Mid-week market update: This bear market has astonishing in its ferocity, but we may be reaching the it’s so bad things are good point. Here are some “green shoots” that are starting to show up.

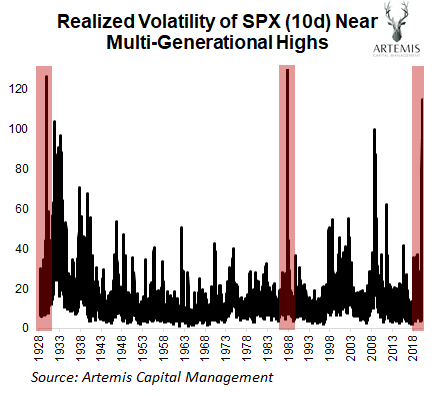

Baron Rothchild was famously quoted as saying, “The time to buy is when blood is running in the streets, even when the blood is your own.” We seem to be at that point of blind panic. Realized maket volatility is now on par with the Crash of 1929 and the Crash of 1987.

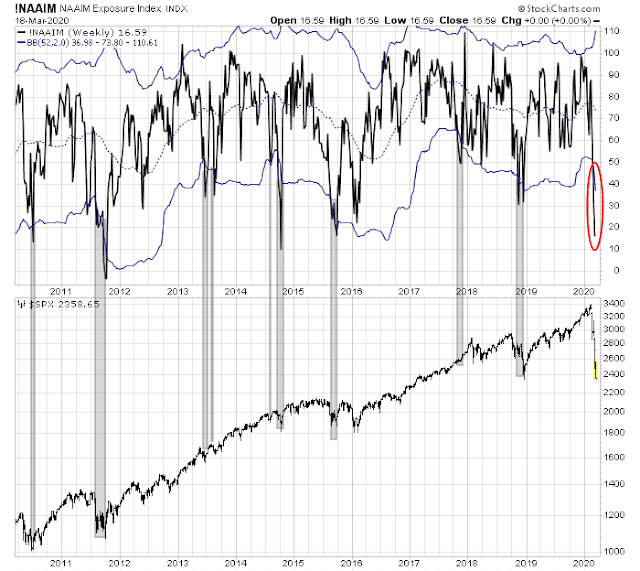

Is sentiment bearish enough for you?

The NAAIM Exposure Index, which measures the sentiment of RIAs managing individual investor funds, is now below its 52-week Bollinger Band. Historically, that has been a good intermediate term buy signal. In the current circumstances, we have seen other “historically good” buy signals fail as stock prices continue to crater.

Another constructive sign is the spike in %Bears in II sentiment. The rising level of bearishness is another sign of washout and capitulation. While I interpret this latest reading as constructive, I would not regard it as outright bullish as there are still more bulls than bears.

Waiting for the sustained bounce

I am still waiting for signs of a sustainable oversold bounce. The hourly S&P 500 charts shows the index tracing out a bullish falling wedge pattern. An upside breakout would be a positive development, but I would watch for confirmation in the form of two consecutive positive days before getting overly excited on the bullish side.

There are hopes for a positive day tomorrow. Rob Hanna’s analysis of 5% downside gaps shows a slight bullish edge the next day (Thursday), but the sample size is small (n=5) and therefore not very dependable.

Bottom-up reports indicate that tomorrow morning’s initial jobless claims reports will show an immense surge. If sustained, it would translate to a rise in the unemployment rate of 1% or more. Watch how the market reacts to that print.

My inner investor is at his level of maximum defensiveness. My inner trader is on the sidelines. The market will eventually stage a “rip your face off” relief rally at some point. My inner trader is waiting for two consecutive days of gains before taking action to jump in on the long side.

Cam— Do you still have a 1600-2150 price target?

Yes, that is still my guesstimate.

Lucky story. A few weeks ago I made a trading mistake and bought some SPY April 190 put options by mistake. The SPY was around 310 and I really wanted to buy the 290 not 190. I realized the error when the fill price was 35 cents instead of many dollars. I bought the 290s (made good return on them) and kept the 190s because the amount of money was so little as the bid was pennies. I forgot about them.

Flash forward to today. I looked in my account and saw they were at three bucks (big surprise) as of yesterday and today the SPY was plunging. I sold them immediately at got filled at over $7. So I made many thousands (20 bagger) with bullshit luck. I just needed the market to fall the most in history in a couple of weeks and the VIX to hit 80. Simple.

Good karma!

Thanks, Cam. I really wish to see two consecutive days of gains and a “rip-your-face rally” soon.

A few weeks ago when we saw the first shockingly big drop in the US market, I posted that momentum theory says that when there is a big event negative or positive (for one stock or the general market) investors will underestimate the news and this sets up a momentum trend to the final destination and once reached often has an overshoot. I’ve studied this for many years and even wrote a book on momentum-style investing (check Amazon.com)

We can now see that things are playing out as the theory expected with losses that surprise investors. We humans can’t foresee the extent of a new big event. We have ‘achoring bias’ around recent prices. We are reluctant to take losses when a downtrend is in place and we too readily buy stocks that hit lower prices thinking they are bargains. This leads to a trend (momentum).

Ken, what’s the title of your book?

Ken, do you have a view on how far the market can fall from here based on your momentum studies? I’m seeing more tweets claiming liquidation by funds now.

Wow! Bigger than I thought.

House Democrats unveil bazooka!

https://seekingalpha.com/news/3553176-house-democrats-unveil-bazooka

Dims think money grows on trees. And they would give away all the money YOU an I have if they could get away with it to buy the election.

See comment from Greg Mankiw

http://gregmankiw.blogspot.com/2020/03/thoughts-on-pandemic.html

fsc_covid-19_legislative_package_-_03.18.20

Sorry – here is the link

https://financialservices.house.gov/uploadedfiles/fsc_covid-19_legislative_package_-_03.18.20.pdf

The Dow futures are still down.

https://www.ig.com/uk/indices/markets-indices/weekend-wall-street

Here are some key provisions of the bill. Let’s see what comes out of the legislature sausage-making.

• At Least $2,000/month for All Adults and $1000 for Each Child.

• Suspend All Consumer and Small Business Credit Payments (mortgages, car notes, student loans, credit cards, small business loans, personal loans, etc.) during the pandemic.

• Establish a Facility by the Federal Reserve or Treasury to Reimburse Creditors, and Servicers for Lost Revenue and Expenses, Including Payment Advances.

• Suspend All Negative Consumer Credit Reporting During the Pandemic.

• Prohibit Debt collection, Repossession, and Garnishment of Wages During the Pandemic.

• Provide $5 billion in Emergency Homeless Assistance.

• Ban All Evictions, Foreclosures, and Repossessions–Including Manufactured Homes, RVs, and Cars Nationwide.

• Suspend Rental and Utility Payments for Assisted Renters and Provide Rental and Utility Payment

• Assistance for Non-Assisted Renters.

• Suspension of Commercial Rental Payments by Private Sector Actors.

• Support Additional Grants ($50B) for Small Businesses.

• Tax Rebates for Small Businesses.

• (SEC to ask companies to) Disclose Supply Chain Disruption Risk.

• (SEC to ask companies to) Disclose Global Pandemic Risk

• Temporary Ban on Stock Buybacks and Dividends

When did we vote to become Venezuela?

It is a starting gambit. I don’t think Prez Trump will be opposed to it though.

What about payments for my dog? She’s more expensive than a kid.

Haha…

You should write to Pelosi. The bill is still in works. I am sure many of our compatriots would agree with you.

See Greg Mankiw, Bush II’s CEA chair

Now is not the time for partisan bickering, nor is it the time to wonder how much it’s going to cost.

http://gregmankiw.blogspot.com/2020/03/thoughts-on-pandemic.html

I’m sorry I read that, Cam. I would like my two minutes back. LOL

For those looking for some good news (I am):

The key assumption of this (exponential) model is a replication rate of 2.3, whereby each person who is infected then infects two others, seemingly without end. But the model does not specify the periodicity of the replication rate or allow it to vary with any downward changes in viral toxicity or human behavioral responses that delay interaction. Nor does the model recognize that if the most vulnerable people are hit first, subsequent iterations will be slower because the remaining pool of individuals is more resistant to infection. And finally, the model explicitly ignores the possibility that the totals will decline as the weather gets warmer.

https://www.hoover.org/research/coronavirus-isnt-pandemic

Let us circle 61.8% Fibonacci retracement of 3400 = 2100. As initial pull back, this is a good target, intraday or on closing basis. Still 10% below where we closed today. This would also mark the peak of Cam’s 1600-2100 bottom, and a good entry for a countertrend rally. I have no crystal ball that says this is going to be correct.

I think before committing investment funds back into the market I want to see a descent rally and successful retest. A “V” bottom will be hard to commit to if it works out that way.

I think Cam has high odds of being right about a rally and a very slow descent to a new low. That would be painful.

Wally, I am talking of a countertrend rally, not a ‘final bottom’. Yes, the final bottom may be a few quarters away (? early next year), and could well be a double bottom (around 2350-2500).

Now, if NY city has a spike of 20-50K cases in the next seven days, expect a sub 2K level on the S&P 500. As we test more people, there will be more number diagnosed (!). We will just diagnose those patients who are not very sick.

Understand and be clear, number of cases in NYC matter more than anywhere else in the US!

Judging from the projected reduction in revenue to our company, there’s a chance that I won’t have a job in a few weeks to a few months.

So, so very sorry to hear.

Very sorry to hear that. Won’t the stimulus bill help your company?

I understand that in most cases, that help won’t be sufficient.

My wife works for a major national trade show company. They just laid off the majority of the company yesterday. We were lucky in that my wife is just getting a 20% pay cut – for now.

The Hulbert HSNSI now exactly where it was during the last week of December 2018.

I know somebody who knows somebody and they are saying that tomorrow the President is going to ask all businesses (except essential businesses) to close for 2 weeks and everybody to stay home. I have no idea how reliable this info is. Just a heads up so you won’t be surprised if it happens.

I know the source is zerohedge.com but still…

===

This all has the smell of a massive global macro fund liquidation and the contagious impact of that leveraged unwind across the global risk markets.

As Bloomberg’s Stephen Spratt details, desks continue to speak of the “sell everything” mentality in markets with huge liquidations and de-leveraging taking place everywhere.

https://www.zerohedge.com/markets/global-dollar-buying-panic-sparks-asiapac-fx-collapse-us-equity-futures-plunge

Anybody checked in with Robert Prechter lately?

One thing that has bothered me for a while is what if the chop from 1998-2009 was a wave 4 of some kind, and the advance from then was a wave 5. If that’s the case, we completed some large scale wave a month ago, and would expect a decline back into the 2000-2009 wave 4 range, ie, below 1500 spx.

The relatively anemic worldwide breadth of the last few years lines up with the wave 5 concept.

At the rate the market has declined, should be there in a week.

Careful, we appear to be past peak VIX (for now).

How long are we going to be dealing with this virus?

https://apnews.com/67ac94d1cf08a84ff7c6bbeec2b167fa

There is an interesting (if technical) model from Imperial College in the UK.

https://www.imperial.ac.uk/mrc-global-infectious-disease-analysis/news–wuhan-coronavirus/

The model does not offer a short or easy path to getting past CoVid 19.

Whether we like this or not, we are all in this together. I am in Canada and I am glad that our government is sending the message that the government is there for all Canadians.

I sold out everything at the beginning of March and will wait out until the overall outcome becomes clearer.

I don’t think there is anywhere ‘safe’ at the moment. Unless you know something and want to share? 😉

From: Jim Glassman, J.P. Morgan Chase economist and labor-market expert.

Subject: Don’t send checks to workers. It is inefficient.

https://www.marketwatch.com/story/memo-to-congress-dont-send-checks-let-banks-quickly-compensate-businesses-so-theyll-hang-onto-workers-says-jpmorgan-economist-2020-03-19?siteid=yhoof2&yptr=yahoo

The Bear’s perspective.

https://www.marketwatch.com/story/hedge-fund-manager-market-purging-could-lead-to-a-plunge-of-at-least-74-2020-03-19?siteid=yhoof2&yptr=yahoo

Senator Dumped Up to $1.6 Million of Stock After Reassuring Public About Coronavirus Preparedness

https://www.propublica.org/article/senator-dumped-up-to-1-6-million-of-stock-after-reassuring-public-about-coronavirus-preparedness

Unless he told people to buy stocks, he can do what ever he wants with his portfolio as far as I’m concerned.