Now that we are slightly over halfway through Q1 earnings season, it would be useful to see what we have learned, and how market expectations have developed through this pandemic period.

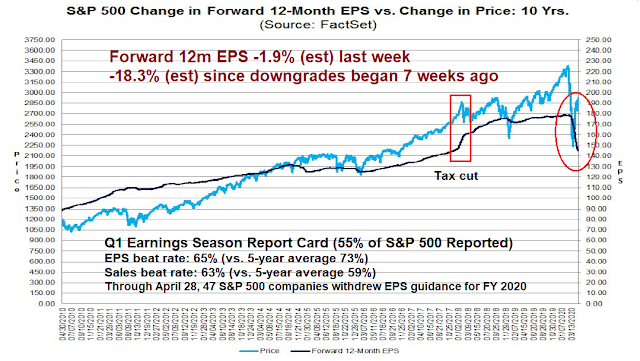

Let’s begin with the big picture. FactSet reported that the bottom-up consensus forward 12-month estimate fell -1.9% last week, and -18.3% since downgrades began seven weeks ago. I have been monitoring the evolution of forward 12-month EPS for several years, and this level of revision is extraordinarily high. In the past, the magnitude of weekly revisions was usually about 0.1%, and swings of 0.2% would be considered high. Now, revisions are an order of magnitude higher at 1% or more. In addition, estimates have been falling while stock prices have been rising.

Companies gave little in the way of earnings guidance during this earnings season. In fact, 47 companies withdrew their 2020 EPS guidance for the full year as management as uncertainty rose. However, there is a remedy for investors looking for greater clarity on the earnings outlook.

Top-down vs. bottom-up estimates

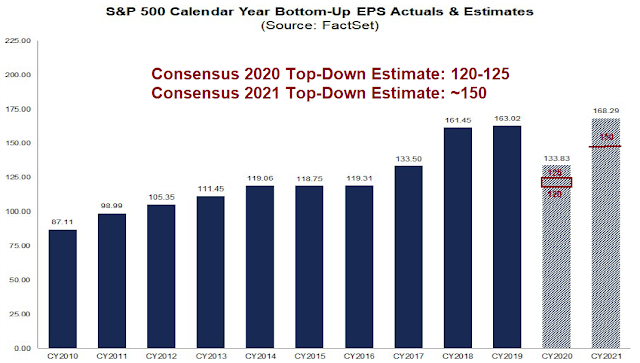

When the market experiences an unexpected shock, bottom-up earnings estimates are always slower to change. That’s because company analysts cannot quantify the shock to estimates without further discussions with management, and that process takes time. By contrast, top-down strategists can use economic models to estimate the effects of the shock on earnings, and top-down estimates are quicker to adjust.

We can see that in late 2017, when Congress passed a substantial corporate tax cut. Top-down strategists quickly coalesced around a one-time upward impact of 7-9% to earnings, while bottom-up company analysts were slower to react.

The same process is occurring today. Top-down S&P 500 estimates for 2020 is about 120-125, and about 150 for 2021. The bottom-up consensus is falling at different rates to converge to the top-down estimate. The bottom-up 2020 estimate of 133.83 is nearing the top-down range, but bottom-up estimates for 2021 are still far too optimistic compared to the top-down consensus.

Expect further bottom-up downgrades, but at a slower pace for 2020. How the 2021 estimates evolve will be of intense interest to investors, especially if they want to look over the valley of a dismal 2020.

What are companies saying?

EPS guidance is not the only way that corporate management communicates with the Street. Their primary tool of communication has been the earnings call, and their description of business conditions. The Transcript, which monitors earnings call, shows a severe decline, signs of stabilization at a low base, but an uncertain outlook for recovery.

It’s still tough to fathom the magnitude of the economic declines

“…we’re continuing to see record low passenger demand and revenue trends here in April and May, with operating revenue down roughly 90% to 95% year-over-year and single-digit load factors.” – Southwest Airlines (LUV) President Thomas Nealon“…since the third week of March when we initiated widespread closures of stores in the U.S. we’ve seen the comps which include the impact of closures based on how we’ve defined comps for this period of time, it’s been fairly steady in the range of minus 60 to minus 70.” – Starbucks (SBUX) CFO Pat Grismer

“…in the United States, physician office visits across various areas of medicine are currently running down in the neighborhood of 70% versus pre-COVID-19 levels. – Merck (MRK) CFO Robert Davis

“We’re going to see economic data for the second quarter that’s worse than any data we’ve seen for the economy.” – US Federal Reserve Chair Jerome Powell

It’s different from the financial crisis. It’s more severe

“One is the early demand patterns, which we see coming out of the China market, some European markets clearly point toward the U-shape. And it’s very different from financial recession because the depth of the crisis is more severe than financial crisis” – Whirlpool (WHR) CEO Marc Bitzer“…this is very different from ’08, ’09 for a bunch of reasons. I mean, first and foremost, it hit the entire economy, and it’s very dependent on the psychology of the consumer economic actors as to the rate and speed of the recovery.” – Lazard (LAZ) CEO Kenneth Jacobs

We are starting to see some leveling off of declines

“…you saw our decline of between 50% to 55% towards the end of the quarter in terms of volume in the last several weeks of March, and we’ve seen that kind of level off” – Laboratory Corporation of America (LH) CEO Adam Schechter“…we’re seeing some early signs at this point that users are returning to more commercial behavior” – Alphabet (GOOG) CFO Ruth Porat

“It is too early to tell if this uptrend in the second-half of April is the start of a recovery…The reason it’s different in the last two weeks of April, is what we have seen is that as some of these stimulus payments have come through, people are prioritizing pent-up demand in areas like automotive, like home improvement, and they’re not spending it on lower ticket categories, like entertainment and restaurants.” – Visa (V) CEO Vasant Prabhu

“…we’re starting to see a little bit of that stabilization impact come through, for example, in markets like Italy, Germany, Poland, Australia – Austria.” – Mastercard (MA) CFO Sachin Mehra

“…we’ve seen a strong improvement in comparable sales over the course of the month of April.” – Restaurant Brands International (QSR) CEO Jose Cil

“We are already seeing green shoots suggesting that economies and industries around the world are either rebooting or preparing to reboot in the coming weeks.” – Stanley Black and Decker (SWK) President & CEO James M. Loree

“The high-yield bond market has begun to reopen, especially at the higher end of the speculative grade rating scale” – Moody’s (MCO) President & CEO Raymond W. McDaniel, Jr.

However, our desire for normalcy may be outpacing reality. This may be the rare time that we don’t get a V shaped recovery.

“I remain very concerned that this health emergency and therefore the economic fallout will last longer than people are currently anticipating. And while there are massive societal costs from the current shelter-in-place restrictions, I worry the reopening in certain places to quickly before infection rates have been reduced to very minimal levels, will almost guarantee future outbreaks and worse, longer-term health and economic outcomes.” – Facebook (FB) CEO Mark Zuckerberg“…realistically, we just can’t expect that things are going to be back to normal in 6 or 12 months. I don’t believe that for a minute.” – Southwest Airlines (LUV) Chairman & CEO Gary Kelly

“…what I would exclude right now, I would say, very low probability, the V-shaped recovery.” – Whirlpool (WHR) CEO Marc Bitzer

The Berkshire Hathaway virtual shareholder meeting on the weekend was also instructive for investors. Here are some important takeaways from that meeting:

- Berkshire made new sales in its equity portfolio and cash and equivalents rose to $137.3 billion, up from $128.0 billion three months ago.

- When asked why he hasn’t bought anything, in the manner of buying preferred shares of distressed companies at the bottom of the GFC, Buffett replied, “We have not done anything because we haven’t seen anything that attractive,” (Translation: Nothing is cheap.)

- Berkshire sold its entire position in airline stocks. Buffett: “When we bought [airlines], we were getting an attractive amount for our money when investing across the airlines…I don’t know that 3-4 years from now people will fly as many passenger miles as they did last year …. you’ve got too many planes.” (Good luck to Boeing, Airbus, and the entire airline industry.)

- On underlying business conditions: Some of the losses in sales are permanent, such as See’s Candy’s Easter inventory, some already-weak businesses are not coming back, and not all job losses will be recovered.

While Buffett was always upbeat about the long-term outlook and warned not to bet against America, this was a sobering outlook from a legendary investor known as the Oracle of Omaha.

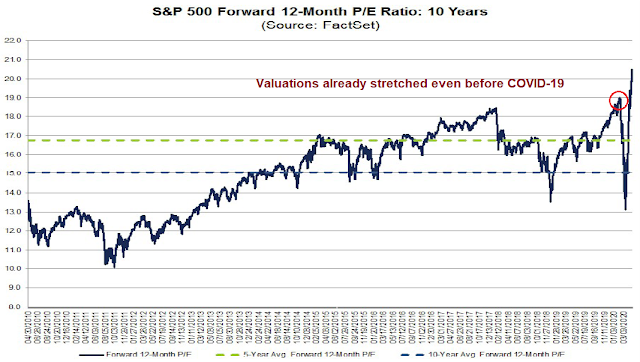

Valuation warnings

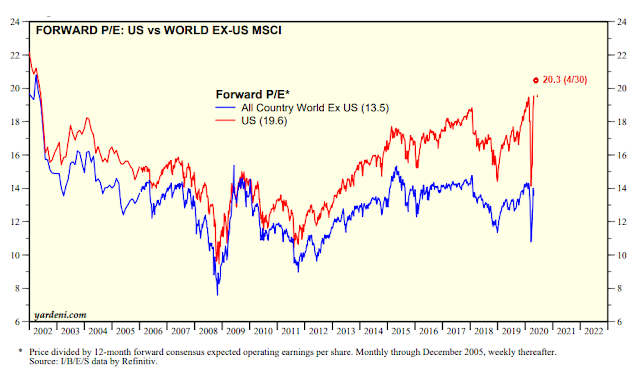

FactSet also reported that, as of last Thursday, the S&P 500 was trading at a forward bottom-up derived P/E of 20.3, which is well ahead of its 5-year average of 16.7 and 10-year average of 15.0. As a reminder, forward 12-month EPS is falling, so forward P/E should rise even if stock prices remain steady. Moreover, valuations were already stretched even before the onset of the COVID-19 pandemic.

From a long-term historical viewpoint, the forward P/E of 20.3 was last exceeded when the market deflated from the Tech Bubble of the late 1990’s.

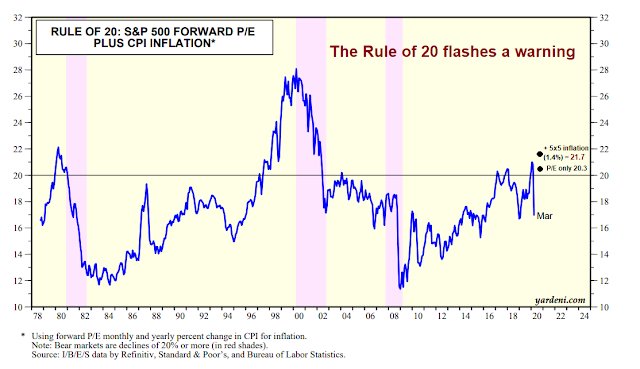

These extraordinary levels of valuation brings to mind the warnings from the Rule of 20, which flashes a sell signal whenever the sum of the forward P/E and inflation rate exceeds 20. Even if we were to assume no inflation, the Rule of 20 warning would be triggered by the P/E component alone. As CPI inflation is backward looking, we substituted the 5×5 inflation expectations from the bond market of 1.4%, and arrived at a Rule of 20 reading of 21.7.

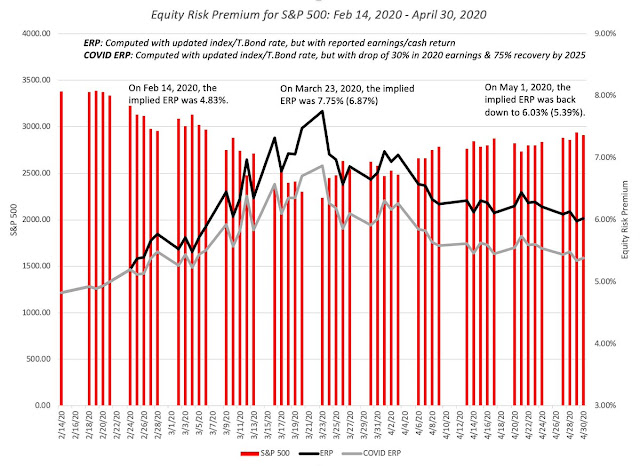

What about the Fed, and low rates? Doesn’t that justify a higher P/E ratio? Aswath Damodaran at the Stern School at NYU calculated an equity risk premium, and a COVID ERP based on a 30% drop in 2020 earnings, and a 75% recovery by 2025 (h/t Callum Thomas). The COVID ERP is not very different from the levels when the crisis began, and equity valuations were already stretched then.

In conclusion, the increasing level of bifurcation between stock prices and earnings estimates is raising valuation risk for the equity market. Forward P/E ratios are already at the levels last seen when the Tech Bubble burst, and long-term valuation techniques like the Rule of 20 and ERP also point to heightened downside risk based on pure valuation approaches. As well, there is little signs of fundamental momentum. Comments from management during Q1 earnings season has been downbeat, and the level of uncertainty is high.

Long-term investors should take note, and assume a position of maximum defensiveness.

Some interesting nuggets from Liz Ann Sonders on the dichotomy between real economy and the stock market, as well as on the likely path to recovery.

“As highlighted in an interesting report from our friends at Cornerstone Macro, we are likely transitioning to an economy that will be less dependent on consumers, and more dependent on investments—from housing to manufacturing; from low tech to high tech; from offshoring to onshoring; and health care of course.”

https://www.schwab.com/resource-center/insights/content/high-speed-bear-and-bull-both-running-full-speed

Sanjay

Thanks for forwarding the missive from the venerable analyst, Liz Ann Saunders. She makes some good points about short term and longer term issues.

Her short term issue about a V shaped stock market recovery that is not being reflected in the economy is well taken, something that Cam has extensively documented.

Her long term premise is more interesting. I quote;

“As highlighted in an interesting report from our friends at Cornerstone Macro, we are likely transitioning to an economy that will be less dependent on consumers, and more dependent on investments—from housing to manufacturing; from low tech to high tech; from offshoring to onshoring; and health care of course.

There are other factors that will likely lead to a shift toward investment over consumption, including China’s descent and the United States’ ascent as a cost-effective place for business investment. This adjustment won’t happen overnight, but it’s something we can put in our back pocket to look forward to down the road”.

If the US has to inshore manufacturing from China, it will need cheaper labor solutions, which means automation and robotics (Hi tech, where the US excels).

DV, Yes, I don’t have access to the Cornerstone report but I assume the long-term premise is based on the acceleration of in-shoring of manufacturing from China.

I need to keep an eye on the automation and robotics businesses.

Hi Cam, I do not understand the “Earnings Per Share” numbers. I look at various corps, for example:

Johnson & Johnson EPS for the twelve months ending March 31, 2020 was $6.41, a 18.7% increase year-over-year.

Microsoft EPS for the twelve months ending March 31, 2020 was $5.99, a 32.52% increase year-over-year.

Procter & Gamble EPS for the twelve months ending March 31, 2020 was $1.84, a 56.29% decline year-over-year.

These don’t come anywhere near 120, 130, 150, etc.

What amI missing?

I am referring to aggregate earnings for the S&P 500.

For example if EPS is 150, and the index is 3000, then P/E is 3000/150 = 20.

Thanks, I knew I was missing something :).

I look at it as four phases: 1. Fear and Panic where Uncertainty and Panic prevailed roughly ending around March 30

2. Shelter in place where people better understood the impacts on health and economy. Government got better organized and prepared. Heavy focus on search for therapeutics and vaccines underway all over the world. Trillions in stimulus.

3. Transition period to new normal – where I think we are now. Experimenting with opening up slowly but surely, effect of stimulus kicking in, medical breakthroughs both in treatment and vaccine. I think this will be second and third quarter. All the bad news is more or less expected. I expect more positive surprises.

4. New normal – fourth to first quarter start. Major changes for consumers, business. Winners and losers.

So,

I think the earnings estimates are just as cloudy as corporate guidance. Both Top down and bottom up. They will evolve significantly during second/third quarter with upside potential. How much worse can it get from here with 8-10 Trillion of stimulus.

I am looking for winners for the other side, selling the losers. Staying in broad index is not going to pay off in my opinion for a while.

Not a question of “how bad can they get” but a question of how quickly can earnings recover.

Forward P/E was 20.3 last Thursday. 10 year average is 15. To get to the 10 year average while keeping price unchanged earnings would have to rise by 35%. Do you really think that earnings could rise that much even with all this stimulus? Earnings rise if sales rise. Can Congress or the Fed make sales go up? Ask the airline CEOs, or hotel and restaurant CEOs.

Any names you like? CTL looks interesting here.. One of the largest of the Tier 1 providers. cheap, 10% div is sustainable, and while there will be SMB revenue loss, large enterprises seem to be adding capacity. They are managing their debt acceptably. Someday, the street may even come to like it. COVID could even help them.

Sorry my focus is primarily top-down and I don’t have the resources to analyze individual stocks.

Sorry, that was for Ravindra based on the picking winners and avoiding indexes.

Cam, are you worried we’ll get to a debt crisis of some kind at some point?

Not sure what you mean by a debt crisis, but I am concerned that we haven’t seen much in the form of defaults that threaten financial stability. The Fed can supply liquidity but it cannot make good on loan losses.

True not yet, perhaps 2-3 months out, defaults and plunging prices in CRE mortgages, or the HY or newly HY bonds.

https://www.youtube.com/watch?v=TxLyq6CHu2Y

Anti China sentiment and socialism will rock the US politics especially if there’s a second wave. If the market going to the gutter might as well take some political risk and go to war with China lol. Will healthcare also get taken out by socialism?

The debate around corona is mostly about scary forecasts and quite unbalanced. Never has one single factor determined so much in investing, and government actions, so it is more important than ever to try to see all viewpoints. Here is a different take from a respected scientist that I found interesting.

https://unherd.com/thepost/nobel-prize-winning-scientist-the-covid-19-epidemic-was-never-exponential/

Thanks Jan!! Very interesting and argues, I think, for a policy adjustment allowing more for opening of economies and return to normal. The politics of it are horrendous though.

I am still wondering about the huge load we have seen on the healthcare systems during the start of the pandemic. The only thing that seems to have stopped the rampage has been social distancing.

There is nothing to say that if we all get close together again, we won’t see another (second wave) outbreak. It seems that there is a great desire to force people back to work to “save” the economy, but look what happens at close quarters – meat packing plants, long term care, cruise ships, etc. Surely we can find a better way than just “opening up” without better testing and better mitigation (drugs, vaccines, etc.)

Looking at the graphs on the various coronavirus tracking websites, the world is still in “hockey stick” progression.

Is it really over? Or was never there in first place? I think not.

Cam – quick question about aggregate EPS figures. Do you know how a data source such as Factset arrives at their bottom up estimates? I have been trying to reconstruct by adding together all 506 constituent consensus EPS forecasts and I get a wildly inflated number. S&P, my data source, says I’m missing some sort of divisor. Just curious your take. Thanks!

John Butters at FactSet has a weekly commentary that gets published on Fridays where he aggregates FY1 and FY2 earnings.

https://insight.factset.com/author/john-butters

I am not sure what methodology you are using, but you need to weight each EPS by the company’s weight in the index in order to arrive at an aggregate value.

I tried it that way too by applying a market cap weight…but that gave me a comically low number…I am wondering if I’m missing something with float..

Thoughts on this? Differences between GAAP and non-GAAP reported earnings

The Earnings Scout

@EarningsScout

1Q20 $SPY #earnings season update:

339 co’s have reported, or 68% of the index.

65% beat EPS ests

Aggregate GAAP earnings are down -71.85% vs. 1Q19

On a per share, non-GAAP basis, EPS is down -9.56%.

60% topped sales ests on +0.90% growth

Lol! Non-GAAP earnings is earnings without the “bad stuff”, which includes one-time write offs.

Thank you! Really appreciate your cutting through the spin Cam! Seemed too good to be true…

According to a recently released study from Los Alamos Laboratory, the COVID-19 virus mutated into a more infectious strain sometime around February in Europe and has quickly become the most dominant strain worldwide.

Source: https://www.biorxiv.org/content/10.1101/2020.04.29.069054v1

This contradicts most recent news that the virus has not mutated.

Should also note, this hasn’t been peer reviewed yet.

If Kübler-Ross is in any way applicable to the markets, we are past denial (thinking Corona would be a China-only problem), and anger (when the market crashed). We may now be bargaining (believing it’ll be OK because the Fed has flooded the market with cash, and we’ll be re-opening soon).

Yet to come: depression (a new crash), and then acceptance, meaning we realize that things will never be quite the same, but we’ll somehow muddle through.

Agreed. It is inevitable that new cases and deaths will go back up as economies reopen. I wouldn’t be surprised if the market falls back through the lows to much lower levels in unison with a second wave and continued news of bankruptcies, mass layoffs, etc.

According to Boston Consulting Group investors are consensus bearish on the rest of 2020 and optimistic about 2021. There is the possibility of things going exactly the opposite way.

One example – Volkswagen saying today that China auto sales are recovering sooner than expected with end-of-April sales above levels during the same period in 2019. Analysts may do a turnaround and extrapolate the recovery to 2021, if earnings projections for 2021 suddenly turn up instead of down next year, we might see a violent market reaction to the upside in cyclical sectors.

The head of the American Chamber of Commerce in Shanghai is a buddy of mine. It’s quite odd to follow his social posts to see him pretty much back to normal, traveling around the country, golfing with clients, etc. Meanwhile life here is completely opposite. South Korea has also resumed all normal activities.

Right. Easy to be bearish right now, and very hard to be bullish. Even when it fails to lift prices, that kind of sentiment at least places a floor under the market.