Mid-week market update: Is this the pullback and correction that I’ve been anticipating? If so, how far can it go?

Be patient.

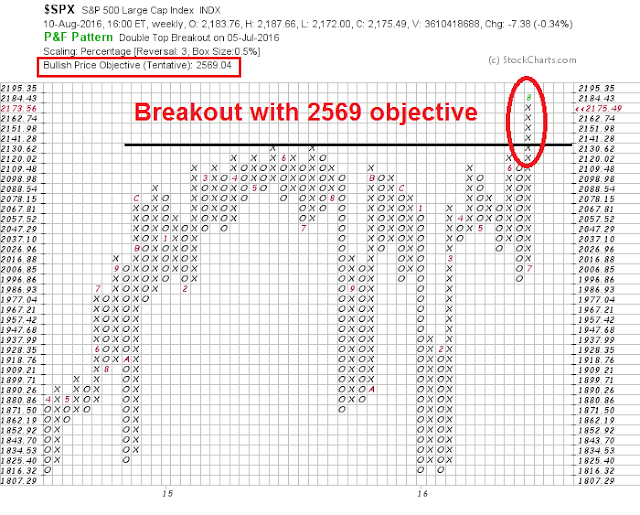

Take a look at this weekly point and figure SPX chart. Is there any doubt that the intermediate term outlook is bullish?

While my inner investor remains bullish based on the intermediate term trend, my inner trader is cautiously bullish and not all-in as there may be some near-term choppiness ahead.

The message from the VIX Index

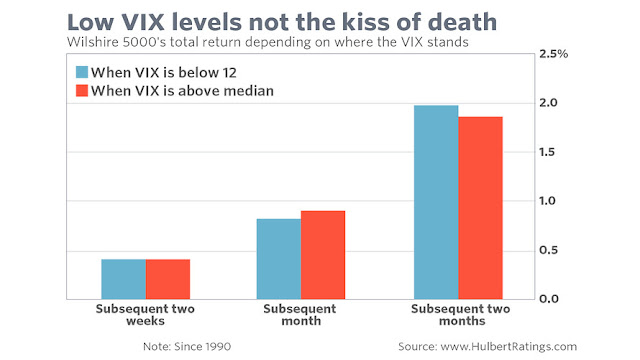

First of all, I want to address the recent article by Mark Hulbert showing that the level of the level of the VIX has nothing to do with future market returns.

I agree 100% with that analysis. As the market has been trading in a very narrow range, realized volatility is shrinking and therefore it is no surprise that implied volatility (VIX) would fall as well. However, there is information when the VIX Index moves too quickly by either spiking or cratering, as defined by its relationship to its Bollinger Bands (BB).

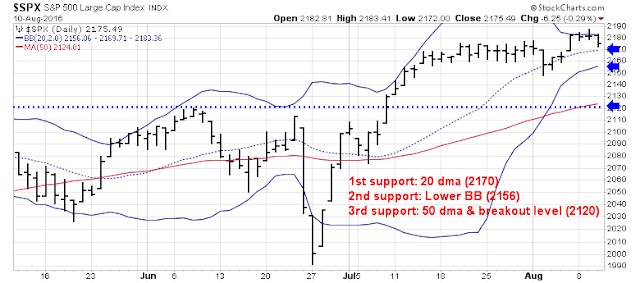

The chart below shows the three-year history of the VIX Index. In the past, the market has either stalled or staged minor pullbacks whenever it has fallen below its lower BB (blue vertical lines). The index breached its lower BB last Friday.

What if the BB band narrows because of reduced volatility? The bottom panel of the above chart shows the BB width and it has fallen to very low levels. As this analysis from SDJ10304 shows, past instances of VIX lower BB breaches combined with BB width under 20 have produced flat to negative returns.

To fully appreciate the statistics from the above analysis, you have to be a bit of a math geek. Please note that the forward 1, 5, and 10 day median returns are flat, while the average returns over the same periods are negative. In addition, the % higher statistic over 1, 5 and 10 days are all 50%. That indicates that the typical returns after such trigger events (VIX below BB and lower BB width) tend to be flat, but there were instances where the market tanked so much that they pulled down the average return figures.

In other words, expect market returns to be flat but risk is skewed to the downside for this week and next.

This conclusion is also supported by the Bloomberg report that large speculators (read: hedge funds) are in a crowded short on VIX Index futures.

These conditions set up the possibility of a short-term volatility spike in the near future. As volatility tends to be inversely correlated to stock prices, it also suggests that the stock market may suffer a near-term setback soon.

Given the positive fundamental tailwinds behind stock prices (see my weekend post Breakout, or fake out?), I expect that downside risk is likely to be limited. If the SPX were to weaken further, it will have to test three levels of support. The first support will be mid-BB, or the 20 day moving average (dma) at 2170; the second support will be the lower BB, which is currently 2156; and the third and major support level is the 50 dma and breakout level of 2120.

My inner trader took some partial profits from his long positions last week but he remains cautiously bullish. He is awaiting either signs of further weakness or an upside breakout to new highs before adding to his long positions.

Disclosure: Long SPXL

GMO thinks spx above 2400 as the emerging bubble.

sorry, remembered it wrong. gmo thinks 2300 is the threshold of valuation bubble on spx. and thinks equity will be fine before election.

“If you’re not confused, you simply don’t know what’s going on.”

That sums up the current situation. GMO has the best minds in the investment world and they have gotten things wrong for a couple of years. What I see is that the better a strategist’s previous record, the worse they are doing. You can see it in the hedge fund industry’s terrible results. Confidence in one’s proven experience is a detriment. Experts are getting their predictions wrong everywhere. Look at Brexit. Let’s pray to our respective higher power that our call on Trump will be right. That way the expert community can get one important prediction right in 2016.

The problem is that we are are in a new environment (please don’t quote Sir John Templeton at me) after the GFC and in a massive digital revolution. Central Bankers are absent from the scene as far as raising rates to take away the punchbowl. This is the Moonless World I talk about.

Globalization and the technology revolution are putting constant downward pressure on prices (for example technology produced and oil glut) and Central Bankers cannot bring themselves to allow the positive forces of healthy lower prices to benefit consumers. They are fixated on an outmoded concept that 2% inflation is necessary to keep ‘inflation expectations’ up to keep people spending. Take a look at the one hundred components of the CPI and ask yourself at every one if you would buy more today if you think the price will go up next year. For example, restaurant meals, movies, clothes, legal fees, vacations, You get the point. The only two items that would produce more spending with ‘inflation expectations’ are homes and cars. Both of those are doing fine and here in Canada the low rates are producing a real estate bubble while the rest of the economy is flattish. The inflation expectations argument is as ridiculous today as it was extremely relevant in the 1930’s. Interesting aside, I actually talked with Nobel Laureate Robert Schiller last week about this and he told me “I would postpone my vacation if I thought prices would go down next year.” Do I smell bullshit?

This fixation with keeping prices rising means they have to keep pumping amazingly to prevent what they think is 1930’s style nasty deflation. But it truly not nasty deflation but healthy lower prices. Do these economists ever buy a computer that keeps on falling in price and yet we all buy one when we need it?

So this new world of Central Bankers clinging to this old ‘deflation’ concept means that rates will stay lower for longer. Consumer will not be conned into borrowing to buy CPI goods and services with lower rates so loan demand will stay low. Governments will not borrow to build infrastructure because they blew out their balance sheets bailing out their banks. Net result no borrowing surge to push up inflation. Stock prices will adjust higher based on their incredibly rich dividend yields compared to bonds. Experts with proven track records will focus on PE multiples moving to bubble levels while Boomer retirees will be buying to get a decent yield. The former will miss this new bull market. The later will accidentally benefit.

This Ken person continues to highjack the site with permanent advertorials about dividend stocks. It is becoming very annoying.

I’m off to a wilderness vacation off the grid for a couple of weeks. No more ‘advertorials” for a while.

All the best!

Thank you Esteban for agreeing with me.

Cam has already pointed out that dividend paying strategies has it limitations and is not the panacea or the gospel for everyone. This is one person’s opinion at best and to forcefully state without any caveats is unprofessional to say the least. Let me list a few things that can derail the strategy.

1. Poor selection of securities.

2. A rise in interest rates. We all have to agree that there is no historical precedence for zero or negative interest rates. If the stock market sentiment is bullish then the “feeling that interest rates will never rise” sentiment is off the charts. Similar to house prices will rise for ever.

3. A black swan event that will make interest rates to rise appreciably.

4. A Central or major bank failure in Europe which causes a “buy in” of depositors.

5. A change in tax policy by various countries.

I am sure Cam can add a few more to the list.

I disagree. Personally, I enjoy Ken’s contributions. Nobody has to read them. It is up to Cam to decide whether anybody even has the ability to hijack his site.

Citing a possible black swan event as a reason to knock an investment strategy sounds like a poor argument to me, unless we are talking about using leverage. Anybody who as read Taleb knows that Black Swans, per definition, are not forseeable. One does not try to forsee possible problems; instead, one tries to devise a “robust” — or better, “antifragile” strategy that profits when markets are in flux. Buying DVY with 200% leverage would indeed be a fragile strategy. But that is not what Ken has been saying.

Martin,

Your point is well taken. However, I would also like to point out to you that even with a non leveraged investment there is a risk of capital. In a rising interest rate environment the dividends may be safe but there be will a loss of principal. This is the point I was making. Witness the drop of the UTY (a proxy for the Utility Index). It has dropped from 672.19 on 7/06/2016 to today at 643.34 a drop of 4.29%. Ken is forgetting that in a bear market in bonds just a normalization of interest rates (inflation + nominal interest rate) will cause a drop in prices of dividend paying stocks to offset the rise in interest rates. Low “interest rates forever” is not cast in stone it is similar to saying that the Titanic will never sink or houses prices will always rise.

Kudos to Ken for his commentary. All opinions on this site are welcome to generate a thoughtful discussion. The fact is dividends have accounted for over 40% of the total return of the market and 100% of the returns in the 1920s, 1970s, and 2000s. Any investor not considering dividend paying stocks and relying solely upon stock picking alone have not examined the statistical unreliability of the methodology.

On the market trend calls, these also can be tenuous. Most major pundits have been bearish for quite some time including not only GMO but also the infamous Lowry’s, Suttmeier, Yamada, etc. It was looking like a classic start of another bear market in late ’15 and early ’16. My favorite analyst though would have been neutral at worst; his name is Marty Zweig. His simple but effective nostrums “Don’t fight the Fed” & “don’t fight the tape” should always be a the top of any investors list. The recent breakout along with a more dovish Fed would have given another full green light according to Zweig. If anyone has not read “Winning on Wall Street” by Marty, grab an old copy. It is well worth the two hours of your time.