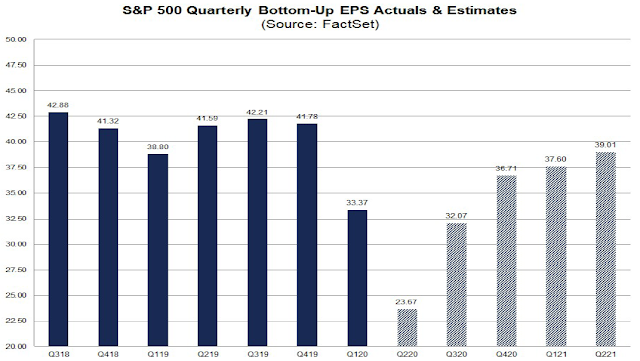

There has been a recent continuing controversy about the usefulness of forward P/E as a valuation tool in the current recessionary environment. On one hand, past bear markets have typically bottomed out at a forward P/E ratio of 10, with a low of 7 (1982) and a high of 14 (2002). FactSet‘s reported market rating of 21.5 forward earnings is very stretched by historical standards.

On the other hand, Liz Ann Sonders at Charles Schwab observed that stock prices and earnings estimates have shown a correlation of over 0.90 in the last 20 years and the recent correlation is a mirror image -0.90 as stock prices rose and earnings estimates fell. She then qualified that analysis by allowing the same negative correlation occurred during the GFC.

Do forward P/E ratios matter at this stage of the cycle? Is the market forward looking and discounting the current weakness and valuing the market at its “intrinsic value”? To answer those questions, let’s get back to basics by considering the drivers of equity valuation.

Back to basics

Aswath Damodaran of the Stern School at NYU offered this follow analytical framework for analyzing companies.

Here are the key questions to consider:

- How will this crisis affect the company in the near term (2020)?

- How will this crisis affect the business the company is operating in, and its standing, in the long term?

- How will the crisis affect the price of risk, including the likelihood of default, equity risk premium, and default spreads?

Current operating environment

Let’s begin with the current operating environment. I am not sure people appreciate how deep this recession is.

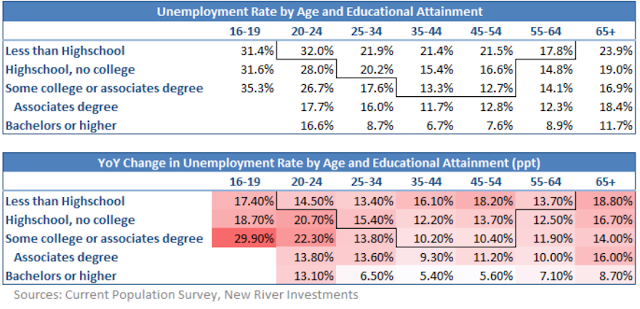

Consider, for example, the scale of the job losses. Continuing jobless claims peaked two weeks ago at 24.9 million, or 7.6% of the population. Imagine a best case scenario where two-thirds of the jobs lost during the pandemic came back relatively quickly. After normalizing for population, this would see the continuing claims to employment ratio falls from 7.8% to 2.9%. But 2.9% would still be worse than the levels reached during recessions of the GFC (2.1%), the Volcker tight money era of 1982 (2.0%), and Arab oil embargo and oil shock recession of 1975 (2.1%). That’s how deep this recession is.

As well, one of the more worrisome developments is the emergence of the fiscal hawks in the current environment. Former Trump chief of staff Mick Mulvaney appeared on CNBC and declared that people are being trained to believe government is free, and debts and deficits will come back to bite Americans. Mulvaney’s remarks could be interpreted in a partisan way as a way to lay the groundwork to oppose the Democrats’ agenda in the event of a Biden victory in November. Nevertheless, the premature withdrawal of fiscal stimulus will be highly contractionary, and would short-circuit any nascent recovery in 2021.

A second wave

The risk of a second wave of economic shock is still present. So far, job losses have mostly been restricted to low paid workers. College educated workers have largely been insulated from the worse of the carnage.

There is mounting evidence that a second wave of white collar job loss is about to hit the economy. Bloomberg reported that a wave of layoffs is impacting Silicon Valley.

Bloomberg analyzed the data on job cuts, working with Layoffs.fyi, which compiles public layoff announcements in the technology industry. While the pandemic fallout has cut hard across the economy, tech merits particular attention. In recent years it’s juiced stock market gains, boosted U.S. gross domestic product and created services that helped other sectors grow. The hobbling of tech companies will have an outsized effect on the pace of the overall American recovery.

As tech companies have cut jobs, so has the rest of the country. Recent U.S. layoffs now exceed those during the Great Depression in sheer numbers, and could end up rivaling the 1930s in percentage terms. At the Depression’s height in 1933, almost a quarter of Americans were unemployed, according to estimates from the Bureau of Labor Statistics. Currently, about 15% of Americans are unemployed, up from 3.6% in January.

Although technology companies often employ fewer workers than their counterparts in other industries, tech makes up the biggest chunk of the stock market, meaning its performance has a disproportionate impact on individual retirement portfolios and other assets. At the end of the first quarter, seven of the top 10 companies ranked by market capitalization globally were technology giants.

The WSJ reported on the job losses from an anecdotal perspective.

Hours after Joe Taylor was laid off by Uber Technologies Inc., as part of the ride-sharing company’s far-reaching cost-cutting, the hardware engineer began looking for a new job. What he’s seeing is a Silicon Valley job market that has lost its spark.

The tech industry has been one of the most resilient sectors of the economy during the Covid-19-induced economic downturn. Microsoft Corp. and Amazon.com Inc. reported strong sales growth for the first quarter even as quarantining measures came into effect. But major layoffs at big companies including Uber and Airbnb Inc., as well as a host of smaller startups, have shaken any sense that the tech industry is insulated from the broader employment destruction—and, for many, undermined hope that jobs lost would be easily replaced.

“Everyone’s just a little more wary,” said Mr. Taylor, 38 years old, who was let go earlier this month. Fewer recruiters have gotten in touch than in past job hunts, he said, as he’s scoured opportunities at large and small firms. The message from many recruiters, he said, has been: “I don’t have anything right now, but let’s stay in touch.’”

The following observation is purely speculative, but if technology companies are more comfortable with the work-from-home trend, then what’s to stop them from outsourcing jobs to cheap wage jurisdictions like India? How long before the Joe Taylors of the article start to compete with Indian software engineers?

American corporations’ growing comfort with remote work has also led Mr. Taylor, the former Uber engineer, to look for jobs farther afield, including in Denver. He plans to remain in the Bay Area, working remotely if needed, but the trappings of a nearby tech-company office no longer feel essential.

That’s how dark the outlook could turn.

A balance sheet recession?

Looking longer term, the growth outlook could further be impaired by a change in household consumption preferences. Gavyn Davies recently raised the specter of a nascent balance sheet recession in an FT article.

One thing that seems different this time is that much of the slump in US consumer spending has been accompanied not by declining personal incomes but by a surge in savings, which suggests consumers may remain cautious during the recovery.

Congress showered the economy with fiscal largess in the form of the CARES Act, but people are saving instead of spending the proceeds.

Despite this income support, consumer spending has collapsed, especially in service sectors and on discretionary goods such as autos. As a result, the savings ratio could well rise to about 20 per cent of household income.

The key question for the economic recovery is how much of this increase will be reversed as the lockdowns are eased. Part of the decline in spending has been involuntary and will be restored as restaurants and stores re open and work patterns return to normal. But the decline in discretionary spending on big-ticket and other items may last longer, especially if the emergency rise in unemployment benefits ends after the end of July, as planned.

The direct US fiscal stimulus in response to the virus has been about 13 per cent of GDP, and this has maintained household incomes as unemployment has soared. Nevertheless, households have curtailed spending causing a recession. Any withdrawal of the fiscal stimulus, at a time when precautionary savings remain high, could continue to depress spending and prolong the recession.

The behavior of households has been a complete mirror opposite of the GFC. During the GFC, investors yanked money from banks and began a bank run. This time, individuals are stuffing their cash into banks to create precautionary cushions against pandemic related liquidity needs.

Here is another way of thinking about the interaction between economic growth, Fed policy, and the savings rate. Fed stimulus has caused money supply growth to rise dramatically, but the saving rate spiked as well. Monetary velocity has tanked, and the economy is not growing.

The dean of the balance sheet recession thesis is Nomura chief economist Richard Koo. Koo made the following points in a Bloomberg podcast.

- Fiscal and monetary policy has put a floor on the economy, but much depends on public health policy and medical advances.

- Households and corporations with weak balance sheets could be psychologically scarred from taking on debt, and saving rates will rise. Rising corporate savings translates into lower propensity for business investment. Koo cited the example of the 1990-91 credit crunch and recession, which restrained companies that survived the experience from assuming debt for close to a decade. People who survived the Great Depression also learned to be frugal and avoid debt, which raised their saving rate.

- The current recession has seen a rush for borrowing. Financial conditions have tightened, and the Fed was correct in flooding the system with liquidity.

- Trade will continue to be a drag on growth. Post-pandemic, Koo expects a short-lived bout of pent-up consumer spending on services, but the lack of global growth owing to slowing trade will lower global growth potential.

If the savings rate stays elevated, we can expect a balance sheet recession to occur, which will depress long-term growth potential compared to the pre-pandemic era. The Great Depression saw a -26% decline in real GDP, and took six years from the 1929 Crash for real GDP to recover its former peak. Real GDP fell -4% during the GFC recession, and recovered its previous level in about three years. While I am not forecasting a Great Depression style downturn, even the expectation of a GFC-style recovery may not be entirely realistic should a balance sheet recession take hold.

The Fed backstop and the price of risk

What about the Fed? There seems to be a belief that Fed intervention can put a floor on stock prices, but the stock market ultimately responds to the economic outlook, which drives earnings. Can we truly see a V-shaped earning recovery if the employment picture is that dismal? Where will demand come from?

Jerome Powell’s 60 Minutes interview provided some clues. Powell declined to make a forecast of when the recession would end. His response was “it really does depend…on what happens with the coronavirus”.

SCOTT PELLEY, CBS NEWS / 60 MINUTES: There’s only one question that anyone wants an answer to, and that is: when does the economy recover?

JEROME POWELL, CHAIRMAN OF THE FEDERAL RESERVE: It’s a good question. And very difficult to answer because it really does depend, to a large degree, on what happens with the coronavirus. The sooner we get the virus under control, the sooner businesses can reopen. And more important than that, the sooner people will become confident that they can resume certain kinds of activity. Going out, going to restaurants, traveling, flying on planes, those sorts of things. So that’s really going to tell us when the economy can recover.

Powell went on to elaborate on the Fed’s estimate of the length of the recession. “It may take a while. It may take a period of time. It could stretch through the end of next year. We really don’t know.” He expressed concerns about the damage to households and businesses in a prolonged slowdown.

So the risk is that there could be longer run damage to the productive capacity of the economy and to people’s lives. And I’ll give you an example. If workers are out of work for a long period of time, it becomes harder for them to find their way back into the labor force. Their contacts get old and cold, their skills can atrophy, and they just lose their relationship network. And it can be hard to get back to work. And the longer you’re unemployed, the more that it’s a factor. So you want to avoid that.

You want unemployment to be relatively short and if people can go back to their same job, that’s great. And a lot of that can happen here. The same thing is true with businesses. At times when there are high levels of business failures, even very good businesses that are failing because of something like this, that can do longer run damage to the economy and make the recovery slower and weaker.

The Fed can do what it can, but its powers are limited [emphasis added].

It can weigh on the economy for years. So we have tools to try to minimize that longer-run damage to the supply side of the economy. And those tools just involve keeping people solvent, keeping them in their homes, keeping them paying their bills just for maybe a few more months.

And the same thing with businesses. Keeping them away from Chapter 11 if it’s avoidable. It’s not going to be avoidable in many cases. But if it’s avoidable, the more of that we can do, the stronger the recovery will be. The less this period will weigh on economic growth going forward.

I have said this before but it bears repeating for emphasis. The Fed can supply liquidity, but it cannot supply equity if a firm were to fail. Quandl has created a Late Payment Index. The latest update shows that companies are stretching out the accounts payable, which is a signal of deteriorating liquidity and rising financial risk. Just ask J.Crew, Neiman Marcus, and Hertz, all of which have filed for Chapter 11 protection. The insolvency cockroaches are crawling out from under the cupboard, and there is never just one cockroach.

The last expansion cycle was unusual in its debt behavior. Households delevered their balance sheets after their debt binge leading up to the GFC. Corporations were not as exposed entering the GFC as households, and corporations increased leverage in the post-GFC era in response to falling interest rates. The latest crisis has dramatically exposed the corporate sector’s vulnerability to financial accidents.

The Fed is doing what it can to mitigate risk premiums, but its powers are limited. I interpret this to mean that while the risk-free rate will stay low, and the Fed will do everything it can to cap out risk premiums, market forces will act to force up risk premiums as the aftershocks of the financial crisis become evident. As the crisis drag on into 2021, expect mass small and large business failures, and the price of risk to rise.

Market punishment doesn’t fit the crime

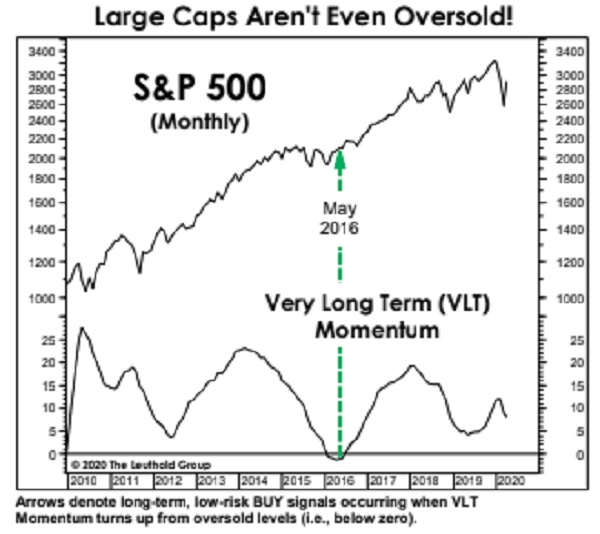

Marketwatch recently reported that Doug Ramsey, the chief investment officer of The Leuthold Group, warned that the stock market punishment doesn’t fit the crime. Even if you don’t believe that the forward P/E ratio is a valid measure of valuation because of depressed earnings, Ramsey pointed out that the market is expensive based on the price-to-sales ratio too.

“The depth and duration of this economic calamity are unknowable, but values don’t yet reflect it,” he told clients in a recent note. “S&P 500 valuations are 30-40% higher than seen at even the comparatively-shallow market low of 2002.”

Ramsey went on to show that the median S&P 500 stock is still historically pricy based on several metrics, including price-to-sales and price-to-earnings.

“If the median S&P 500 stock traded down to the average valuation seen at the last three bear market bottoms, it would have to decline another 46% from April 30th levels” he said. “If we play along and assume that valuations bottom at the ‘richest’ levels ever seen at a bear market low, there’s still 32% downside remaining in the median S&P 500 stock.”

The stock market reacted to the initial COVID-19 shock when prices skidded in March, but it hasn’t even begun to discount recessionary aftershocks. The depth of this slowdown is unprecedented, at least in the lifetimes of investment professionals who are working today. But the width of the recession also matters. Anyone who thinks that the Fed can solve all problems with unconventional monetary policy is dreaming.

We began this journey by going back to the basics of equity valuation with the following questions:

- How will this crisis affect the company in the near term (2020)?

- How will this crisis affect the business the company is operating in, and its standing, in the long-term?

- How will the crisis affect the price of risk, including the likelihood of default, equity risk premium, and default spreads?

The current operating environment is dismal, and there is little hope of relief over the next few years. Credit conditions are deteriorating. Unless some miracle medical advance appears in the immediate future, we are likely to see widespread business failures over the next 12 months that will cripple the economy and, in Jerome Powell’s words, “make the recovery slower and weaker”. The Fed is doing what it can to put a cap on risk premiums. It can print liquidity, but it cannot print sales, nor can it print equity for failing firms.

One (Fed support) out of three isn’t good enough. Current valuation is discounting a V-shaped recovery, and strong Fed support. It has not even begun to discount the aftershocks of the COVID-19 crisis. Equity risk and reward is tilted to the downside.

Don’t worry about the CC thing, Cam. Most of us know what it is like trying to get new software to do what you want and work smoothly. LOL

What happens with school is a big one for me personally and perhaps for the economy as well. Work from home and home schooling is impossible. The impact on productivity, even for tech workers that can work remote, is high. Kids need extra attention during this time. Getting things done at work is difficult, as clients and team members have the same challenges. Multiply this out and the impact is large.

Coronavirus is creating all sorts of issues for the economy like this, many that are difficult to quantify or have yet to fully manifest.

This sudden plunge into recession was due to medical and health crisis. The country and the world were totally unprepared for the pandemic. As we look back over the last few months, we have endured the worst of the crisis (with a significant loss of human life, economic output, and harm to businesses, states, and individuals) and have made significant progress in dealing with this crisis.

The number of daily tests are over 400k +, positivity rate is declining, Number of new cases in US are declining, number of new deaths are declining, businesses in all fifty states are starting to open in a thoughtful phased approach. There are surges locally for example in Alabama. That does not call for US to be shut down!!

There is progress on therapeutic (Remdesivir which shortens the hospital stay), three vaccines in clinical trial and many more in development, progress in understanding the virus, how to treat the patients in the hospital. We are much better equipped and prepared to deal with a surge if it happens, contact tracing etc. More than anything, humans adapt rapidly to new situations and find ways to progress. Particularly Americans!!!

Any major catastrophe reshuffles the deck. Weak companies before COVID will not survive. Not all segments of the economy will return at the same pace ( leisure and entertainment) but they will. Because humans like travel and entertainment. The Golf tournament recently had huge TV ratings, if not the highest.

There has been unprecedented monetary and fiscal response with Fed ready to do whatever it takes, Congress preparing for further stimulus and consumers eager to work, earn, consume and live a normal life.

There will be headwinds but will it stop the progress? Emphatically no.

I believe glass is more than half full. That is good enough for me.

A key to future valuation is taxation. The huge deficits will need higher corporate and personal taxes for a long time. I see Damodaran had it on his valuation chart but I think he should have highlighted that with its own box.

After WWII when government debt was equally high as it will be soon, the personal tax rates were incredibly high (my memory thinks 70-90%) on top earners.

Also the internet giants won’t be able to escape.

Also every country will be doing this so corporations won’t be able to evade by shifting profits overseas.

The Dems will be extremely tough but Republicans will be forced to join. So higher taxes regardless of who wins in November.

Are you sure there is no way around higher taxes?

Negative rates: Taxation of capital by other means.

Is that true? Lower and negative rates also imply higher asset prices. That along with lower taxes likely more than offsets the interest earned.

Negative rates is a form of wealth tax. Ask the eurozone, especially the banks, how well negative rates worked out.

Cam, Sanjay

True on both counts.

Are we still in recession? Or it is over, Very confused about the reality and the market behavior.

See the continuing claims as % of population chart, and compare the current figures to past major recessions.

Do you think we are still in recession?

If US unemployment claims continue at the same rate in the last 3 weeks, there will be no jobs left by end of year.

Hence, the rush to reopen.

If the US continues to have higher rates of COVID than much of the rest of the world, Americans will not be doing as much international travel. I do not see why other countries would accept Americans in for tourist activities if those countries successfully contain the virus and this country does not.

Americans take more trips/person in a year than most other countries. International trips will be lot lower. That would lead to more domestic trips. Road trips will increase significantly IMO. US is the third most visited country. That would be a significant loss for airlines, hotels etc.

There will be winners and losers.

Agree. More domestic trips, road trips, and RV/ camping, far fewer international tourism to/ from US.

It may take time and a few bankruptcies in the airline and cruise ship industry. In the end, the companies that survive may be good buys. In the mean time, yes, domestic vacations may be the norm, until things turn around and Americans start to fly again (inter)nationally.

Number of trips vs. length of trips: European get vacations that are much longer than American ones.

How many Americans do you know get 5-6 weeks a year of vacation time, and take them?

Good point, Cam.

Urban Carmel sounds more bullish today than he has in weeks https://twitter.com/ukarlewitz/status/1266753239631843328?s=20

(a) Who’s been buying stocks/ what’s driving prices higher? Indexes are unable to rally without consistently higher bids.

(b) How accurate are economic forecasts? If the vast majority of economists were unable to predict (or even foresee) the GFC, what makes us think they’re able to predict the fallout from Covid-19?

(c) It should be ‘easy’ to make money shorting stocks/ buying long-dated puts at these levels, right? We know the correct answer is ‘No. Making money in the markets is never easy.’ Maybe that’s all we need to know. There are so many castastrophic predictions – and by implication so many traders/ investors positioned for a decline – that it’s almost impossible for prices to go down.

https://www.marketwatch.com/story/why-the-stock-market-right-now-is-stronger-than-even-the-most-bullish-investors-believe-2020-05-29?mod=article_inl

The road to recovery will be drawn out. Even if an effective vaccine is produced by EOY, it would take 2-3 years before supply would reach the general public. After that, at least another year before herd immunity is achieved.

Its going to be a long 3 – 4 years from here on out.

Serum Institute of India alone makes 1.3 billion doses of vaccines each year and are building the platform for COVID-19 vaccine in concert with Oxford University. Bill Gates is investing billions on facilities to manufacture seven most promising vaccines. Preparatory work is under way by JNJ and PFE.

Key unknown is when a vaccine will get approved but I think manufacturing will be rapid.

This seems instructive: https://www.bloomberg.com/news/features/2020-05-30/will-life-go-back-to-normal-after-coronavirus-texas-says-no

Somebody should do an index of the number of comments in this blog. It has skyrocketed since the Covid. I looked back at last year and we had two or three usually and if we had more it was a reaction to somebody’s comment rather than a new thought.

This shows us the extreme attention investors (we and they) are paying to markets as they rock and roll up and down more in a week that they normally do in a month or even a year.

Bob Farrell said bear markets have an initial crash and a reflex rally followed by a long grind down to its final low. My guess is we are in the reflex rally and when we grind down to some future bear market low, we will all be exhausted and our posts will be few.

Not to say, I don’t love the action but it would be nice to not feel it necessary to wake up in the middle of the night and check overnight global markets and the U.S. futures.

Just a random thought my Humble warriors.

Thanks, great perspective!

‘The stock market hates uncertainty.’

Amirite?

Cam, I disagree that the Fed can’t print equity. They have been and are. When a company’s employees are paid for 3 months by a completely forgivable loan from the Fed this money flows to the bottom line compared to if you had to pay them from equity.

My daughter’s company took advantage of this plan and will have a stellar 3 months as a result, and she’s by no means alone. Many companies that are government contractors with years of contracts in hand have done exactly the same thing and are also having stellar quarters. Many are public.

If you can get your government to pay your employment expenses, there is no way that’s not printing equity.

Are they really having a “stellar” quarter, or are they just made solvent with the cash flow? Productivity is not up in most businesses and consumers are not consuming. Fed did help a lot but I don’t think the majority of small businesses are in a stellar position.

I think it’s important to note that the Fed can print liquidity, but it can’t print solvency. Key difference: sustainability. The Fed can inject liquidity, but ultimately a business derives its value from its productivity, and if there is no customer demand that’s able to purchase its services or products eventually the business fails and wipes out its equity.