I just wanted to follow up to yesterday’s post (see Don’t relax yet, the week isn’t over). One of the key developments that I had been watching has been the recent hawkish evolution in Fedspeak. Last night, uber-dove Lael Brainard gave an extraordinarily hawkish speech. She started with the following remarks:

The economy appears to be at a transition. We are closing in on full employment, inflation is moving gradually toward our target, foreign growth is on more solid footing, and risks to the outlook are as close to balanced as they have been in some time. Assuming continued progress, it will likely be appropriate soon to remove additional accommodation, continuing on a gradual path.

As a reminder, Brainard had been the Federal Reserve governor who, if given 10 reasons to raise rates and one reason to wait, she would focus on the single reason as a way of mitigating systemic risk. The last paragraph of her speech concluded, not so much with a discussion of whether to raise rates, but what to do with the Fed’s balance sheet after the rate normalization process had begun:

To conclude, recent developments suggest that the macro economy may be at a transition. With full employment within reach, signs of progress on our inflation mandate, and a favorable shift in the balance of risks at home and abroad, it will likely be appropriate for the Committee to continue gradually removing monetary accommodation. As the federal funds rate continues to move higher toward its expected longer-run level, a transition in balance sheet policy will also be warranted. These transitions in the economy and monetary policy are positive reflections of the fact that the economy is gradually drawing closer to our policy goals. How the Committee should adjust the size and composition of the balance sheet to accomplish its goals and what level the balance sheet should be in normal times are important subjects that I look forward to discussing with my colleagues.

When a dove like Brainard sounds this hawkish, there is little doubt about whether the Fed will raise rates at its March meeting.

What about Buffett’s bullish comments?

In a recent CNBC interview, legendary investor Warren Buffett stated that stocks are on the cheap side, but that assessment would change if rates were to rise:

Billionaire investor Warren Buffett told CNBC on Monday U.S. stock prices are “on the cheap side” with interest rates at current levels…

“We are not in a bubble territory” in the stock market, he said on “Squawk Box.” If rates were to spike, however, then the stock market would be more expensive, he added.

It looks like the Fed is about to raise start a rate hike cycle. So what now?

Isn’t growth rising?

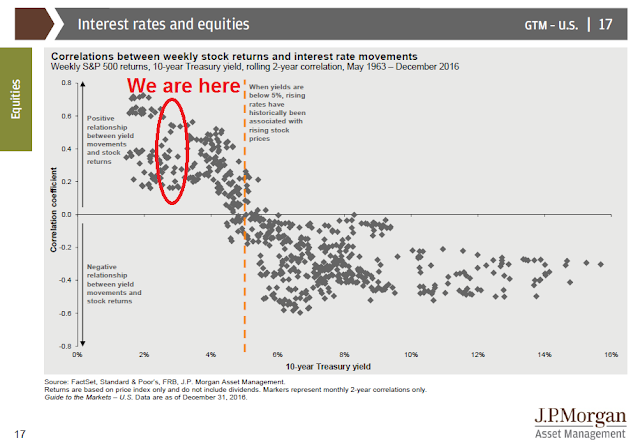

Bulls could be comforted by this historical analysis from JPM Asset Management indicating that when 10-year yields are below 5%, rising rates have meant rising stock prices (annotations in red are mine).

However, that analysis was only applicable because interest rates were historically much higher than they are today. Stock prices rise during the initial phase of a rate hike cycle because the bullish implications of expected higher growth overwhelms the bearish forces of higher rates and lower P/E multiples.

The latest update from Factset shows that a stalling forward 12-month EPS, which is the best normalized indicator of expected earnings growth. Past episodes of flat to falling forward EPS have seen equity markets struggle or correct.

We are seeing a similar message from the bond market. The chart below depicts the 2/10 yield curve. A steepening yield curve is interpreted as the bond market’s expectation of higher economic growth, while a flattening yield curve reflects expectations of slower growth. Growth expectations bottomed out last summer and started rising in conjunction with the global cyclical rebound. However, they have started to flatten in 2017, indicating a slowing growth outlook.

Meanwhile, Barron’s reports that the “smart money” insiders are selling at a torrid pace. Note that the period of heavy insider selling seems to parallel the latest episode of slowing growth expectations. Coincidence?

Does the combination of these conditions look like the start of a bullish thrust to you?

What about price momentum?

I received several comments from some readers that went something like this, “Don’t be an idiot. You’re fighting the (bullish) tape.”

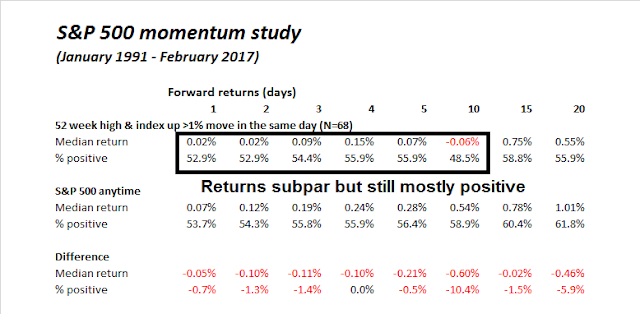

Yesterday (Wednesday) saw the major market indices rise over 1%. As Urban Carmel pointed out, these kinds of momentum thrusts tend to occur at market bottoms, not when the market is making new highs.

I went all the way back to 1990 and looked for instances when the SPX rose 1% or more while making a 52-week high. As the table below shows, the market tended to underperform, but it was not an outright sell signal for traders.

This is a frothy and over-extended market. This combination of a hawkish Fed, a faltering growth outlook, and the overbought momentum are suggestive of an exhaustion top, rather than the start of a bullish momentum thrust.

Disclosure: Long SPXU

The 2s/10s yield curve flattening may be complicated by EU politics. The recent squeeze on Schatz and Bund scarcity due to ECB buying and the optionality of buying bunds were the EU to fail – distorts the long end of the global bond market, coupled with BoJ actions as well. So maybe after the French election we will know the real price of global long ends, assuming Le Pen loses.

The US curve has been flattening but I think the above is certainly part of the reason but how much is as ever hard to tell. It is widely believe economic surprises will start to roll over but we must also remember there is a hell of a lot of stimulus out there, and if banks get deregulated then we may have a Richard Koo moment…..

https://www.youtube.com/watch?v=8YTyJzmiHGk

This is a long piece but essential watching for any macro people.

Did you add to your SPXU position, Cam?

Not yet. Waiting for another bearish break first

A key thing to address is whether this is an intermediate top or a final bull market top. Many strategists are saying this is the final innings of an eight year bull market. Even the ones that aren’t will likely turn to that explanation if the market starts to correct. It will look like a blow-off ending.

But for a full-fledged bear market to hit, I believe leading economic indicators have to turn down. Right now, leading indicators are accelerating not slowing, not just in the U.S. but globally.

My contention has been that the last global bull market ended in spring-2015 and the subsequent bear market ended in February of 2016. So this new bull market is less than a year old. The Trump election plus the Chinese massive 2016 stimulus kicked us into a second leg of the new bull market.

If this scenario is true, any pull-back is not especially dangerous. It also means that upside surprises could still occur.

It also means the level of interest rates in this globally highly indebted world are a key factor in predicting a final peak. So far, the jump in rates has been big but the level is still historically very low.

Wow! Intersting idea of China starting a new leg up. What you have written here is opposite of what Cam is saying.