Ever since Janet Yellen made that her “high pressured economy” speech, market analysts have been scrambling to understand what she meant by that term. The Fed Chair used that term in the context of a research conference held at the Boston Fed. So was it an academic musing, or was it a hint of a subtle shift in Fed policy?

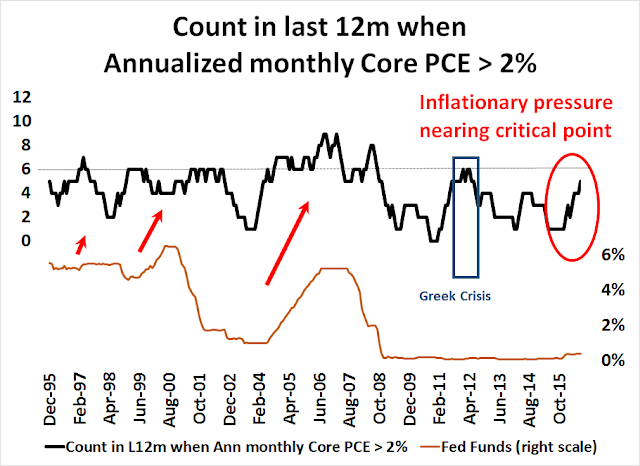

The chart below shows the number of instances in the last 12 months when Core PCE has exceeded 2%, which is the Fed’s inflation target. As the chart shows, the FOMC has tended to start a tightening cycle whenever the rolling count has hit six. The only exception occurred in 2011, when Europe mired in a Greek debt crisis.

The latest September Core PCE reading, which was released today, came in an annualized 1.7%, which was short of the 2% target. With the current count at five and therefore nearing the threshold for a tightening cycle, the question of the degree of tolerance for higher pressure in an economy is an important issue for monetary policy.

High pressure economy = Optimal control?

Here is what Yellen said about the high pressure economy in her speech. She laid out the problem of hysteresis, or persistent low growth:

The idea that persistent shortfalls in aggregate demand could adversely affect the supply side of the economy–an effect commonly referred to as hysteresis–is not new; for example, the possibility was discussed back in the mid-1980s with regard to the performance of European labor markets. But interest in the topic has increased in light of the persistent slowdown in economic growth seen in many developed economies since the crisis. Several recent studies present cross-country evidence indicating that severe and persistent recessions have historically had these sorts of long-term effects, even for downturns that appear to have resulted largely or entirely from a shock to aggregate demand. With regard to the U.S. experience, one study estimates that the level of potential output is now 7 percent below what would have been expected based on its pre-crisis trajectory, and it argues that much of this supply-side damage is attributable to several developments that likely occurred as a result of the deep recession and slow recovery. In particular, the study finds that in the wake of the crisis, the United States experienced a modest reduction in labor supply as a result of reduced immigration and a fall in labor force participation beyond what can be explained by cyclical conditions and demographic factors, as well as a marked slowdown in the estimated trend growth rate of labor productivity. The latter likely reflects an unusually slow pace of business capital accumulation since the crisis and, more conjecturally, the sharp decline in spending on research and development and the very slow pace of new firm formation in recent years.

Yellen then went on to suggest that the Fed could compensate for secular low demand with a cyclical policy of running a “high-pressure economy”:

If we assume that hysteresis is in fact present to some degree after deep recessions, the natural next question is to ask whether it might be possible to reverse these adverse supply-side effects by temporarily running a “high-pressure economy,” with robust aggregate demand and a tight labor market. One can certainly identify plausible ways in which this might occur. Increased business sales would almost certainly raise the productive capacity of the economy by encouraging additional capital spending, especially if accompanied by reduced uncertainty about future prospects. In addition, a tight labor market might draw in potential workers who would otherwise sit on the sidelines and encourage job-to-job transitions that could also lead to more-efficient–and, hence, more-productive–job matches. Finally, albeit more speculatively, strong demand could potentially yield significant productivity gains by, among other things, prompting higher levels of research and development spending and increasing the incentives to start new, innovative businesses.

What did she mean by that? Was this the remark of an academic laying out a hypothetical policy option as an area for further research? It sounds a lot like what Yellen said about optimal control theory in her November 2012 speech:

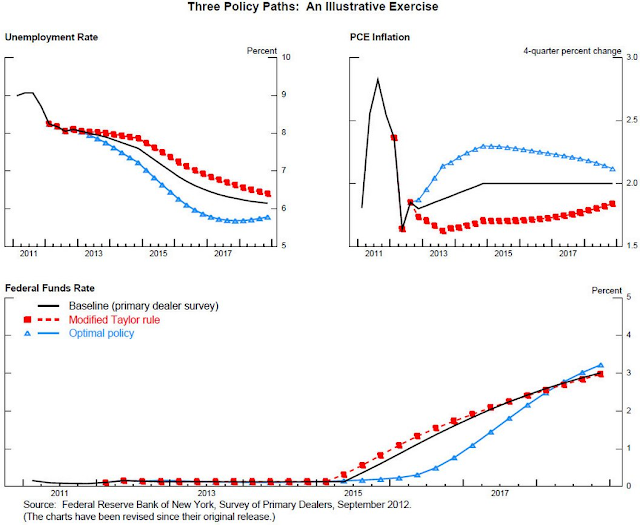

To derive a path for the federal funds rate consistent with the Committee’s enunciated longer-run goals and balanced approach, I assume that monetary policy aims to minimize the deviations of inflation from 2 percent and the deviations of the unemployment rate from 6 percent, with equal weight on both objectives. In computing the best, or “optimal policy,” path for the federal funds rate to achieve these objectives, I will assume that the public fully anticipates that the FOMC will follow this optimal plan and is able to assess its effect on the economy.

The blue lines with triangles labeled “Optimal policy” show the resulting paths. The optimal policy to implement this “balanced approach” to minimizing deviations from the inflation and unemployment goals involves keeping the federal funds rate close to zero until early 2016, about two quarters longer than in the illustrative baseline, and keeping the federal funds rate below the baseline path through 2018. This highly accommodative policy path generates a faster reduction in unemployment than in the baseline, while inflation slightly overshoots the Committee’s 2 percent objective for several years.

Demographically induced low growth

One of the clues I am monitoring is further acknowledgement from the Federal Reserve that the economy is in a low growth environment. There has been a lot of buzz about recent Fed research about demographic effects on growth, such as Understanding the New Normal: The Role of Demographics. In it, the authors postulated that “demographic factors alone can account for a 1 1/4 percentage-point decline in the equilibrium real interest rate in the model since 1980”. They concluded that, “low investment, low interest rates and low output growth are here to stay, suggesting that the US economy has entered a new normal.”

At the Boston Fed research conference, James Stock and Mark Watson presented a separate study that modeled the influence of demographic and other factors on the economy (paper here, presentation here). They framed the question as, “Why has the post GFC recovery been so weak?”

They concluded that the slow growth in the post Lehman Crisis era cannot be blamed on the Great Financial Crisis. Instead, more than half of the slowdown can be blamed on demographic factors and the rest mainly to slower government spending and hiring (annotations in red are mine).

In conclusion, there seems to be a lot of hand wringing and research about the causes of low growth. One of the key culprits seems to be demographics. Indeed, even the mildly hawkish Stanley Fischer gave a nod to demographic influence on the growth environment in a recent speech. In that speech, Fischer acknowledged that the Fed was running out of bullets to fight the next downturn, but the task of raising interest rates was not simple:

I am sure that the reaction of many of you may be, “Well, if you and your Fed colleagues dislike low interest rates, why not just go ahead and raise them? You are the Federal Reserve, after all.” One of my goals today is to convince you that it is not that simple, and that changes in factors over which the Federal Reserve has little influence–such as technological innovation and demographics–are important factors contributing to both short- and long-term interest rates being so low at present.

Lower for longer?

Even though a December rate hike is more or less baked in, all of these musings are increasingly pointing to some form of “lower for longer”, or even “once and done” approach to monetary policy. Not so fast!

Please take note that even super-dove Charles “don’t raise until you see the whites of inflation’s eyes” Evans, who has bought into the idea of running a “high-pressure economy” is backing off a little from his dovish stance (from his presentation).

Evan is projecting a December rate hike and two more quarter-point hikes in 2017 (via Matthew B at Bloomberg).

His dot plot is shown in red.

What to watch for

In this week’s FOMC statement and subsequent Fedspeak, I will be carefully watching for references to inflation expectations. Which version of inflation expectations will the Fed give greater weight to, market based expectations or survey expectations? Market based expectations seem to be bottoming and starting to turn up and caused a significant sell-off in the bond market, while survey based metrics are flat to slightly down.

Further, I will be watching for acknowledgement of a low-growth environment, or the problems of low r*. In addition, any references to demographically induced influences on growth will be interpreted as dovish.

Cam: You write as if Yellen and the other Fed members know what they are doing. They don’t. They couldn’t possibly be more clueless, as shown by none of their predictions for the economy or interest rates ever coming even close to being correct.

And even if they go through with their mighty 0.25% interest rate increase in December, after threatening to do so all year long, it will only be so that people don’t laugh in their faces going forward, but politely wait until leaving the room before doing so.

As for the lower for longer plan, that is positive for stocks as long as there is decent enough upward momentum, but not beyond that point. As John Hussman pointed out in his commentary this week (http://www.hussman.net/wmc/wmc161031.htm):

“As for monetary policy, I’ve demonstrated in U.S. and Japanese data that central-bank easing actually supports the financial markets only when investors are already inclined to speculate. That inclination is best inferred from the uniformity of market action across a broad range of securities, because when investors are inclined to speculate, they tend to be indiscriminate about it. In contrast, when investors are risk-averse, safe, low-interest liquidity is viewed as a desirable asset rather than an inferior one, so creating more of the stuff doesn’t provoke risk-taking or prevent market collapses (recall, for example, the aggressive and persistent Fed easing throughout the 2000-2002 and 2007-2009 collapses).”

It doesn’t matter whether you think whether the people at the Fed are competent, or if they have the correct policy. What matters is they have the hand on the wheel and investors need to know which way the Fed is likely to steer policy.

That`s why whether discussions about demographics or optimal control are important. They can become inputs to policy.

Cam–The Fed has the ability to create a context for future economic and investment activity. That the Fed has often been wrong is beyond dispute but also irrelevant. IF a rate rise causes disruptions including a bear market it will announce rate decreases. I has to rate rates in order to later lower them. At what point is this the likely outcome? I am sure that you will re-vist you prediction of a bear market starting sometime in 2017. maybe the 2nd rate increase in 2017 will be the tipping point.

Bob Millman

Global Central Bank policy on inflation is flawed in today’s world of globalization and the technology revolution. These two factors are putting healthy downward pressure on prices. Rather than let these positive forces lower the prices of goods to their citizens, the outdated policies flood the economy with QE and negative interest rates. It is simply a travesty.

This policy of forcing inflation towards their 2% threshold to negate the benefits of globalization is the reason for the rise of nationalism and anti-trade pack groups. It leads to greater income disparity and related citizen angst.

The forces of globalization and technology innovation are so strong that they find it extremely difficult to hit their 2% sweet spot. This will continue. Just think in terms of future driver-less trucks, cheap solar, AI replacing workers etc etc etc.

Here is a thought experiment to show the “Emperor has no clothes”

Economic theory states that if people believe that prices will fall (nasty deflation), they will defer their purchases and the economy will go into a self-destructive tailspin. That was certainly the case back in the Depression of the 1930s. Not today.

Here is a link to the goods and services in the Consumer Price index. Bear with me.

http://www.bls.gov/cpi/cpid1609.pdf

Go down the list and for each item ask yourself if the price was heading down would anyone delay buying. It’s like a bad joke. Restaurant meals, “Dear, we’ed better wait for our anniversary dinner.” Legal fees. “Better wait to sue that guy until next year.” Telephone services, “Ditch the cell phone, the monthly charge is falling. We can get a better deal next July.” Medical Services, “I hear drug prices will be lower under Hillary. I’ll defer buying my heart meds.”

Consumers don’t even know the price of goods nowadays let alone whether they will fall. Our grandparents in the 1930’s knew the price of everything and used hard-to-get cash money to buy them. Today’s consumers are used to huge falling prices of computers and other electronics and yet buy them when they need even though they know they will be cheaper later.

The only two things on the CPI list that respond the old way to ‘inflation expectations’ are homes and cars. These are the things that are goosed up in today’s world with today’s low interest rates. Canada has a real estate bubble. Many cities in the U.S. have higher home prices than before the GFC. Auto sales in both countries are robust. Mission accomplished, Central Bankers! You are making home ownership unaffordable for the next generation at the same time you drive up the prices of the other 98 items on the CPI list.

As long as this flawed concept of ‘inflation expectations’ is the mantra, rates will stay ‘lower for longer’ and populism and economic distortions will continue.

Spread the word, “The Emperor as no clothes.”

I view the Fed’s use of demographics to explain low growth as the monetary equivalent of poor corporate earnings due to weather or currency exchange rates. That is, it is convenient and hard to dispute but not likely the cause. A paper by Dr. Stephen Williamson, a VP in the St. Louis Fed has a different explanation for low growth. It is my understanding that his paper suggests the Fed’s QE and ZIRP are in fact causing low inflation and thus low growth. For example, Dr. Williamson notes that the interest rate on excess reserves – currently about 0.25% – determines short term interest rates and thus until the interest rate on reserve changes short term rates won’t change.

“Theory, for example Williamson (2012, 2014a, 2014b), tells us that, when there is a significant quantity of excess reserves in the financial system, short-term interest rates are determined by the interest rate on reserves.” [pg 7]

Dr. Williamson also suggests that the Feds QE efforts not only have failed to encourage economic growth but may in fact be a hindrance.

“Further there is no work, to my knowledge, that establishes a link from QE to the ultimate goals of the Fed inflation and real economic activity. Indeed, casual evidence suggests that QE has been ineffective in increasing inflation, For example, in spite of massive central bank asset purchases in the U.S., the Fed is currently falling short of its 2% inflation target. Further, Switzerland and Japan, which have balance sheets that are much larger than that of the U.S., relative to GDP, have been experiencing very low inflation or deflation.” [pg 9]

He goes even further to argue about the value of QE (in a backhanded way by referencing the Fed balance sheet).

“Is the existence of a large central bank balance sheet a threat to price stability? The available theory and empirical evidence says no. With respect to theory, Williamson (2014a), for example, shows how QE can actually lead to lower inflation. When government debt is in short supply as collateral, this imparts a liquidity premium to safe assets, and the real interest rate is low, just as has been the case in the United States since the beginning of the Great Recession. Under these circumstances, if the central bank conducts a swap of short-maturity government debt for long-maturity debt, as it did under Operation Twist, this acts to increase the effective stock of collateral. As a result, the liquidity premium falls, and the real interest rate rises. If the nominal interest rate is zero, then an increase in the real rate implies a decrease in the inflation rate, i.e. QE causes inflation to fall. The same result applies if we consider the effects of increases in the central bank balance sheet accomplished through purchases of long-maturity government debt at the zero lower bound.” [pg 10]

See: https://research.stlouisfed.org/wp/2015/2015-015.pdf

Given the history of the Fed from Greenspan forward, it is more likely they are acting as monetary carpenters who consider every economic issue a monetary nail. There is little regard for regulatory or fiscal policy and no effort whatsoever to reject inappropriate mandates. The low unemployment rate should not be a concern of the Fed but of the administration. It is possible – just – that Yellen has read Dr. Williamson’s paper and is slowly attempting to right the monetary ship by raising interest rates. Certainly Cam is correct that references to demographics is a dovish comment but it is not in the best interest for long term economic growth nor long term equity value improvements.

@Jeff, some questions if you would on this part of your post ” If the nominal interest rate is zero, then an increase in the real rate implies a decrease in the inflation rate, i.e. QE causes inflation to fall.” Is the real interest rate rising and is the nominal interest rate defined as the fed funds rate or the ones that banks charge its customers?

@Ken, QE pushing up cost of owning homes and so making for an uneven recovery and greater wealth inequality. This I can kinda understand. But isn’t technology led deflation good only if productivity is also increasing? Productivity has been quite a drag which may or may not be a byproduct of QE itself. The problem may be that productivity has been quite good in developing markets while only wage growth (and low productivity) is seen in US. Like in a high pressure cooker leakage must be prevented for it to be cooked properly and so globalization should be stalled for now to increase domestic capital spending and innovation led by wage growth pressures?