About three weeks ago, I wrote about opportunities in European equities (see Worried about US equities? Here’s an alternative!). I pointed out that stock prices in Europe were far cheaper than US, the fears about European integrity and financial system were overblown, and the market seemed to be ignoring signs of a growth recovery.

Since then, the FTSE 100 has moved to new recovery highs since the Brexit vote.

The Euro STOXX 50 has rallied through a downtrend resistance level and it’s has retreated to test support.

American investors can see a similar pattern on the USD denominated ETF (FEZ).

If you missed the first opportunity to buy into Europe, this may be your second chance.

Fears are abating

There are numerous signs that investor fears are fading over Europe. The latest BoAML Fund Managers Survey shows that concerns over a European risk premium have fallen from first place to third.

As the chart below shows, portfolio managers have been selling down their eurozone positions, but portfolio weights may have bottomed last month as the weightings ticked up slightly.

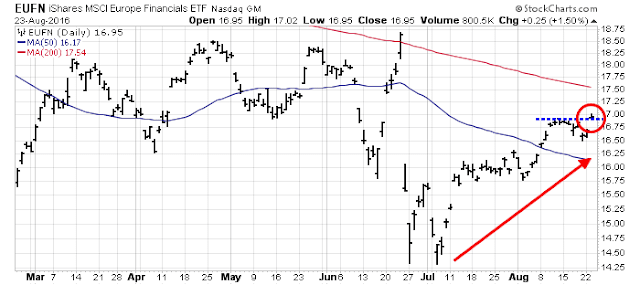

Remember all the hand wringing over European banks? This chart of European financials show that they are in an uptrend and broke out to a post-Brexit recovery high today.

When I put it all together, these are signs that Europe equities are healing. If you haven’t diversified your equity holdings into Europe, it’s not too late.

Cam

Which is better hedged or non-hedged European ETFs? Thanks.

I have no strong opinion on currency. In the absence of opinion, I generally prefer unhedged as it offers a greater diversification effect.

Cam, Do you have any opinion on UK market? VGK which has ~30% UK exposure seems to outperform FEZ on a 1month and 3month basis.

correction: comparing VGK with FEZ is faulty due to mkt cap differences. Just want to know about UK if you have any opinion on it. Thanks.

The UK market seems to be roaring ahead and it’s the relative strength leader. For an American investor, the way the participate is EWU.

For value investors, I would look at FEZ. If you are more the momentum type, EWU is the obvious choice in Europe.

Dear Cam,

I used to be able to see some of the links to articles of interest which you had read on the right hand side of the screen. I cn no longer see them. Is this because I am now reading from an Ipad?

I am still also wondering about the hegemony of the US dollar and how that will likely play out geopolitically, given the high levels of inflation that afflict the emerging world which will surely now become more visible in the “West”. Any thoughts on this exorbitant privilege?

EM inflation is less of a problem as most EM countries, with a few exceptions, have built up significant foreign currency reserves to cushion them against another FX crisis.

I got rid of those links because my analysis showed that no one was clicking on them. You can still find the same links on the old site at http://humblestudentofthemarkets.blogspot.com/

Such a nice service. This goes beyond my initial expectations of US only outlook. Thanks.

Shucks, thanks.