Preface: Explaining our market timing models

We maintain several market timing models, each with differing time horizons. The “Ultimate Market Timing Model” is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, “Is the trend in the global economy expansion (bullish) or contraction (bearish)?”

My inner trader uses the trading component of the Trend Model to look for changes in direction of the main Trend Model signal. A bullish Trend Model signal that gets less bullish is a trading “sell” signal. Conversely, a bearish Trend Model signal that gets less bearish is a trading “buy” signal. The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below. Past trading of the trading model has shown turnover rates of about 200% per month.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities

- Trend Model signal: Risk-on

- Trading model: Bullish

Update schedule: I generally update model readings on my site on weekends and tweet any changes during the week at @humblestudent. Subscribers will also receive email notices of any changes in my trading portfolio.

Reading the electoral tea leaves

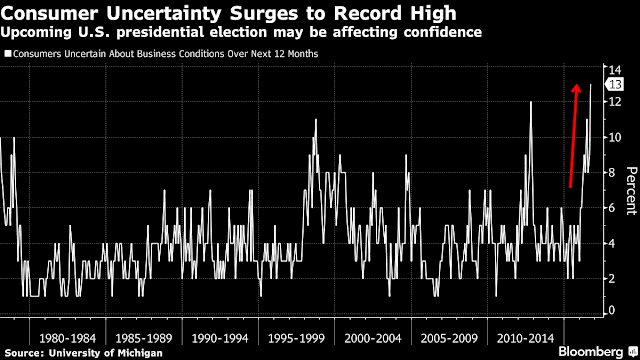

Recently, there have been numerous reports on the unsettled macro and market environment as a result of the US presidential election. Bloomberg reported that consumer uncertainty had spiked.

Business Insider highlighted the deterioration in small business confidence ahead of the election:

Tom McClellan also identified a rough correlation between the stock market and the polls. The market seems to interpret a rising Clinton lead as bullish and rising Trump lead as bearish.

It’s time to ask the question, “What is the likely equity market trajectory under a Clinton or Trump presidency?”

Clinton vs. Trump

It is said that while Trump has ideas, Clinton has policies. This article details the Clinton team’s meticulous policy preparations and implementation details:

It’s just that they’re focusing on November 9, and what Clinton would do if she manages to make it to the White House—where she would face an even less habitable political environment than Obama did. Unlike him, she’ll be entering office without a huge reserve of personal popularity to draw on. She’ll be hemmed in by Republicans on one side and a newly emboldened progressive wing of the Democratic Party on the other. With almost no room to maneuver, Clinton has to find a way to do something good for America. It almost makes the election look like the easy part.

By contrast, it’s difficult to pin Trump down on what his administration might do. This New Yorker article explains:

Many of Trump’s policy positions are fluid. He has adopted and abandoned (and, at times, adopted again) notions of arming some schoolteachers with guns, scrapping the H-1B visas admitting skilled foreign workers, and imposing a temporary “total and complete shutdown of Muslims entering the United States.” He has said, “Everything is negotiable,” which, to some, suggests that Trump would be normalized by politics and constrained by the constitutional safeguards on his office.

While Trump has shown himself to be mercurial, he has shown that he has some core principles:

When Trump talks about what he will create and what he will eliminate, he doesn’t depart from three core principles: in his view, America is doing too much to try to solve the world’s problems; trade agreements are damaging the country; and immigrants are detrimental to it. He wanders and hedges and doubles back, but he is governed by a strong instinct for self-preservation, and never strays too far from his essential positions.

Ideas? Definitely. Policies? Well, the devil is in the details.

Consider, for example, the idea of putting restrictions on Muslims, whether as US visitors, or American citizens and residents. In order to implement a policy like that, the federal government would have to create an enormous bureaucracy to identify, verify, and monitor the religious beliefs of every US visitor and resident. I doubt if that’s the sort of Big Brother intrusion that Trump supporters had in mind.

How about a compromise solution of banning visitors from key Muslim Middle Eastern countries that are at high risk of being sources of terrorism, such as Egypt, Syria, Libya, Yemen, and so on? “Mr. President, what do we do about the Coptic Christians in Egypt, which is one of the oldest Christian sects around?” (See above discussion about monitoring religious beliefs).

Here are some more examples from the New Yorker article:

In some cases, Trump’s language has had the opposite effect of what he intends. He professes a hard line on China (“We can’t continue to allow China to rape our country,” he said in May), but, in China, Trump’s “America First” policy has been understood as the lament of a permissive, exhausted America. A recent article in Guancha, a nationalist news site, was headlined “Trump: America Will Stop Talking About Human Rights and No Longer Protect NATO Unconditionally.”

…Other militant organizations, including ISIS, featured Trump’s words and image in recruiting materials. A recruitment video released in January by Al Shabaab, the East African militant group allied with Al Qaeda, showed Trump calling for a ban on Muslims entering the U.S.; the video warned, “Tomorrow, it will be a land of religious discrimination and concentration camps.”

…Closer to home, Trump’s criticism of Mexico has fuelled the rise of a Presidential candidate whom some Mexicans call their own Donald Trump—Andrés Manuel López Obrador, a pugnacious leftist who proposed to cut off intelligence coöperation with America. In recent polls, he has pulled ahead of a crowded field. Jorge Guajardo, a former Mexican diplomat, who served in the United States and China, warns that the surge of hostility from American politicians will weaken Mexico’s commitment to help the United States with counter-terrorism. “Post-9/11, the coöperation has gone on steroids,” Guajardo told me. “There have been cases of stopping terrorists in Mexico. Muammar Qaddafi’s son wanted to go live in Mexico, and Mexico stopped him. But people are saying, If the United States elects Trump, give them the finger.”

I could go on, but you get the idea.

Clinton = Status quo

I believe that the market’s reaction to the polling results is not so much as an affinity for Hillary Clinton, but a preference for the status quo that Clinton represents. This interpretation is confirmed by this WSJ article indicating that nearly one-third of Fortune 100 CEOs supported Mitt Romney in the last presidential election, but none have supported Donald Trump this year. Markets don`t like the uncertainty of a Trump presidency, because the implementation details of his policies are unknown.

Under the status quo (Clinton win) scenario, there are numerous good reasons to be bullish on stocks. Josh Brown recently charted the “career risk trade”. SPX YoY returns have turned positive since the Brexit rally and managers are likely to be buying and chasing performance into year-end.

Sam Bullard of Wells Fargo wrote about the expectation of further fiscal stimulus in 2017. Both Clinton and Trump have committed themselves to more government spending which should provide a short-term boost to the growth outlook (chart via Business Insider).

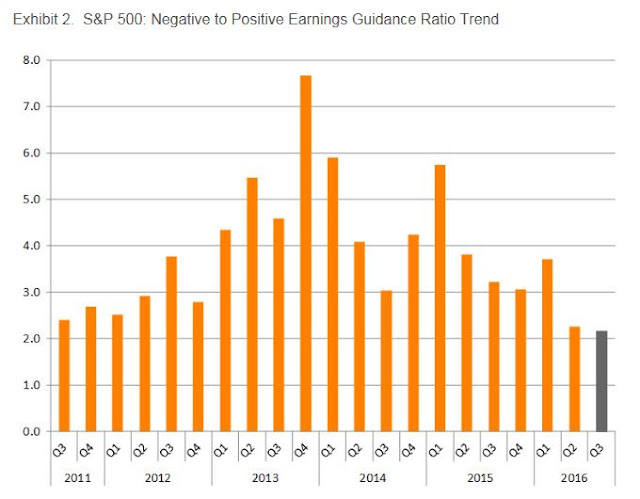

In addition, there is room for optimism for the Q3 and Q4 earnings outlook. I wrote last week that analysis from Lipper Alpha Insight indicated that Q3 earnings season is likely to see an upbeat tone because of the falling level of negative guidance.

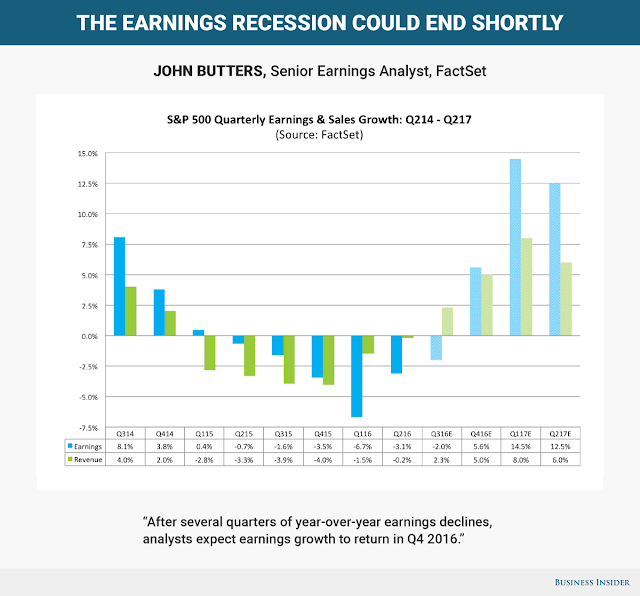

John Butters at Factset also pointed out that the Street expects the earnings recession to end shortly. Coupled with a better than expected Q3 earnings season, these developments should be good news for stock prices.

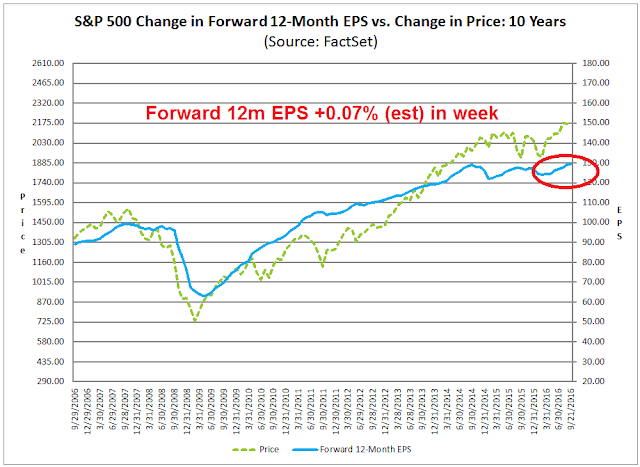

The expected earnings revival seems to be on track. Butter’s weekly earnings outlook report shows that last week’s decline in forward 12-month EPS turned out to be a data blip. The latest figures show that forward EPS has resumed its rising trend. This is another good reason for optimism stock prices to rise (annotations in red are mine).

Rising earnings growth is bullish for stock prices, even if the Fed were to raise interest rates. Jim Paulsen at Wells Fargo Asset Management provided analysis showing that the stock market tends to perform well when YoY earnings growth exceeds the 10-year Treasury yield. Assuming that we get the positive earnings surprise and the earnings recession ends, equity prices should see a rising tide into year-end and beyond.

Bullish technical outlook

The intermediate term technical outlook also appears to be bullish. The Wilshire 5000, which is the broadest index of the US stock market, is on the verge of a bullish MACD crossover on the monthly chart. Such signals have tended resolve bullishly in the past.

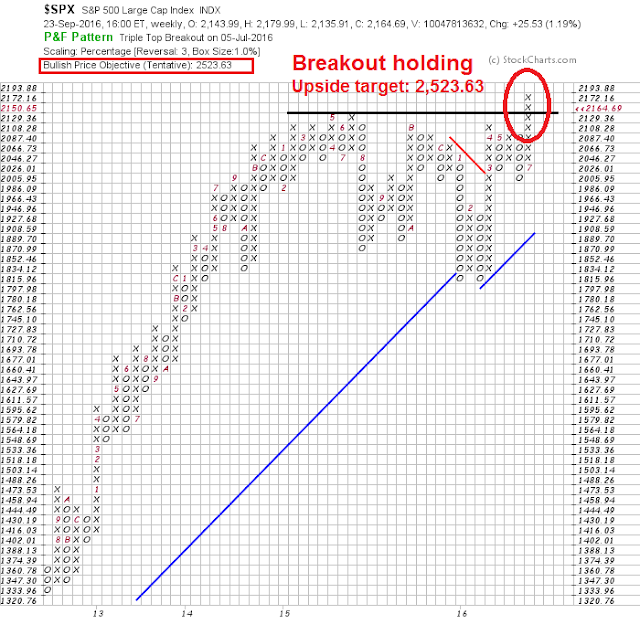

Also don’t forget that the upside breakout is holding on the point and figure chart, with an intermediate term upside SPX target of over slightly over 2500.

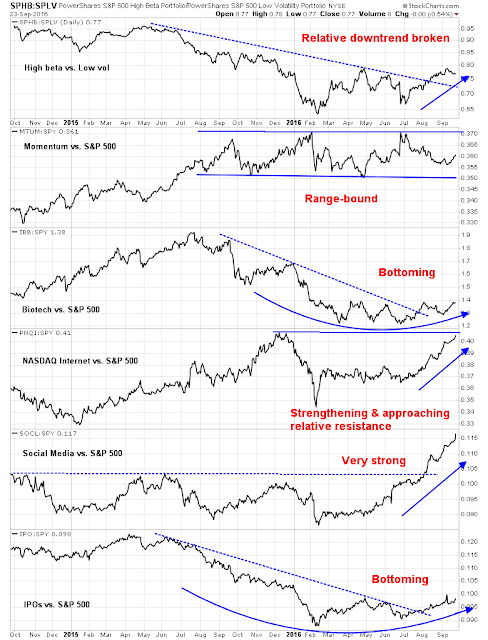

Moreover, a survey of the charts of high beta and glamour stock groups show that their relative performances are either constructive or showing signs of strength. These are all signs of bullish internals that will likely lead the stock market higher in the weeks and months ahead.

The Trump surprise

By contrast, a Trump victory, or even the whiff of a Trump win, is likely to create market uncertainty. As I stated before, Trump has ideas but few actual policies with implementation details. As I have written before , the most likely beneficiary of a Trump presidency is gold (see The Trump arbitrage trade). As the chart below shows, the gold vs. stock pair trade remains in a trading range.

If you want to bet on a Trump victory, the gold/stock pair trade is the most obvious choice. However, the macro fundamentals of a Trump presidency may not necessarily be equity bearish. Fiscal policy is likely to be very loose and it could be the equivalent of the American government throwing a HUGE party. The USD would crater, which would be positive for earnings growth and therefore equity bullish (see Super Tuesday special: How President Trump could spark a market blow-off).

If you are really, really, really worried about Trump, there is always Maple Match as a way of escaping to Canada.

The week ahead: Be careful

Looking to the week ahead, my inner trader is getting more cautious. I sent out an email alert to subscribers on Friday indicating that I was reducing my long exposure (also see Back in the rut).

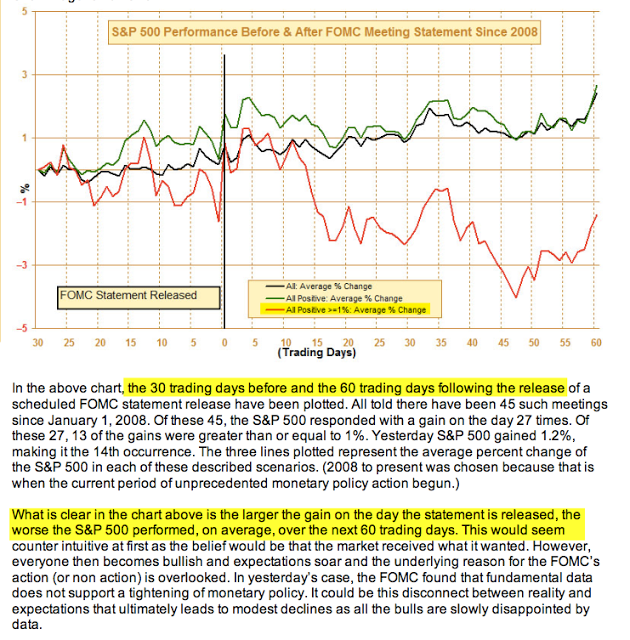

Another reason for caution comes from the outsized positive market reaction to the FOMC statement on Wednesday. Urban Carmel wrote back in December 2015 that 1%+ rallies on FOMC days tended to retrace themselves in short order (red line represent the average market trajectory after 1%+ gains on FOMC days).

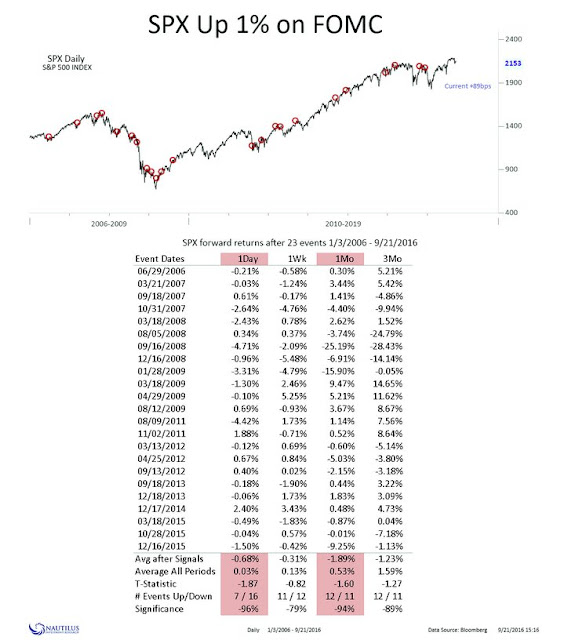

Other historical studies came to a similar conclusion. This one is from Nautilus Research.

The VIX/VXV ratio, which measures the term structure of the VIX Index, is showing signs of complacency. In the past, the market has tended to consolidate sideways or correct when such readings were at similar levels.

On top of that, there is possible volatility from the presidential debates scheduled for Monday. Given the dynamics of the race, the potential of a “I knew Jack Kennedy” moment from either side that blows the race up is high.

Here is Nate Silver’s summary of the race:

In football terms, we’re probably still in the equivalent of a one-score game. If the next break goes in Trump’s direction, he could tie or pull ahead of Clinton. A reasonable benchmark for how much the debates might move the polls is 3 or 4 percentage points. If that shift works in Clinton’s favor, she could re-establish a lead of 6 or 7 percentage points, close to her early-summer and post-convention peaks. If the debates cut in Trump’s direction instead, he could easily emerge with the lead. I’m not sure where that ought to put Democrats on the spectrum between mild unease and full-blown panic. The point is really just that the degree of uncertainty remains high.

My inner investor is focused on the longer term outlook and he is unperturbed by these short-term developments. Clinton is still leading in the polls and a Clinton win remains his base case investment scenario.

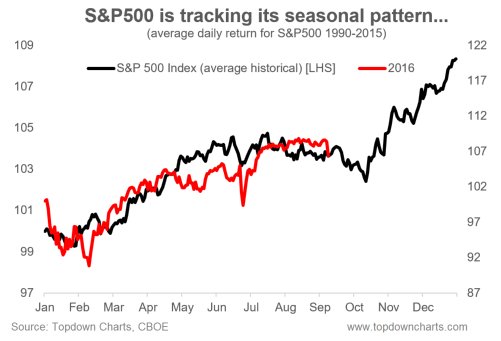

My inner trader is bullish but nervous. That’s why he reduced his long position into next week. The market may be poised to repeat seasonal pattern of past election years (chart via Callum Thomas).

Disclosure: Long SPXL

One might also consider the fact that a ban on individuals who follow a particular religion is anti constitutional and therefore antiAmerican in concept and unconstitutional legally. There’s not much reason to speculate on how the government would implement a policy that is a priori illegal.

Great writeup Cam! 360 degree view combining macro, TA and sentiment. No one else does it like this.