The latest Chinese GDP release came in right in line with expectations at 6.7%, but the growth came at a cost. I had written about this problem in my previous post, Big Trouble with 5-year China?). The Chinese authorities appear to be up to their old tricks again of using credit to drive growth, which is a worrisome sign.

The markets had been signaling this shift in policy for several months. My New China-Old China pairs had been rolling over in favor of Old China, where “New China” is represented by stocks exposed to the Chinese consumer and “Old China” is represented by financial stocks.

Mini cycles

Indeed, the latest overnight analysis (via FT Alphaville) confirms the theme of credit driven growth. Wei Yao of SocGen wrote:

In our view, the most obvious underlying factor behind this recovery is credit. In Q1, increases in total credit exploded to CNY7.5tn, up 58% yoy and equivalent to 46.5% of nominal GDP – one of the highest ratios ever. Credit growth accelerated to 15.8% yoy to end-March, the quickest pace in 20 months.

David Keohane of FT Alphaville outlined the risks:

The fact is that a crisis isn’t likely to just spring up out of nowhere. Unlikely not impossible we stress. China has the tools to manage its problems for a while more, it’s just the longer it leans on the same old policy levers the bigger the problem will get and the harder it will be to sort out. It may be as Deutsche’s Zhiwei writes that “The government is aware of the negative side effects of policy stimulus. We think they do not intend to push growth above 7%. As the economy shows more positive signs, we expect the government to shift focus to financial stability. The current rapid pace of credit growth imposes macro risks in the long term, hence we expect the government to contain such growth.” But we’re unwilling to share his confidence.

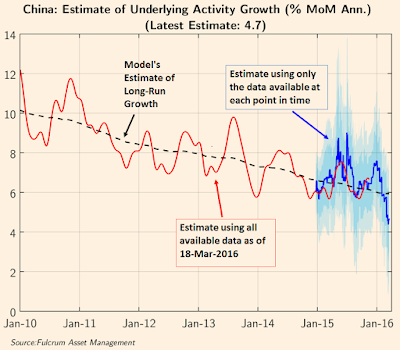

So far, we just have a “this will not end well” investment story, with no obvious trigger. Gavyn Davies had pointed out that Chinese growth is decelerating in the context of a series of mini-cycles:

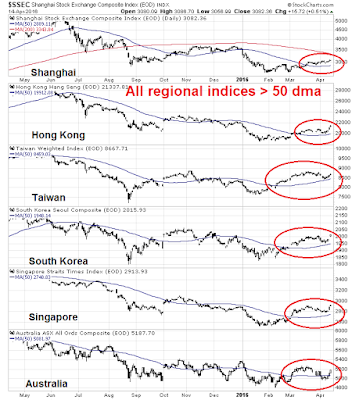

In the meantime, China is seeing the upleg of the latest min-cycle. The stock markets of China and her major Asian trading partners are all undergoing a cyclical revival. All regional indices have rallied above their 50 day moving averages.

Enjoy the party, but be aware of the risks.

The consumer to financials ratio is going down now because the financials are going up faster. If the risks to the system are from financials, that seems to be a good thing.

Last year the consumer to financial ratio was going up strongly because financials sank, that was obviously a prescription for worry in an over-indebted society.

This chart is great for watching the tilt towards a consumer economy but it would be best to see the ratio going up when financials are strong and consumer stronger.