Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses the trading component of the Trend Model to look for changes in direction of the main Trend Model signal. A bullish Trend Model signal that gets less bullish is a trading “sell” signal. Conversely, a bearish Trend Model signal that gets less bearish is a trading “buy” signal. The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below. Past trading of the trading model has shown turnover rates of about 200% per month.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Risk-on

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends and tweet any changes during the week at @humblestudent. Subscribers will also receive email notices of any changes in my trading portfolio.

Positive seasonality ahead

Recently, Jonathan Krinsky of MKM Partners highlighted a bullish seasonal pattern with a likely market bottom in early October (chart via Marketwatch, annotations in red are mine).

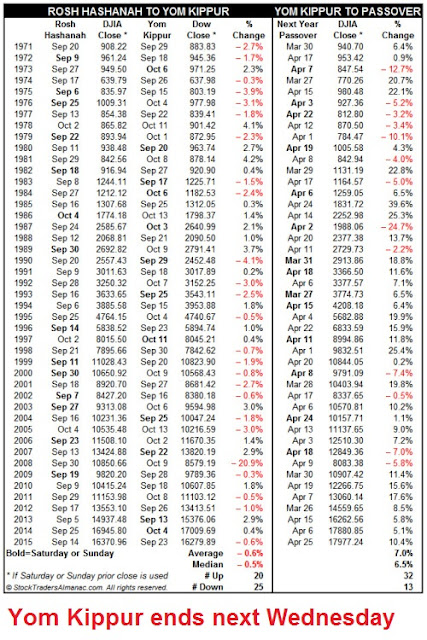

Jeff Hirsch also documented the trading results from the trader’s adage of “Sell Rosh Hashanah, buy Yom Kippur”, as well as the returns from Yom Kippur to Passover, which occurs in the spring.

Normally, I don`t give a lot of weight to seasonal patterns in my investing and trading, but it appears that macro-economic, fundamental, and technical factors are all lining up for the positive seasonal pattern for the remainder of the year.

The economy perks up

I have writing about an imminent improvement in the economic growth for several weeks now and we are finally starting to see signs of a turnaround. The Citigroup Economic Surprise Index, which measures whether high frequency economic releases are beating or missing expectations, is starting to rise again.

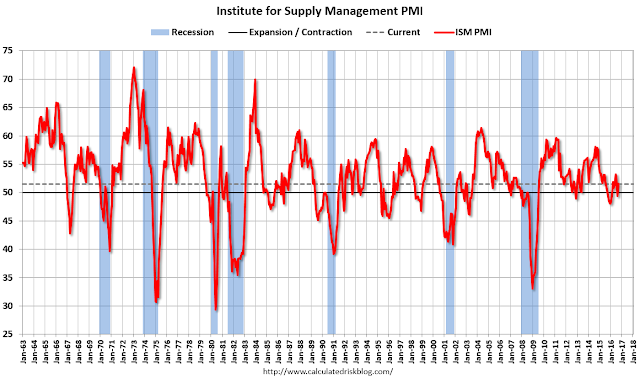

Early last week, we saw good news from ISM Manufacturing, which rose and beat expectations (via Calculated Risk).

ISM Non-manufacturing, which is highly correlated with employment because it measures the more important and larger part of the US economy, also printed a blow-out number and jumped almost six points (via Calculated Risk).

The 4-week average of initial jobless claims fell to levels not seen since 1973, Together, these data points paint the picture of a healthy economic expansion.

Although the headline Non-Farm Payroll report missed expectations, the internals were healthy enough for Fed vice-chair Stanley Fischer to characterize it as “pretty close” to a “Goldilocks number”. The closely watched participation rate rose as more discouraged workers re-entered the work force.

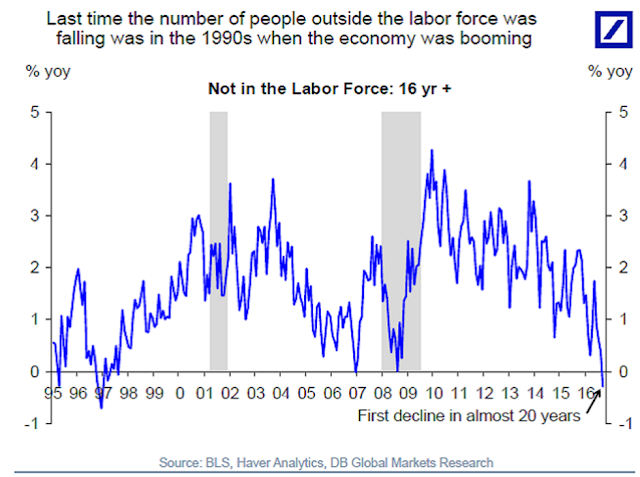

Torsten Sløk of Deutsche Bank interpreted the Jobs Report as a sign of a booming economy: “For the first time in almost 20 years, we are now seeing a decline in the number of people outside the labor market. As the first chart shows, this is consistent with what we saw in the mid-1990s and 2006, when we also were at full employment.”

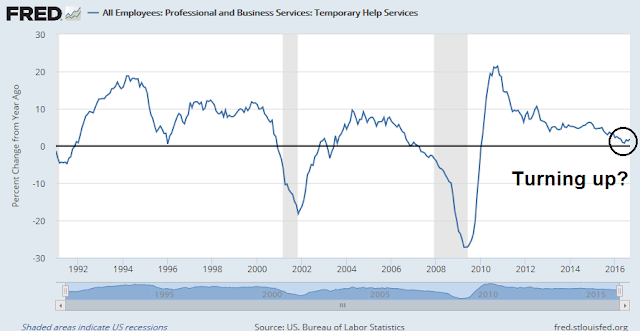

Equally encouraging was the revival in temporary employment, which tends to lead full time employment. Temporary employment growth had been decelerating and bottomed in June, but it may be in the process of turning up again.

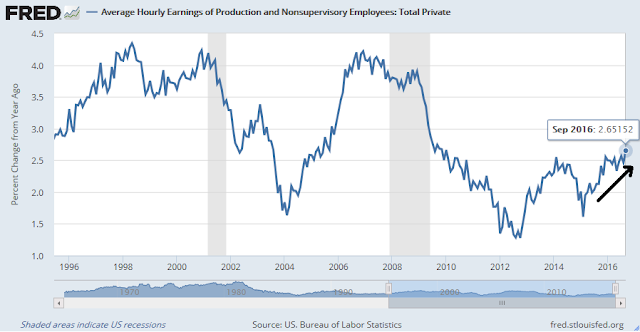

Just as important, average hourly earnings were rising in a healthy manner. The wage growth among the non-supervisory workers is an indication that growth is not just restricted to the top tier of the labor market.

The Atlanta Fed confirmed this trend of cyclical strength by noting that part-time wage growth is accelerating at a faster pace than full-time wages. Broad based wage growth are positive for economic growth because lower paid workers tend to spend most of their earnings. More consumer spending can then kick starts the virtuous growth cycle of better consumer demand, more employment, which leads back to further consumer spending.

Poised for a good Q3 earnings season

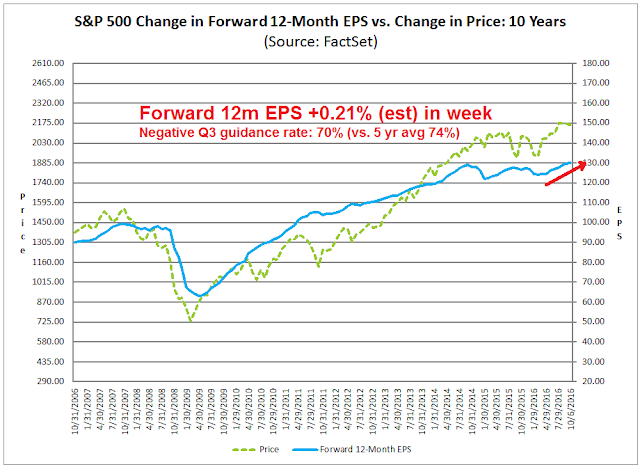

From a bottom-up perspective, the future also looks bright. The latest update from John Butters of Factset indicates that forward 12-month EPS continues to rise. With Q3 earnings season just about to start, Butters also observed that the negative guidance rate is below average. The combination of rising Street optimism and below average earnings warnings add up to a possible blockbuster earnings reports in the weeks to come.

That upbeat assessment of equities is confirmed by the actions of Barron’s report of the “smart money” insiders, whose aggregate activity has been flashing a “buy” signals for three of the last four weeks.

Reflation lives!

When I put all of these elements together, it spells R-E-F-L-A-T-I-O-N. Jeroen Blokland described the current macro environment as inflation being just around the corner.

There is a case to be made for an inflationary surge. The chart below shows the number of times in the last 12 months that Core PCE has exceeded 2%, which is the Fed’s inflation target. In the past, the Fed has tended to start a rate hike cycle when the trailing count reached 6. The one exception that the Fed did not raise rates under these circumstances was in 2011, when Europe was gripped by a Greek debt crisis.

Risk appetite rising

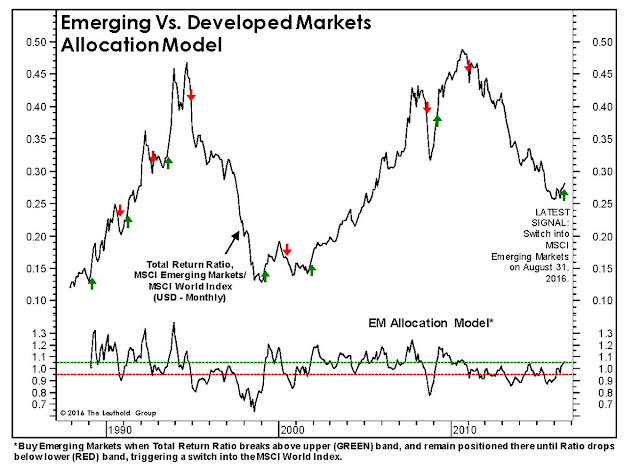

If inflationary pressures are indeed around the corner, then the logical portfolio response is to overweight resource sectors and emerging markets because of their inflation hedge qualities due to their higher commodity sensitivity. Recently, the Leuthold Group flashed a buy signal for emerging market stocks over developed markets.

It’s not just the Leuthold Group buy signal for the high beta EM stocks that got me all excited. Market internals are also showing signs of renewed risk appetite. In the fixed income markets, US high yield (HY) bonds and emerging market bonds are also telling a risk-on story.

Even as the stock market consolidated sideways, there were other bullish divergences to be seen under the surface. Risk appetite indicators such as high beta vs. low volatility, and small caps vs. large caps show that the risk and TINA (There Is No Alternative) trades ares performing well.

On the other hand, defensive sectors such as Consumer Staples, Utilities, and Telecom have been lagging the market.

In addition, Jeffrey Kleintop observed that equity flows tend to follow trailing 5-year returns. With rolling 5-year returns turning up, equity fund flows could get a lot stronger in the weeks and months ahead.

Get ready for the year-end FOMO rally, especially in light of what Josh Brown terms the “career risk trade”, where under-invested managers scramble to buy stocks as we approach year-end. The bottom panel of the chart below shows pressure that managers are facing, which is in the form of rolling 52-week market return that has been trending up since the Brexit referendum.

Risk on! Let’s party!

S&P 500 at 2500?

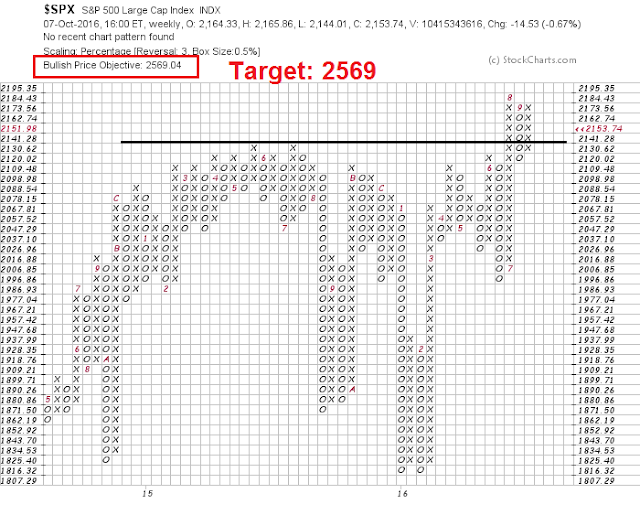

In light of these bullish factors, I believe that the SPX point and figure target of over 2500 should be achievable by next spring.

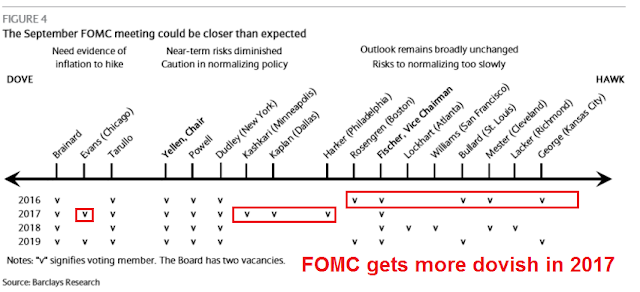

The one key question is how the Fed responds to the signs of rising inflation pressures (see How the Fed could induce a bear market in 2017). Given the “Goldilocks” nature of the September Jobs Report, a December rate hike is more or less a done deal. The only question is the trajectory of interest rates in 2017. As the chart below shows, the composition of the FOMC next year will be more dovish than 2016 (annotations in red are mine).

The combination of improving fundamentals and a dovish FOMC 2017 are creating the tantalizing possibility of an equity market blow-off to levels that I may not be able to project.

The week ahead: Waiting for Yom Kippur

Looking ahead to next week, the sideways pattern of the stock market over the past weeks have been frustrating for traders. Volatility has risen since early September, but we have seen no significant breakouts or breakdowns out of the trading range.

Most sentiment and breadth indicators are showing neutral readings, which could be interpreted bullishly as the market is very close to its all-time highs. On the other hand, they provide little guidance as to the near-term outlook for stock prices. As an example, the Fear and Greed index is dead neutral.

AAII sentiment is in neutral territory. Rydex readings are neutral to mildly oversold.

Breadth indicators from IndexIndicators are not giving any hints of market direction either. Stocks above their 10 dma are slightly below neutral but not oversold.

Stocks with net 20 day highs-lows is showing a “wimpy” oversold reading, but there is no sign of excessive fear.

The single bright spot from a short-term trading viewpoint comes from the analysis of Twitter breadth from Trade Followers. As the chart below shows, bullish breadth has been slowly improving and bearish breadth has been falling, which results in a net rise in Twitter breadth.

My inner investor remains bullish on stocks. My inner trader is starting the get the FOMO fever and he may not be able to hold out much beyond Yom Kippur, which is next Wednesday. He is long the market, but he would prefer to see a decent pullback before buying in. In light of the imminent start of earnings season, he may start to add to his long positions next week on either a minor dip or a convincing breakout to new highs.

Disclosure: Long SPXL

OK. But make sure you buy after sundown.

I believe a lot of investors were worried about a Trump win and were waiting until after the election to buy once Hillary won. Now with Trump going down in flames with Republican leadership vocally abandoning him after the groping comment, those folks will buy now rather than waiting. This week could start the market surge that Cam has been calling for. Fasten your seat belts.