I would like to think that my last post, The road to a 2016 market top, panicked the market into a vicious sell-off on the first trading day of the year, but I can’t think of many people with have the hubris to make that kind of suggestion. As the market closed, the SPX was down 1.5% and it was off over 2% at the worse point of the day. What`s next?

At the close, the SPX managed to stay at a key support zone, with RSI 5 at an oversold reading on roughly average trading volume. These readings appear to be constructive and suggest that downside is limited from these levels.

Other key metrics are also flashing oversold readings, but I would warn that oversold markets can get more oversold and my initial take is that there may be some further minor downside risk from these levels.

Oversold markets can get more oversold

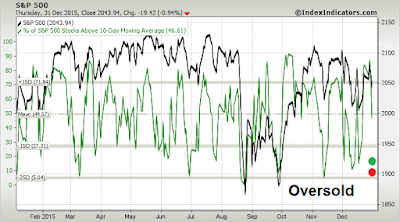

Consider these breadth measures from IndexIndicators, where the red dot is my estimate of the intra-day low and the green dot my estimate of the close today. The % of stocks above their 10 day moving average is certainly at an oversold level consistent with a short-term bottom.

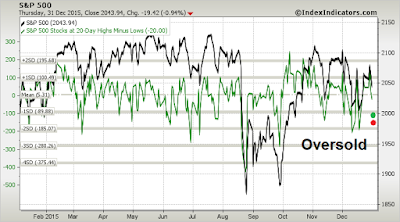

Similarly, the same could be said of net 20-day highs-lows:

Not enough panic?

Other sentiment measures are at elevated levels of fear, but not enough to warrant to be called “panic” levels. Two of the key metrics that I watch for are the term structure of the VIX Index (spot vs. 3 month forward) and TRIN, both of which are key components of my Trifecta Bottom Indicator (describe in Sell Rosh Hashanah? and last discussed in Do you believe in Santa Claus?).

The chart below shows the hourly chart of the VIX term structure and TRIN. The VIX/VXV ratio inverted briefly early in the trading day by spiking above 1, but TRIN did not rise above 2, which is an indication of panic selling.

My main takeaway from these readings is that the market is oversold, but it may not be oversold enough for a durable short-term bottom to take place. In all likelihood, the market is going to be volatile this week and we are back to watching how the Chinese stock market performs overnight.

My inner trader unfortunately got caught on the long side as the market sold off. He is looking to do some bottom fishing in the next few days should we get signs of capitulation.

Thanks, as always. Really appreciate posts after big moves.

Naw, it was your “market top” commentary. Write something bullish!

Also see trading analysis from:

Rob Hanna (Quantifiable Edges) http://quantifiableedges.com/the-bullish-news-about-the-end-of-quarter-selloff/

Ryan Detrick https://twitter.com/RyanDetrick/status/684002374604603392

TRIN was near 3 on 12/30. does that have any implication?

Not sure if that mattered. There was hardly anyone around last week.

Love the site! And the fantastic customer service!

Hi Cam, I am pretty nervous due to the fact that I am 100% long Spxl. Is it possible that market top on Spy is already over? Thank you for answer.

My condolences! I was caught long too in my trading account, though not 100% long.

Given the pre-market action, we could be at a tradeable bottom today, but I need to see the numbers later today. At the very least, the market is too oversold to get short at the moment.