Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don’t buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the those email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Sell equities

- Trend Model signal: Bearish

- Trading model: Bearish

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of the those email alerts is shown here.

Has market psychology turned?

Urban Carmel made an interesting point last Friday. Despite a string of ugly macro news, the market has not made new lows.

Does that mean it’s time to sound the all-clear for the stock market?

A look at sentiment

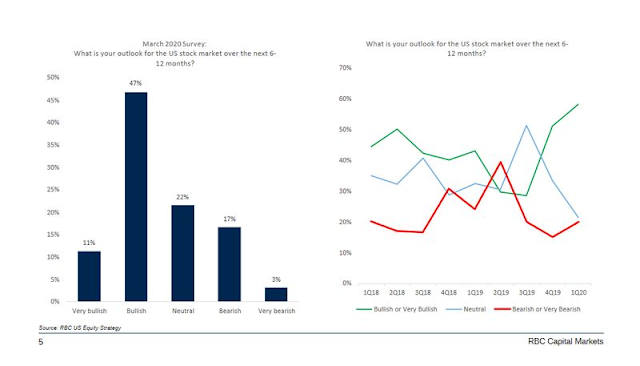

Let’s start by analyzing the long-term outlook from a sentiment perspective. Both Marketwatch and Bloomberg reported that an RBC survey of institutional equity investors conducted betweent March 25 and March 31 indicate a surprising level of bullishness. Capitulation has not occurred yet, and the market is therefore vulnerable to negative surprises.

Even as the spread of COVID-19 accelerates in many regions of the U.S., institutional investors are becoming ever more bullish about the prospects for the stock market, according to a survey released Thursday by RBC Capital Markets.

“Our respondents are highly bullish on stocks, the most optimistic they’ve been since we started our survey in the first quarter of 2018,” wrote Lori Calvasina, head of U.S. equity strategy at RBC Capital Markets.

She said that the survey respondents provided three reasons for optimism, including attractive valuations, faith in the Federal Reserve to take actions necessary to support the economy and “a belief that the economic damage from the public health crisis will be manageable.”

What about retail sentiment? I prefer to monitor monthly AAII Asset Allocation Survey, which measures what AAII members are actually doing with their money, as opposed to the weekly survey, which measures opinions. The asset allocation survey shows that while equity allocations have fallen and cash allocations have shot up, readings are not at the extreme levels seen at past major market bottoms. In addition, anecdotal evidence from different sources shows that retail investors are not panicked at all. Instead, they are open to putting new cash into equities. That’s simply not how sentiment at major market bottoms behaves.

As well, the stock market’s relief rally stalled last week just short of its first Fibonacci retracement level, while the Fear and Greed Index recovered off an extreme fear condition to 21. These conditions are more consistent with a short-term relief bear market rally than a major market bottom.

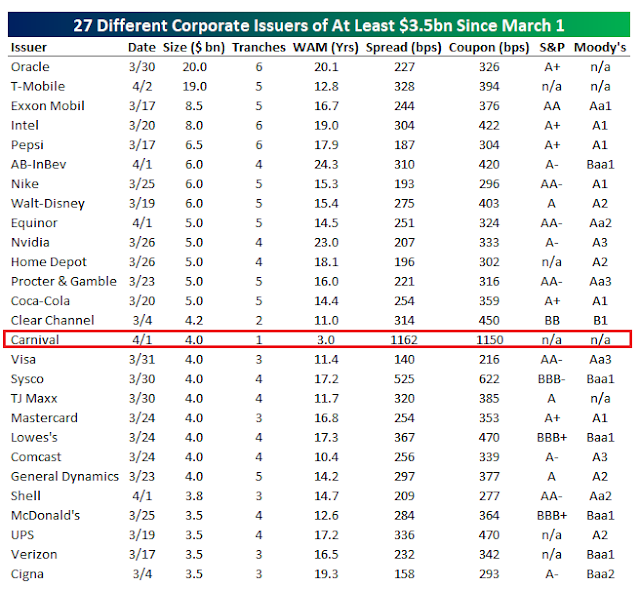

What about the bond market? While credit conditions have tightened, investor appetite for bonds is still healthy. There have been 27 different issuers since March 1, including a cruise line. Most investment grade issuers are borrowing at the long end, at a cost of around 3%.

These are not the signs of blind panic that are found at major market bottoms.

Limited valuation support

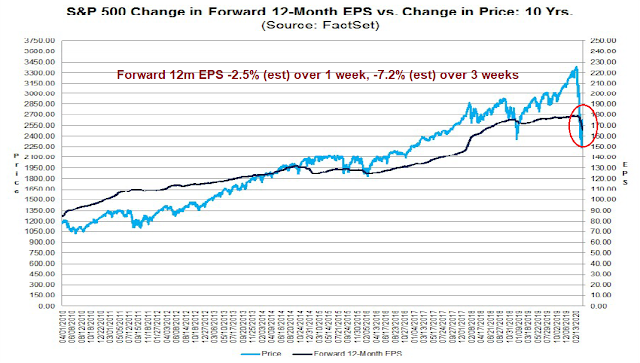

FactSet reported that the market is trading at a forward P/E multiple of 15.3, which sounds reasonable at first glance, though it’s not wildly cheap. However, the E in the forward P/E ratio been falling rapidly, and it skidded -7.2% in only three weeks.

Investors can expect the negative EPS estimate momentum to continue. While the pace of quarterly earnings downgrades is ugly, it has not even beaten the pace set in Q1 2016, which was not even a recession. In addition, the rate of Q1 negative guidance is only roughly in line with historical experience, and bottom-up aggregated analyst price targets call for 12-month price target gain of 33%.

Q1 earnings season is just about to begin. While Q1 earnings may not be that bad because they represent stale data, corporate guidance is likely to be very negative. Based on the current rate of negative guidance and aggregated price targets, Street expectations are overly ambitious and need to be further adjusted downwards.

While FactSet’s analysis is from a company bottom-up aggregated perspective, the top-down view is also supportive of my case for further downside before the market can make a durable long-term bottom. A reader pointed out that Ed Yardeni has cut his 2020 S&P 500 EPS estimates to $120, and his 2021 estimates to $150. A brief survey of other Street strategists indicate that Yardeni’s forecast is about the consensus. Consider what this means using our handy forward 12-month P/E analytical technique:

If the market were to bottom out in mid-2020, forward 12-month EPS would be 50% of 120 + 50% of 150 = 135. The market bottomed in 2011 at a forward P/E of 10, and in late 2018 at about 13. Apply a 10-13 times P/E multiple to those earnings, you get 1300 to 1755, which translates to downside risk is -48% to -30% from current levels.

If the market were to bottom out Q3 2020, forward 12-month EPS would be 25% of 120 + 75% of 135 = 142.50, which translates to a range of 1425 to 1852, or downside risk is -43% to -25%.

Still ugly any way you look at it.

Market internals: A mixed bag

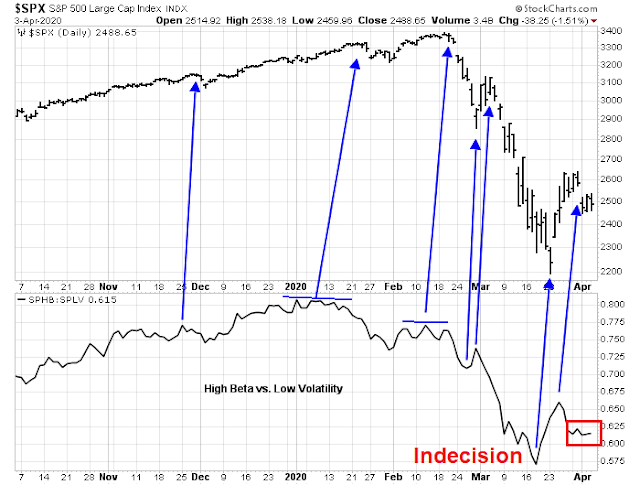

In the shorter term, the market’s technical internals present a mixed bag. My recent favorite directional indicator, the high beta to low volatility ratio, has flattened out, indicating indecision.

I had expressed concern in the past that the offshore USD shortage presents a risk to EM stability. The latest indicators of EM market risk appetite is also inconclusive.

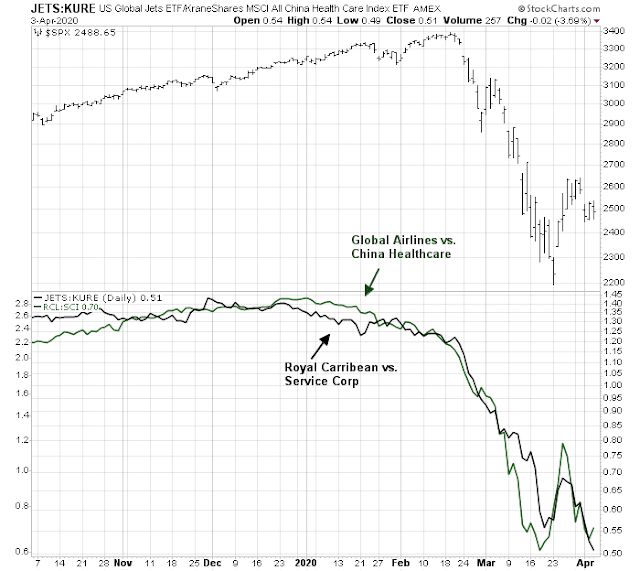

The coronavirus pairs of global airlines to Chinese healthcare, and Royal Caribbean (cruise line) to Service Corp (funeral homes) are falling, indicating a risk-off environment, though airline stocks did exhibit a minor rebound on Friday. However, the disclosure after the close that Warren Buffett was selling his airline holdings is unlikely to be supportive of further strength in this pair.

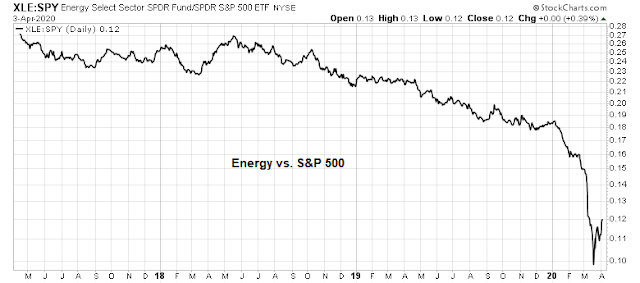

What about the oil price? Could a cessation in the oil price war spark a stock market rally, or at least put a floor on stock prices? The relative performance of energy stocks displayed a strong dead-cat bounce quality from an extremely oversold condition, and there is potential for more upside from this beaten up sector.

On the other hand, the energy sector is now the second smallest sector in the index at 2.6%. A 10% rally in these stocks would only move the index by 0.26%. A double translates to a rally of only 2.6%, everything else being equal.

Signs of stabilization

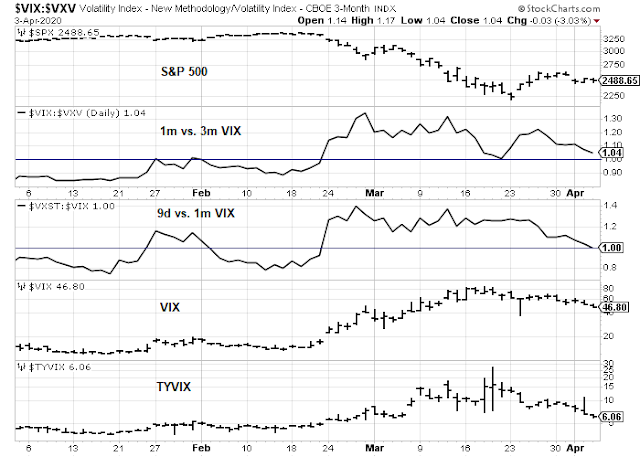

To be sure, there are signs of stabilization in the market, which is constructive. Not only is the VIX Index falling, TYVIX, which measures bond market volatility, is falling in lockstep. As well, the term structure of the VIX futures curve is beginning to normalize. The 9-day to 1-month VIX ratio has moved from an inverted condition to flat, and the 1-month to 3-month ratio is also flattening. All of these readings indicate that market psychology is transitioning from utter panic to a greater calm.

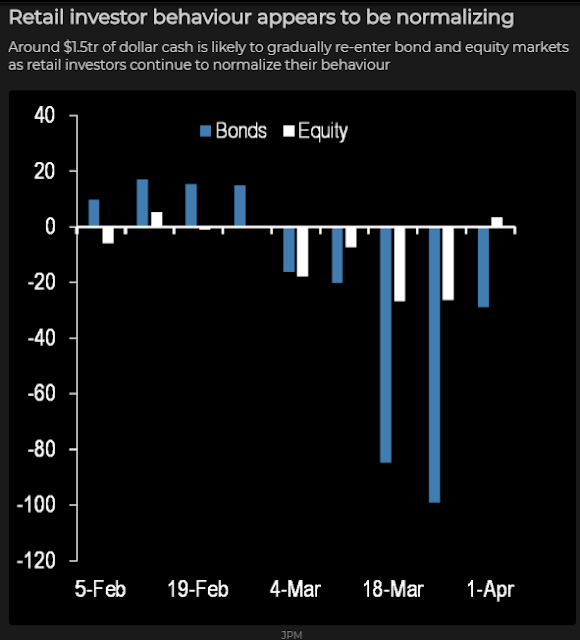

As well, fund flows are starting to normalize. After a bout of panicked selling, investors are tip toeing back into equities and bonds again.

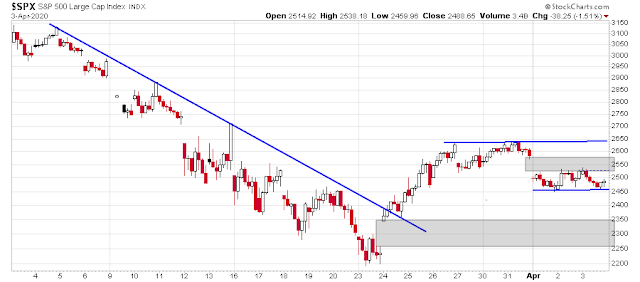

Where does that leave us? The hourly S&P 500 chart tells the story. The index staged a relief rally by breaking out of a falling trend line, but the rally stalled at 2650. It then gapped down to find support at 2450. The bulls could not rally the market above resistance at 2530 to fill the gap at 2530-2580. On the other hand, the bears could not break support at 2450, whose violation should see the gap at 2250-2350 filled quickly.

It’s time for the market to give us some clues on further short-term direction. While I am leaning bearish, we need to see a decisive breakout from the recent trading range of 2450-2530 for further clues. My base case scenario calls for a choppy range-bound market for the next few weeks. While the market may decline to test the March lows at about 2200 and the relief rally high at 2650, neither the bulls nor the bears will be able to break the deadlock.

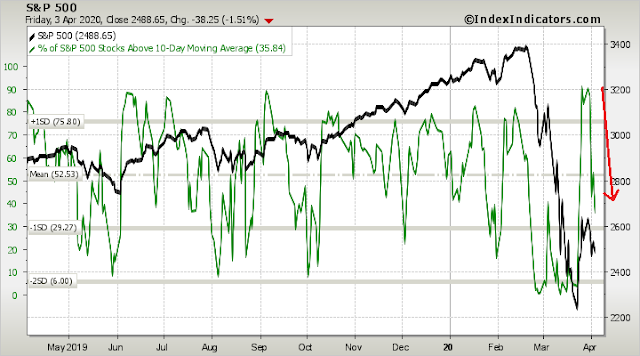

Short-term breadth is neutral, but momentum is negative. The odds favor further downside in the next few days, but don’t get too greedy and count on a break of major support.

Disclosure: Long SPXU

Cam

Thanks for the detailed report on current valuations, individual and professional sentiment, Factset EPS, inner workings of the bond markets (table of issuance), short term metrics etc.

Thanks for pointing out that with VIX and TYVIX stabilizing, huge further downside may be limited, and to not get greedy for trading buys.

It would be interesting to speculate how this market may bottom in the next few quarters, below 2200, whether this decline takes place in Q2-Q3 2020 time frame or a longer time frame. That said, Fact Set is still showing an year end of target of 3100! I am glad to see the stabilization of the corporate bond market (for now).

Thanks for the update on Energy, which appears to be a long term buy. It is simply difficult to believe that Energy as a percentage of S&P 500 may not approach 10% at some point (it could, if S&P 500 reaches 1500-1800).

To Urban Carmel’s point, markets rise or fall based on surprises. The current decline in the market was due to a black swan event that no one saw coming. This pandemic is now leading to a discussion of human existence (!) in some blogs. So, the question is what are the unknowns going forward that will cause further sell off? Cam astutely pointed out to watch China, in his yesterday’s post and sure enough, new lock downs/restrictions are being reported from some of the Asian countries. We have a good idea of the EPS and interest rates that will remain low for as long as the eye can see (Cam’s post yesterday). So, what else is an unknown yet, that will drive prices down below 2200?

A slow, drawn economic recovery, could well push equity valuations further down. This could be mitigated by tax cuts and infrastructure spending that may be in the pipeline. As Cam pointed out yesterday, a self imposed hiring freeze, closure of small businesses, impoverishment of Americans as a result of this pandemic, could cause a significant longer term, drawn out recession (Greg Ip’s article, it is the length not depth of the recession that matters).

Fiscal policy response: WIth what Cam has written over the weekend, one would be right to ask the question of how the US government is going to turn this recession around.

Taking a leaf from 1929 depression and 2008 GFC, it would appear that the US government is likely to spend money like it was going out of style perhaps on crumbling US infrastructure, providing job opportunities.

There could well be tax cuts, and this is likely to become the usual political football in Congress.

What else?

Monetary policy response: We have already seen what the Fed is up to (stabilizing the bond market, including the Muni bond market), providing USD liquidity swaps to major central banks, new QE etc. To Cam’s point though, lowering interest rates further is unlikely to promote spending, even if these rates are in the negative.

Add to that a US consumer is well liquified (see previous post), and saving more. Such consumer behaviour reflects on graying of Americans, and is not necessarily a positive for the economy but will stave off personal bankruptcies. The write up above reflects on individual investors who have not panicked yet. Is this a change in paradigm? We shall see.

Housing market: This is a big part of the US economy and time will tell if this sector takes it on the chin. After the 2008 debacle of this sector, it appears that US housing is supported by significant amount of cash and housing may prove to be more stable/resilient than a decade ago. This remains to be seen.

D.V., what are the odds of passage of an infrastructure bill? Could it be as large as $2trn as Trump said? How come infrastructure stocks (machinery stocks such as CAT, DE, TEX, CR) haven’t reacted to it yet?

Good question. Hard to say. If economy contracts drastically, joblessness goes up significantly, there is increasing business bankruptcies, both parties will support this. How social distancing works with infrastructure would need to be seen.

It is a good election muse!

Hindsight.

https://www.sfgate.com/news/article/The-U-S-was-beset-by-denial-and-dysfunction-as-15179067.php

The analysis on sentiment is quite similar to what I’ve observed with my (US) co-workers. Most have gone long, some even on margin. Very little concern with job stability or issues with the business despite the vast changes in the market and obvious signs of economic deterioration happening around them.

The few that went long on margin have conviction that the Fed stimulus will produce a rally similar to the one in 2009-2010.

As always, thank you for the informative and rational update.

Cam, I was somewhat surprised that you weren’t more bearish, short term, in your analysis. I guess we have to go where the data is pointing and not get ahead of ourselves.

Cam, you wrote: “Q1 earnings season is just about to begin. While Q1 earnings may not be that bad because they represent stale data, corporate guidance is likely to be very negative. Based on the current rate of negative guidance and aggregated price targets, Street expectations are overly ambitious and need to be further adjusted downwards.”

Once the businesses begin to provide (or not scrap them altogether) the 2Q 2020 and 2020 guidance, won’t that be trigger for further downside in coming weeks?

Don’t jump the gun. We’ll have to see the nature of the guidance. It’s possible that some companies will refuse to give guidance because they just don’t know.

For some perspective, I just read a BAML research report that showed bottom-up 2020 estimates at 159.60 and top down estimate at 115.00. It shows the vast gulf between the uncertainty faced by individual analysts and companies, compared to top-down analysis of the economy.

According to the internet, the expected duration for quarantine measures is correlated to the number of people tested and the availability of a vaccine.

https://youtu.be/Zv2imTjQfGo

Anyone heard of other viable measures for an “exit” strategy?

Based on the HK/Singapore/Vietnam experience, as soon as they take the foot off the social distancing pedal, case count rises. Unless we get a treatment, the lockdown is going to be a lot longer than anyone thinks.

Cam, unfortunately, that is so true. The vaccine won’t be available at least for another year. Some treatment (therapeutics to relieve the disease) might be available sooner than that.

Where does that leave us? Can the US really afford to extend full social distancing through that long period? Can the most of the economy be grounded for that long?

Or, will we have the economy in fits and starts? The US is way behind in terms of tracking, treating and isolating specific infected patients.

Looks like this is the way forward:

“You would need to keep on these control measures (suppression-and-lift) to varying degrees until one of two things happen: One, is there is natural immunity by active infection and recovery, or there is sufficiently wide availability of an effective vaccine administered to at least half the population, to create the same effective herd immunity.

Leung added that we’ll go through “several cycles” of tightenings and easings “before we will have resolution.”

https://www.theatlantic.com/international/archive/2020/03/lockdowns-hong-kong-china-coronavirus/608932/

To naturally push the R0 to below 1 (without social distancing measures) 60-90% of the population must’ve built up an immunity to it depending on how virulent it is. It’s called herd immunity. The UK PM was once a fan of it albeit briefly. Virus mutation is another black swan.

Cam, can you please explain the meaning of fund flows. Statements like “cash is re-entering the bond/equity markets” does not make sense to me if for every buyer there is a seller.

Is this a measure of the increase/decrease of AUM of ETFs and mutual funds? In which case it is a measure of sentiment rather than actual net cash “flow.”

Your are correct. Fund flows = funds moving into and out of ETFs and mutual funds

In simple modelling terms, due to incomplete testing coverage, it seems that the only ‘safe’ numbers to use are the deaths per million from ‘reliable’ sources. Spain and Italy are reporting more than 250 deaths per million. We know that Italy does not report a covid death if it does not occur in hospital and I expect Spain has a similar undercount of some sort. If we allow an additional 50% underreporting, that gets to 375 per million deaths. As neither country has yet peaked, and the down side will probably be slower that the up side of the deaths curve, a doubling of the 375 number to 750 per million is not unreasonable. And that is if the death rate goes to 0, which is highly unlikely.

If the US experience is not very different, this puts a minimum death count in the US at:

500 * 330 (million people) = 165,500 (Reported)

750 * 330 (million people) = 247,500 (Actual).

This is under a current lockdown in many places. If the lockdowns are lifted and we go back to more cases, it becomes a sort of rinse and repeat.

The game changer would seem to be not a vaccine, but a test for antigens tat can reliably determine who has had the disease. These people should be safe to leave lockdown and we should be better able to manage the disease spread otherwise.

Until then, lockdowns will be needed and the economy will suffer, I suppose.

I am reminded of the phrase “The lockdowns will continue until the economy improves”.

The S&P 500 year to date is down 23%. To think that this is a good price to buy in, I first look at the outlook now versus December 31, 2019 looking ahead to 2020. Back then, investor sentiment was very bubbly according to sentiment measures at Sentimentrader.com. In fact it was historically optimistic. Investors had just powered stock indexes up almost 30% in 2019 with no earnings growth in the index. The Fed was seen as a powerful ally that had investors backs and of course Trump would be a cheerleader for stocks right through to the November election. That was a rosy picture and now we are 23% below that price. It seems to me that the markets were more than 23% overpriced before the pandemic hit. One should then decide how much lower the new outlook should move markets down.

The current picture is a global recession of unknown magnitude and length. The next quarter will see a plunge in economic activity never scene in human history. For the health of the human race, governments are placing their economies into what Paul Krugman, the economist, called an economically induced coma. The extent of the corporate earnings decline is unknown but huge and the longer term effects are a mystery. The government bailout programs are wonderful on paper and as political rhetoric but the bureaucracy in implementing them will be a frustrating nightmare. If the powers that be say these measures are needed and needed now, then the delays that we will witness in the coming months will be devastating. The American healthcare system is not equipped for what’s happening not just in infrastructure but in social equal access. This will strain society in ways we cannot fathom.

So the stocks of America are offered to investors now at 23% less than the bright an sunny days of December 31, 2019. Hmmmm?

I often talk about behavioral economics and ‘anchoring’ is a key bias that hurts investors results. It says that people anchor on today’s prices that are lower than recent higher prices and believe that’s a bargain rather than understanding the new environment to gauge the true value. The plunge in markets has been so swift that everyone should assume that their viewpoint will be distorted by ‘anchoring’. Just think about it, is a 23% discount a reasonable bargain given the new future economic, social and business background that is unfolding?

Behavioral economics tells us we humans are overconfident in their abilities. We think we can pick and choose the individual stocks that are down much more than 23% and make a killing. My suggestion would be that a caveman’s overconfidence when hunting mammoths would be more dangerous than overconfidence when he went fishing. We are in a new environment that a bad guess on a stock or industry could get your portfolio trampled. Better to wait until the new business environment is revealed and mistakes will just get you wet.

At the start of every bear market I’ve been through (many), pundits tell us we should hold on and “look across the valley”. Then what happens is investors who take that advice panic when we get into the valley. It is early days in this bear market. Down 23% is just a short distance down the road of the big valley that is ahead of us.

Thanks Ken for your insights.

Thanks as always Ken,

=> is a 23% discount a reasonable bargain given the new future economic, social and business background that is unfolding?

=> It is early days in this bear market. Down 23% is just a short distance down the road of the big valley that is ahead of us.

Ken, a wonderful and very insightful comment. Thanks for posting this.

I am bemused and confused….

9th March post – “OK, I’m calling it…” recession call to

5th April post – “Time to sound the all-clear?”

Is now your view, Cam, that there really is no recession and this has really been a massive correction and we are going to have a colossal V market?

Or is there really worse to come?

The title “Time to sound the all clear?” has a question mark, and it was posed as a rhetorical question.

As I made it clear in the text, it is definitely not time to sound the all-clear.

That’s how I read both articles, it just seems that there’s a lot of “It’s all OK, now” out there and even some of the comments here seem to support that view.

I do not see how, with rising death counts, continued lockdowns, poor social policy both in the US and around much of the world, and no clear exit strategy fron pandemic world to normal world, there can be anything but extended economic malaise.

While the cure seems terrible, the disease is unfortunately worse.

Cam has been clear about a recessionary bear that is unfolding in front of our eyes, with final bear market bottom around 1600-2100. He has also been on record that such bear markets usually have a double bottom.

If you must play, selling calls or strangles would be more favorable at present situation.

A world of caution about holding spxu or spxs for extended period, or you will lose money even if spx continues to move down.

It looks like the market is trying to fill the 2530-2580 gap. Could that be a good short entry point?

There is news of several European countries easing up the lock down restrictions. The virus may also be peaking (in short-term) in the US. I wonder if this may have some more leg over the coming days.

Try short calls on bad stocks (more volatile, e.g. BA), and short strangles on good stocks (more stable, less volatile, but you double the decay, e.g. AMZN). You have to manage them actively.

Thanks. I generally don’t do short-term options trading. May buy some LEAPS if we print very low numbers on indices.

The IHME covid19 model was just updated.

Predicting 81k (range 50k-135k) total US deaths.

California prediction dropped by more than half to 1,700 deaths.

https://covid19.healthdata.org/projections

If the government works quickly and put the necessary stimulus and lockdown in place the economy would be fine. But this is assuming the lockdown occurs only once which is still questionable. The government offering loans to small businesses and deferring mortgages for the period where they’re not making any money doesn’t sound like a good plan unless the lockdown occurs only briefly which is quite doubtful. Printing money to offset wages would be a good start.

“Investors should prepare for a coronavirus-induced ‘vicious spiral’ more than twice as bad as the financial crisis, says J.P. Morgan”

https://www.marketwatch.com/story/investors-should-prepare-for-a-coronavirus-induced-vicious-spiral-more-than-twice-as-bad-as-the-financial-crisis-says-jp-morgan-2020-04-06

I think I see a pattern here. The last two hours Friday was for traders to cover shorts and get long for the weekend and Monday positive news slant. The last two hours of today (Monday) is for Traders to cover longs and put on shorts for the negative news slant this evening and tomorrow.

Until major resistance lines (support lines) are breached and followed by three consecutive positive days (negative days), this pattern will be the theme this week. But as Cam would say, let’s the markets give us cues.

Today is a big surprise for me (negative one). The only thing that is good is that the move +5% is typical for bear market rally.

Something for my nerves :-).

News of $1-1.5 trillion stimulus coming in mid May is moving the market.

THX, Wally.

Austria’s plan to reopen the economy:

Small shops, large DIY stores and garden centers – April 14

Slightly higher risk businesses (e.g. hair salons) – May 1

Restaurants and cafes – mid-May

Public events – may be in July

Schools – no date given

Facemasks required in supermarkets, shops and on all public transport

Bill Gates wants to keep us in our homes until we are cleared of Covit-19 and chipped according to Armstrong Economics.

Bill Gates will be proven right at the end.

The virus won’t go away until we either have a vaccine or therapeutics to cure the infected. Authorities are under tremendous pressure from businesses and citizens to loosen up lock-down restrictions for the commerce to commence. They will re-open but will be forced to close again when (it will) the virus re-emerges. It is sort of catch-22. If the economy gathers pace, the risk of a second wave (or multiple) of infections rises.

This is happening in Singapore, Korea and even in China where the authorities have implemented very rigorous testing, tracing and isolating procedures. No government is (cannot?) doing that in either Europe or in the US.

Over time, we are also building “herd immunity” by flattening the infections and without overwhelming the healthcare system.

As the weather gets warmer, we may get a respite. Outside of that, we will be playing the game of cat and mouse with Covid-19 over many months (a year or more, sadly) to come.

Cam

So, did the ZBT signal trigger end of March?

Lol, no.

Despite today’s incredible rally, Friday’s closing reading for ZBT was the equivalent of having the ball on your own 10 yard line with 45 second left in the game and down 2 touchdowns.

Dear Cam, the futures invalidated all resistance and it looks that the relief rally will be completed today A-B-C – 2190-2620+(A) – 2620-2430 (B) – 2430-2720+(C) – Am I right? Will it stop around 2740-2780?

Market usually does what makes everyone looks like a fool. Professionals are expecting a double bottom here, but we should be prepared for a rally that may have a few hiccups here and there but keeps going on.

Cam, are we seeing a breadth thrust?

Cam, what’s the call here regarding SPXU? The market exploded yesterday, it’s running up today … what’s next for you?

The S&P 500 broke through first resistance at 2650. Next resistance is the 50% retracement at 2780.

Normally, I would have placed a stop loss order just above 2650, but the market gapped up to 2740. My inclination is to say that, while it’s painful, the risk/reward here looks favorable to be short when the next resistance is only 40 points away.

Your own mileage (and pain threshold) may vary.

Bad earnings coming, people getting sick and dying everywhere and the market goes up 4 Dow digits. The words, “Don’t Fight The Fed” keep popping into my head.

Agree… SPX down 15% from “blue skies ahead” to “the deepest recession of our lifetimes” sure feels like a generational selling opportunity. (If not, we are headed for a truly impressive amount of inflation.)

Closed my short Friday but looking to get back in. Getting the entry point right is tough in this volatility.

That’s agree that the risk/reward here looks favorable to be short when the next resistance is only 40 points away.

Plenty of debate on Twitter re retest or no with both sides making good arguments. The market is quite good at fake-out moves – my take is that we’re seeing a pretty convincing snap back rally – one designed suck in as many buyers as possible before the downtrend resumes. Investors are too savvy to fall for a move that isn’t emotionally compelling.

The 1000 point dma is presenting some interesting points and has provided some support resistance in the past. Here are the levels for the two main indexes.

Dow 1000 dma = 23435 (we are there now)

S&P 500 1000 dma = 2624 (broke at the open)

An honest question. The extent of this rally has really surprised me. We all know that this is not a hurricane that passes in a few days. We will still be dealing with this virus a year from now (or until a vaccine is available or drugs to cure the patients). Even if the authorities re-open the economy, the virus will come back and spread forcing the lock-downs again. There is no political will or technology/infrastructure available for extensive testing, contact tracing and quarantine of infected individuals. The virus may subside in summer but will come with a vengeance in winter.

What’s driving this rally? Have investors really become rosy about the pandemic outlook? Are investors optimistic because of the monetary and fiscal stimulus?

Is there a concerted effort on the part of powers-to-be to suck small and unsophisticated investors in while they unload their positions?

Sanjay,

I don’t think investors have become rosy about the Pandemic outlook, I think this is just traders trying to make money. I am sure we will be in the depth of the despair/decline again in a few days, when people actually read the ways this virus is killing people.

So, medical issues propping up with this virus that I am reading about in a Healthcare group

that I am part of and while looking up medical research.

1) Lung damage.

2) Heart damage coming out in a few days to lay people.

3) Brain damage coming out in a few days to lay people.

Also seems to be causing Thrombus events.

Also causing problems with Hemoglobin molecule, permanent damage to blood cells is another issue they are finding out about. Blood is losing the ability to carry oxygen, which causes different organ systems to fail.

There is more to this virus then what we have found thus far.

And let’s not forget the last thing about markets, “You can never time the markets”, so gotta stay invested for the long run. I do think we will see another down draft.

Just my $0.02

Mohit, thanks a lot for sharing this.

Can you share some articles that give more details on what you listed here?

Here are a couple:

Kaiser Health news:

https://khn.org/news/mysterious-heart-damage-not-just-lung-troubles-befalling-covid-19-patients/

Research

https://chemrxiv.org/articles/COVID-19_Disease_ORF8_and_Surface_Glycoprotein_Inhibit_Heme_Metabolism_by_Binding_to_Porphyrin/11938173/5?fbclid=IwAR00V6sN-tmcanNAsrCKo-eRn7lji30iNByeCRxGqVRkRwxXjdCNadWlQmM

Purely as an administrative matter, the system has a spam filter that holds your comment for moderation if there are two or more links in the comment (one is ok).

If you have more than one link, please send me an email as an alert so I can unblock the comment.

Here is the one about Neurological issues: https://www.cureus.com/articles/29414-neurological-complications-of-coronavirus-disease-covid-19-encephalopathy

BTW, these articles are NOT to scare anyone, just showing what medical professionals are looking at and how things are progressing from the inside.

Thanks for the article.

Here is what I think is going on. We have an approximately $20 trillion GDP economy. The Fed has expanded it’s balance sheet about $5 trillion and we have a $2 trillion stimulus with another $1.5 trillion coming in May. That’s about $9 trillion in just two months and people think the government could do a $2 trillion stimulus every month.

Look at Spain – they have decided to provide every citizen with a monthly check from the government.

The U.S. has been spending like a drunken sailor for decades. Obama doubled the debt from $10 trillion to $20 trillion. Trump is on schedule to do the same or more. Yet, we have seen no pain. No inflation at all.

The Democrats have convinced a large portion of the population that the government can give everyone money, an education, health care and everything else under the sun without any pain. They have convinced the public that there are no repercussions. The government can just keep printing money and giving it to us.

Investors see much of this money finding its way into the stock market. It drives prices to unreasonable levels but who cares. If there is no inflation the money can just keep coming.

The day of reckoning seems to be far off if never!

Example: A close friend of my is a former state supreme court chief justice. When I told him there is nothing but faith backing up our currency he seemed shocked. In fact, I don’t think he believed me. The entire population believes money grows on trees.

Wally, all of this fiscal and monetary stimulus won’t bring back the demand and steady production if consumers and workers are stuck at their homes. Steve Schwarzman of Blackrock expects $5trn damage to the economy in 2020.

Sanjay, the point is that without inflation and a FED that can step into the secondary market and support Treasury prices with purchases, there is no inflation. So far, we have financed the debt. How much longer can we do that when it reaches $30 trillion? What are we going to do when all the entitlements consume every tax dollar collected (estimated to happen this decade)?

What if the FED and Treasury decides we must monetize the debt as there are not enough bond buyers? We are on the fast track to a currency crisis but who knows when it will hit. Keep an eye on inflation for a clue.

BTW, if the damage to the economy is only $5 trillion then no problem. The government is giving us $9 trillion. (so far) LOL

And you mention that fiscal and monetary stimulus won’t bring back demand when everybody is at home. I beg to differ. I make purchases on Amazon and other online retailers almost every day. Today I ordered $200 in groceries from my local grocer to be delivered directly to my front door in a day. That is consumer demand, my friend.

Sure. The consumer demand for basis needs can still be fulfilled. The discretionary demand is gone for now and cannot be met (except when delivered online).

I think it’s emotionally driven. Investors who watched markets dive hard for weeks under an apocalyptic scenario are now relieved at reports of fewer-than-expected fatalities and earlier-than-expected dates for recovery. As the rally unfolded, frantic covering by shorts + FOMO buying by under-invested traders + pedal-to-the-medal buying by algos have propelled indices higher than justified by the news. JMO.

It is great to share and learn from each other. Thank you for participating in this forum. It helps me stay grounded.

Quick question to the Moderator, why are my article links waiting so long in the Moderation? These are research things that I am looking at and sharing here to show people what else is going on.

Sorry for my rant, everyone. It’s my pet conspiracy theory until it isn’t.

Fortunatelly(!) Today we saw shooting star. Similar situation as in 14/10/2008, 21/6/2010, 17/9/2015, 13/3/2018(?), 7/2/2018 and today (7/4/2020). Sorry for writing date dd/mm/yyyy.

Nicely done, Petr!

Looks like the bears took control after lunch today, Petr. There was a big fight the last hour but the bulls couldn’t turn it around. Let’s hope for more tomorrow for those of us still holding our shorts.

I thought I would dip my tow in for a day trade with a few ES contracts.. man did I regret doing that.

To say the least, volatility made it difficult to control risk.

Me too. Lost a high percentage but low $s as I did not ‘invest’ much.

https://twitter.com/RenMacLLC/status/1247873439488258048

Black swan virus story driving the market, conventional analysis not so useful.

Will this effect wearing off soon?

“The most likely scenario we face today with the lockdown measures we’ve introduced is a successive series of reinfections over a prolonged period of time.”

https://www.foxnews.com/opinion/coronavirus-beyond-flattening-curve-end-pandemic-william-haseltine

Just scary….

The thinking about how to respond is just amazingly simplistic and bad. We’ll end up with financial destruction leading to social and political destruction. God help us.

It’s going to be a long 12 months or so until they get a viable vaccine approved.

Agree there!

i.e….. After 2 or 6 months of “stay at home” orders/lockdowns, percentage virus .vs. businesses remaining? Another 6 months, percentage recoveries in each?

“Our national problems usually do not cause nearly as much harm as the solutions.” Thomas Sowell.