On this 4th of July Independence Day weekend, let’s try a change of pace and indulge in some technical analysis of a different sort. The behavioral finance basis for technical analysis is the wisdom of the crowds.

Francis Galton observed a competition at a local fair in 1906 where about 800 people tried to guess the weight of an ox. To Galton’s surprise, the average of all the guesses was 1,197 lbs. The actual weight came in at 1,198 lbs. Other studies have confirmed that a diverse crowd is better at estimates than any single expert.

This adage, “the wisdom of the crowds” is really another formulation of the Efficient Market Hypothesis, in which it is difficult for any single analyst to gain a consistent edge. Technical analysis is one way of listening to the markets, and applying its message to understand what the market is discounting.

With that preface in mind, consider this mystery chart. Would you buy, hold, or sell this security?

The mystery chart is the price chart of the Trump contract on PredictIt, which pays off at $1 if Trump were to win the election in November. The contract exhibited several support violations on high volume, which are worrisome signs for Trump bulls. As always, this analysis is not intended to be an endorsement of any candidate or political party, only to estimate the market effects of an electoral outcome.

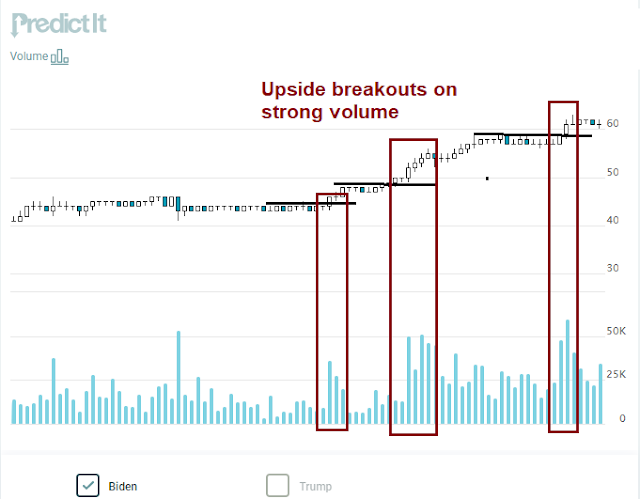

For completeness, here is the Biden contract, which has staged multiple upside breakouts on strong volume, indicating conviction. That’s why my base case scenario increasingly tilts towards a Biden victory in November, which has important implications for equity investors.

I conclude that the market has not fully discounted the prospect of a Biden win just yet. If and when it does, it may act to de-rate equities based on the prospect of a lower 2021 earnings outlook. A Biden victory will mean a 6-12% fall in 2021 earnings, which translates to a 6-12% decline in stock prices if P/E multiples stay the same. Should the market see P/E compression from the current lofty levels, downside risk could be considerably higher.

A referendum on Trump

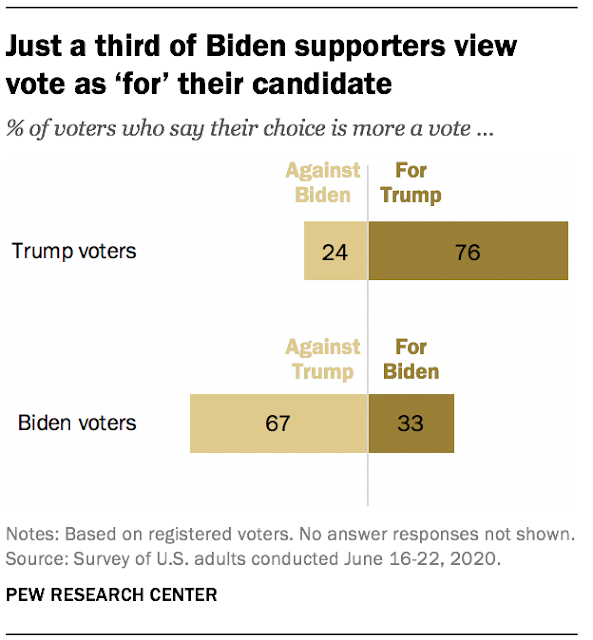

A recent Pew Research poll is highly revealing about the internals of the race. Instead of the usual “horse race” asking respondents who they would vote for, the poll probed voter attitudes about each candidate. What is clear is that the race is becoming a referendum on Trump. Prospective Trump voters are mainly voting for Trump, while prospective Biden voters are voting against Trump, and not for Biden.

Even though the election is four months away, and four months is a long time in politics, Trump’s electoral problems seem intractable compared to 2016. Here is how Trump won in the last election. Even though he lost the popular vote to Hillary Clinton, he won enough of a plurality in a handful of swing states to eke out a path to the White House.

The 2016 election was highly unusual inasmuch as both major candidates had high negative ratings. Voters viewed both Trump and Clinton more negatively than positively. Trump waged a masterful campaign to drive up Clinton’s negatives, and to encourage defections to third-party candidates. As the consensus was a Clinton win, there were sufficient voters who dislike her sufficiently to cast protest votes for the likes of Green Party candidate Jill Stein that Trump was able to gain a plurality in key battleground states.

Fast forward to 2020. The polling data shows that Biden voters are voting against Trump, instead of for Biden. Trump is entering this election with high negative support, while Biden’s ratings are slightly positive. Here are the ways that Trump can find a path to victory.

- Energize the base (not sure how much more juice there is left in that lemon).

- Drive up Biden’s negatives.

- Change the focus from a referendum on Trump.

- Encourage the emergence of a third-party candidate.

Another headwind is the Never Trump contingent within the Republican Party have become far more vocal in its opposition. Reuters reported that former George W. Bush officials have formed a Political Action Committee to raise funds to elect Biden, though the former president is not involved in the campaign.

Hundreds of officials who worked for former Republican President George W. Bush are set to endorse Democratic White House hopeful Joe Biden, people involved in the effort said, the latest Republican-led group coming out to oppose the re-election of Donald Trump.

The officials, who include Cabinet secretaries and other senior people in the Bush administration, have formed a political action committee – 43 Alumni for Biden – to support the former vice president in his Nov. 3 race, three organizers of the group told Reuters. Bush was the country’s 43rd president.

As well, a group of Republicans at the Lincoln Project have been running anti-Trump ads in key battleground states. If you haven’t seen them, check out their YouTube lineup of ads to see how they are driving up Trump’s negatives.

To be sure, the Trump campaign still has a funding advantage. Despite the news that the Biden and Democrats had better fundraising success than Trump and the Republicans for both the months of May and June, the Trump-RNC fund reported $295 million in its account at Q2. The Biden-DNC campaign did not report its cash for June yet, but it had about $122 million at the end of May.

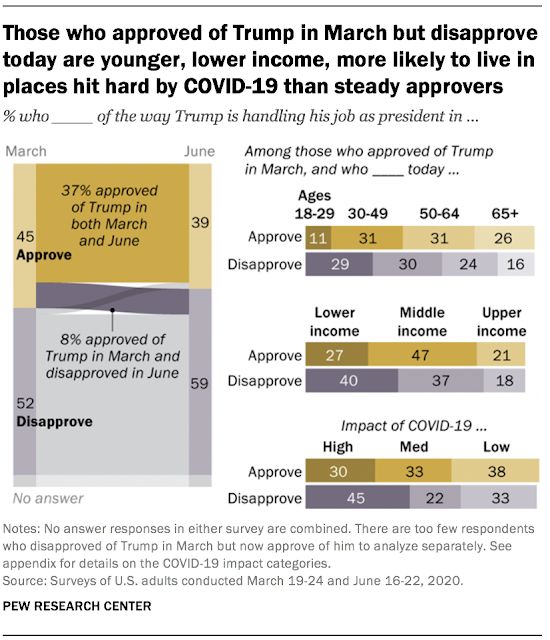

While nothing is impossible, those are indeed formidable challenges for the Trump campaign. The Pew Research poll asked respondents what soured voters on Trump. The disapproval ratings on Trump rose for people who are younger, have lower income, and more likely to live in areas most affected by COVID-19. He has to improve his performance in those areas, especially among the key low-income demographic and in the COVID-19 regions.

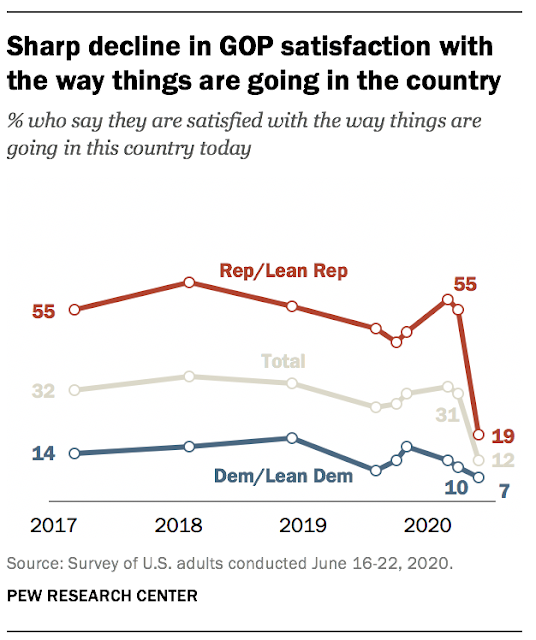

As well, Trump’s falling poll numbers are likely to affect the Republicans down ballot too. The consensus is the Democrats will retain control of the House, but the real battle will be the Senate. Biden needs to control both chambers of Congress to push through his programs should he win in November. The Pew Research poll shows that approval among Republican supporters is tanking, which is an ominous sign for GOP Senators in November.

The PredictIt odds for Senate control has been steadily rising for the Democrats. While the price action is not as definitive as the Biden contract, this contract did stage an upside breakout on strong volume.

These results call for a base case scenario of a Biden win, accompanied by a Blue Wave where the Democrats take both the House and Senate in November.

Investment implications

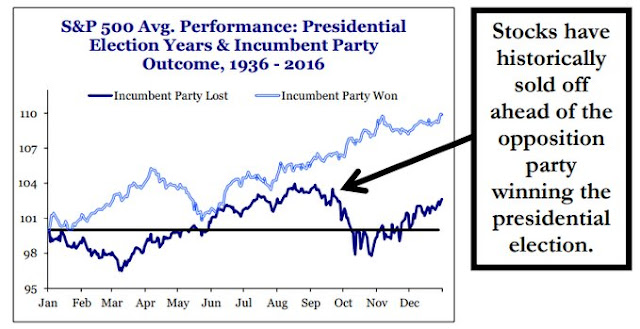

Here are the investment implications for equity investors. In the past, the market performs much better if the incumbent wins, compared to if the incumbent loses the election. With Biden starting to pull away in the polls, will the market start to follow the incumbent loss pattern in 2020?

I reiterate my conclusions in my past publication (see What would a Biden Presidency look like?).

A Biden victory is expected to be a net mild negative for equity prices. Much depends on the degree of control by the Democrats should Biden win the White House. The chance of a Blue Wave sweep is possible, and it would embolden the progressives within the Democratic Party to steer policy further to the left with bearish consequences for the suppliers of capital.

The most immediate effect of a Biden win would see higher taxes. Expect a higher corporate tax rate, and the imposition of a minimum corporate tax. As well, the top rate is expected to rise, and so will the capital gains and dividend tax rates. High income earners will also face higher social security taxes.

The market will focus mainly on those immediate negative factors. Consensus bottom-up 2021 earnings currently stand at $163.39. Unwinding the 2017 tax cuts would reduce about $10 off 2021 earnings, and second-order effects of potential Biden proposals, such as the corporate minimum tax, changes to the global intangibles tax, and so on, could reduce 2021 earnings by another $10. This translates to a 2021 P/E ratio of 20.5 to 22.0, which are stratospheric for FY2 P/E multiples.

From a practical perspective, the immediate effect of a Biden victory will mean a 6-12% fall in 2021 earnings, which translates to a 6-12% decline in stock prices if P/E multiples stay the same. Should the market see P/E compression from the current lofty levels, downside risk could be considerably higher.

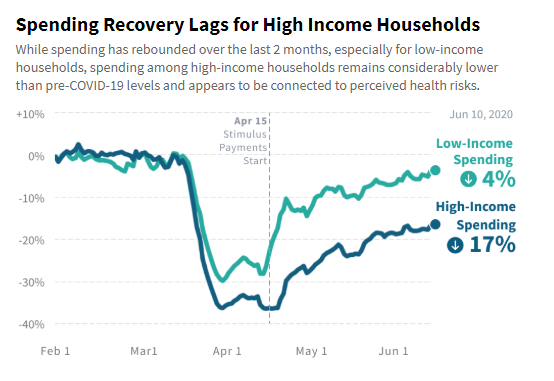

To be sure, there will be long-term positive effects of the Democrats’ re-distribution policies. We have the results of a real-time experiment of fiscal support and re-distribution policies. When the CARES Act gave households a flat dollar amount, the spending recovery rose faster for low-income households than high-income households. That’s because lower-income workers have a higher propensity to spend extra income, while higher income workers have a lower propensity to spend and a higher propensity to save and invest the government’s fiscal support.

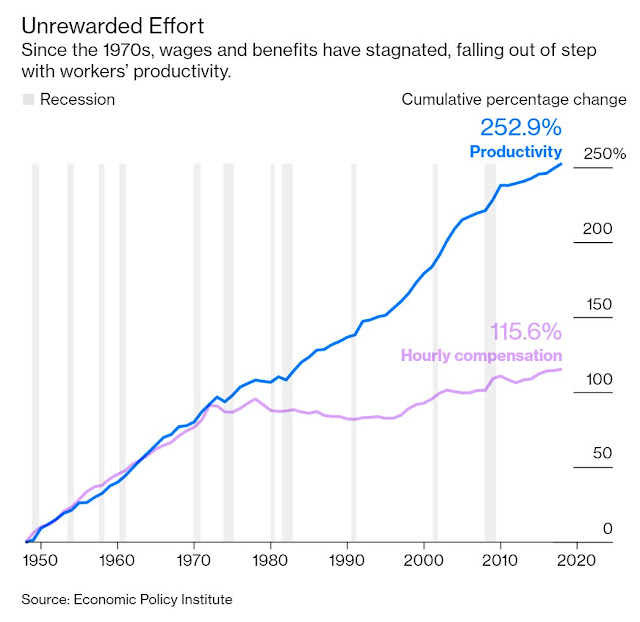

Over time, re-distribution should lead to higher GDP growth, though that may not necessarily be bullish for equities. Other government measures, such as higher tax rates, re-regulation, and labor friendly legislation like a higher minimum wage are likely to squeeze profit margins. Wage growth has not kept pace with productivity gains since 1970, and much of the excess gains have gone to the suppliers of capital. Expect the returns to capital to fall, and returns to labor to rise under a Democrat-led administration.

What to watch

Here is what to watch for over the next four months.

- How are the political odds evolving on betting sites like PredictIt and UK based sites like Betfair?

- Can health policy bring the pandemic under control? Will there be an effective vaccine before year-end?

- Who will Biden pick as his vice-president? Biden is view as dull by most voters. The right VP candidate can act to energize the Democratic base.

- Can Trump either drive up Biden’s negatives, or drive up his own positives?

The market has not fully discounted the prospect of a Biden win just yet. If and when it does, it may act to de-rate equities based on the prospect of a lower 2021 earnings outlook. A Biden victory will mean a 6-12% fall in 2021 earnings, which translates to a 6-12% decline in stock prices if P/E multiples stay the same. Should the market see P/E compression from the current lofty levels, downside risk could be considerably more.

Don’t forget to stay tuned for our tactical market analysis to be published tomorrow.

“While nothing is impossible, those are indeed formidable challenges for the Trump campaign”.

Is the path of least resistance a Biden victory then?

That’s my base case scenario. Biden win 60%, Trump win 40%.

Thanks for the clarification, Cam. One needs to be careful after September based on your graph above. All said, Biden could still meet the same fate as Hillary Clinton in 2016.

Very very tough call.

https://www.politico.com/news/2020/07/04/biden-polling-lose-to-trump-348607

I can assure you from the American MidWest, shooting ranges are packed, ammunition shelves are getting emptied out, and Trump supporters appear to be getting ready for a bitter, knife fight.

I agree. The Republicans are strong in the South and Midwest. States like IN and OH are going to stay red.

October is always a tough month for the market regardless of who will be leading in the polls & I expect to see a 10% correction then. The market will rally if the Republicans keep the Senate..if they lose the WH & Senate …the 10% correction will establish the new trading range.

With due respect, 10% correction is optimistic IMHO.

Wow!! Let me point out a couple things about this analysis, Cam.

1. You mention “this analysis is not intended to be an endorsement of any candidate or political party” then you proceed to provide one sided stats as if you are a CNN anchor.

2. You say that in 2016 Trump managed to “Eke out a path the the White House.” Let me remind you that Trump won with 304 electoral votes to 227 for Hillary. That is hardly ekeing out a win.

3. Although you use data from Predictit which is a betting site located in New Zealand, you fail to take into account the type of people who would use such a site. Although there is no hard data that I could find, I suspect Predictit users are mostly younger people who lean heavily democrat. Thus skewing any usefulness that site might provide.

4. Although you do show data showing that Trump supporters are voting “For” Trump and Biden supporters are voting “Against” Trump (not for Biden) you fail to mention that this is evidence of a huge voter enthusiasm. This means that it is likely that Biden will have a weak turn out to the polls and Trump will have a strong turn out. This could more than make up for any underlying support for democrats. And,

5. I was only able to find the demographics on one of the recent Biden favorably polls. Most of these polls are run by news organizations and/or are affiliated with with left leaning organizations. The one poll I did find demographics on heavily polled democrats giving producing a bias in the poll of about 12%. More than enough to swing that poll the other way.

If you are going to provide an analysis of the Presidential election, Cam, at least try to make it fair and not inject your biases into only reporting what the left would like you to report.

Trump is not going to give up his position as President even if he loses the election. A lawsuit will be filed in the event he is not elected to dispute the results. The lawyers have already been retained, the judges are in place, and the briefs have been written. Same strategy used in the Bush vs Gore.

https://en.wikipedia.org/wiki/Bush_v._Gore

I think that is nonsense, Alex1. The only ones to try that were Democrats, Hillary Clinton and Stacy Abrams.

Don’t believe everything the Liberal MSM tells you.

BTW, Bush won that election and won Florida. I know because I was one of the 300 or so who pushed Bush over the top in Florida.

Also, SCOTUS shut down the democrats bid to steal the election with phone write in votes. They ruled that write in voting cannot be expanded which appears to have settled it for the 2020 election and they also ruled that Alabama can require photo ID (or I should say a photo copy of an ID) with each mail in ballot.

On PredictIt: Past studies of betting odds (London, University of Iowa) going back to Carter/Ford has shown that the market odds are better estimators of election odds than pundits.

On Trump For and Against. If people are voting against Trump with Biden as a proxy (it could almost be anyone except Bernie) then arguably there is also voter enthusiasm to turn Trump out.

On polling: Even the Fox News polls show Trump lagging Biden.

PredictIt shows Biden ahead about 60-40. I defer to the markets and would call it a 60% chance of a Biden win.

Examples: Heading into the election in 1980, the polls show that Reagan and Carter were running neck and neck. The betting sites showed that Reagan was ahead about 60-40 to 65-35. The rest is history.

Bush-Gore: Bush was leading at the University of Iowa around 55-45. It was a close one, but he won Florida.

I could go on, but you get the idea.

Cam, did the betting sites predict the outcome of 2016 election correctly?

2016 was the exception. Everyone, including the betting sites, expected Clinton to win. Though I vaguely remember that the Trump odds rose slightly at the end.

But the only substantial betting was in Vegas pre-2016. I still say it is the young who are pushing sites like Predictit and most of them are liberal and don’t vote.

The only real sample is 2016 that is comparable and you know how that turned out. 2020 is even a more outlier with the pandemic and a democrat candidate who cannot string two sentences together. The biased polling and the youngster betting sites are going to be shown up for what they are.

I also, noticed that you did not refute my suggestion that you are biased and presented the facts as the left would like you to. I see that as an admission that your analysis is deeply flawed.

I repeat. There were betting sites in London going back to the 70’s that were better estimates of the election.

When Reagan won in 1980, did you think the young liberals pushed his odds up then? No, the market is apolitical and it’s only interested in maximizing expected returns.

In 1980 the young weren’t indoctrinated into the left/socialist/liberal ideals like they are today by schools and universities. In 1980 nearly all of America believed in America and believed socialism and communism were evil. Today the young have not been taught the history of those ideals.

LOL. I don’t see it that way. Of course I have a bias but so do you, Cam. I see Trump winning the election but you are welcome to draw what ever conclusion you wish. This is going to be like you prognosis of a retest of the bottom instead of recognizing what is really going on.

I think you will see a tremendous absence of democrat voters on election day. Nobody is excited about Biden but it is still possible he won’t be the democrat candidate. 60%/40% Biden is just whistling in the wind. That will never happen.

Whatever you think about the fundamentals, you also have to give some weight to what the charts are telling you.

Yes, and I have provided substantial evidence that there is bias in the data and it is most likely wrong.

Also, the professor who predicted Trump’s 2016 win months in advance is also predicting his re-election. Here is an article explaining his analysis:

https://www.foxnews.com/media/professor-predicted-trump-win-prediction-biden-2020

Everyone has a different sort of analysis. My conclusion is based on the charts.

The polling internals confirm the uphill battle Trump is facing. I understand that you are an ardent Trump and Republican supporter, but the odds are against you this time.

My guess is we get a backlash in 2022 because they get mad as hell and they can’t take it anymore, and the Rs retake either the House or Senate.

Well, maybe when November 3rd rolls around it will open your eyes a bit to look deeper into where the data you are using comes from and the built in bias that leads it to be wrong so often.

Even if you pull data from different sources it is important to, at least mentally, weigh the importance of that data and arrive at a truly balanced conclusion.

Is this the liberal media at work? Asking for a friend

https://www.foxnews.com/politics/fox-news-poll-biden-widens-lead-over-trump-republicans-enthusiastic-but-fear-motivates-dems

Conducted June 13-16 2020 under the joint direction of Beacon Research (D) and Shaw & Company (R).

I have no idea who these companies are. I’ve never heard of them so I don’t know their track record of bias one way or the other. I do know that a few years ago Murdock turned over operations of Fox to his two liberal sons and liberal Disney has some say in how Fox operates now, too. Most Fox viewers have noticed a definite trend away from conservative views since this change.

“My guess is we get a backlash in 2022 because they get mad as hell and they can’t take it anymore, and the Rs retake either the House or Senate.”

That sounds like a gridlock, which is usually good for the markets.

Wally,

The story about the professor predicting Trump election is dated May 29, 2020. A lot has changed since.

“That said, according to Newsday, there are some factors the professor doesn’t take into account like the state of the world — a pandemic, an unprecedented economic crisis, a country in turmoil over systemic racial injustice…”

“Norpoth conceded to Ingraham that the COVID-19 pandemic could have an impact the model doesn’t take into account but noted that he’s not seeing a “dent” in Trump’s approval rating.”

https://www.foxnews.com/media/professor-predicted-trump-win-prediction-biden-2020

Also, the tech tycoon Peter Thiel is staying away from the Trump Re-Election Campaign this time. He was an ardent support of Trump in the last election.

https://www.wsj.com/articles/tech-tycoon-peter-thiel-shies-from-trump-reelection-campaign-11593730590

Looks like you are clearly a Trump supporter – Cam’s analysis has been fair and balanced – this is not a Fox News outlet. Go to Fox News if you desire some Trump.

to me, Wally comes across as a political hack, and as a Trump fanboy. Who cares whether Cam is “fair and balanced”, this isn’t some half-axxed Fox News channel. We are looking for investible advice, and not for boring political views that don’t make Republican snowflakes melt.

Cam,

I think the VP candidate Biden chooses may have enough impact to tilt the election outcome against him. He has already boxed himself by stating that he will choose a female candidate. Moreover, there is a lot of pressure to pick an African American woman. Either way, some potential voters for his candidacy might be discouraged with his choice.

The VP candidate pick is really important in this year’s election because of his advanced age. It should have some material impact. Expect Trump to squeeze some juice out of it.

That’s true, Sanjay. Nobody expects Joe will make it 4 years. I’m sort of hoping he picks Stacy Abrams. LOL.

I doubt if he’ll pick Abrams, she doesn’t have the experience to step in should anything happen to Biden. As well, there are hints that he may not stay more than 4 years.

On the other hand, Abrams could energize the black vote in GA. Arguably, she could win GA for the Ds, and win them the two Senate seats this cycle (though I’m not holding my breath for that).

The safe choice for him is Harris.

Nobody on Biden’s list has the experience to step in as President. Not even Joe.

I predict Susan Rice as a surprise VP pick. She is a brilliant centre professional with global experience. She is like a female Colin Powell. Certainly not a scary socialist.

But she did go on national TV and lie to the American people. Many could never forgive her for doing that.

https://www.theatlantic.com/politics/archive/2020/05/biden-vice-president-susan-rice/612115/

I wonder if the US of A is ready for a female President, and an African-American female President in particular. The latter may stir a particular constituency but Democrats may lose White voters at a national level.

I’d prefer Susan Rice over Kamala Harris as well.

Cam,

I think your most important chart is your “Average Election Year Performance.” Suppose the administration could reproduce the reelection pattern this year, then the voters would surely reelect, or that is the administration’s position. The chart produces the outcome and not the other way around as you have suggested.

To that end I point out a relatively obscure account that I call the administration’s bank account. This is the account where your tax payment will be deposited. It’s basically best understood as Trump’s government checking account. It historically contains a balance of about 400 billion dollars, or 5 weeks of government obligations. Currently, it has an unprecedented $1.6 trillion and rising to be used (I anticipate) before the election in an effort to replicate the winning “Average Election Year” chart and thus the victory.

I think this the major reason the market is performing so well. If Trump replicates the winning chart, he wins.

Simple.

Chart : https://fred.stlouisfed.org/series/WDTGAL

“Some tax receipts, primarily individual and other tax payments made directly to the Treasury, are deposited in this account, and it is also used to collect funds from sales of Treasury debt.”

It also contains the funds received from the sales of Treasury debt.

Precisely. That’s QE money.

I don’t think this is QE money. Are you suggesting the Fed has drawing rights on this account ? That is not my understanding, but perhaps you have further evidence you can share.

Sanjay,

Significant money is deposited into this account by the Fed (and this year the vast majority has been deposited by the Fed). Otherwise, there could be no deficit spending.

Wes,

Exactly. I was making the same point. This money does not JUST represent the tax dollars collected from the taxpayers.

I am finding it hard to reconcile the odds of a Biden victory (as per PredictIt and other sites) and the performance of the stock market.

Here is an interview with Ari Wald, a well-respected Technical Analyst, who is expecting the market to exceed its Feb peak and the technology stocks to ascend steadily over the next 6-12 months.

https://twitter.com/AriWald/status/1273633499564724224

Just want to keep the other viewpoints in my sight as well.

Sanjay, I keep mentally going back to that chart that you (I think it was you) posted showing a chart of the market during the 1918 Spanish flu. I was struck by the resilience of the market as the flu and the economy worsened. It reminded me of how the market is acting now as this pandemic is worsening.

Wally, is this what you are referring to?

https://www.marketwatch.com/story/market-behavior-a-century-ago-suggests-the-worst-could-be-over-for-stocks-if-not-for-the-coronavirus-pandemic-2020-03-19

Yes, Sanjay. That was the chart I spent some time studying after you posted it.

Wally, I think this chart was posted by D.V.

Oh, OK, thanks a lot for posting that link before D.V.

Sanjay

I would like to think that the market does not take elections seriously till September.

D.V., Both betting markets and the stock markets was about making money and both should be reflecting the odds accurately about the election results, IMHO.

So, did polls and betting houses predict an Obama win? Try memory, they did not, but chime in.

I believe they did. McCain/Palin was a disaster at the end in 2008.

See polling history here. Don’t have betting prices, but I would imagine they followed the polls

https://www.realclearpolitics.com/epolls/2008/president/us/general_election_mccain_vs_obama-225.html#!

Thanks Cam. Late September 2008, there was a red wave that year, but a sudden turn in October to blue and the rest is history (see graph from your article). The real phun in the stock market started from October 2008 (John Paulson was the architect who orchestrated everything behind the scene).

I did not pay much attention that year to elections that year, except to meteoric rise of Sarah Palin with very nebulous credentials. That said, what is striking, from the graph, is how uninspiring and range bound Obama numbers were through out the summer.

My gut feeling is that the elections are going to be a yawn until October 2020. Somewhere we get sudden bout(s) of volatility. A Biden victory, should assure a bottom in March 2021 (below 2000). The month of March has an uncanny ability to create major market bottoms.

To be sure, 30-40% pull backs are rare. That said, statistically, one does expect a 50% loss once every decade, or so, and we are long due for one.

So, if Trump wins 2020, good chance, market keeps rallying, new trade wars will start, more tax cuts, etc. and the above may not be correct way to think.

I don’t recall the betting polls but I do recall the lead up to McCain’s demise. As I recall it, McCain had a fair lead in September until the economy started to unravel. This had been predicted by an article I read a month or two earlier from the Royal Bank of Scotland.

As the economy headed south McCain still had a chance until he called for a summit on the economy. At that late October summit McCain had absolutely nothing to say. That was his final straw. I remember being so angry with him I nearly blew my top!! LOL

So, did polls and betting houses predict an Obama win? To my memory, they did not, but please chime in.

IMO, talking about politics is pretty useless prediction of the direction of the markets. As Byron Wien, senior investment strategist at the Blackstone Group said “People buying stocks are not worried about earnings in 2020 or even 2021,” “They’re thinking, ‘Am I paying the right price for 2022?’ ”.. And the veteran strategist adds, “If the markets thought he (Biden) would shift to the extreme left, they would be reacting more negatively. The markets seem to have accepted the fact that he (Biden) could be the winner, but adopted my view that he will move gradually on taxes and regulation.”

https://www.yahoo.com/news/trump-steps-back-done-being-162033507.html

This is an interesting strategy!

https://www.yahoo.com/entertainment/herman-cain-hospitalized-covid-19-001059330.html

DJ Trump needs to distance himself from the zig zag course of Covid19. Herman Cain is a good example, after proclaiming that “people are fed up with masks”, he himself declares that he is positive for Covid19.

On the democratic side, the campaign is whisper quiet as President Trump is doing their job. Just watching from a distance, who would be the eventual fore runner, and how it affects the stock markets (very worried if Biden wins).

The concept that “masks” are protective has been politicized. The Republican base obviously disbelieves in masks and their leader has to support the base, as the tail wags the dog.

Science supports wearing masks does limit transmission, no doubt about it.

Sure, politicians may risk their lives to support their base (Herman Cain is an example here). What an irony. Sorry Mr Cain.

https://factcheck.afp.com/misleading-mask-graphic-claims-show-exact-chance-covid-19-spread

https://www.cnbc.com/2020/07/04/florida-reports-more-than-11000-new-coronavirus-cases-another-daily-record.html

To be sure, this is a human tragedy. As cases rise, in these two states, death are lagging , though Houston ICUs are sending cases to other cities.

https://abcnews.go.com/US/houston-hospitals-transferring-covid-patients-running-icu-beds/story?id=71552472

There is suggestion that deaths lag by about two weeks. Sorry to see these two are larger economies are learning the lessons the hard way about Covid being led by Pied Pipers, who were in denial.

So, when the time comes for reelections, we know today, Texas and Florida politicians (you know their names), were definitely supportive of masks, we also know today that their constituents were advised to take all precautions!

So, so fed up of these politicians.

I agree, D.V. Especially with your last bracketed comment.

Not so much on your next comment. I don’t think the revolt against wearing masks is a Conservative thing. I think it is personal and runs across all parties evenly. I for one will not go out without wearing a mask and some times wearing sealed 3M glasses.

https://www.yahoo.com/news/masks-good-trump-says-hed-204251818.html

“I’m all for masks,” Trump said in an interview with Fox Business Network. “I think masks are good.”

The leader of the Republican party, does a flip flop now.

Wally

Res Ipsa Loquitor.

D.V. Trump is only against wearing a mask for himself. I don’t recall him advocating that people shouldn’t wear mask.

However, Dr. Fauci did at one time say masks offered no protection but from his own statements later he admitted that he only said that because there was a shortage in hospitals and he wanted people to stop buying/hording them.

Hmm.. Why did Yahoo categorize the Herman Cain story under Entertainment? Ironic!

https://www.yahoo.com/entertainment/herman-cain-hospitalized-covid-19-001059330.html

Some can find humor in any tragedy, Sanjay.

I think Trump wins by a landslide in November.

IMO, polls are highly suspect. It’s all talk, and people can (and will) say whatever they want – even behind a wall of anonymity, they will tend to be politically correct.

When it comes time to vote, they reveal their true selves – and often our true selves are nothing like the versions we present to the outside world.

Good points, RX. There’s lots of truth behind your statements. Just like a lot of Trump supporters will not answer poles. I don’t even answer my phone unless I know who it calling. If it is important they can leave a message.

Wally, I know a guy who never answers his phone, never has, and has always had call waiting even when it costs extra. People are strange.

Wes, I don’t answer my phone because I get several calls a day that are scams. I asked a guy once if his mother knew he was scamming people for a living. He hung up on me. LOL

Hahaha… That’s a good one. I will try that next time.

We know Mr. Trump. We know his policies. We don’t really know Mr. Biden. The odds may change dramatically when he lays out his vision, his choice for VP and how people perceive his mental agility and acuity (phone ringing at 3 am). I think he will be torn between his deep beliefs and what progressives want him to be. How he handles that will be critical. Debates pose an existential crisis for him. Media cannot hide his gaffes.

The failure of Bernie/ Warren implies that Democrats are not ready for a big push to the left. Left will be very unhappy if they don’t get someone like Warren.

So, relax and enjoy till the campaign really begins. And we will see what polls, pollsters, betters and the voters say and do. Till then, I am staying with stocks I believe will perform better in the new economy.

Looks like a lot of enthusiasm here for the coming election. We, as investors, are just trying to make money. Personal preference should not interfere with that goal. As we always do in our investment process: scenario analysis. Respect the market price action and adjust accordingly. Don’t get emotional. Like everything in life (especially in politics), respect and study your adversaries and try to learn from them. Whatever the outcome of the election, we need a plan to make money, not sitting around feeling lost or unnecessarily joyful.

https://www.yahoo.com/news/rapper-kanye-west-announces-u-023307380.html

Elon Musk is his first big supporter!

Go figure.

It would be very useful to see the similar “% of voters who say their choice is more a vote …” in 2016 for a direct comparison.

As far as fundraising goes. I believe Biden is on track to match Clinton’s # (1.2B total in 2016). Trump on the other hand, only raised about 600M in 2016 and he is already at 900M for this cycle.

I don’t know what the result will be but right now it looks like they might be equally likely.

The “Where The Campaign Cash Is Coming From” map might provide us with further insight regarding candidates’ odds.

Based on these maps, not only I don’t see how Ds could flip TX and GA, it seems Rs might even flip NM (new mex) and MN….

https://www.npr.org/2020/05/20/858347477/money-tracker-how-much-trump-and-biden-have-raised-in-the-2020-election

Great info, thanks.

There we were at the shortstop position, gloves firmly in hand ready to stop any ball hit in our direction and then the Chinese moved the stadium.