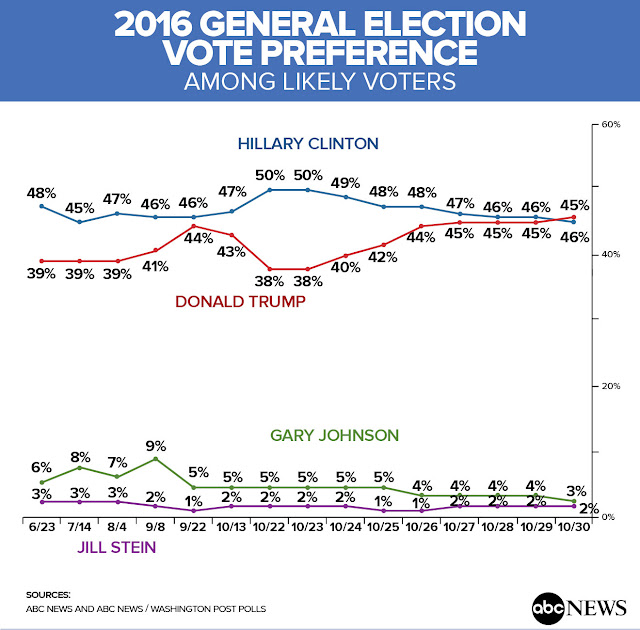

Mid-week market update: The stock market sold off today on no apparent fundamental or economic news. The most likely cause was the latest ABC/Washington Post tracking poll that showed that Trump had overtaken Clinton. The race had been tightening for several days, but this seemed to be the last straw for the markets, which threw a tantrum in response.

The Mexican peso, which has been an excellent barometer of the presidential race, tanked as a result.

The stock market did too. The SPX has now broken a key support level at 2120 and I am seeing bearish technicians coming out of the woodwork in my social media feeds. The Fear and Greed Index is diving into fear territory.

What`s next?

The presidential race in perspective

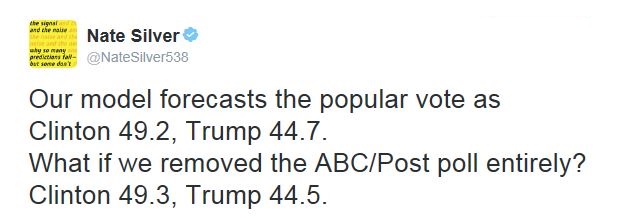

For some perspective, here is Nate Silver of FiveThirtyEight on the state of the presidential race. His odds show that Clinton holds a 72-28 advantage over Trump. While those odds are diminished from last week when Clinton’s odds were over 80%, the lead is still quite substantial.

As polling numbers are inherently noise, FiveThirtyEight averages polling results. Nate Silver pointed out that the ABC/Washington Post poll had a negligible effect on their forecast.

Bulls shouldn’t freak out.

Sentiment is overdone

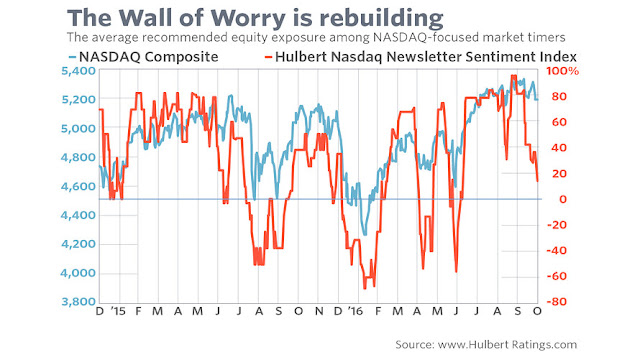

I am seeing signs of a severely oversold market everywhere. Even before today’s market weakness, Mark Hulbert observed that his sample of NASDAQ market timers had turned surprisingly negative on the market in the face of a shallow pullback, which is contrarian bullish. Hulbert speculated that the bearishness was politically motivated: “While timers don’t often reveal why they change their outlook, one possibility is a reaction to the reopening of the Clinton email investigation and an increase in the odds of a Donald Trump victory, since almost half of the drop occurred since Friday’s close.”

The market is flashing even more oversold signs that have been sure fire signals of a near-term market bottom. The combination of an oversold RSI-5 condition and VIX Index above its Bollinger Band has signaled short-term bottoms in the past.

In addition, the market has become sufficiently oversold that we are seeing the setup for a Zweig Breadth Thrust (see Bingo! We have a buy signal for an explanation of the ZBT). While a ZBT setup does not guarantee a buy signal, as it requires a quick momentum-based recovery from an oversold condition, we do have the oversold condition today. The top panel of the chart below shows past ZBT buy signals. The second bottom panel shows the ZBT Indicator, whose values are delayed, and the bottom panel shows my estimate of the ZBT Indicator. As the chart shows, we have an oversold condition that defines a ZBT setup (use this link for real-time updates to follow along at home).

As I write these words, the interim closing CBOE put/call ratio stands at 1.44. Those readings have represented capitulation levels in the past.

These are all signs of an oversold market where panic is setting in. To be sure, this doesn’t mean that an oversold market can’t get more oversold, but major bear moves simply don’t begin with sentiment readings at these levels.

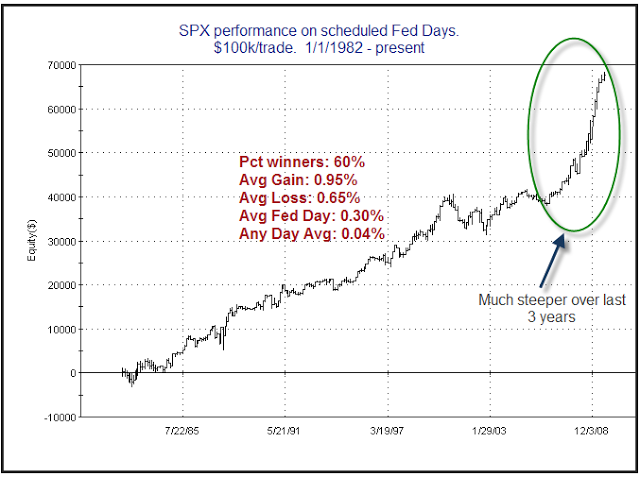

Notwithstanding the Trump Tantrum, there is hope for the bulls. Urban Carmel observed that tomorrow is FOMC day – and such days have tended to see a positive market bias in the recent past.

My inner trader was caught long and wrong, but the market is oversold and he is standing pat with his long positions.

Disclosure: Long SPXL, TNA

Thank you very much for your post. I am also caught long and wrong :-(.

Hopefully will not be the outcome of Presidental election of 11/8/2016 the same for US as for Czech the outcome of the battle of White Mountain (Prague) of 11/8/1620 :-). The result of the battle of White Mountain for Czechs was the 400 years under the rule of Habsburk Empire (Austria), mandatory conversion of Protestants to Catholics, etc.

In worst case scenario US has to survive 4 years “under the rule” of the new President. But I wish US citizents to have the President as capable as Roosevelt not Truman :-).

Regards

P.

there is a good chance that even Trump becomes the president wont change spx much. but that wont be proven truth til too late, even if we have a chance to see it. It is always the system that matters more than the individuals. Peso is prob a buy by the end of this Friday.

While the jump in CPC is bullish very short term, I hardly see today as capitulation. In fact, sell off has been very orderly with ISEE Equity Only closing above 100 despite a wide range down day. If I may make a prediction, this will be similar to mid Aug and late Dec last year and the bottom is still fair distance away.

You have seriously underestimated the longer term consequences of this election. Even if HRC eks out a victory–which remains likely–she enters the Presidency under a terrible cloud. Trump is set to use every legal means to challenge the results in tight races. He is not “going quietly into that dark night”. He is utterly shameless. Best case scenario is that the new set of e-mails adds nothing special and Comey does not recommend prosecution to the DoJ. Which will of course reject the recommendation even if it is made. The country is seething with rage on left and right. Technical indicators are the tail not the dog. A big relief rally? Yes very likely. But longer term? Bob Millman

I agree, she won’t have an easy time if she wins. Militia groups are getting set all over the country for a Clinton presidency.

If I am right on my macro analysis, we will see a severe global recession starting in late 2017 or 2018, which will likely doom her to a single term.

Anybody else buying EWW?

Peso future might be a good trade on Friday or Monday. (if trump wont be elected)