I have had a number of discussions with subscribers asking for more “how to” posts (see Teaching my readers how to fish). This will be one of a series of occasional posts on how to build a robust investment process.

For traders and investors, one of the challenges is how to build a robust discipline that works well through different market regimes. As a case study, consider this study from Simple Stock Model that generates signals based on the cash flows in and out of the SPY ETF as a sentiment signal. The trading rule is: “If the 4-week average of the 3-month change in SPY’s percentage of shares outstanding is greater than +5%, be out of the market.”

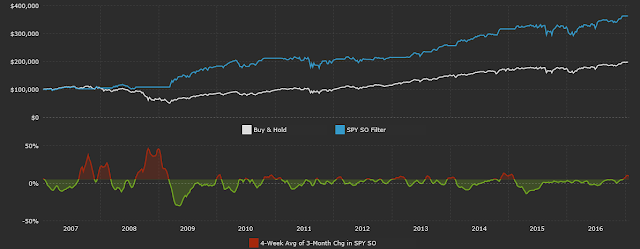

The chart below shows the equity curve from this trading system (white line = buy and hold, blue line = trading system). The results look pretty good, especially for a relatively low turnover model. (Incidentally, it’s on a sell signal right now).

Not so fast! Don’t jump to conclusions before digging into the data and reading the fine print.

One big call

If you look at the details of the equity curve, you will see that the trading system made its money by avoiding the devastating bear market of 2008-09, but the market kept rising when it flash its other “sell” signals. If we were to restart the equity curve from the time this trading system flashed the all-clear buy signal after the 2008-09 bear market, it underperformed its buy-and-hold benchmark.

This is the first lesson. Evaluate the success rate, or batting average, of any trading system to see if the results are acceptable. In some cases, you may decide that a system with a low success rate with outsized gains is acceptable – just be aware of its characteristics and manage your risk properly.

Asymmetric signals

This trading model is a sentiment model and I used it as an example to illustrate another point. The market response to model readings don’t always behave the same way at buy and sell extremes. Model signals can be asymmetric, especially for sentiment models.

Consider this chart of NAAIM exposure, which measures the sentiment of professional RIAs. In this example, I have arbitrarily set the trading rule to buy when the NAAIM exposure falls below 20 and to sell when it rises above 95. The “buy” signals are marked with blue vertical lines and the “sell” signals are marked with red lines. As the chart shows, the “buy” signals have tended to be pretty good, as they have tended to mark panic market bottoms. On the other hand, “sell” signals, which indicate complacency, have been less than effective.

As these are backtested results, it could be argued that when I set the buy and sell signals at 20 and 95 respectively, I was torturing the data until it talked. As an alternative, I set the buy and sell signals when the NAAIM exposure reading penetrated its 2 standard deviation Bollinger Band with a one-year moving average. The conclusions are similar. Buy signals work much better than sell signals.

That is the second lesson. Measure the effectiveness of both your buy and sell signals. They may not be the same.

In a post next week, I will address some the issues that face the professional and institutional investor.

In my experience, the flaw technical trading systems is the rules are applied to all periods the same. A head and shoulders is treated the same as are MACDs, overbought/oversold or moving average crossovers etc etc.

The key to success is to use a system when it is needed. This eliminates a lot of frustrating trades that tempt one to stop using the strategy. Below I will describe how I will start using a system soon that I think will be needed.

Investors tend to start using any trading system after a period when it proved a savior. For example, a moving average strategy or a stop loss strategy would have saved your ass in 2008. So investors in 2009 who regretted not using stops started doing it and it was a costly and frustrating strategy thereafter. Most have given up on using these protective strategies just in time to need them again. So investors abandon good strategies about the time they will work.

I used moving averages in 2008 to avoid the crash with my client portfolios. I hadn’t used it for years before that. Here is a link to an article in our national financial newspaper about our celebration in December 2008 for missing the crash.

http://wandcv.com/wp-content/uploads/2016/07/ROBdec08-pdf-Adobe-Acrobat-Professional-28429.pdf

When I confirmed in my own way that a new bull market started in 2009, I stopped using moving averages to trade the market. That has allowed us to have maximum exposure to the bull market since.

I will soon be starting to use a moving average system again to exit the market in stages. I am 100% invested in equities in my model growth portfolio. The least I own is 50%. Since I now believe markets are becoming overvalued and sentiment is getting frothy, I will exit in 10% increments (more if rates go up too quickly or markets go up too much hurting valuation).

All this to say, I now think protective strategies are now useful for the first time in eight years.

I have never wrote before on this site, I want to thank you Ken for your comments, it brings additional added value to Cam’s posts. I’m really appreciate that and I’m reading each your comment. Keep going! 🙂