We are continuing our coverage of earnings season during these turbulent times. Last week, we highlighted the disconnect between earnings expectations and valuation (see Earnings Monitor: Reality bites). This week, we are seeing greater signs of stabilization, and hope for the future.

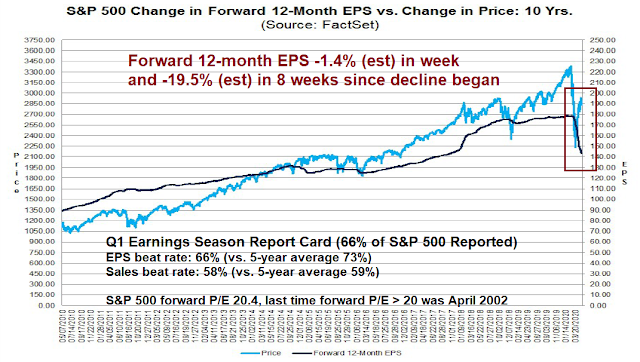

Let’s begin with the big picture. FactSet reported that the bottom-up consensus forward 12-month estimate fell -1.4% last week (vs. -1.9% the previous week), and -19.5% since downgrades began eight weeks ago. The EPS and sales beat rates were both below their 5-year historical averages.

Signs of stabilization

For the bottom-up view of operating conditions, here is the latest from The Transcript, which monitors and summarizes earnings calls.

Succinct Summary: Companies are reporting signs of improvement in the economy. But the rebound is coming off such a low base that these numbers would still be considered very bad in any other environment. The duration of this rebound will depend heavily on whether or not there’s a second wave of infections. Still, even without the virus it probably will take the economy a long time to recover from such a severe shock.

On an industry basis: private capital markets are searching for price levels; consumers are dreaming of the future; tech is chugging along; and the industrial/energy economy is feeling immense pain.

The good news is the decline is stabilizing and exhibiting some signs of growth. The bad news is the absolute levels are still horrendous. As an example, Hilton’s global occupancy improved from 13% to 21%.

But when business was down 90%, -80% looks good

“Week-to-week comparisons showed a third consecutive increase in room demand, which provides further hope that early-April was the performance bottom. TSA checkpoint numbers, up for the second week in a row, aligned with this rise in hotel guest activity, which still remains incredibly low in the big picture. Overall, these last few weeks can be filed under the ‘less bad’ category ” – STR Senior VP of Lodging Insights Jan Freitag“We’re also seeing good booking activity in June and July. In June, we’re seeing booking activity in the 13% to 15% range in July, it’s significantly higher.” – Host Hotels & Resorts (HST) CEO James F Risoleo

“In addition, we are starting to see double-digit increases in digital traffic and booking activity across all segments. Global occupancy levels have gone from a low point of 13% to 23% currently. Assuming we start to see mobility and we don’t have a significant recurrence, demand should slowly rebuild in the third quarter.” – Hilton (HLT) CEO Chris Nassetta

“We are starting to see improvements in our sales with global same-restaurant sales being down approximately 10% for the week ended April 26 from down approximately 30% the last week of March.” – Wendy’s (WEN) CEO Todd Penegor

As different jurisdictions reopen their economies, much will depend on whether there will be a second wave of infections.

The recovery will depend heavily on whether or not there is a second wave

…”hopefully, we will not have a second wave but…requiring to go back to sheltering place…would be the largest risk that we’re seeing because…the factories will be shut down, the demand would be low…That I see as the biggest risk.” – Microchip (MCHP) CEO Steve Sanghi“I fear 2Ws. W number one is war..my second W is the second wave…If I look to the economic consequences of all that, clearly even without the two Ws, I think we have the most unpreceded economic crisis that we have seen in peacetime, and the damage that is inflicting in our economies around the world is really causing damage to families, to jobs, to the capacity to bounce back, and we simply have no real good sense of how badly economies are affected” – European Central Bank (ECB) President Christine Lagarde

Second wave risk

In addition to the risk of a second wave of infections, I am concerned about the prospect of a second wave of negative growth hit the economy.

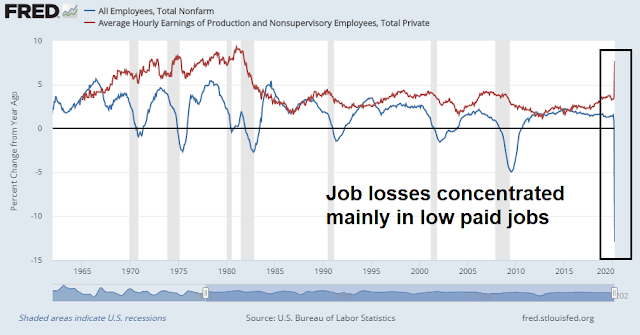

We have all heard about the joke that it’s a recession when your neighbor loses his job, and it’s a depression when you lose your job. This was starkly illustrated by the April Jobs Report. Non-farm payroll fell by -20.5 million. Lost in the initial shock of the report was the surge in average hourly earnings, which can be explained by the concentration of job losses in lower paid workers.

While this could pivot to a discussion on gaping inequality during this crisis, I do not believe it is appropriate to detour into politics during investment analysis. Nevertheless, it is difficult to believe that average hourly earnings will not converge towards the rate of job losses, rather than the other way around. I recently discussed the vulnerability of small businesses, which operate mainly in the low margin, high volume segment, and not well capitalized. How long can they endure cratering sales?

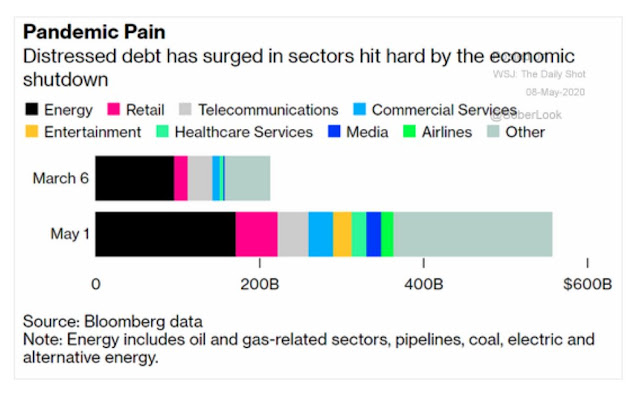

Bloomberg recently reported that defaults are rising, but many default events are showing up under the radar because of distressed debt exchanges:

The worst recession since the Great Depression is prompting indebted companies to default, and increasingly more will do so in a way that’s harder for investors to detect.

Rating firms predict that more companies will pursue distressed debt exchanges, in which they try to overcome liquidity problems by swapping debt or buying it back at steep discounts. Such moves are less stark than missed payments and can fly under the radar for the general investing public, but often result in losses for creditors and are usually counted as defaults by rating companies…

“Distressed exchanges often are just ‘bandages’ and the firm eventually goes bankrupt,” said Edward Altman, a professor emeritus at New York University’s Stern School of Business and director of credit and debt market research at the NYU Salomon Center. Altman, who developed a widely used method called the Z-score for predicting business failures, estimates that up to 40% of distressed exchanges end in bankruptcy within three years.

The pandemic is driving a surge in distressed debt in the obvious sectors. When will the next shoe drop?

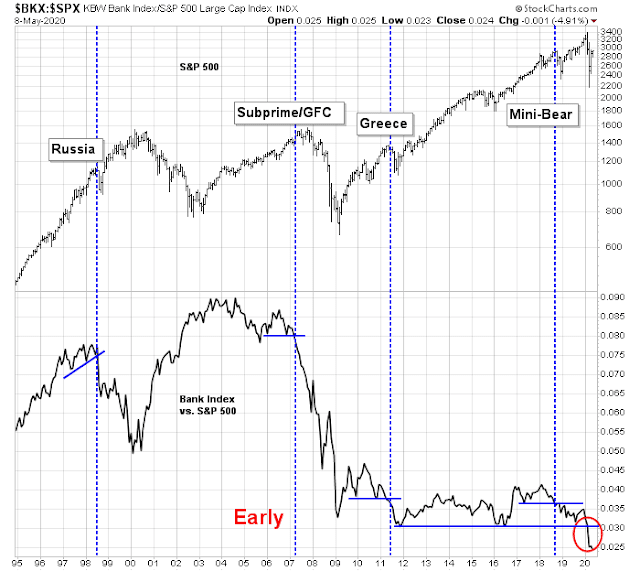

The relative performance of bank stocks is already anticipating a wave of financial distress. So far, the market has been held up by the perception of Fed’s support, but the Fed cannot supply equity to companies that have gone bankrupt. Will this cycle be any different from past cycles?

Challenging valuations

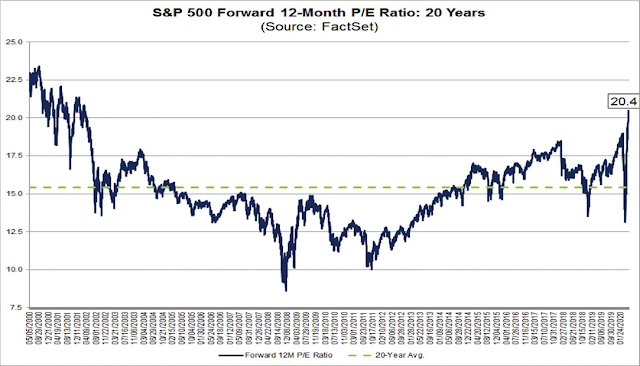

In the meantime, valuations are still challenging. FactSet reported that the market is trading at a forward P/E ratio of 20.4. The last time the market traded at these levels was in 2002, when it deflated from the dot-com bubble.

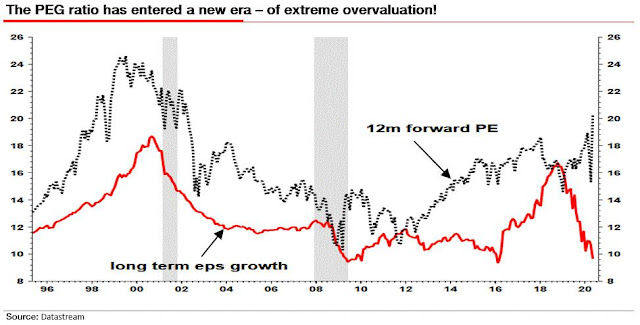

Much depends on the relationship between valuation and expected growth. I hate to quote the perennially bearish Albert Edwards, but he has a point about the PEG, or P/E to Growth ratio, as reported by Marketwatch:

Yes, the Société Générale economist who refers to himself as an “uber bear,” once again, lived up to his self-billing in his gloomy note to clients on Thursday.

“We are in the midst of a monetary and fiscal ideological revolution. Nose-bleed equity valuations are being supported by nothing more than a belief that a new ideology can deliver,” he wrote. “Meanwhile the gap between the reality on the ground and expectations grows wider.”

Edwards used this chart to show “how ludicrous current equity valuations have become and by implication how vulnerable equities are to a collapse”

As the market rallies, I am seeing an increasing number of articles and observations that investors are in a win-win situation. If the reopening is successful, the growth outlook improves; if it’s unsuccessful, the Fed has your back. Investors can’t lose.

I reiterate my view that there are limits to the Fed’s support. The Fed can supply liquidity to the markets in order to compress risk premiums, but it cannot supply equity if firms were to fail. Investors should be mindful of the risks embedded in market pricing, especially in view of the highly stretched nature of valuations.

Thanks Cam. What are your thoughts on the Nasdaq right now relative to earnings potential?

Relatedly, Urban Carmel has been pretty skeptical of this rally overall until today it seems if I am interpreting his thread correctly… cannot tell if we are seeing bear capitulation in sentiment and potential to go higher.

https://twitter.com/ukarlewitz/status/1259881887494836224?s=19

Thanks a lot Cam. It is almost impossible to stay calm and navigate others in such market situation we are facing NOW. IT IS LIKE TO NAVIGATE THE SHIP IN THE STORM!

Today I wait if you decide to change your short term portfolio. VIX ended under its lower BB according stockcharts. But there are a lot of opose signals that are driving short term movements nowadays.

Should you comment on that – on Wednesday I would appreciate it.

Thanks for a good job. Petr

We got a glimpse of bearish capitulation from the Callum Thomas weekend poll. Not sure what happens next, that’s why my trading account is in cash.

Thanks! DIX reading is high today– still trying to make sense of what that means in the short term as well.

An epidemic is when your neighbor gets sick. A pandemic is when you get sick.

Lol.

Sentiment has turned significantly more bullish. Among other things, Hulbert’s Newsletter Sentiment Index spiked +9% as of today’s close to a level not seen since late February.

There may be enough momentum to power the SPX to 3000, but if feels as if we’re transitioning from bear trap to bull trap. The lower end of Cam’s trading range provides a good target.

Clarification – the index ended the day nine percentage points higher.

thanks!

I think historical analogies of how this bear market will behave are inadequate. Earlier the thought was this is a deep recession approaching depression. Now it is about how successful we will be in opening our economy. Our progress has been tremendous since the dark days of March. Why would this progress now come to a screeching halt or reverse? NY was one of the worst state at the outset, now it is one of the best. It must ignite hope and optimism even in the perma bears. No one can doubt that Fiscal and Monetary responses have been extraordinary. Yes, it can’t make a poor business solvent and successful but there is always an attrition even in good times. It will make the economy more productive. Our challenge is to train workers for the jobs that will be there in the future. The world will not be the same but it does not mean no growth anywhere.

P/E by sectors is interesting to look at. Some cyclicals have high p/e due to trough earnings forecast. I believe that investors should focus on where the opportunities are and will be.

I am of the view that there will be a tug between bulls and bears. I have an optimistic bias.

Cam,

Just a basic question. Do the forward 12 month EPS figures take into account that there will be some “bounce-back” when people start returning to work over the next couple of weeks/months ? Thanks.

Forward 12m EPS is the consensus index estimate, aggregated on a bottom up basis. To the extent that any of the consensus expects a bounce back, it will be reflected accordingly.

Cam, do you follow the McClellan Oscillator? Any pros/ cons of that model?

I keep an eye on it once in a while. It seems to be rolling over a bit.

Thanks!

What we are seeing is a Corona ‘Lite” model, in the eye of the public and media opinion. If we get a quick rise in cases, and reimposition of lock down, things may start looking differently. Let us start to be on the look out for such evidence. In some countries, we are already seeing such evidence of resurgence and reimposition of lockdown/social distancing measures.

That said, there are other unknown factors that may mitigate this pandemic (temperature/humidity in the Northern Hemisphere for one, though unproven factors).

Jeremy Siegel was one of those that said win-win situation. I believe this market is more forward looking (e.g. 12-18 months ahead instead of 6 months) because of: 1) unprecedented stimulus (in size and speed), 2) it’s a disease, 3) disease is quite deadly but not too deadly and 4) the vaccine and medicine seems like a certain thing by next year (i.e. max duration of crisis).

I’m thinking that with past recessions people were thrown off and didn’t know how the economy gets hurt in terms of both depth and duration and how it’ll heal itself. But now much of this uncertainty is greatly diminished because the fed and government are on steroids and super active when compared to past recessions. As for unemployment, the politicians will also be all over it due to the election.

I think Cam is right that markets are overbought but can’t be sure if we’ll test the lows. Persuasive arguments on the bearish side were mentioned such as: 1) the bankruptcy risks of small businesses, 2) high valuation (but if market is so forward looking and with low rates valuation can maybe stay high?), 3) uncertainty regarding the second wave, 4) covid19’s fatality rate (still unknown due to asymptomatic cases but it doesn’t matter since it wreaked havoc in NY’s hospitals), 5) whether or not we can even produce a vaccine (homo sapiens never successfully produced a single coronavirus vaccine but maybe didn’t try hard since it’s not very profitable. They certainly failed at many other diseases too) and 6) markets are too optimistic in viewing how this situation will affect the economy in the coming months (what if demand is still not there post-lockdown due to higher savings rate, risk of further demand erosion due to resurgence of cases, indirect effects of bankruptcies, etc.)

Cam, Regarding Warren Buffett I’m thinking that he may have been c*blocked by the fed in that the speed of market rebound was far too fast for him to react and digest this whole covid19 situation.

Regarding retail traders buying this rally, I would be surprised that it was them that lifted the market off of the lows initially. Maybe they came in at the latter half of the market rise? Curious to know which group of people contributed the most in crashing the market in March and who contributed the most in this rally. If large institutions are also buying then maybe they’re also buying this idea that a vaccine will be ready by next year and looking far ahead into the future.

A vaccine is not guaranteed. There’s never been a successfully developed vaccine for a coronavirus.

I think the way out of quarantine and another wave of infections is through mass testing – which is possible by next year. 5-10 million tests per day will minimize the danger of a second wave.

Reuters about PayPal’s bond issuance: “This follows the trend of other issuers such as Apple last week, that have been able to price bonds at attractive or even record-breaking low rates.”

The credit market is willing to lend and corporations are happily adding liquidity, especially tech companies are able to access cash at very low rates. The market reaction to this weeks’s fed speakers might give us a better idea of where treasury yields are about to trend, but appetite for the corporate bond market seems very healthy.

The Nasdaq 100 may be a decent short here.

Covering the QQQ short. I don’t like to hold short positions overnight.

Hulbert comes out with a modestly bullish take on his sentiment index, which is somewhat surprising.

https://www.marketwatch.com/story/heres-how-investors-current-mood-could-affect-the-stock-market-over-the-next-12-months-2020-05-12

Vaccines for coronaviruses are not easy. There is a risk of worsening the reaction, the paradoxical inflammatory response.

But never mind that, there are some segments of the economy that will take a long time to recover…movie theaters, sports events, concerts etc….when.will people go.

On Thursday I went to Walmart.

About 75% of customers had masks…still too low, but on Saturday after things reopened, only maybe 10% had masks. No way that wave 2 is not coming.

Denial rules.

But, the market goes where it goes.

Maybe we need 50% unemployment to hit a new high…110% (pay recently dead people UI)…irrational.

So yesterday there were only 18000 new cases in the USA and approx 1000 deaths…sounds pretty over to me…not!

S. Briese with commitment of traders is comparing this to 2007 when commercials bought on the way up.

I just don’t believe this rally, but then I don’t believe in bitcoin, so what do I know?

One guy managed to spread it to 100 people during a single night of bar hopping.

https://www.vice.com/en_us/article/ep44dp/over-100-coronavirus-cases-in-south-korea-have-now-been-linked-to-one-guys-night-out-clubbing?utm_source=reddit.com

Good call today, Cam. Thanks!

He’s got his mojo back! Nice after hours follow-through as well.

I think so. He nailed it today.