Mid-week market update: It is said that the adage “hindsight is 2020” may have been a garbled warning from a future time traveler. This year is certainly turning up like that.

The S&P 500 fell -20% in Q1 2020, and recovered 20% in Q2. It’s been that kind of year. Tactically, the index is backtesting the violation of the rising channel, but the bearish island reversal remains intact, and the market has been unable to breach the moat surround the island at about 3160.

To say that 2020 has been an unusual year is an understatement.

Wobbly internals

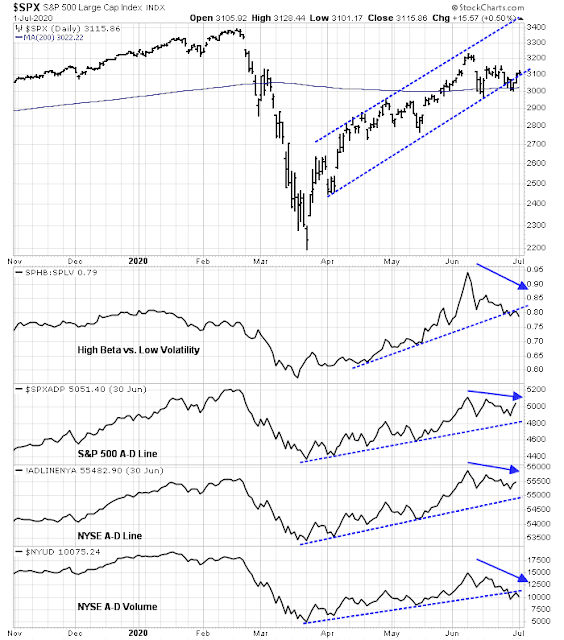

Market internals still look wobbly under the hood. Equity risk appetite, as measured by the high beta to low volatility ratio, and different versions of Advance-Decline breadth, are all showing lower highs, and, in some cases, lower lows.

Credit market risk appetite, as measured by high yield (junk) bond prices to duration-equivalent Treasuries, and by leveraged loans, are also exhibiting minor negative divergences. This is a somewhat surprising result in light of the Fed`s efforts to keep credit spreads from blowing out.

In addition, Troy Bombardia pointed out that SKEW is spiking, which may be a warning of heightened tail-risk going forward.

Volatility ahead

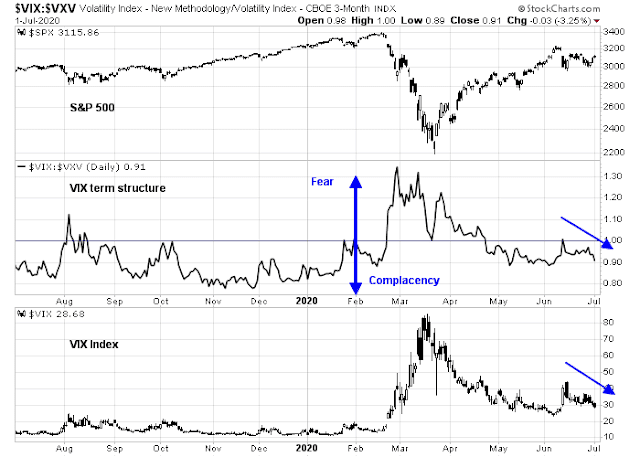

I interpret these conditions as warnings of rising uncertainty and likely volatility. Jerome Powell highlighted the high level of uncertainty about the future outlook in yesterday`s testimony to Congress [emphasis added].

While recent economic data offer some positive signs, we are keeping in mind that more than 20 million Americans have lost their jobs, and that the pain has not been evenly spread. The rise in joblessness has been especially severe for lower-wage workers, for women, and for African Americans and Hispanics. This reversal of economic fortune has caused a level of pain that is hard to capture in words as lives are upended amid great uncertainty about the future.

Output and employment remain far below their pre-pandemic levels. The path forward for the economy is extraordinarily uncertain and will depend in large part on our success in containing the virus. A full recovery is unlikely until people are confident that it is safe to reengage in a broad range of activities.

As another measure of uncertainty leading up to Q2 earnings season, my former Merrill Lynch colleague and small cap specialist Satys Pradhuman observed that small cap earnings estimate dispersion has spiked, and readings are above the levels seen at extremes of the GFC.

At the same time, the VIX Index, as well as the term structure of the VIX, are relatively benign and show no signs of volatility fears.

Sideways consolidation

I wrote on the weekend (see A shallow or deep pullback?) that while I was tactically bearish, but I was keeping an open mind about the possibility of a sideways consolidation after the trend break of the rising channel. It appears that the market is resolving itself with a period of sideways choppiness.

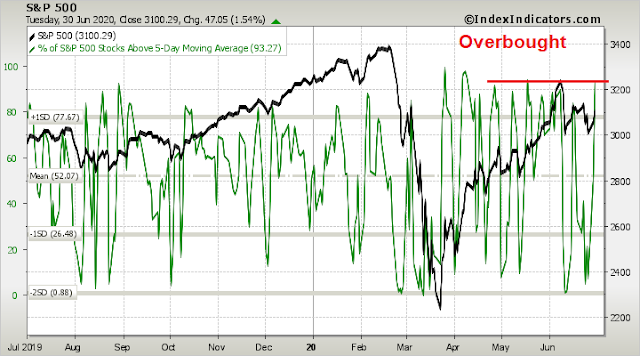

Short-term breadth was already at overbought extremes based on Tuesday night’s closing prices. Despite today’s market advance, the roughly even balance between advances and declines is likely to slightly ease the overbought reading.

My inner investor remains neutrally positioned. My inner trader is still short the market. His base case scenario is now a range-bound consolidation, and he expects to cover his short if and when the market reaches the bottom of the recent range and becomes oversold.

Disclosure: Long SPXU

Thanks Cam– insightful post! It sounds like in the near term you are looking for a range bound trade. What range are you looking at?

I know your longer view of SPX is that it is highly overvalued per recent comments. How does that view fit in with the thesis of the range bound trade?

The range is roughly 3020 at the bottom and 3160 at the top.

thanks!

I found this video helpful in case it helps others re: RSI divergence and QQQ https://twitter.com/TDANetwork/status/1278347327858769922?s=20

“bottom of the recent range”

Would that be around 3000 then?

If the market trades near 3000, I think its probably going to go lower than that.

Another trade war with China would probably do it.

not sure if I understand the SKEW index’s predictive ability. It spiked in early December 2019; what could the market have known about Covid-19 at that point?

At Investopedia, it says “In practice the SKEW index has been a poor indicator of stock market volatility. Financial writer Charlie Bilello observed data from the biggest one-day falls in the S&P 500 and the SKEW Index preceding these falls. “Going back to 1990, none of the worst declines had a SKEW Index in the prior month that was within the top 5% of historical values. So, when actual tail risk was present, SKEW did not predict it,” Bilello said. “

In this kind of environment, trading indices are not very profitable. Stick to trading strong sectors and industries. We will be seeing range bound market the rest of the year, but every new range should be higher than immediately previous range. In other words, Occam’s razor applies here: steadily improving data mixed with occasional flare-up of virus news.

Not necessarily. I’ve found it difficult to predict which sectors will spike on any given day/week. It’s been easier to just own the entire global market and let the bull wave unfold on its own terms.

Cam, if the market closes the island gap today or tomorrow, will that change your prognosis of a trading range market or does it need new highs?

When we look back in a year on 2020, it will be interesting to hear the ‘stories’ investors come up with to explain the moves this year.

If the crashes from here, it’s not hard to imagine what they’ll be – in fact, we’re hearing those stories right now.

But what if 2020 becomes yet another ‘V’ move? We have to at least consider the very real possibility that market participants miscalculated (and perhaps continue to miscalculate) the economic impact of the pandemic.

RX, I’ll just be happy if I’m still alive in a year from now! LOL

Looks like the gap in SPX ~ 3166-3180 is still intact. https://twitter.com/WalterDeemer/status/1279070127804289025?s=20