Mid-week market update: With stock prices pulling back to test its technical breakout to record highs, it is perhaps appropriate to watch other asset classes for clues to equity market direction, especially on a day when the FOMC made its monetary policy announcement.

From a cross-asset perspective, there is much riding on the direction of the USD. As the chart below shows, the USD Index has weakened after making a high in December. It is now testing a key support zone, as well as a Fibonacci retracement level. Despite the pullback, the uptrend remains intact.

The other panels of the chart shows the UST 2-year yield and its rolling 52-week correlation with the USD. As well, I show the price of gold and its rolling correlation to the USD. The correlation charts show that the relationship between the USD and these two assets have been remarkably stable. The USD has been positively correlated to interest rates, as measured by the 2-year UST yield, and inversely correlated to gold prices.

As well, please be reminded that gold and equity prices have recently shown a negative correlation. In the past few months, stock prices have risen when gold fell, and vice versa.

With these cross-asset, or inter-market, relationships in mind, what happened to the USD in the wake of the Fed announcement?

Nothing. Sure, the greenback weakened a bit in response to the FOMC decision, but soon bounced back. The same could be said of interest rates, and stock prices.

That leaves investors and traders waiting for a decisive break for clues to stock market direction. Equities are mildly oversold, but my metrics of risk appetite remains in an uptrend. I am inclined to give the bull case the benefit of the doubt, but with reservations.

A mildly oversold condition

Regular readers know that I watch the VIX Index closely for clues of short-term market direction. As the chart below shows, past instances when the VIX Index has risen above its upper Bollinger Band (blue lines) have been reasonably good buy signals. Interestingly, the opposite condition, when the VIX has fallen below its lower BB (red lines), have been less useful as sell signals (see my past comment about asymmetric signals in How your trading model could lead you astray). The market got close to a buy signal on this indicator on Tuesday when it traded above its upper BB, but did not close there.

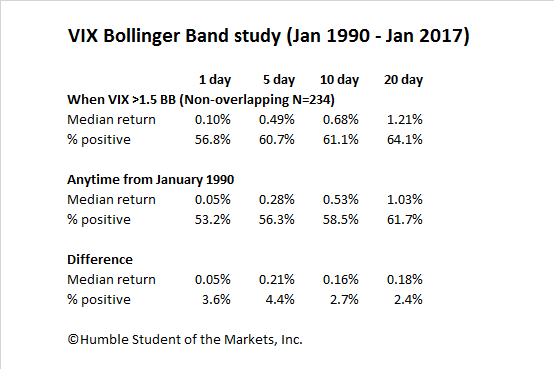

I conducted a study of this signal going back to 1990 shows that the market tends to see an oversold bounce under these conditions.

Even relaxing the rule to the VIX rising above 1.5 standard deviations, instead of the usual 2 standard deviations in BB analysis, showed positive results. Call this a mild oversold condition, which is what happened on Tuesday.

Indeed, analysis from Index Indicators confirm my assessment of the market’s mild oversold condition. This chart of stocks above their 5 day moving average (1-2 day time horizon) shows a mild oversold reading, with the caveat that oversold markets can get more oversold.

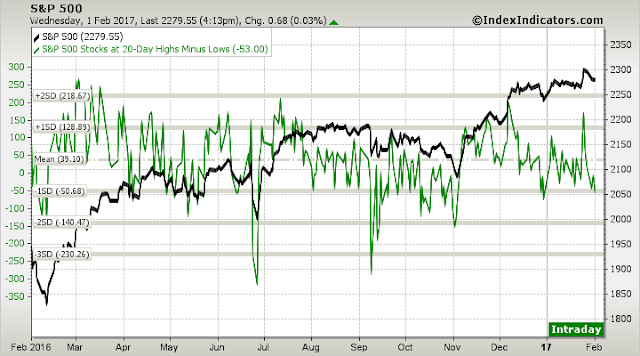

This chart of net 20-day highs-lows, which is a trading indicator with a 1-2 week time horizon, also shows a mild oversold condition where stock prices have bounced in the past.

In addition, measures of risk aversion shows that their uptrends remain intact.

In conclusion, the SPX mildly oversold, risk appetite still bullish, and testing a key support zone centered at 2270. I am therefore inclined to give the bull case the benefit of the doubt.

However, my inner trader will be carefully watching these bearish tripwires over the next few days.

Disclosure: Long SPXL

Here is an interesting chart. It shows the U.S. Utility Index. Sentimentrader.com notes that in the past when the index trades between the 200 day moving average and the 50 day for a while like now, when it breaks up or down the bond market follows suit. It almost broke out on the upside but failed. If it breaks to the downside bonds are heading lower (rates higher).

https://product.datastream.com/dscharting/gateway.aspx?guid=969dea3f-98e2-4b57-a2a1-9a91df95a26c&action=REFRESH

I read recently how certain bond indexes we negative YOY for the first time in a very long time. That is a very negative sign. They got crushed in the last quarter of 2016.

Higher rates can kill any bull market in stocks.

I expect people are expecting the Tea Party in Congress to limit Trump spending and tax cuts if the budget deficit explodes a a result. But if the appear to be willing to go along, the bond market could take a tumble.

A key to watch.

Note the Treasury 20 Bond ETF chart is also on the link.

A few observations:

1. Victor Sperandeo (Aka Trader Vic) in his book Principles of Professional Speculation had made an interesting observation. ” The 2B Rule. In an uptrend, if prices penetrate the previous high, fail to carry through, and then immediately drop below the previous high, then the trend is apt to reverse. The converse is true in downtrends”. This is what has happened in various indexes: Dow, S&P 500 etc..

2. In technical terms we have had an island reversal. A gap in the charts of the S&P 500 futures going above the previous high followed by a gap on the downside. This is normally considered bearish.

3. Even the though the S&P 500 and the Dow had broken to new highs the Russell 2000 which is a more broader index did not confirm the breakout. Non confirmations are normally seen at turning points.

4. On a fundamental basis the Trump administration is going to continue to jawbone the U.S. dollar which is dollar bearish and gold bullish. Peter Navarro’s statement in the FT against the Euro. Trump’s statement against various currencies and his statement on the US dollar.

I would now watch the previous lows 2264 on the S&P 500 futures and 1339 on the Russel 2000. A decisive break of those levels with increasing volume would be intermediate bearish. Remember, we have not had a 5% correction since about a year ago.