Mid-week market update: At week ago, I identified two technical triangle formations to watch (see Why small caps are lagging (and what it means)). Since then, both the SPX and NDX have struggled at key resistance levels despite a generally positive news background of earnings beats, and now they have moved sideways through a rising trend line. The obvious short-term downside target are the gaps to be filled below (shown in grey).

The market seems to be afflicted with a case of SPX round number-itis, where the index advance stalls when it reaches a round number.

Weakening NASDAQ

Notwithstanding the all-time high exhibited by AAPL, most of the weakness is attributable to the lagging performance exhibited by the high octane go-go stocks, such as internet, social media, and IPOs.

I have been monitoring the top five sectors, which comprise nearly 70% of index weight, for clues to market direction. An analysis of the top five sectors reveals lagging performance by FAANG dominated sectors, namely technology, communication services (GOOGL, NFLX), and consumer discretionary (AMZN). It is difficult to see how the index could make much bullish headway without the bullish participation of a majority of the top five sectors.

The analysis of the relative performance of the equal weighted top five sectors tells a similar story as the capitalization weighted analysis. As a reminder, equal weighting the stocks in each sector reduces the effect of the large cap FAANG heavyweights. All sectors show the same pattern of relative performance, except for consumer discretionary stocks (bottom panel), which is outperforming were it not for the drag provided by AMZN.

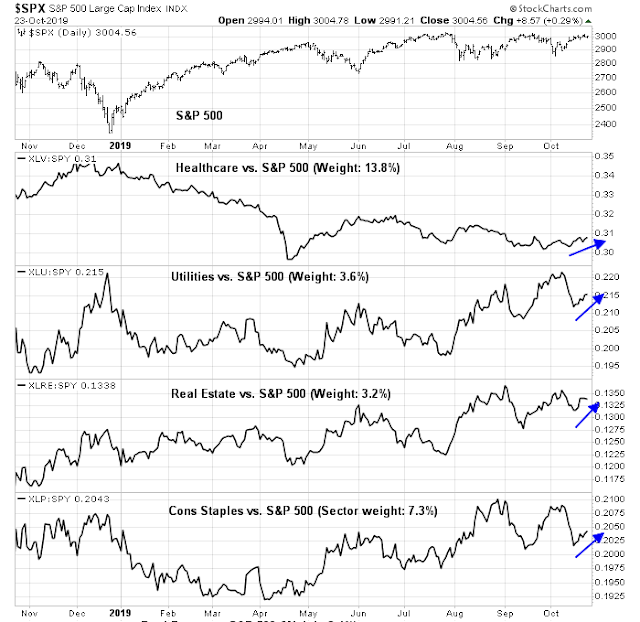

The relative performance of defensive sectors also tells a similar story. Even as the market consolidated sideways, defensive sectors were creeping up in relative performance, indicating the bears were trying to take control of the tape.

Still, I find it difficult to be overly bearish on stock prices. The fundamental news backdrop from Q3 Earnings Season has generally been positive, and both earnings and sales beats are coming in at above historical norms. My inner trader remains tactically short, but he is prepared to cover most of his positions and possibly reverse long should the market retreat to fill the gaps below.

The bear is only at the door, peering inside. He is not rampaging inside the house. Downside risk should be fairly limited.

Stay tuned.

Disclosure: Long SPXU

Hi Cam, it looks like that there is a “FIGHT” between enormous liquidity created by FED (repo), China central bank, … and the reality – bad profits of some companies – Twitter, … and also some misses like New home sales (US)… In my view you the market went down each time after the slashing interest rate by FED (e.g. 2 previous instances) so the history should rhyme … hopefully. Thank you for all you do. Petr

Since this is FOMC week, is it possible we don’t get a rate cut?Since the last FOMC meeting, we had the repo problem and all of this liquidity being injected into the market. Is it possible the fed might balk at a rate cut seeing as to how much it has put into those repo operations?

Of course, if the market wants to go up and there is no rate cut, the story will be that the market/economy is so strong it doesn’t need a cut….a variant of bad news is good news

Possible but highly unlikely. With the market expecting a cut, this Powell Fed doesn’t like to surprise like that