President Trump surprised the market on Sunday with a tweeted threat:

Notwithstanding his misunderstanding that tariffs are not paid by the Chinese, but American importers, this tweet sounds like an effort to put pressure on China, just as Vice Premier Liu He is scheduled to arrive in Washington on Wednesday with a large (100+) trade delegation for detailed discussions. News reports indicate that both sides have given significant ground, and a deal may have been possible by Friday.

In response to Trump’s tweeted threat, the WSJ reported that the Chinese may reconsider making their trip to Washington because “China shouldn’t negotiate with a gun pointed at its head”. CNBC subsequently report indicated that the Chinese are preparing to visit Washington, but with the delegation size will be reduced, the timing of the visit is not known, and it is unclear whether Vice Premium Liu He will be in the group.

A Chinese delegation will come to the U.S. this week for trade talks after President Donald Trump upended negotiations by threatening new tariffs on Sunday, according to sources familiar with the matter.

One of the sources briefed on the status of talks said the Chinese would send a smaller delegation than the 100-person group originally planned. It is unclear whether Vice Premier Liu He would still helm this smaller group, an important detail if the team were traveling to Washington with an eye toward sealing a deal. Two senior administration officials described Liu as “the closer”, since he had been given authority to negotiate on President Xi Jinping’s behalf.

The team from Beijing was set to start talks with American negotiators on Wednesday as the world’s two largest economies push for a trade agreement. It is unclear whether the talks will still start Wednesday.

Another encouraging sign was the report that Chinese media censored Trump’s tweets, which could be interpreted as a signal that Beijing did not want to unnecessarily escalate the conflict. The front pages of the two major Chinese news portals had no mention of Trump’s threats.

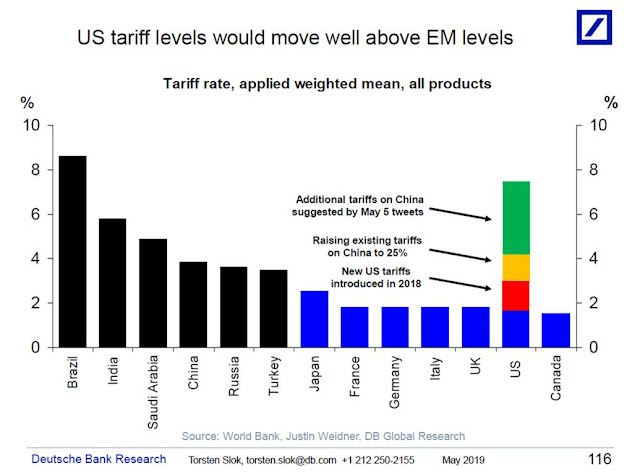

US tariffs are already higher than most developed market economies. If implemented, the new levels would be higher than most EM economies, and have a devastating effect on global trade.

I spent Sunday responding to emails and social media inquiries about how to react to this news. In many ways, it was more exciting than watching the latest episode of the Game of Thrones.

Assessing both positions

Let us start by examining how strong a hand each side thinks it holds. China’s official and Caixin PMI softened in April, indicating that the effects of the last stimulus program may be petering out. On one hand, they may be waiting for a trade deal as another way of boosting their economy ahead of the October celebration of the 70th anniversary of the founding of the PRC.

On the other hand, Tom Orlik of Bloomberg Economics believes that the full effects of the stimulus program hasn’t fully filtered through to the economy yet.

Bloomberg also reported that the recent stimulus program may have bought China more time to address their financial stability problems:

Recent efforts have instead been directed at the government’s real goal: making the financial system safer. The China Banking and Insurance Regulatory Commission is focused on mitigating the risk of contagion along multiple fronts: rolling back lending between banks and other financial institutions; preventing the system from feeding credit into blatantly speculative activities; migrating risk from shadow lenders back to the formal banking system; and improving bank asset quality.

Recent efforts have instead been directed at the government’s real goal: making the financial system safer. The China Banking and Insurance Regulatory Commission is focusedon mitigating the risk of contagion along multiple fronts: rolling back lending between banks and other financial institutions; preventing the system from feeding credit into blatantly speculative activities; migrating risk from shadow lenders back to the formal banking system; and improving bank asset quality.

Judged on those terms, the results are promising. Shadow banking has contracted, as has interbank lending. Efforts by institutions to dispose of nonperforming loans more quickly are themselves a form of deleveraging. All of this has massively reduced the amount of complexity in the financial system and put the regulators in a better position to manage risk.

It’s also increased the system’s capacity to safely support higher levels of debt. That’s where the current stimulus comes in. Rather than a free-for-all where banks and shadow banks are given the freedom to shovel as much credit as possible into the economy — which broadly describes the approach pursued repeatedly between 2009 and 2016 — the current effort is targeted and limited only to banks (which have been chastened since their freewheeling days) and the bond market.

This time the stimulus is focused on tax cuts, local government bond issuance to support investment in public works, and providing banks with liquidity expressly for the purpose of lending to small firms.

Those measures have been designed specifically to avoid undoing regulators’ progress in reducing risk in the last two years. Indeed, rather than contradicting the deleveraging campaign, it represents a commitment to making that campaign successful.

Axios reported the Chinese were reported backing off some concessions, indicating Beijing believes it holds a strong hand. “A source familiar with the situation told me that the Chinese had been backing off of agreements the U.S. negotiating team believed they had already made.” If the Chinese delegation were to delay its scheduled trip to Washington, that would another signal that Beijing believes it holds a strong hand and it can wait out the Americans.

Push comes to shove, China has a Plan B of more stimulus, raising tensions in the South China Sea, and encouraging North Korea to make more missile or nuclear tests.

What’s Trump’s Plan B?

The same Axios report indicated that Trump thinks he holds a strong hand, “Trump’s view, the source said, is that he’s negotiating from a position of clear economic strength, especially with the latest strong U.S. jobs numbers.”

In addition, the latest Gallup poll ending April 30 shows Trump’s approval rating at 46%, an all-time high, which gives him political room to maneuver.

While both sides would like to make a deal to help their respective economies, I would characterize Trump’s hand as strong economically, but weak for political reasons:

- Trump will own any market fallout. The market’s risk-off response is Trump’s Achilles Heel. Trump views the stock market as a scoreboard for the success of his Administration. If it were to crater because of a failed trade negotiation, he will own the market retreat. He won’t be able to blame the Fed, or anyone else.

- Trump is being pressured by the Democrats to be tough on China. CNBC recently reported that Bernie Sanders unveiled a platform challenging Trump’s China policy. He will have to appear tough, but not too tough as to sink the trade deal. This tweet from Senate Minority Leader Chuck Schumer makes it clear that there is bipartisan support for a tough stand on China.

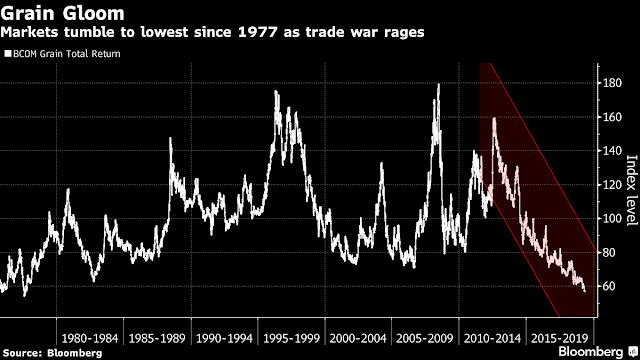

- Trump needs a trade win. Senator Chuck Grassley has refused to even consider the NAFTA replacement without the repeal of the steel tariffs. Trump needs a trade win heading into the 2020 election. In farm country, where much of the Republican support can be found, grain prices have fallen to levels last seen in 1977, and the latest tweets are not helping.

Unsurprisingly, farm bankruptcies have been rising.

What’s Trump’s Plan B if the negotiations fail? Does he want a crashing stock market, a tanking economy, and soaring farm bankruptcies ahead of an election?

The market’s verdict

When it comes to unexpected news, my tactical inclination is to stand aside and let the market tell the story, and then reassess once the dust is settled. As the closing bell rang Monday, the market’s tone had changed considerably from the open. While volatility will undoubtedly rise in the week ahead as the market reacts to new headlines, it is clear that the bears had failed to seize control of the tape.

For the past few weeks, I had been writing about how the stock market had been advancing steadily while exhibiting a series of “good overbought” signals on the short-term 5-day RSI. Market pauses were marked by overbought readings on the 14-day RSI. Brief corrections were halted when the 14-day RSI returned to neutral, and the VIX Index spiked above its upper Bollinger Band.

To my surprise, this pattern remains intact. The SPX successfully tested its rising wedge support, and the 14-day RSI did not decline below neutral.

The small cap Russell 2000 staged an upside breakout on Friday. Not only did the breakout hold, the index rose further today, indicating further strength and momentum.

NASDAQ leadership also remains intact, which is another indication that the bulls remain in control of the tape.

What do we say to the bear-faced market god? Not today.

Disclosure: Long SPXL, TQQQ

It’s also possible that failed talks this week (along with the imposition of additional tariffs) sends markets in China higher.

China has always played the long game. We have no inside knowledge of the cards they hold, but we can infer they’re holding one or more that US negotiators are either unaware of, or have mistakenly dismissed.

I believe the only major cards China holds is the support of American corporate and agricultural interests. I hope that Trump can win this important confrontation. Better to crush the China economy before they crush us.

Thanks very much for the timely post!

What are your thoughts after today Cam?

The Chinese aren’t going to give the President the satisfaction of folding on key issues ahead of a threatened tariff rate hike. So, there is more to go on the downside for now. IMHO

A wedge in to the double top!

I don’t think it’s possible to arrive at a deal by Friday. However, if Trump wants to jack the markets – one Hail Mary tweet about extending the deadline is all it would take.

What I find interesting is the short duration for this ultimatum! Trump tweeted on Sunday and the tariffs go in effect on Friday. If you push the deadline out again, doesn’t the potency of your threat lose effectiveness over time?

Looks like time to consider buying some grain ETFs – they are really down a lot.

It’s entirely possible (probable even) that China intentionally provoked the US into an ultimatum. In other words, the Chinese wish to exit the talks – ie, they don’t like the way things are going – but in a way that allows them to sidestep the stigma of failure. Liu He has postponed his arrival to Thursday. An increase in tariffs the following day (which are in any case borne by US importers) provides a great opening for him to walk away on Friday.

My understanding is that tariffs are being borne by both Chinese exporters (reduced export prices and therefore lower profits) and US importers (passing on the costs to consumers).

I’m not an expert on tariffs, but the general definition indicates that the tariff (or duty) is paid by the importer upon arrival of goods at the port of entry.

https://en.wikipedia.org/wiki/Customs_duties_in_the_United_States

I don’t have the exact numbers either but here you go:

https://www.reuters.com/article/us-usa-trade-china-tariffs-explainer/explainer-who-pays-trumps-tariffs-china-or-u-s-customers-and-companies-idUSKCN1SC1ZC

“Chinese suppliers do shoulder some of the cost of U.S. tariffs in indirect ways. Exporters sometimes, for instance, are forced to offer U.S. importers a discount to help defray the costs of higher U.S. duties. Chinese companies might also lose business if U.S. importers find another tariff-free source of the same goods outside China.”

“What do we say to the bear-faced market god? Not today”

XD

This market has become a one sided. There are massive short bets on the VIX index (3 short to one long), beating the drum for a rally in the market. We saw such conditions in February 2018. The massive correction in February 2018 was due to unwinding of such short contracts on the VIX. Watch out.

China is shaking in its shoes, NOT.

https://www.cnbc.com/2019/05/08/china-backtracked-on-nearly-all-aspects-of-us-trade-deal-sources.html?&qsearchterm=china%20backtrack