It is said that while bottoms are events, but tops are processes. Translated, markets bottom out when panic sets in, and therefore they can be more easily identifiable. By contrast, market tops form when a series of conditions come together, but not necessarily all at the same time.

I have stated that while I don’t believe that the stock market has made its final cyclical top, we are in the late stages of a bull market (see Risks are rising, but THE TOP is still ahead). Nevertheless, psychology is getting a little frothy, which represent the pre-condition for a major top.

As a result, this is another post in an occasional series of lists of “things you don’t see at market bottoms”. This week, I focus on the theme of “subprime is the new black”:

- How cov-lite loans have become the norm

- The popularity of subprime auto loan ABS

- A start-up for customers with no money but want to buy things

Subprime is the new black

Just when you thought that subprime lending was dead and buried, it has come back to life. The Argentina 100-year bond deal showed how yield starved the market is.

Indeed, the stretch for yield has prompted issuers to take advantage of the easier credit environment. As the chart below shows, the percentage of covenant light loans has been rising steadily since 2010 and cov-lite loans are now the norm.

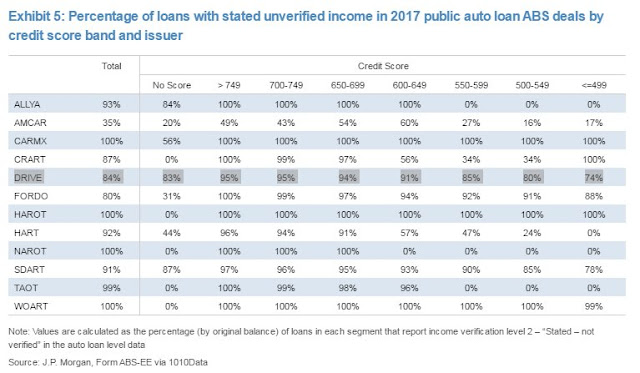

Here is another sign that investors are stretching to get more yield, JP Morgan observed that Santader Consumer USA priced a deep subprime auto loans ABS deal where 84% of the loans are to borrowers with unverified income (via Tracy Alloway).

In case you were wondering, the AALYA deal on the first line is another Santander issue.

A start-up for customers with no money

If “irrational exuberance” is defined as equity investors throwing caution to the winds, what do you call the excessive consumer risk-taking behavior? The following news item recently came across my desk (via Tech Crunch):

If you’re looking to buy something, but don’t want to pay for it yet, Blispay thinks it has the solution for you. The start-up works with small and mid-sized businesses to help retail customers defer payments for six months…

If someone walks into a participating store and wants to make a purchase of at least $199 without paying anything upfront, they can sign up on the Blispay app in 2–3 minutes and once they submit the form they will find out if their credit is approved within 15–20 seconds. They can then take the item home without any payments or any interest for six months, while also getting 2% cash back. Blispay makes money off customers who don’t end up paying for the item when the six months comes around and then they are subject to 19.99% interest.

But as far as the businesses are concerned, it costs them nothing more than the roughly 3% credit card processing fee that they would be paying Visa anyway. Blispay allows businesses “to leverage technology in a way that makes it efficient and affordable to service a far broader swath of a merchant base,” said Lisiewski.

File this as another item under “things you don’t see at market bottoms”.

Time for the Fed to get “unpredictable”?

Alan Greenspan biographer Sebastian Mallaby recently penned an Op-Ed in the WSJ to address the problem of excessive risk taking by staying unpredictable and ambushing the markets once in a while:

With every passing month, the U.S. economy feels, ominously, more like it did in 1999 and in the mid-2000s. Both were times when a promising mix of full employment, low inflation and buoyant spirits gave way to a financial convulsion that triggered a recession. Unfortunately, the Federal Reserve under Janet Yellen is ignoring a relatively painless policy that would reduce the danger of a sequel…

A different debate could help the Fed out of this bind. Even if Ms. Yellen’s current, rather gradual pace is appropriate, the Fed can reduce the odds of a financial bust by tweaking the manner of its tightening.

To do so, the Fed should examine a tenet of the central-banking faith: that transparency is always virtuous. By being less transparent—and reserving the option of deliberately ambushing investors with a shock move—the Fed could discourage them from taking too much risk.

Such an ambush would unsettle markets, to be sure; but that would be the point. The painfully learned lesson from the late 1990s and mid-2000s is that excess financial serenity leads to excess risk-taking, which in turn increases the chances of a blow-up. In the first case, that meant the tech bust of 2000; in the second case, it meant the planet-shaking subprime-mortgage meltdown. Since market convulsions caused the last two recessions, reducing the probability of the next one must be a Fed priority.

In effect, Mallaby was echoing what Mark Carney said at Jackson Hole in 2009 about policy transparency at central banks:

How central banks communicate can influence the degree to which low, stable, and predictable inflation fosters excess credit growth. It is important that markets understand how a central bank formulates policy, but that does not equate to perfect foresight. Differences in judgment and the fundamental uncertainties surrounding the economic outlook should mean occasional differences in view. These should be particularly marked during turning points in the economic cycle. As the review of liquidity cycles suggests, wider “markets” in expected economic outcomes (which would mean greater short-term volatility) could promote long-term financial stability.

The alternative would be to generate price instability to prevent financial instability. That is, the price objective might have to become less stable in order to disrupt the endogenous liquidity creation that comes from relatively stable, predictable rate paths.16 This, rather than a higher inflation rate (if reliably achieved), would appear necessary to disrupt the dynamics described earlier.

Instability can be a source of stability.

I feel the title of the series of articles should be called “Things that one sees at market tops”. One day, there would be another series that could be appropriately titled “Things that one sees at market bottoms”.

Here is one more anecdote that one sees at market tops: My colleagues have been disinterested in investing their retirement savings in the stock market for the past five years. However, they now want to invest as much as they could into the stock market! So far, they have been buying short terms bonds and CDs! Unfortunately, some of these colleagues have been buying oil and gas partnerships in the past five years (80% of capital invested in these oil wells is written off in the first year is the lure; leave apart that energy is seeing a periodic, cyclical bear market, and perhaps a secular bear). Some of my colleagues were also foreclosing on expensive water front real estate circa 2012, who are now getting bullish on the stock market.

Joe six pack is still buying bonds, relative to stocks (https://www.ici.org/research/stats/flows/combined/combined_flows_06_28_17)

Market peaks usually see significant euphoria for stocks. For now, Joe six pack is pushing money into bonds.

What does a bond bear market look like? A 30-100% rise in yield (http://www.schwab.com/public/schwab/nn/articles/Anatomy-of-a-Bond-Bear-Market-What-to-Look-For-When-Yields-Rise).

Should the US federal reserve generate financial instability, to promote long term price stability is the question at hand. I quote from the article:

“As the review of liquidity cycles suggests, wider “markets” in expected economic outcomes (which would mean greater short-term volatility) could promote long-term financial stability. The alternative would be to generate price instability to prevent financial instability.”

Well, the US federal reserve was never mandated to create “financial instability”.

https://en.wikipedia.org/wiki/Federal_Reserve_System

The US Fed is entrusted with the mandate of “financial stability”. Whilst the way to achieve financial “stability” is through an occasional “jolt to the market (see Cam’s link to WSJ; Alan Greenspan biographer Sebastian Mallaby recently penned an Op-Ed in the WSJ to address the problem of excessive risk taking by staying unpredictable and ambushing the markets once in a while).

So far, the US Fed has not promoted the idea of SHORT TERM financial “instability” to promote long term price “stability”. Why is that? The US fed was never really created to “trick” the market, nor was it created to enslave the market, nor was it created to be the sole “governor” of the market. Furthermore, the monetary policy as dictated by the US fed was supposed to work in conjunction with fiscal policy, as determined by the US Congress. Past Fed Chairman, Alan Blinder wrote a paper that beautifully illustrates the conflict between what the Fed would like (monetary constraint) and what the politicians would prefer (fiscal profligacy).

So, the let us get back to the question at hand. IMHO, the US fed will not “trick” the market into reducing excessive risk taking, It is a back stop to excessive risk taking. There are first world countries like England and New Zealand where excessive risk taking has been curtailed.

So, is it healthy to be engaged in excessive risk taking? IMHO, the answer is an unqualified Yes. In the recent past, OPEC cartel has been broken by the idea of excessive risk taking. The USA is where it is today because of excessive risk taking. The US Fed was supposed to be the back stop.

One hopes that the “privilege” the US Fed has will not be abused. The privilege may not be abused, but it is not n endless well. One day, the powers of the Fed will not be able to back stop the system of profligate risk taking, and all hell would break loose. Think abut it. Do you have countercyclical (non-correlated) assets in your portfolio?

Are we there yet, remains the question at hand? By the metric of Joe six pack, we are ways away. That said, this time, Joe six pack may have already become insignificant.

Cam, thanks for writing another thought provoking article.

D.V.

So, what are counter cyclical (non-related) assets then as per your analysis? Everything is inter-related today. Stocks, Bonds, Gold, real estate, etc. are open to the whims of markets, though some things might move inversely. Where does one go to find things that are even more counter cyclical? I am not questioning your assumptions/analysis, just wondering what do you consider counter cyclical.

Thanks.

Mohit

The idea of correlation or lack thereof is in of itself a broad topic, and difficult to discuss in one missive alone, and I am far from an expert on this topic. But here is my 2 cents.

The asset classes you mentioned can be put together as a portfolio which would create an interlocked “lower” correlation portfolio. However, I have a different take. I classify assets as

1. Paper or proxy assets (Stocks and bonds)

2. Hard assets (Precious metals, commodities/mining, farmland, timber/forestry, income producing real estate and art and collectibles)

3. Cash

Whilst it appears that everything is inversely correlated to the US $ (over a period of time, $ looses value against all other assets). This is true over very long periods of time. However, let us examine a few exceptions to this rule:

In the last two bear markets, circa 2008 and 2000, $ gained massively against US stocks. This was true in 1929 also.

Gold massively gained value against the US $ from year 2000 to 2011. Gold also massively outperformed US stocks during the same time. Gold however lost significant value against $ from 1980 to 2000.

Since 2011, however, gold lost value against US stocks (Gold to stock ratio from 2011 till today, shows massive loss of value of gold as measured by US stocks) and $.

Let us examine the value of Class A Illinois farmland. Illinois farmland was roughly 2500-3000 $ per acre circa 1992. Today, it is circa 12-15K per acre. Against the US $, it has massively gained in value, however, against US stocks, it has gained less, and against gold, less (as measured till year 2011).

I wanted to give some examples how assets, appear on the surface to be inversely correlated to the US $ in the RECENT past, however, over longer periods of time, are not. Taken as a portfolio, they appear to create stable value portfolios, as compared to stocks or stocks and bonds alone. Such portfolios are likely to produce lower returns than stocks, however, will be more stable in value (lower volatility).

So let us look at a portfolio that contains assets of different classes I have noted above:

1. Stocks (20%)

2. Bonds (20%)

3. Hard assets (20%)

4. Cash (20%)

5. Income producing real estate (20%)

Diversification of stocks is straightforward. There are many portfolios online that do the job. Just make sure, such a portfolio has some small caps (The S&P 500 has no small caps).

Under the bond umbrella, I include high quality corporates, TIPS and munis. Munis also have low correlation to US 10 year treasuries. The preference here is to own the bonds not bond funds. For munis, one may be better off buying a large mutual fund, unless there is a competent advisor that is able to buy high quality, investment grade, escrowed munis.

Under hard asset categories, farmland is relatively easy to buy. Timber/Forestry, mining may be purchased through ETFs and mutual funds. As regards precious metals, gold, silver and platinum bullion (not mutual funds or ETF type instruments), purchased over a lifetime, would do the job.

Real estate: IMHO, income producing real estate is better asset class than REITs. Physical ownership of assets like single family homes for rental income or apartments is superior than paper assets like REITs. Back in the day, commercial real estate was the way to go, however, it is becoming apparent that due to Amazonian effect, commercial realty may not be as stable as one would want. As America exports jobs, office space is also becoming dicey. Single family homes and condos (not co-ops) may be a better asset class in this space.

One of course needs to rebalance. Furthermore, asset valuations need to be considered when creating such very long running portfolios. What I have described here as a portfolio mix is not set in stone. So 20% cash may be brought down to zero or increased to say 40% by selling stocks and bonds.

I have avoided the broader discussion of the idea of correlation here. Asset correlation is dependent on time period(s). What is less correlated today may not be in another time frame. My goal is to limit “proxy” assets, and purchase the asset itself. So, gold bullion is a better buy than GLD. A rental home is better than REIT. A bond is a better buy than a bond fund.

Two cryptocurrencies are being floated, backed by gold. As an example, preference would be to buy gold, instead of the proxy asset (cryptocurrency).

Here are some links that I found useful in this respect.

https://www.bogleheads.org/forum/viewtopic.php?t=113258

https://www.vanguard.com/pdf/s130.pdf

https://personal.vanguard.com/pdf/flgerm.pdf

D.V.

Thank you for your response. I really appreciate you taking the time to explain in such detail. I had similar ideas in my head however wanted to gleam more knowledge from others in this forum and add to my “ability to learn to fish”, as per Cam’s intentions with this blog. Thanks again.

Sincerely,

–Mohit

Mohit, You are welcome. I am still learning to fish.