by the prospect of a V-shaped recovery. It points to data such as the ISM Manufacturing PMI, which rose from 43.1 in May to 52.6 in June, indicating expansion. The employment index improved from 32.1 to 42.1, and the new orders index increased from 31.8 to 56.4..

While those are positive developments, this is not indicative of a V-shaped rebound. PMIs are designed to measure month-to-month changes. The economy is still in a big hole it’s trying to dig out of, and there are signs the recovery is stalling.

June Employment Report

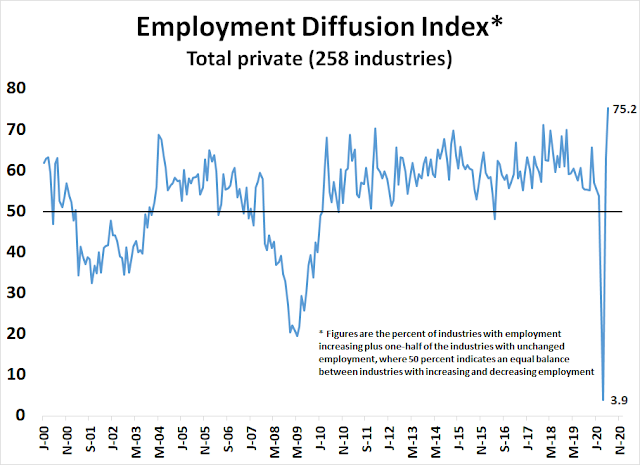

Let’s begin by analyzing the June Employment Report. The economy added 4.8 million jobs, which was well ahead of expectations. In addition, the diffusion index spiked, indicating a broad rebound. That’s good news.

The picture looks far less rosy beneath the surface. Here are the good, the bad, and the ugly parts of the report.

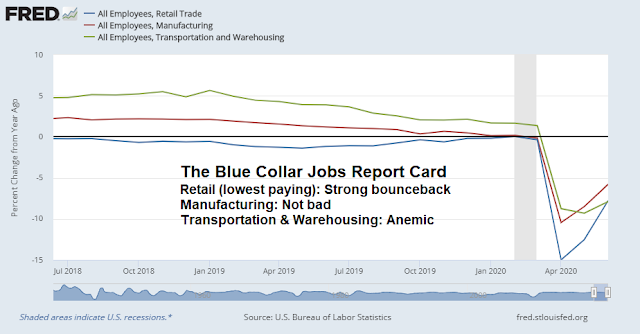

- Good: Low-wage positions like retail and leisure and hospitality, were devastated by the shutdown, and they have bounced back strongly.

- Bad: The high-wage white collar job recovery is stagnant.

- Ugly: Government job growth skidded during the pandemic, and state and local governments are facing urgent budget pressures. Without federal aid, there will be another wave of layoffs in that sector.

The story is the same within the blue and pink collar job sector. Low paying retail jobs have bounced back nicely. The rebound in high paying manufacturing jobs has been less strong, and transportation and warehousing job growth is stagnant.

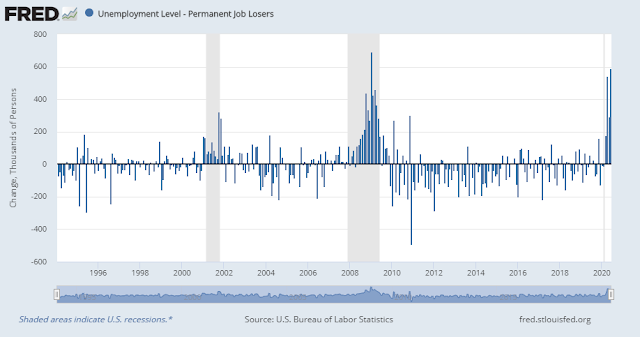

So far, the jobs recovery can be seen in the reversal of temporary furloughs. The unfortunate news is the number of permanent jobs lost.

The V-shaped recovery can only be found in low-wage positions. The rest of the jobs market faces a far cloudier outlook.

The consumer pulls back

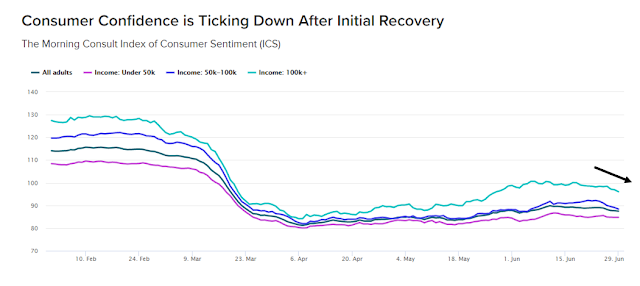

The June Employment Report is a snapshot of the economy in mid-June. High frequency data since then has shown a stalling in consumer activity. Morning Consult reported that consumer confidence is starting to roll over. The weakness began just after mid-June, which was just after the data date of the Employment Report.

The ECRI Weekly Leading Index has flattened out in the last two weeks.

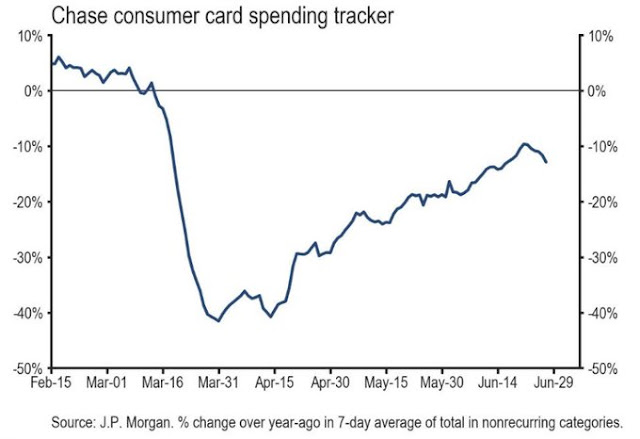

As well, Chase reported that consumer card spending is also weakening.

Blame the pandemic

The slowdown is probably related to a rise in COVID-19 cases in the US south and southwest. Mobility is slowing in the states showing high case growth rates.

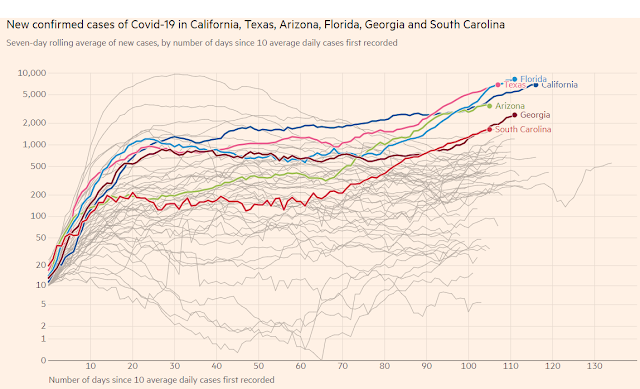

The surge in case counts in a number of states is well-known.

Deaths have not risen so far, which is attributable to a number of reasons. First, young people are being infected, and they tend not to be as vulnerable as the older population, which was the group that was the most affected initially. There is also a lag in the data. The sequence of reports is case count, followed by hospitalization, and deaths. The lag between case count and death is roughly four weeks. Hospitalizations exacerbate the fatality rate, because hospitalization is a signal that a case is serious, and at risk of death or serious complications. However, there is no national database of hospitalizations, and some states, like Florida, do not report hospitalization. Nevertheless, hospitalization rates are rising, with Texas and Arizona being the most seriously affected states.

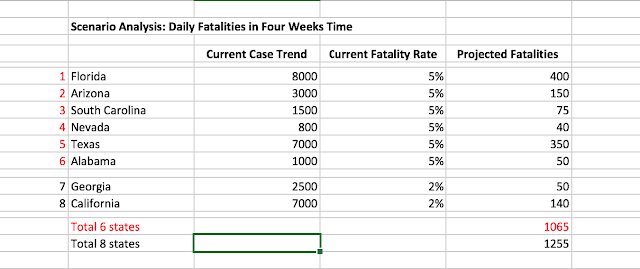

The death rate has not risen for now. If the lagged sequence of case count, hospitalization, and death were to hold, the daily fatality rate in the key states is expected to rise to 1,000 per day or more by late July.

Regardless of what happens with the virus, the high frequency data shows that the consumer is already reacting with greater caution. State and local authorities are also reacting to the rising infection rates with new edicts. Texas is the first state to re-impose a lockdown after reopening its economy. The mayor of Jacksonville, Florida, began requiring face masks to be worn in public last week, and the measure could jeopardize the Republican National Convention, which is scheduled for August 24-27 in that city.

Forget about the V. Business Insider reported that Christophe Barraud, who was ranked by Bloomberg as the most accurate forecaster of US economic data eight years in a row, said the US won’t return to its fourth quarter 2019 real GDP level until at least 2022. For some European countries, a recovery won’t happen until 2023.

Investment implications

Looking ahead, the trajectory of stock prices will depend mainly on investor reaction to the Q2 earnings season, and the official policy response.

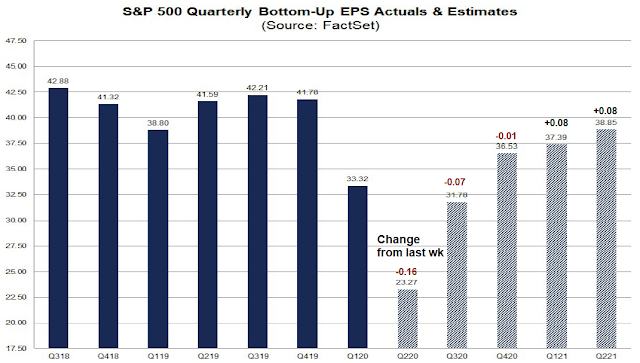

As we enter the Q2 earnings season, companies will undoubtedly discuss their near-term outlook. The latest update from FactSet shows that the Street is lower near-term 2020 estimates, while raising longer term 2021 estimates. Much will depend on the companies’ body language this earnings season, though an extraordinary number of withdrawn guidance owing to high levels of uncertainty.

The Transcript, which monitors earnings calls, gives us an early glimpse of the tone of Q2 earnings reports. The latest update shows reports of a rebounding economy combined with nervousness from executives about rising virus cases in some states and countries.

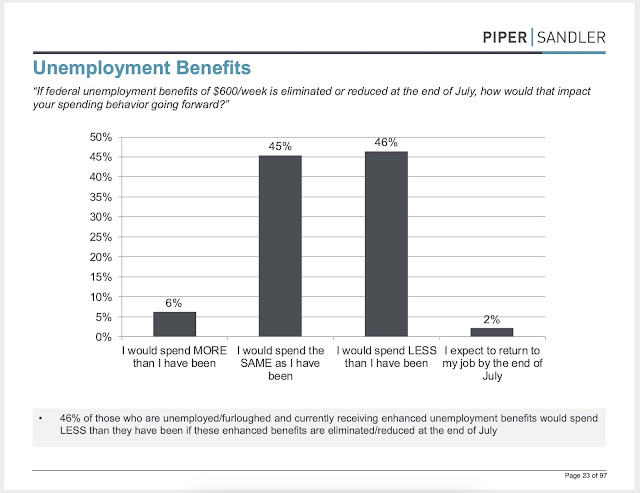

Policy response has several elements: fiscal policy, monetary policy, and health care policy. The economy has been supported by what amounts to “battlefield surgery” fiscal support, which runs out at the end of July. It is clear the economy needs further support beyond July, but it is unclear whether the Republicans and Democrats can agree on a second rescue package so close to an election.

The June FOMC minutes gave the market some direction on the path of monetary policy. The Fed is clearly concerned about the pandemic response, and it stands ready to act.

Participants all agreed that the effects of the pandemic would weigh on economic activity in the near term and that the duration of this period of weakness was uncertain. They further concurred that the unpredictable effects of the coronavirus outbreak were a source of major downside risks to the economic outlook…Participants stressed that measures taken in the areas of health care policy and fiscal policy, together with actions by the private sector, would be important in shaping the timing and speed of the U.S. economy’s return to normal conditions. Participants agreed that the Federal Reserve’s efforts to relieve stress in financial markets would help limit downside near-term outcomes by supporting credit flows to households and businesses, and that a more accommodative monetary policy stance would provide support to economic activity beyond the near term.

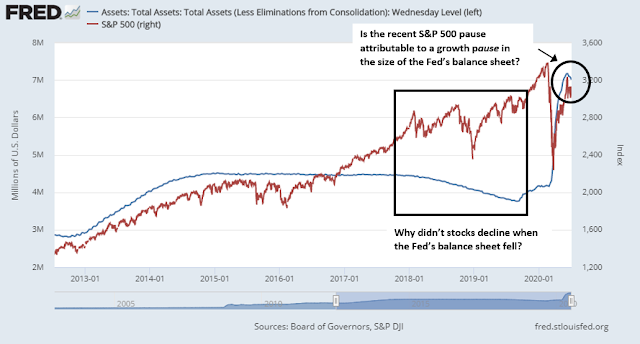

The effectiveness of the Fed’s response is in the eyes of the beholder. The Fed’s balance sheet shrank for a third week in a row. The reduction in the first two weeks was mainly attributable to the unwind of USD swap lines with foreign central banks, and the latest decline can be traced to a reduction of bank repos that injected liquidity into the banking system. The repo unwind should continue for a few more weeks. The Fed is continuing its purchase of Treasuries and other fixed income instruments during this time.

There has been an apparent near-term correlation between stock prices and the size of the Fed’s balance sheet. Arguably, the recent stall in the market can be explained by a rollover in balance sheet size. On the other hand, the size of the Fed’s balance sheet had flattened and began to fall in 2017, and stock prices continued to rise.

As for health care policy, NBC News reported that the White House is pivoting to a “learn to live with it” message in battling the virus:

At the crux of the message, officials said, is a recognition by the White House that the virus is not going away any time soon — and will be around through the November election.

As a result, President Donald Trump’s top advisers plan to argue, the country must figure out how to press forward despite it. Therapeutic drugs will be showcased as a key component for doing that and the White House will increasingly emphasize the relatively low risk most Americans have of dying from the virus, officials said.

However, there is some hope on the therapeutics front.

Next week administration officials plan to promote a new study they say shows promising results on therapeutics, the officials said. They wouldn’t describe the study in any further detail because, they said, its disclosure would be “market-moving.”

Stay tuned for the new “market moving” announcement. Will it be any more than a one-day wonder, or will it have a sustained effect on the outlook?

Trading note: The market has been strong today owing to a melt-up in the Chinese markets. I am conducting a more detailed analysis of the trading framework, which I will publish in the next one or two days.

I think we are going to possibly be confused in the next while by U.S. markets going up or at least staying up with bad news around about the domestic pandemic and poor business conditions. Here’s why.

For the first time, we are seeing the other two global developed regions, Europe and Far East strongly leading the way with sound healthcare, reopening strategies and clear pathways to improving business. Their stock markets are outperforming, especially ex-FANG.

Usually the American economy and stocks lead and drag the world up with them. Now the world leads and drags the Yankees along.

Europe ex-U.K. is worth a look.

Agree – it’s not all about the US.

Speaking of the US – Jeff Saut out with his bullish take:

https://www.marketwatch.com/story/wall-street-vets-stock-market-outlook-stuns-cnbc-host-joe-kernen-2020-07-06?mod=mw_latestnews

Agree. I’m glad I went long EUFN, Euro industrials, and commodities like copper a couple of weeks ago…

Looks to me like the market got wind of the announcement coming next week from the White House on a new treatment, just as Cam did. I expect this will push the market over its highs of early June. Full speed ahead, bad news be damned.

Hi Wally

Yep, somethings up. By the way, I stumbled upon this brave Texas E&R chain senior executive’s first hand thoughts last week. Worth a close read: https://threadreaderapp.com/thread/1277773122301804546.html

Donald, it seems like covid has been so politicized we aren’t get the true story from the press.

Interesting stuff. So better reimbursement rate if you use the code for Covid! That explains some of the rise in new cases.

If there was “good news” on the therapeutics front Trump would already have tweeted about it.

In other news, I see old Warren is finally opening up the check book:

* The conglomerate is spending $4 billion to buy the natural gas transmission and storage assets of Dominion Energy.

* Including the assumption of debt, the deal totals almost $10 billion.

* It’s Berkshire’s first major purchase since the coronavirus pandemic and subsequent market collapse in March.

* With the purchase, Berkshire Hathaway Energy will carry 18% of all interstate natural gas transmission in the United States, up from 8%.

https://www.cnbc.com/2020/07/05/warren-buffetts-berkshire-buys-dominion-energy-natural-gas-assets-in-10-billion-deal.html

Donald, he had to buy something, didn’t he? Cash doesn’t provide much of a return these days.

😉

Cam, is it your thesis that this “not V shaped recovery” leads to a collapse in the indexes and share prices? Or will the stock market stay divorced from the economy while the FED (especially) and the governments (in general) continue to push liquidity / stimulus?

We know that the V is likely to roll over, but we won’t know how much that matters if one of the these four things dominate the headlines.

1) How will the market react to earnings season? Will the loss of momentum become evident during the earnings reports?

2) Will Congress put together another stimulus package?

3) How will the Fed react (probably less important at this point)

4) What happens to the pandemic, and health care policy?

Hi Cam, are you still expecting another big dip to back to 2000 spx? Or the V is a done deal for SPX?

At what point does it become a ‘V recovery,’ and are we talking about the economy or the markets?

I can understand the challenges facing the economy, but a safe and effective vaccine (and/or safe and effective treatment) will quickly change the outlook.

The Nasdaq has clearly carved out a ‘V.’ The global index and the SPX are still in the red YTD, but not by much.

I suppose it ulimately comes down to semantics but from a trading perspective, if an index recovers from a -30%+ decline to less than -3% – isn’t that close enough?

Cam, today’s close and high breached your upper S&P 500 range of 3150-3160. The close was almost 20 points higher. Will that cause you to cover your small short trading position or will you wait to see if we break the early June highs?

As I mentioned, I am doing further analysis on a trading framework. The study isn’t finished so I don’t want to give you an incomplete answer.

I’ll have something either Tuesday or Wednesday. Please be patient.

OK. Got it. Thank you.

Wally

3140 was the line in the sand that we crossed higher. in the last 24 hours but pulled back today. That said, the “range” is narrowing, with top at 3160, give or take a few points. 3160, is below the 3180 level where Cam went short a few weeks ago. We still have not caught up to 3180, so traders are now selling around 3160 (playing close to chest). Last night, and now, we are trading around the 3142 range. I do not like narrowing trading ranges as we approach intermediate resistance (3160). Always wary when I see this chart pattern.

Thanks, D.V.

I trust everyone has noticed that China has chosen to pump their market as well.

Are all the bears dead yet?

Among the gurus I follow, Cam, Buffet, Howard Marks and Macro Charts are the only remaining bears out there. Everyone else seems to have turned bullish several weeks ago.

Cam cited the ECRI LEI chart in today’s note. The ECRI co-founder is positive on the economic recovery for the next 6 weeks at least. Cautions to remain vigilant…

https://www.cnbc.com/2020/07/06/summer-market-hot-streak-is-just-starting-lakshman-achuthan.html

Barring something huge, $SPX ‘golden cross’ on Wednesday

https://twitter.com/ukarlewitz/status/1280262889752784896

$SPX golden crosses – Only 1 in last 40 years immediately turned out badly

https://twitter.com/ukarlewitz/status/1280264184878346240

The one instance was in Nov, 1999 when the dot com bubble raised the $NDX:$SPX ratio to 2.1. The same ratio now? It is 3.35 showing how overpriced the Nasdaq 100 is to the S&P500. The dot com bubble bursted when that ratio reached 3.12 in March 2000. If we compared the RSI 14 period of the ratios between the two points in time, we get 88.81 currently, about one month away from the peak first reached back in March 2000.

Citi Economic Surprise Index

https://twitter.com/ukarlewitz/status/1280549705886253058

Wow! That’s Surprising!

Pulmonary fibrosis is a lung disease that occurs when lung tissue is damaged and scarred and is caused by aggressive viruses like COVID-19.

This thickened, stiff tissue makes it more difficult for your lungs to work properly and exchange oxygen and can lead to respiratory failure.

https://www.dailymail.co.uk/news/article-8463549/Top-medical-expert-warns-thousands-Americans-survived-COVID-19-ticking-time-bomb.html

Pulmonary fibrosis is a terrible condition. My father died of complications from it (after many years of smoking). It was a slow descent over ten years, each year he was able to do less. At the end his brain was starved of oxygen leading to black outs and dulled thinking, and his body unable to process fluids leading to painful buildups.

This is not something to take lightly!

Livewell,

Sorry to hear that. The article is definitely scary. Even if you are young and healthy, you should do your best to avoid catching the virus. Covid-19 is still a new disease. We are still learning about the virus. Not many people are aware of these post-virus recovery issues.

The island started to look real good today. As always, tomorrow and tomorrows will tell more.

https://www.yahoo.com/news/coronavirus-outbreaks-under-control-outbreaks-lockdown-who-134409719.html

https://www.cnn.com/2020/07/07/health/us-coronavirus-tuesday/index.html

The news get worse on the Covid front (despite the technicals, detailed by Sanjay and others).

Sorry. I am worried that there is steep pull bak here before too long.

With worsening Covid news, I am quite worried that fear is gong to take over, soon. VIX is not exactly going down either.

“What, Me Worry?” ~ Alfred E.

Mr Frederick said he would be “shocked” to see the Vix fall below 20 before the nation goes to the polls.

https://www.ft.com/content/a6a42b46-e916-442d-b3ae-4dedb068bf23

DV, I am worried as well. I think we may see the market either range-bound or rise a bit to 3,300 over the next few weeks and then the prospects of raging virus, overflowing hospitals, partial shutdowns and people staying indoors will weigh upon the economy and eventually sink the stock market.

Of course, we are likely to see the CARES Act II by the end of July, and possibly the next act by Jay Powell (buy stocks as you have been saying!)

The markets also need to consider the odds of a change at the White House and the Senate at some point.

I sold some stocks and bought some inverse ETFs last week. Will do more in coming days and weeks.

You mean there’s a wall of worry 🙂

RX, a wall of worry is a funny thing. Sometimes you can climb it and other times you fall off.

the clock is ticking. Around four weeks after the case rate growth which become very noticeable around June 24, we will see whether deaths are growing too. If death numbers stay horrible-yet-moderate, then the music won’t necessarily stop playing. But if it turns out that Covid is not under control, then all bets are off.

Today’s action is always the most interesting to me and so far the island remains intact and a breakout higher seems less likely than one lower.

Employment going down again…

https://twitter.com/ernietedeschi/status/1280876252019204096

Activities and risk of catching Covid-19.

https://www.texmed.org/uploadedFiles/Current/2016_Public_Health/Infectious_Diseases/309193%20Risk%20Assessment%20Chart%20V2_FINAL.pdf

https://www.marketwatch.com/story/british-government-says-it-will-pick-up-half-the-checks-at-restaurants-to-help-boost-economy-2020-07-08?siteid=bnbh