Mid-week market update: Let me make myself absolutely clear, I remain intermediate term bullish on US equities based on the points I made in past remarks (see Equities in a macro sweet spot and The trend is your friend (breadth, seasonality and sentiment too)). As the SPX struggles with a technical resistance level at about 2080, there are signs that the market may be due for a temporary pause in the uptrend for the following reasons:

- Negative divergence in breadth and momentum indicators

- Price mean reversion in a post option-expiry (OpEx) week

This is purely a tactical trading call with a time horizon of 1-2 weeks.

Negative divergences = Caution ahead

I am starting to see broad based signs of negative divergence of technical internals. As the chart below shows, the SPX is testing the 2080 resistance level, but both RSI-5 and RSI-14 did not make new highs, indicating bearish divergences in momentum.

In addition, negative divergences are appearing in breadth indicators, such as the SPX A-D Line, % bullish and % above the 50 dma. Correction: The data for the SPX A-D Line has made a new high. The data had not been updated at the time of publication.

The bulls aren’t feeling the love from credit market risk appetite, whose indicators are not confirming this week`s stock market rally.

OpEx mean reversion

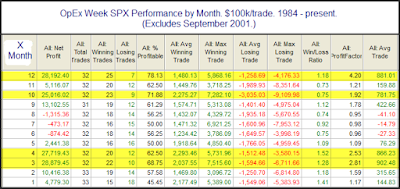

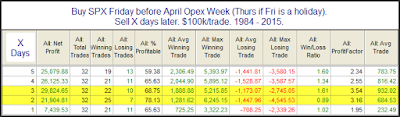

I had highlighted analysis from Rob Hanna of

Quantifiable Edges that the week of April OpEx tends to be one of the most bullish weeks in the OpEx calendar.

Though I am not very confident about relying the results of daily average returns,

Hanna’s analysis indicates that, on average, the market tends to peak out on Wednesday (today) of April OpEx week:

All of these readings suggests that the stock market is due for a pause or pullback of unknown magnitude in the days to come. A logical support level would be the 200 dma at about 2015, but I have no idea whether the bears have the strength to push the index down that far. The market is be volatile as it reacts to the major earnings reports of the day during this critical Q1 Earnings Season.

My inner investor remains long equities and he is unconcerned about possible minor market blips. My inner trader is tightening up his trailing stops and he will likely lighten up his long positions later this week.

Disclosure: Long SPXL

Thanks for this update, Cam. If you care to comment, what are you seeing in the metals ( gold, silver)?

Thank you Cam. Any comment on the economic environment/data updates that recently came out? E.g. drop in retail sales, rise in inventory-to-sales ratio (in an uptrend for a while), etc. Furthermore, what do you make of the usually defensive sectors (gold, utilities, bonds) rising along with equities in this run up? It is confusing to see defensive low-risk sectors rise coupled with this equities risk-on situation.

Thanks, Cam for the timely e-mail update today. For those of us who are not able to follow your Twitter posts through the trading day, this is most helpful and appreciated greatly. Thank you!