Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses the trading component of the Trend Model to look for changes in the direction of the main Trend Model signal. A bullish Trend Model signal that gets less bullish is a trading “sell” signal. Conversely, a bearish Trend Model signal that gets less bearish is a trading “buy” signal. The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below. Past trading of the trading model has shown turnover rates of about 200% per month.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Risk-on

- Trading model: Bearish (downgrade)

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers will also receive email notices of any changes in my trading portfolio.

So many questions, so few answers

Regular readers know that I have been calling for a cyclical market top in 2017 (see The roadmap to a 2017 market top). Outside of the risk of permanent loss from war or insurrection, severe bear markets have been mainly associated with economic recessions. My analysis has been based on the likely path of the US economy, and the timing of the next recession.

My base case, call it the “blow-off top” scenario, goes something like this:

- The economy, which is in the late stages of an expansion, starts to overheat.

- Investors and traders get enthusiastic about growth and bid stock prices up to unrealistic levels (hence the “blow-off”)

- The Fed responds by raising rates to cool off the economy, but find it’s behind the curve…

- Which results in a recession and bear market.

The blow-off top scenario would see the SPX reach the 2500-2600 level this year as it tops out.

I have been considering an alternative, call it the “wimpy top” scenario, where the market may have topped out already.

- The economy, which is in the late stages of an expansion, starts to overheat.

- Investors and traders get enthusiastic about the prospects for cuts cuts and deregulation under the Trump tax reform plan, which is what has happened so far.

- Tax reform gets tied up in Congress and gets delayed until 2018.

- Trump appoints hawks to the Federal Reserve board (now there are three vacancies with the resignation of Daniel Tarullo).

- The new Trump appointed Fed governors, composed of hard-money advocates, becomes more aggressive, tightens monetary policy, and pushes the economy into recession.

- An equity bear market is the result.

The wimpy top scenario is based on a double whammy of fiscal policy disappointment and a pivot to a more hawkish Fed policy. In that case, Current stock index price levels are roughly as good as they get.

The key differences between the two scenarios are the likely path of fiscal and monetary policy. Those are the big questions to which we have no answers. This week, I explain the risks and offer some suggestions of how to watch which scenario is the more likely one to unfold.

Geopolitical tail-risk

The risk of permanent loss from war or insurrection is the greatest toxic risk to an equity portfolio. The most likely potential US conflicts are with China, Iran, and North Korea. Reports such as this one from USA Today that indicated that Trump advisor Steve Bannon believes that the America and the western world are engaged in a war of civilizations against Islam, as well as the inevitability of war in the South China Sea are likely to spook markets.

Relax! Peter Lee (@chinahand on Twitter) reported that SecDef James Mattis signaled that the Trump administration is walking back much of its tough talk on China, North Korea, and Iran (use this link if the video is unavailable). At a minimum, any shooting war is unlikely in 2017.

There are also other hopeful signs that of a Sino-American thaw. Bloomberg reported that China has reached out the Trump administration through the Jared Kushner-Ivanka Trump back channel. Trump also sent a letter to Xi Jingping seeking “a constructive relationship” (via Bloomberg). What’s more, Trump told Xi in a phone call that the US would honor the “one-China policy”.

Tensions are being defused. The risk of war is off the table, at least for now.

A late cycle expansion

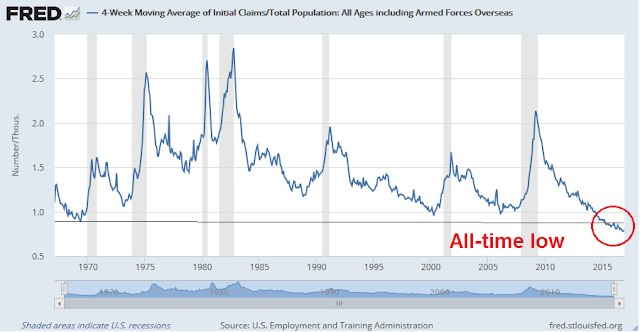

The economy is in the late stages of an economic expansion. The chart below depicts the latest initial jobless claims data normalized by population is at an all-time low. Further fiscal stimulus is likely to spark a round of wage driven cost-push inflation that forces the Fed to raise rates faster than market expectations.

The combination of a late cycle expansion that is starting to overhead, and rising interest rates from Fed policy are the key ingredients of a classical market top.

Doubts over Trump

I have also detected a rising level of anxiety over the Trump administration and the post election Trump rally. One prominent example was the New York Times profile of the legendary value investor, Seth Klarman:

In his letter, Mr. Klarman sets forth a countervailing view to the euphoria that has buoyed the stock market since Mr. Trump took office, describing “perilously high valuations.”

“Exuberant investors have focused on the potential benefits of stimulative tax cuts, while mostly ignoring the risks from America-first protectionism and the erection of new trade barriers,” he wrote.

“President Trump may be able to temporarily hold off the sweep of automation and globalization by cajoling companies to keep jobs at home, but bolstering inefficient and uncompetitive enterprises is likely to only temporarily stave off market forces,” he continued. “While they might be popular, the reason the U.S. long ago abandoned protectionist trade policies is because they not only don’t work, they actually leave society worse off.”

In particular, Mr. Klarman appears to believe that investors have become hypnotized by all the talk of pro-growth policies, without considering the full ramifications. He worries, for example, that Mr. Trump’s stimulus efforts “could prove quite inflationary, which would likely shock investors.”

These worries are nothing new, but concerns over protectionism, and the inflationary effects of fiscal policy are becoming more visible. Business Insider also outlined the reservations over Donald Trump voiced by well-known investors and analysts such as Ray Dalio, Nouriel Roubini, David Einhorn, and several others.

Don`t count Trump out

I would caution any Trump opponents and Never Trumpers not to allow their politics to get in the way of their investing. Even Paul Krugman, who styles himself as the “conscience of a liberal”, had a warning for investors who might be getting overly bearish.

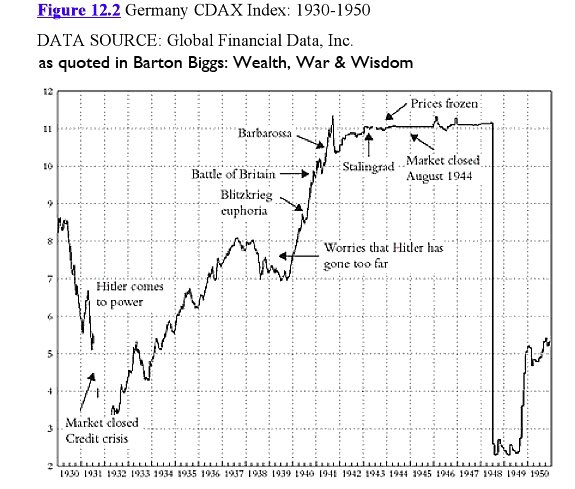

Supposing that you thought that Donald Trump is destined to be another Adolf Hitler (not a view that I endorse), the historical record shows that the DAX actually performed well under much of Hitler’s reign. Investors just had to watch for the bearish trigger and to get out at the right time.

Tax reform: Bullish or bearish?

Even if we were to eliminate the tail-risk of a shooting war, investors need to consider a number of factors before taking either a bullish or bearish outlook on stocks.

Consider, for example, Trump’s headline program of tax cuts and tax reform. The economic effects of Trump’s proposed tax reform proposals are highly inter-connected and their effects are multi-dimensional. It is therefore difficult to forecast their effects without knowing all the program specifics.

Here is the bull case. Brian Gilmartin highlighted analysis from BCA and BAML which indicated that the combination of a Border Adjustment Tax and offshore cash repatriation would add roughly 10% to SP 500 earnings. Marketwatch reported that JPM’s estimates of BAT would add 6% to earnings, everything else being equal.

The key phrase here is “everything else being equal”. But everything else isn’t equal.

The bear case can be observed from the macro analysis from Barclay’s estimated fiscal effects of a likely tax reform package (via Sam Ro). Sure, there will be significant stimulus in the form of tax cuts, but most of it will be paid for by a Border Adjustment Tax. If enacted, the sheer size of the BAT indicates that these measures are hugely protectionist. Not would it bring the multi-decade globalization trend to a halt, it would play havoc with the global supply chains of American multi-nationals and likely devastate their operating margins. While brokerage firm analysts have modeled the first order effects of BAT, I have not seen anyone model those second and third order effects of protectionism and likely trade war.

Watch for the details of how the tax reform proposals might evolve. We will no doubt see lots of negotiations within the Republican Party before this process is complete.

What Wall Street wants

The reaction from Wall Street to the rising level of uncertainty is instructive. As an example, Goldman Sachs has become more cautious about the how the market has priced in Trump’s proposed tax cuts and deregulation (via CNBC):

In a note to clients on Friday, the investment bank noted President Donald Trump’s agenda was already running into bipartisan political resistance, with doubts growing about potential tax reform and a repeal of the Affordable Care Act, among other marquee Trump administration initiatives.

Just two weeks into his tenure, “risks are less positively tilted than they appeared shortly after the election ,” Goldman wrote. Growing resistance to Trump’s executive orders on immigration and financial reform has galvanized opposition while dividing members of the president’s own Republican Party.

In effect, Wall Street is asking Washington, “Where are my tax cuts?” Barry Ritholz wrote that, in order to succeed, Trump needs to focus on his economic agenda:

The disastrous roll out of President Donald Trump’s clampdown on refugees and visitors from majority-Muslim countries wasn’t how his supporters were expecting his administration to begin. While it was a cornerstone of his election campaign, it was poorly thought out, with little consideration given to the inevitable legal challenges, protests and political backlash.

If this seems somewhat familiar, you need only recall President Barack Obama’s disastrous launch of the Affordable Care Act, a piece of legislation the administration strained to get through Congress. The website was unusable and crashed constantly, and was widely recognized as a costly and avoidable error. It was obvious that the people in charge hadn’t thought this through and failed to stress test the site. It tarnished perceptions of both the program and the administration’s cherished reputation for competence…

By failing to act boldly on financial reform, the Obama team allowed a smoldering resentment to take hold and build among the public. The massive taxpayer wealth transfer to bankers who should have lost their jobs sowed the seeds of the backlash that fueled the rise of the Tea Party, and led to the huge electoral losses for the Democratic Party and Trump’s November victory.

Fast forward to 2017. It looks as if Trump is making a similar error by focusing on immigration first — and in an ill-considered and misguided way — instead of making tax reform his biggest priority.

Edward Harrison echoed Ritholz’s remarks and he believes that Trump is likely to fail in his first term if he stays a “cultural warrior”:

Early on in President Trump’s new administration, too much of his energy is being placed on divisive ‘cultural’ issues and not enough attention is being paid to economic policies. To the degree Trump has turned to the economy, much of his policy has been focused on issues that will not yield long-term economic benefits but contain considerable risk, like trade with Mexico and China. And so, while Donald Trump is only a few weeks into his presidency, I think we can begin to take stock of what his presidency will mean for the US economy…

“A successful Trump who keeps his campaign promises would work with McConnell, Ryan, Sanders, and Pelosi to get an infrastructure bill through Congress. Meanwhile he would force US allies to increase their military spending and purchase of US weaponry while the US pares back its own defense spending. And finally, a successful Trump would cut the FICA tax that supposedly ‘funds’ social security, something that is both a cost for employers and for employees and therefore a highly regressive tax. Cutting business taxes or lowering the top tax bracket won’t get that job done. But those kinds of tax cuts will increase income inequality…

“A failed Trump who bought lock, stock and barrel into Republican orthodoxy would go back on his pledge to leave social security and medicare alone and focus on privatizing or cutting social security as a way of lowering the deficit. And he would focus on killing TTIP and TPP or extracting the US from NAFTA. You could make ideological arguments on these issues after robust growth and lower broad unemployment have returned. But, by then we would see whether economic and job growth had changed the path of debt and deficits and unemployment demonstrably. Moreover, none of these goals would immediately stimulate growth in the short term. They could mean recession and doom his presidency, if they became his signature economic goals.”

The latest political developments yield a mixed picture. On one hand, Reuters reported that Trump promised a “tremendous tax plan” in the next 2-3 weeks. On the other hand, the WSJ reported that Trump downgraded the position of chair of the Council of Economic Advisers (CEA) as he won’t be part of the cabinet. This development is a worrisome sign over the medium term for the health of the economy.

Assume a Clinton presidency

What if there is no Trump tax reform, or the legislation gets stalled until 2018? CNBC reported that Goldman Sachs had fretted about the possibility that Trump’s tax reform package might get stalled in Congress:

In a note to clients on Friday, the investment bank noted President Donald Trump’s agenda was already running into bipartisan political resistance, with doubts growing about potential tax reform and a repeal of the Affordable Care Act, among other marquee Trump administration initiatives…

“While bipartisan cooperation looked possible on some issues following the election, the political environment appears to be as polarized as ever, suggesting that issues that require bipartisan support may be difficult to address,” the bank added.

The balance of risks “are less positively tilted than they appeared shortly after the election,” Goldman said, which may blunt the force of future growth.

Amid reports that top GOP members are reportedly becoming nervous about the impact of a full-fledged repeal of health care, that political pushback “does not bode well for reaching a quick agreement on tax reform or infrastructure funding, and reinforces our view that a fiscal boost, if it happens, is mostly a 2018 story.”

To model the effects of a stalled tax reform plan, imagine that the status quo candidate, Hillary Clinton, had won the election. The world would still have undergone a global reflationary recovery, which was in place regardless of who had won. Market fundamentals on a backward looking basis would not be very different today in a Clinton victory scenario.

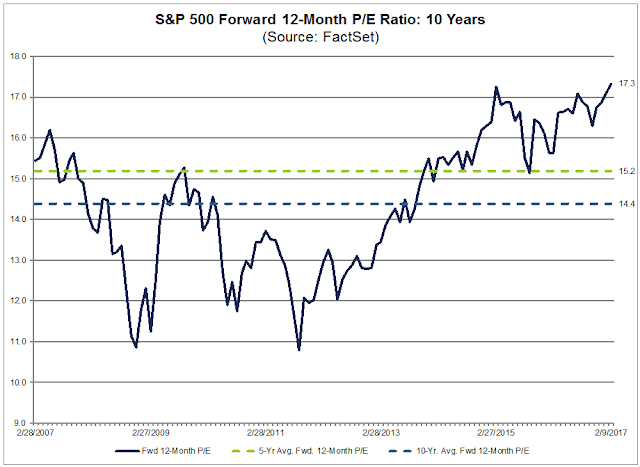

We observe today`s market’s forward P/E ratio from Factset is 17.3, which is quite elevated when compared to its own history. US equities would be regarded as expensive, especially in light of the lack of the promise of tax cuts and deregulation in the near future. Deflate prices by about 12%, and valuations fall to its 5-year historical average.

Now return from your alternative universe of a Clinton victory to today’s Trump presidency, should you freak out about a correction potential of about 12% if tax reform is delayed by a year? In all likelihood, the decline would be less as the market will still look ahead to the potential benefits from future tax cuts.

Changes at the Fed?

Friday’s news of the resignation of Fed governor Daniel Tarullo was a surprise. There are now three vacant seats on the Fed board, which gives the Trump administration an opening to dramatically shape the course of monetary policy.

Here is the big question: Who will Donald Trump appoint? Will the low interest loving Trump seek out doves to accommodate his expansionary fiscal policy, or will he stick with Republican supply-side orthodoxy and appoint hard-money hawks? Names like John Taylor and Kevin Warsh have been floated as possible future Fed chairs to replace Janet Yellen. If so, then watch for their names to be appointed to the board as a first step. Both Taylor and Warsh can be considered to be more hawkish than Yellen.

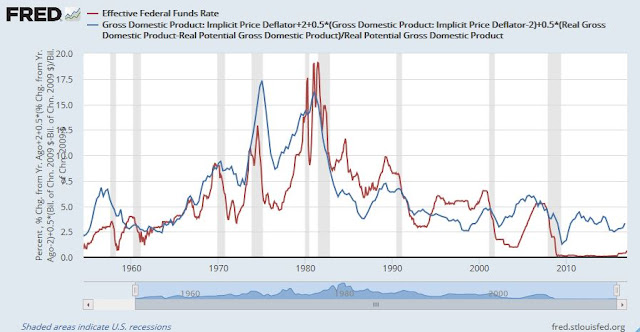

To illustrate my point about Taylor, here is a chart of the interest rates under the Taylor Rule, proposed by John Taylor. Taylor has been an advocate of a rules based approach to setting monetary policy. Taylor Rule rate assumptions are based on a 2% real rate and 2% target rate. As the chart shows, the target rate is considerably higher than current Fed Funds rate, which imply a tighter monetary policy under a Taylor Fed.

Kevin Warsh was a hawk when he was a Fed governor. In a speech he made on September 25, 2009, about a year after the Lehman collapse, he made it clear that he was itching to tighten monetary policy.

Ultimately, when the decision is made to remove policy accommodation further, prudent risk management may prescribe that it be accomplished with greater swiftness than is modern central bank custom. The Federal Reserve acted preemptively in providing monetary stimulus, especially in early 2008 when the economy appeared on an uneven, uncertain trajectory. If the economy were to turn up smartly and durably, policy might need to be unwound with the resolve equal to that in the accommodation phase. That is, the speed and force of the action ahead may bear some corresponding symmetry to the path that preceded it. Of course, if the economy remains mired in weak economic conditions, and inflation and inflation expectation measures are firmly anchored, then policy could remain highly accommodative…

In my view, if policymakers insist on waiting until the level of real activity has plainly and substantially returned to normal–and the economy has returned to self-sustaining trend growth–they will almost certainly have waited too long. A complication is the large volume of banking system reserves created by the nontraditional policy responses. There is a risk, of much debated magnitude, that the unusually high level of reserves, along with substantial liquid assets of the banking system, could fuel an unanticipated, excessive surge in lending. Predicting the conversion of excess reserves into credit is more difficult to judge due to the changes in the credit channel.

Here is what’s at stake. The chart below shows the US federal debt, which has exploded in the past decade.

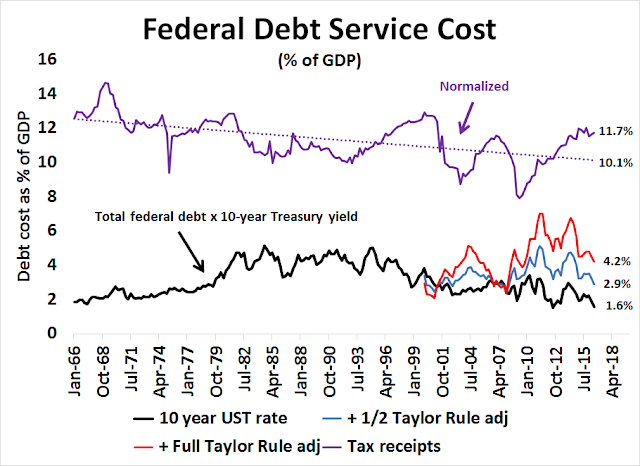

How will the federal budget handle those payments if interest rates were to rise? In the chart below, debt service is estimated as the total debt times the 10-year Treasury yield as an approximation (black line). To estimate the impact of a tighter monetary policy, I added the differential between the Taylor Rule rate and the Fed Funds rate (see above chart) to the 10-year rate. I assumed that rates either rise by one-half of the differential (blue line), or the full differential (red line). For added perspective, the purple line shows total tax receipts as a percentage of GDP. If we were to accept the Republican supply-side orthodoxy that tax rates are too high, the dotted line represents the linear regression of tax receipts, which I defined as “normalized” tax receipts. (All data was downloaded from FRED, calculations are mine).

As the above chart shows, if rates were to rise to even half of the Taylor Rule adjustment, debt service costs would surge dramatically. A full Taylor Rule adjustment would raise debt service charges to 2.6 times the current rate. The federal deficit would explode in the absence of offsetting revenues.

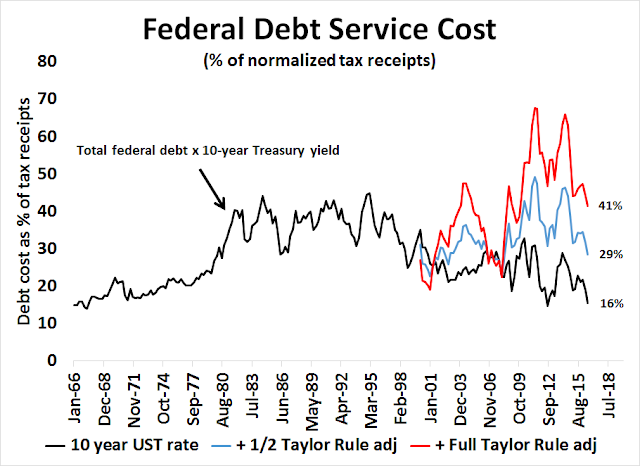

The chart below depicts debt service costs as a percentage of normalized federal tax receipts (dotted line in the previous chart). If rates were to rise to between 50% and 100% of the Taylor Rule adjustment, debt service costs would become 30-40% of total tax revenues. Yikes!

I recognize that there are a number mitigating factors to this study. Firstly, interest rates would not adjust immediately and rise to a Taylor Rule rate, but would occur over a longer period. As well, tax revenues could increase under the Trump fiscal stimulus plan because of increased tax receipts from better economic growth. On the other hand, the history of Republican tax cuts have not turned out to be revenue neutral but ballooned the debt (see total debt chart above).

In summary, a hawkish pivot of Federal Reserve monetary policy would result in a surging federal deficit, and make a 2018 recession a virtual certainty. I am not sure if Trump fully grasps the implications of his Fed appointments just yet. His actions to downgrade the chair of CEA from a cabinet post indicates that he has little respect for economists. Has anyone pulled him aside and explained the implications of Fed governor appointments? If he opts to steer the Fed toward a dovish course, can he find enough governors who are as dovish as the current board?

Watch this space!

Where we stand today

I wrote at the beginning of this post that there are more questions than answers. The market faces a number of key policy uncertainties. What is this “tremendous tax plan” that Trump promised, and will it pass muster with the deficit hawks in the Republican caucus?

Who will he appoint to the board of the Federal Reserve? So far, none of the three vacant posts at the CEA have been filled. Even some CEA appointments could give some hint as to possible policy direction.

So many questions, so few answers.

Here is what I am watching. First, the direction of fiscal policy by way of the reception of the Trump team’s tax reform proposals is important. Equally important, but more ignored, are hints about who might be appointed to the Fed board.

Fortunately, the probability of a recession in 2017 is low to nonexistent. On the other hand, a recession in 2018 is still an open question. New Deal democrat is starting to see a few dark clouds on the horizon in his monitor of high frequency economic indicators, and that’s before all of the possible policy effects that I discussed:

The interest rate components of the long leading indicators have improved enough to be neutral. The yield curve and money supply remain positive (but with the positivity in real M2 decelerating). Purchase mortgage applications are neutral. Refinance mortgage applications remain quite negative. The important change this week is that growth in real estate loans has decelerated enough to turn from positive to neutral…

While the shorter term 6 month forecast remains strongly positive (barring a trade war), The 12 month + forecast is shading even more neutral to negative, with money supply, the yield curve, and spreads being the remaining positives.

The markets are forward looking discounting machines. Market trends can therefore provide clues as to whether the cyclical top is in. My approach of applying trend following techniques to a variety of asset classes across different geographic regions gives a holistic picture of global macro conditions, as well as investor risk appetite. To be sure, trend following models are always late and they will never get you out at the exact top. They are, however, designed to avoid the worst of any bear market and allow investors to take appropriate action to protect themselves.

Still, I am hopeful that the market will follow the blow-off top path. The wimpy top scenario just doesn’t “feel right”. While every market cycle is different, we are not seeing the kind of investor and trader giddiness that accompanies a typical cyclical top. The more likely scenario calls for a benign resolution of these tax reform proposals, followed by a rally where market participants pile into stocks and move into a crowded long position on risky assets. That’s when I will signal “sell” and be derided for being an idiot, a Never Trumper, or something worse.

Near-term risks

In the interim, the market faces a number of near-term risks. The uncertainty over the tax reform proposals and the risk of rising protectionism are factors that will spook the markets.

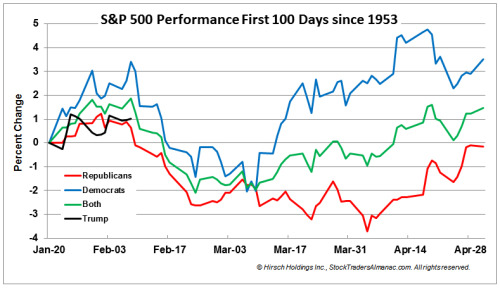

In addition, Jeff Hirsch at Almanac Trader observed that we are entering the most bearish part of the first 100 days of a new presidential administration. In particular, Republican presidents have had a tougher time that Democrats.

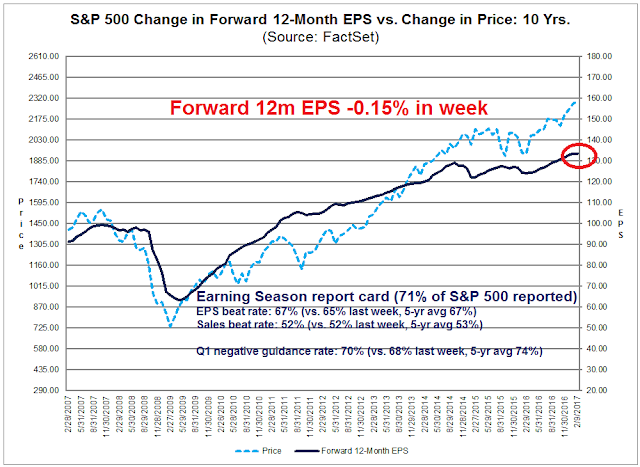

The latest update from John Butters of Factset shows that Wall Street is pulling back on the earnings growth outlook. While earnings and sales beat rates for Q4 are roughly in line with historical averages, the negative guidance rate edged up from last week. More importantly, forward 12-month EPS deflated by 0.12% in the week. These are all signs for traders and investors to brace for some near-term turbulence.

Another warning comes from a combination of mild overvaluation and insider activity. The charts below shows a mild overvaluation of stock prices of 3%, from Morningstar’s fair value estimate, and several weeks of consistent insider selling (via Barron’s). Under these conditions, stock prices are likely to face headwinds until the details of the fiscal stimulus proposals are not clear.

Still, there is no reason to panic. All of these factors are only mildly bearish. They can be resolved with a shallow pullback. Bear markets are caused by either by growth disappointments or rising interest rates. Unless we see evidence of full scale protectionism, or if the Fed stomps on the monetary brakes, the equity outlook remains benign.

So don’t freak out.

The week ahead: Brace for turbulence

Looking to the week ahead, I stand by my tactically bearish trading view in my last post (see What’s wrong with the VIX?). Even though major market averages all achieved all-time highs on Friday, the move may be interpreted as exhaustive.

The lack of confirmation of the new high by the junk bond market is worrisome from a cross-asset basis, as junk bonds is a key metric of the market’s risk appetite.

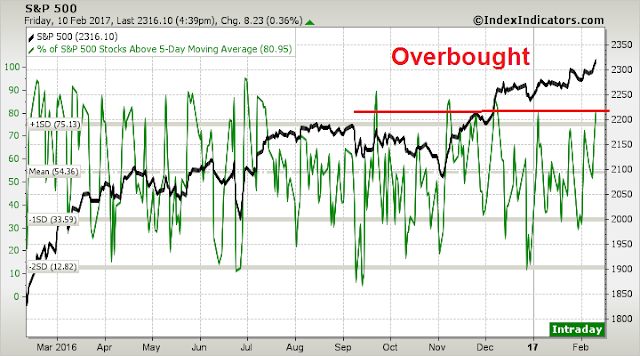

This Index Indicators chart of stocks above their 5 dma (1-2 day time horizon) is flashing an overbought reading, which suggests that a near-term pause is in order.

This Index Indicators chart of net 20 day highs-lows (1-2 week time horizon) is showing a near overbought reading, indicating that upside potential is limited at current levels.

My inner investor remains bullish on equities. He is unlikely to turn bearish in the absence of a recession warning, which is not present, or significant technical deterioration in the major market indices.

My inner trader moved to cash last week. Even though the trading model flashed a “sell” signal, it is not a high conviction call. He is therefore staying on the sidelines for now.

“The more likely scenario calls for a benign resolution of these tax reform proposals, followed by a rally where market participants pile into stocks and move into a crowded long position on risky assets. That’s when I will signal “sell” and be derided for being an idiot, a Never Trumper, or something worse.”

….very true, Cam. I still remember the general reception your http://humblestudentofthemarkets.blogspot.co.nz/2015/05/why-i-am-bearish-and-what-would-change.html post got back in May 2015….it was straight out of the fable of the emperor and his new clothes! 😉

“The wimpy top scenario just doesn’t “feel right”.” Agreed, but perhaps it’s that this time is *really* different. I mean, who was the last President who threatened to start an all-out trade war? Which administration was comparably unpredictable? It’s risky to use a conventional heuristic in unconventional times.