This is the second in an occasional series of posts on how to build a robust investment process. Part 1 was addressed to the individual investor and trader (see The ways your trading system could lead you astray). This posts explores the issues that face the professional and institutional investor.

I had illustrated in the past why managers closet index. That`s because even a single misstep in an individual position could sink portfolio performance (see How Valeant revealed the dirty little secret of fund management). In this post, I would like to focus on how style and factor exposures affect business risk.

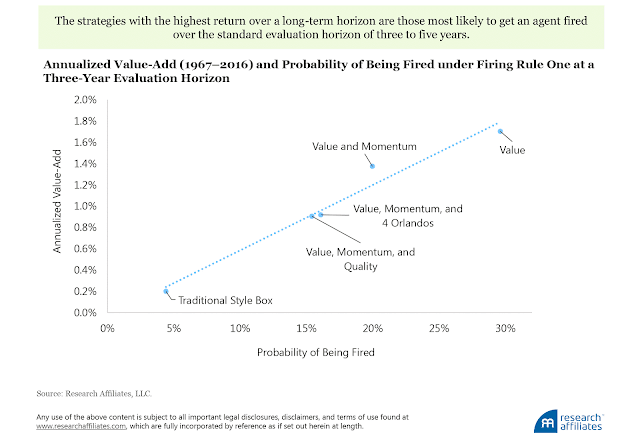

I recently came upon a study by Research Associates, which showed the tradeoffs between investment returns and business risk. The authors modeled a series of hypothetical portfolios with different styles, namely value, growth, momentum, quality, and random selection, which they called the “4 Orlandos”, for the period 1967-2016. As it turns out, the styles that showed the best performance also had the highest chance of getting a manager fired.

The termination criteria for a manager (which they called an “agent”) is detailed below and roughly reflects the patience level of institutional sponsors:

We select two highly stylized rules for a hypothetical investment board to use in evaluating the agent’s performance:

1) Fire the agent if more than 50% of funds selected by the agent underperform the benchmark in a given period.

2) Fire the agent if the equally weighted portfolio aggregated from the selected funds underperforms the benchmark by more than 1%.

In the light of these results, the big question for institutional investors is, “We all want good performance, but how far do you want to stick your neck out?”

When should you fire a manager?

Imagine that you are a hypothetical board member of a pension or endowment fund. You are reviewing the performance of a value manager, which is shown in the chart below. As the top panel of the chart shows, the manager underperformed the index for three years since 2009 and returns have been roughly flat ever since. Is there any reason to be patient with this manager? The initial knee-jerk reaction to this analysis is the board has been far too patient with this manager and it’s time for a new one.

The manager’s name is Warren Buffett.

The bottom panel of the chart shows a better picture, as Buffett has been steadily beating his style benchmark, the Russell 1000 Value Index. Nevertheless, the bottom chart begs the question of whether the board should be patient with this particular investment style.

Your pain threshold isn’t your client’s pain threshold

Take the example of the value manager. According to the Research Associates study, long-term returns have been stellar over the study period, but the manager is taking a 30% chance of getting fired over any single three-year horizon. I have met a number of dyed-in-the-wool managers of various styles who steadfastly refuses to change their stripes, arguing that “our clients hire us for style X”. But time horizons are shortening very quickly in this business, and the investment risks that the manager takes in his portfolio may not be compatible with the goal of business survivability.

In other words, your pain threshold is different from your client’s pain threshold. A CIO may choose to construct a portfolio with certain style and factor tilts in order to maximize the returns to his style and investment approach, but he also has a responsibility to the employees of the firm. Do the employees want to take the same level of business risks that the CIO wants to take? During the difficult periods of performance, the firm may have to downsize and people will lose their jobs (as an example, see Grantham’s GMO cuts 10% of workforce as assets shrink). Are the employees’ pain thresholds the same as the CIO’s?

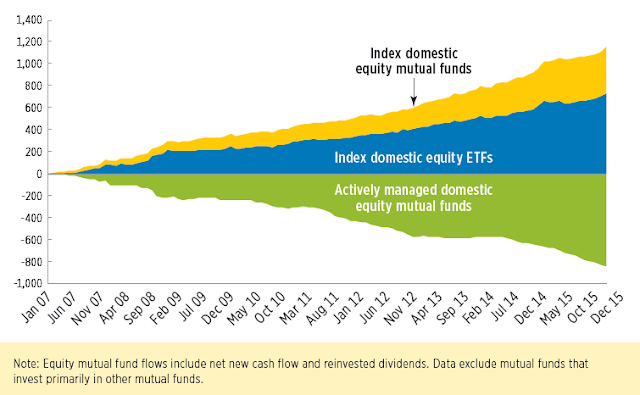

The rush into passive funds

In addition, the investment industry faces a challenge as investors re-allocate their cash flows into index funds and ETFs. This chart from the Investment Company Institute’s 2016 Investment Company Fact Book tells the story.

This trend of a wholesale re-allocation from active to passive funds raises a few questions, with my thoughts in brackets:

- Much of the allocations are based on robo, or robo-like algorithms. Will investors be disciplined enough to buy back into equities in the next bear market? [Knowing human nature, probably not]

- If not, then will the next bear market be the acid test for active management? [Best guess: Yes]

- If your answer to the above question is “yes”, will you survive long enough in the profession to see that turn?

Controlling business risk

Investment fads go in cycles. There is no doubt that if you have the combination of a successful investment discipline and enough patience from investors, you will prosper as an investment professional.

Stop me if you’ve heard a story like this. In my youth, I met a successful investment manager. Let’s call him M. M began working as a trust officer, and over the course of time, cultivated a lot of relationships and gathered many clients. He eventually struck out on his own and founded his own investment firm. Returns were good, and success followed. When I met him, M was the “it” manager and assets were rushing in the door as people clamored to become his clients. Then events started to spiral downwards. M made a big bet on the bond market and performance suffered. He was so sure of his conviction that he doubled down on his exposure. It didn’t work. Clients left and the firm eventually shut its doors. A number of years later, I spoke to one of his former partners who ruefully told me, “Our biggest mistake was we were out past the 90th percentile in bond allocation when compared to the SEI median”.

In other words, M showed the courage of his conviction and the firm went over a cliff. For us mortals not named Buffett, we have to manage business risk in order to survive into the next cycle.

There are a number of ways that I can suggest to control business risk and enhance returns, all without changing your alpha generation secret sauce:

- Set an investment benchmark that reflects your business risk: For example, if you are a manager of a certain style that is also evaluated against the market benchmark, why not set your neutral weight between your median competitor’s weight and the market benchmark weight? That way, you will beat either your competitor or the market.

- Distill and control your bets: Identify what you are good at and maximize your intended bets to a specified risk level. Then minimize or eliminate your unintended bets.

- Optimize your trading to fit your style: Trading is often relegated as an afterthought in many investment firms, but it is an essential part of the investment process. Optimize the way you trade based on the reasons why you are trading. Sample reasons include alpha generation (information trading), risk control and cash re-allocation (information-less trading). Treat each trade differently. The spread between a top quartile and median manager for a large cap US equity mandate over a 10-year time horizon comes to about 1%. A good trading desk that can squeeze 50bp out of trading can mean the difference between below median and above median performance.

- Portfolio implementation and shortfall analysis: I find that an organization learns the most when it encounters subpar performance. That’s when the investment team pores over its analytics and finds the places where it fell short.

- Process integration: Ask yourself if all parts of the investment process work together like a well-engineered Deming Process, or did they clash with each other? Did the portfolio construction process undo many of the intended bets that came out of alpha generation? Was the trading desk not properly incentivized, or did it mis-understand the reasons for trading and left performance on the table?

This is just a basic outline, but it should be enough to get anyone started.

For anyone who is interested, I am also part of a consulting practice that conducts investment process tuneups that optimizes investment performance without any changes in the formulation of the “secret alpha generation sauce”. We also offer other services, such as estimating the macro exposure of your competitors in real-time so that managers can better control the business risks in their portfolios. For more information, please contact Ed Pennock at Pennock Idea Hub.

My two cents worth on why style managers are too dumb to avoid getting fired and how they can change and keep their specialized expertise in full view and not hidden by indexing and have superior returns in all types of style markets.

Envision a world out there in the universe like earth where farmers simply planted seeds every month of the year, all four seasons. They harvested when plants matured and did relatively well. Crops were wonderful in fall months in the northern hemisphere and in February to April in the southern.

An earth spaceship lands and shows them that they should not plant when it’s freezing but wait for warmer weather when the seeds will sprout. They change and have a merry Christmas.

This is the problem with style managers. They do the same thing day in and day out. They haven’t researched when their style does well and when it doesn’t and acted accordingly. They plant seeds in the winter because long term research has shown if you plant their type of style seeds every month for fifty years you will make a decent rate of return.

I am a momentum investor. Research has proven that if I plant momentum seeds every month for my career, I will outperform the market. But there are big periods of time when it underperforms and ‘been there done that’ I did get fired by some clients during some of them. I studied to find why. Now finding why could mean one of two things. First, it could mean finding why the clients were inpatient and fired me. This could lead to cloaking devices as mentioned above to not frustrate them to leave. Second, it could mean why the momentum strategy had periods of underperformance and NOT USE IT WHEN YOUR RESEARCH HAS DISCOVERED IT SUCKS. That way you keep your client and your job and you produce great results in all style markets.

Let me share my momentum style discoveries which I outline in a new book I just finished writing on the subject. Momentum works most of the time but doesn’t in two periods.

First period of underperformance: After a bear market, for about a year, the underperforming stocks that have gone down the most, recover the most. For example, Exxon goes down 15% when junior oil company Gunslinger Oil falls 80%. When the bear market ends, Exxon goes up 10% and Gunslinger doubles. So as the crap that went down too far in the panic recovers more than the good stuff that was outperforming during the bear, Result – momentum underperforms hugely, until the world is orderly again, about a year from my research. One must stop using momentum at the BIRTHING of the new bull market. You would be a total psychic genius at that point if you bought the cheap crap that will soar but that is too much to ask. You are not schizophrenic. You have one investing personality. That is where the value guys start looking good buying those cheap diamonds in the rough. Momentum investors should simply buy the index for the first year after a bear until momentum starts to work again.

Second Period of underperformance: When the stock market in general (dot com boom) or a sector (biotech in 2015) reaches bubble territory after being a momentum darling for a long time, the following crash has momentum licking very big wounds until sanity prevails again.

I have researched these bad momentum periods and learned how to avoid them. I plant seeds in the spring. Value investors should research their discipline the same way. My hint would be to check if a value stock is being disrupted by the digital revolution to where it won’t revert to a previous norm, read Walmart

PS I discovered a third period of momentum underperformance with the Trump Election. When a new, huge surprise event happens like the surprise election result, buy the previously underperforming groups that are favored by the event. If you wait for the mathematics of momentum to have those favored things outperform, you won’t own them for the first dynamic up-leg. It will take you months to get on board and have to pay high prices. So treat this type of great event like the end of a bear market and buy in the ‘BIRTHING’ of a new momentum trend. I did this in the first couple of days and my clients are owning the Trump winners. Other momentum portfolio managers are going to get scolded for owning utilities and defensives in the fourth quarter and maybe get fired.

Ken if you’ve written a book, I’d like to read it.

Absolutely Amy

Let us know when it’s out, Ken, please.