In my last post (see 2020 bounce = 1987, or 1929), I had been searching for a template for the current bear market. I had suggested in the past that the roots of this bear has thematic similarities to 2008 (see A Lehman Crisis of a different sort). Today, health authorities are urging the use of social distancing to mitigate COVID-19, while financial institutions practiced similar social distancing at the time of the Lehman Crisis, which ended by seizing up the global financial system.

As the growth of COVID-19 cases continues outside of China, one other template comes to mind. 9/11.

The 9/11 analogy

As most of Europe and America go into lockdown to start the week, a review of The Transcript, which is a compilation of earnings calls, brought to mind a 9/11 analogy for the current situation.

COVID-19 is now a global pandemic with Europe as the epicenter

“We have therefore made the assessment that COVID-19 can be characterized as a pandemic. Pandemic is not a word to use lightly or carelessly…Europe has now become the epicenter of the pandemic with more reported cases and deaths than the rest of the world combined apart from China” – WHO Director-General Tedros Adhanom GhebreyesusDaily life has come to a halt in many places

“Daily life has come to a halt, it certainly appears if you are a human being on this planet.” – Korn Ferry (KFY) CEO Gary BurnisonThis is a fear-based event more akin to 9/11 than 2009

“I think this event is very similar to 9/11 in terms of the psychology of what’s driving it. It’s a fear based event” – JetBlue Airways (JBLU) CEO Robin Hayes“This is a fear event, probably more akin to what we saw at 9/11 than necessarily what we saw in 2009. I think you’re seeing a suspension of activities, whether it be corporate activities, group activities, events where people get together in large numbers, all of which impact our demand set. So, I think it’s really premature to try to be drawing too many corollaries.” – Delta Air Lines (DAL) CEO Ed Bastian

“We are in a situation which is exceptional in every respect…more exceptional than at the time of the banking crisis, I would say.” – The German Chancellor Angela Merkel

with significant demand deterioration for airlines worse than after 9/11

“when I look at how the demand has deteriorated last couple of weeks, it appears to be worse than what we saw after 9/11.” – JetBlue Airways (JBLU) CEO Robin Hayes

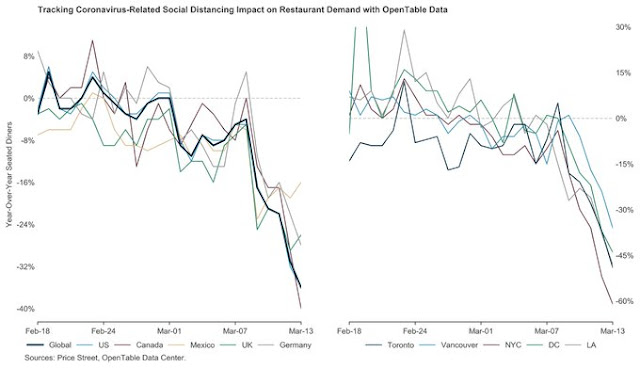

What caught my eye was the comment, “This is a fear-based event more akin to 9/11 than 2009”. Indeed, Open Table restaurant bookings are down -36% year over year globally, -36% in the US, -40% in Canada, -61% in New York, and -49% in Toronto.

Bloomberg also reported that most airlines could be bankrupt by the end of May.

Limitations to the 9/11 analogy

However, there are limits to the 9/11 analogy. The post-9/11 sell-off occurred in the middle of a bear market and recession. The latest COVID-19 shock is the spark for a new recession. The market bounced as fear subsided, but didn’t bottom until about a year later with a double bottom in July and October 2002.

Today, Wall Street is just coming to to grips with a sudden slowdown which is only just starting, and analysts are scrambling to estimate its magnitude, but the situation is so fluid that any estimates are virtually worthless by the time they are published.

Joe Wiesenthal at Bloomberg made a sensible comment this morning about the fears gripping the market: Physical social distancing is creating financial difficulties for households and the corporate sector, which is worrisome for financial solvency [emphasis added]

The House passed a bill on Friday night to provide relief to some people who are affected by the virus, but it’s far short of the fiscal bazooka that several economists believe we urgently need. What’s weird about this situation is that we need massive fiscal help from DC, but we don’t exactly need stimulus, per se. Stimulus typically implies an attempt to get the economy moving positively again. But that’s not exactly what we want right now, because in the ideal scenario everyone could just wait this thing out by spending a month or two in their homes eating canned goods, watching Netflix and facetiming. Then when the virus is mostly gone, go out and have a bacchanal for the ages in the warmer weather. The problem, as Larry Summers eloquently put it, is that “economic time has been stopped, but financial time has not been stopped.” In other words, if we all cocoon for two months, we might physically survive, and the infrastructure of the modern world would be waiting for us upon our re-emergence, but in the meantime the bills pile up. The rent’s due. The mortgage is due. Or the landlord’s mortgage is due. The credit card bill is due. Taxes are due. For a business, paychecks must go out. Suppliers must be paid. Sp we don’t need economic stimulus right now. We don’t need people out shopping or building new infrastructure or building new homes. Every one of those things involves people congregating and risks spreading the virus. What we need is cash to keep people from going bankrupt or evicted. Cash to keep the lights on. Cash to keep people employed; to keep their healthcare. Cash to buy basic necessities, like food and medicine. So let’s not think in terms of reviving growth for now. Let’s think in terms of cash, so that for as long as we’re in deep freeze, people can stay alive and continue to meet their financial obligations.

Former Bush era CEA chair Greg Mankiw recently made the following sensible policy prescriptions:

- A recession is likely and perhaps optimal (not in the sense of desirable but in the sense of the best we can do under the circumstances).

- Mitigating the health crisis is the first priority. Give Dr. Fauci anything he asks for.

- Fiscal policymakers should focus not on aggregate demand but on social insurance. Financial planners tell people to have six months of living expenses in an emergency fund. Sadly, many people do not. Considering the difficulty of identifying the truly needy and the problems inherent in trying to do so, sending every American a $1000 check asap would be a good start. A payroll tax cut makes little sense in this circumstance, because it does nothing for those who can’t work.

- There are times to worry about the growing government debt. This is not one of them.

- Externalities abound. Helping people over their current economic difficulties may keep more people at home, reducing the spread of the virus. In other words, there are efficiency as well as equity arguments for social insurance.

- Monetary policy should focus on maintaining liquidity. The Fed’s role in setting interest rates is less important than its role as the lender of last resort. If the Fed thinks that its hands are excessively tied in this regard by Dodd-Frank rules, Congress should untie them quickly.

The analysis from Wiesenthal and Mankiw leads to the idea that the economy has suffered a sudden shock, and recovery will take some time. Wall Street analysts have not fully modeled or even had the time to estimate the full impact of the COVID-19 pandemic. It will therefore take time for the market to adjust to new expectations. This leads to the following market scenario:

- The market will bounce as fear fades (but don’t ask me when the bounce occurs).

- Watch for a rally and a test of the old lows several months in the future as the realization that the global economy is slowing, and the magnitude of the slowdown.

I am reiterating my downside estimate for the S&P 500 of 1600-2160 (see My recession call explained), which is based on applying a range of 10x to 13.3x P/E multiple to a forward 12-month EPS discounted by -10%.

OK, thanks Cam! So basically another -10% to -30% from today’s close.

A few thoughts:

(a) Forced selling. With cities around the world now locked down, how many investors have been or will be be forced to sell in order to raise cash?

(b) The beginning or the end? Is anyone able to say whether the pandemic has peaked? Are we at the beginning of the end – or at the end of the beginning? The same can be said re current levels of panic/fear – it may get worse before it gets better.

(c) Earnings revisions. It will be weeks before companies announce the effects of a global lockdown.

We can argue that human nature will play out as it always has, but how certain are we that markets now eflect the full brunt of fear/anxiety + economic disruption? -30% off the highs no longer seems to be enough…

Probably no surprise that the Bay Area is now locked down-

‘Officials in six San Francisco Bay Area counties issued a shelter-in-place mandate on Monday affecting nearly 7 million people, including the city of San Francisco itself.

‘The order says residents must stay inside and venture out only for necessities for three weeks starting Tuesday in a desperate attempt by officials to curb the spread of the novel coronavirus.

‘If affects the counties of San Francisco, Marin, Santa Clara, San Mateo, Alameda and Contra Costa, as well as the city of Berkeley.’

https://www.marketwatch.com/story/stocks-arent-bargains-yet-but-a-buying-opportunity-will-come-heres-how-youll-know-its-here-2020-03-16?mod=home-page

Here is GMO’s 7-year forecast for stocks and bonds, as of 2/29/20. As of that date, the Dow was at 25,409, and the 10-year at 1.13

Remember that these are compound rates over a seven year period.

https://www.gmo.com/americas/research-library/gmo-7-year-asset-class-forecast-february-2020

Obiously things have changed a bit since two weeks ago.

What is your favorite ’emerging value’ play?

Are you willing to hold EM over a 7 year horizon? EM is move volatile than other markets.

That said, the value play is probably Russia. A short-term growth play would probably be China.

Are the volatility and momentum-driven algorithms creating the havoc in the market?

https://www.wsj.com/articles/why-are-markets-so-volatile-its-not-just-the-coronavirus-11584393165

See the Schwab article I posted below.

Maybe these two paragraphs will shed some light on how far we have to go. Just ask yourself how severe do you thing this will be.

“The S&P 500 on average has fallen 28% from peak to trough during recessions, according to an analysis of the past 70 years from Keith Lerner, chief market strategist at Truist/SunTrust Advisory Services. As of Monday’s close, the benchmark index had declined 29.5% from its Feb. 19 closing record high.”

“But the market’s plunge was much deeper over a decade ago during the financial crisis, with the S&P 500 tumbling more than 50%.”

https://finance.yahoo.com/news/d-word-rears-head-coronavirus-050658349.html

A very sensible article though not as optimistic as I am. Worth a read.

https://medium.com/@gavin_baker/we-are-in-a-severe-recession-what-now-for-both-companies-and-investors-f5b1763253ae

Cam

Is the conclusion of this article that we are in a recession and final bottom may be several quarters away?

Yes

Friends, let us see when the US cases plateau;

https://www.arcgis.com/apps/opsdashboard/index.html#/bda7594740fd40299423467b48e9ecf6

https://www.schwab.com/resource-center/insights/content/who-fueled-fastest-bear-market-ever

Thx, very useful.

“The fastest bear market ever seems to have been driven by short-term traders, rather than long-term individual investors.”

That’s too bad. That means a lot of people have had much of their retirement savings wiped out. Only one person that I know had the foresight to liquidate as the decline was about to begin – me. Thanks, Cam.

Thanks, DV. Good to see a different perspective.

My brother and a friend dipped their toes into the market over the last 2-3 days after being in cash for many years.

There is a story in the WSJ this morning that starts:

“Experts now agree the virus’s spread can be slowed but not contained. It will take its place among mostly seasonal respiratory infections. After a time, recurrent outbreaks will be moderated by a large number of potential carriers who have immunity from their last infection.”

https://www.wsj.com/articles/questioning-the-clampdown-11584485339

Though delayed, the Trump administration response (I think) has been swift and bold since last Friday. I think they learnt from the slow and relatively timid response at the onset of the GFC crisis.

BREAKING: Here’s the White House “Stimulus 3” plan

-2 rounds of $1,000 checks (April, May)

-$300bn in small biz loans

-$50billion airline lending facility

-$150bn in lending for other distressed industries (hotels, cruise)

https://twitter.com/byHeatherLong/status/1240292132625268738